See more : Cabasse Group (ALCG.PA) Income Statement Analysis – Financial Results

Complete financial analysis of Burberry Group plc (BURBY) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Burberry Group plc, a leading company in the Luxury Goods industry within the Consumer Cyclical sector.

- Eik fasteignafélag hf. (EIK.IC) Income Statement Analysis – Financial Results

- Autostreets Development Ltd (2443.HK) Income Statement Analysis – Financial Results

- HYUNDAI MOTOR INDIA LIMITED (HYUNDAI.BO) Income Statement Analysis – Financial Results

- Tharisa plc (TIHRF) Income Statement Analysis – Financial Results

- National General Industries Limited (NATGENI.BO) Income Statement Analysis – Financial Results

Burberry Group plc (BURBY)

About Burberry Group plc

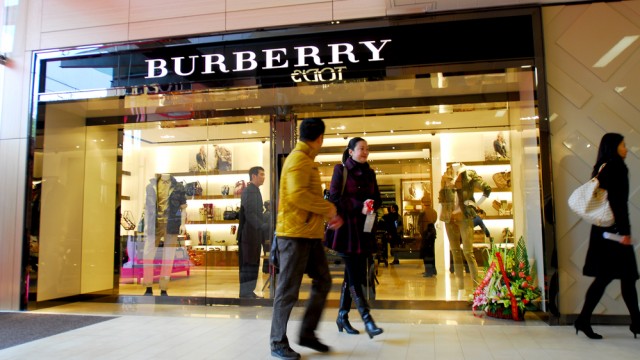

Burberry Group plc, together with its subsidiaries, manufactures, retails, and wholesales luxury goods under the Burberry brand. The company operates in two segments, Retail/Wholesale and Licensing. It provides womenswear, menswear, childrenswear, beauty, eyewear, shoes, and accessories, as well as leather goods, such as bags. The company also licenses third parties to manufacture and distribute products using the Burberry trademarks. Burberry Group plc sells its products through Burberry mainline stores, concessions, outlets, digital commerce, Burberry franchisees, department stores, and multi-brand specialty accounts, as well as through Burberry.com website. As of April 2, 2022, the company operated 218 stores, 143 concession stores, 57 outlets, and 38 franchise stores. It operates in the Asia Pacific, Europe, the Middle East, India, Africa, and the Americas. Burberry Group plc was founded in 1856 and is headquartered in London, the United Kingdom.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 2.97B | 3.09B | 2.83B | 2.34B | 2.63B | 2.72B | 2.73B | 2.77B | 2.51B | 2.52B | 2.33B | 2.00B | 1.86B | 1.50B | 1.19B | 1.20B | 995.40M | 850.30M | 742.90M | 715.50M | 675.80M | 593.60M | 499.20M | 427.80M | 225.70M |

| Cost of Revenue | 959.00M | 1.25B | 1.14B | 977.90M | 1.19B | 859.40M | 835.40M | 832.90M | 752.00M | 757.70M | 671.30M | 556.70M | 558.30M | 491.60M | 423.90M | 535.70M | 374.60M | 327.50M | 296.80M | 291.30M | 284.20M | 261.30M | 248.10M | 0.00 | 0.00 |

| Gross Profit | 2.01B | 1.84B | 1.68B | 1.37B | 1.44B | 1.86B | 1.90B | 1.93B | 1.76B | 1.77B | 1.66B | 1.44B | 1.30B | 1.01B | 761.20M | 665.80M | 620.80M | 522.80M | 446.10M | 424.20M | 391.60M | 332.30M | 251.10M | 427.80M | 225.70M |

| Gross Profit Ratio | 67.69% | 59.57% | 59.59% | 58.28% | 54.86% | 68.41% | 69.43% | 69.89% | 70.10% | 69.97% | 71.19% | 72.15% | 69.94% | 67.26% | 64.23% | 55.41% | 62.37% | 61.48% | 60.05% | 59.29% | 57.95% | 55.98% | 50.30% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 356.00M | 353.00M | 367.00M | 317.00M | 283.60M | 558.90M | 568.90M | 560.90M | 528.20M | 547.40M | 524.60M | 410.30M | -249.70M | -140.50M | -118.40M | -127.50M | 26.60M | -29.10M | -123.50M | -20.40M | 0.00 | 237.60M | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 1.25B | 1.21B | 1.12B | 943.00M | 1.08B | 863.80M | 861.90M | 913.50M | 816.70M | 762.90M | 673.60M | 604.20M | 446.00M | 325.90M | 286.50M | 236.90M | 177.70M | 146.50M | 125.90M | 111.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 1.60B | 1.20B | 1.17B | 949.60M | 976.80M | 1.42B | 1.43B | 1.48B | 1.36B | 1.31B | 1.20B | 1.01B | 196.30M | 185.40M | 168.10M | 109.40M | 204.30M | 117.40M | 2.40M | 90.60M | 0.00 | 237.60M | 0.00 | 0.00 | 0.00 |

| Other Expenses | -13.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 600.00K | 800.00K | 800.00K | 100.00K | 100.00K | 100.00K | 100.00K | 100.00K | 900.00K | -2.30M | 3.20M | -2.00M | -1.60M | -700.00K |

| Operating Expenses | 1.59B | 1.20B | 1.17B | 949.60M | 976.80M | 1.43B | 1.49B | 1.54B | 1.35B | 1.32B | 1.22B | 1.01B | 905.00M | 709.50M | 545.10M | 573.20M | 438.70M | 370.20M | 290.40M | 262.90M | 251.90M | 240.40M | 156.60M | 358.80M | 205.60M |

| Cost & Expenses | 2.55B | 2.45B | 2.31B | 1.93B | 2.17B | 2.29B | 2.33B | 2.38B | 2.10B | 2.08B | 1.89B | 1.57B | 1.46B | 1.20B | 969.00M | 1.11B | 813.30M | 697.70M | 587.20M | 554.20M | 536.10M | 501.70M | 404.70M | 358.80M | 205.60M |

| Interest Income | 19.00M | 21.00M | 3.00M | 3.10M | 7.60M | 7.30M | 5.90M | 4.00M | 3.10M | 1.90M | 1.30M | 3.40M | 2.90M | 1.90M | 1.10M | 7.20M | 5.70M | 5.50M | 4.30M | 5.50M | 2.40M | 1.80M | 4.90M | 15.60M | 7.40M |

| Interest Expense | 54.00M | 42.00M | 34.00M | 33.30M | 26.60M | 3.60M | 3.50M | 1.80M | 2.30M | 1.80M | 1.60M | 2.30M | 3.60M | 5.10M | 6.20M | 12.40M | 11.00M | 6.20M | 1.80M | 600.00K | 100.00K | 5.00M | 5.50M | 3.10M | 3.90M |

| Depreciation & Amortization | 104.00M | 341.00M | 313.00M | 276.70M | 330.80M | 115.80M | 124.00M | 151.50M | 147.10M | 120.40M | 122.80M | 111.20M | 87.60M | 62.60M | 52.30M | 49.60M | 32.70M | 27.70M | 24.50M | 24.40M | 35.30M | 25.40M | 14.00M | 11.10M | 5.60M |

| EBITDA | 522.00M | 1.02B | 855.00M | 693.10M | 524.80M | 533.10M | 578.40M | 580.90M | 530.80M | 560.70M | 568.20M | 463.80M | 464.30M | 363.40M | 268.50M | 45.90M | 239.40M | 190.20M | 183.70M | 191.20M | 166.10M | 109.10M | 104.30M | 94.70M | 31.50M |

| EBITDA Ratio | 17.59% | 31.71% | 29.26% | 29.57% | 30.33% | 19.60% | 21.17% | 21.00% | 21.11% | 22.22% | 24.39% | 27.08% | 25.00% | 24.28% | 23.78% | 14.59% | 22.15% | 22.27% | 24.51% | 27.02% | 25.92% | 18.60% | 21.92% | 22.30% | 14.05% |

| Operating Income | 418.00M | 640.00M | 514.00M | 416.40M | 467.80M | 445.00M | 471.80M | 451.20M | 402.90M | 440.30M | 445.40M | 345.80M | 376.90M | 302.10M | 216.50M | -9.90M | 201.70M | 157.00M | 154.50M | 161.30M | 138.00M | 88.30M | 85.40M | 65.10M | 18.50M |

| Operating Income Ratio | 14.08% | 20.69% | 18.19% | 17.77% | 17.77% | 16.36% | 17.26% | 16.31% | 16.02% | 17.45% | 19.12% | 17.30% | 20.29% | 20.12% | 18.27% | -0.82% | 20.26% | 18.46% | 20.80% | 22.54% | 20.42% | 14.88% | 17.11% | 15.22% | 8.20% |

| Total Other Income/Expenses | -35.00M | -23.00M | -32.00M | 73.80M | -20.20M | -4.40M | -59.20M | -56.40M | 12.70M | 4.30M | -1.00M | -77.40M | -10.90M | -6.40M | -5.10M | -6.20M | -6.00M | -700.00K | 2.50M | 4.90M | 2.30M | -3.20M | -600.00K | 15.40M | 3.50M |

| Income Before Tax | 383.00M | 634.00M | 511.00M | 490.20M | 168.50M | 440.60M | 412.60M | 394.80M | 415.60M | 444.60M | 444.40M | 350.70M | 366.00M | 295.70M | 211.40M | -16.10M | 195.70M | 156.30M | 157.00M | 166.20M | 140.30M | 85.10M | 84.80M | 80.50M | 22.00M |

| Income Before Tax Ratio | 12.90% | 20.49% | 18.08% | 20.91% | 6.40% | 16.20% | 15.10% | 14.27% | 16.53% | 17.62% | 19.07% | 17.55% | 19.71% | 19.70% | 17.84% | -1.34% | 19.66% | 18.38% | 21.13% | 23.23% | 20.76% | 14.34% | 16.99% | 18.82% | 9.75% |

| Income Tax Expense | 112.00M | 142.00M | 114.00M | 114.30M | 46.90M | 101.50M | 119.00M | 107.10M | 101.00M | 103.50M | 112.10M | 91.50M | 100.60M | 83.20M | 58.80M | -11.00M | 60.50M | 46.10M | 50.60M | 54.30M | 47.30M | 32.90M | 28.30M | 26.10M | 6.60M |

| Net Income | 270.00M | 490.00M | 396.00M | 376.00M | 121.70M | 339.30M | 293.50M | 286.80M | 309.50M | 336.30M | 322.50M | 254.30M | 263.30M | 208.40M | 81.40M | -6.00M | 135.20M | 110.20M | 106.40M | 111.90M | 93.00M | 52.20M | 56.50M | 54.40M | 15.40M |

| Net Income Ratio | 9.10% | 15.84% | 14.01% | 16.04% | 4.62% | 12.47% | 10.74% | 10.37% | 12.31% | 13.33% | 13.84% | 12.72% | 14.18% | 13.88% | 6.87% | -0.50% | 13.58% | 12.96% | 14.32% | 15.64% | 13.76% | 8.79% | 11.32% | 12.72% | 6.82% |

| EPS | 0.74 | 1.27 | 0.98 | 0.93 | 0.30 | 0.82 | 0.69 | 0.65 | 0.70 | 0.76 | 0.74 | 0.58 | 0.60 | 0.48 | 0.19 | -0.01 | 0.31 | 0.25 | 0.23 | 0.23 | 0.19 | 0.11 | 0.11 | 0.11 | 0.03 |

| EPS Diluted | 0.74 | 1.26 | 0.98 | 0.93 | 0.30 | 0.82 | 0.68 | 0.65 | 0.69 | 0.75 | 0.72 | 0.57 | 0.59 | 0.47 | 0.19 | -0.01 | 0.31 | 0.25 | 0.22 | 0.22 | 0.18 | 0.10 | 0.11 | 0.11 | 0.03 |

| Weighted Avg Shares Out | 365.36M | 386.10M | 402.50M | 404.10M | 408.00M | 412.30M | 425.70M | 439.10M | 441.90M | 440.00M | 437.90M | 436.20M | 435.90M | 435.00M | 432.60M | 431.30M | 432.10M | 437.80M | 464.40M | 494.10M | 495.60M | 498.10M | 499.60M | 499.60M | 499.60M |

| Weighted Avg Shares Out (Dil) | 366.20M | 388.00M | 404.80M | 405.10M | 409.00M | 415.10M | 429.40M | 442.20M | 446.10M | 447.80M | 447.30M | 446.50M | 444.30M | 444.00M | 441.90M | 431.30M | 442.80M | 446.10M | 477.60M | 504.50M | 505.90M | 506.20M | 508.10M | 508.10M | 508.10M |

Burberry shares sink 9% as luxury spending slowdown bites

Burberry sales screech to near-halt as luxury slowdown hits

Burberry share price has collapsed but a rebound is possible

Aviva, Royal Mail and Burberry update as heavyweight roll call continues: Thursday previews

JWN or BURBY: Which Is the Better Value Stock Right Now?

Is Burberry in trouble following LVMH sales miss?

Citi brokers react to Burberry's Daniel Lee collection

Top 40 High-Yield Blue-Chip U.K. Stocks: Autumn 2023

Boohoo and Burberry shares slide amid tough times for British fashion brands

Daniel Lee's Burberry turnaround vision dashed by analysts

Source: https://incomestatements.info

Category: Stock Reports