See more : Hankook Shell Oil Co.,Ltd. (002960.KS) Income Statement Analysis – Financial Results

Complete financial analysis of First Busey Corporation (BUSE) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of First Busey Corporation, a leading company in the Banks – Regional industry within the Financial Services sector.

- Suven Pharmaceuticals Limited (SUVENPHAR.NS) Income Statement Analysis – Financial Results

- iMedia Brands, Inc. (IMBI) Income Statement Analysis – Financial Results

- Exopharm Limited (EX1.AX) Income Statement Analysis – Financial Results

- Interlink Telecom Public Company Limited (ITEL.BK) Income Statement Analysis – Financial Results

- Tong Kee (Holding) Limited (8305.HK) Income Statement Analysis – Financial Results

First Busey Corporation (BUSE)

About First Busey Corporation

First Busey Corporation operates as the bank holding company for Busey Bank that provides retail and commercial banking products and services to individual, corporate, institutional, and governmental customers in the United States. The company operates through three segments: Banking, FirsTech, and Wealth Management. It offers customary types of demand and savings deposits; and commercial, agricultural, real estate construction, commercial and residential real estate, and consumer loans, as well as home equity lines of credit. The company also provides money transfer, safe deposit, IRA, and other fiduciary services through banking center, ATM and technology-based networks. In addition, it offers investment management, trust, estate advisory, and financial planning services, as well as business succession and employee retirement planning services; investment strategy consulting and fiduciary services; and security brokerage services. Further, the company provides asset management, philanthropic advisory, tax preparation, and professional farm management services; and commercial depository services, such as cash management services. Additionally, it offers payment technology solutions through its payment platform, such as walk-in payment processing for customers at retail pay agents; online bill payment solutions; customer service payments accepted over the telephone; mobile bill pay; direct debit services; electronic concentration of payments delivered to automated clearing house network; money management and credit card networks; and lockbox remittance processing to make payments by mail, as well as provides tools related to billing, reconciliation, bill reminders, and treasury services. The company has 46 banking centers in Illinois; 8 in Missouri; 3 in southwest Florida; and 1 in Indianapolis, Indiana. First Busey Corporation was founded in 1868 and is headquartered in Champaign, Illinois.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 50.82M | 450.24M | 403.50M | 401.20M | 403.64M | 331.40M | 287.84M | 229.83M | 176.61M | 160.52M | 162.65M | 169.00M | 169.41M | 179.90M | 180.42M | 179.76M | 143.19M | 104.98M | 94.50M | 79.67M | 72.92M | 68.13M | 65.01M | 61.05M | 53.60M | 47.60M | 43.10M | 9.87M | 8.95M |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 50.82M | 450.24M | 403.50M | 401.20M | 403.64M | 331.40M | 287.84M | 229.83M | 176.61M | 160.52M | 162.65M | 169.00M | 169.41M | 179.90M | 180.42M | 179.76M | 143.19M | 104.98M | 94.50M | 79.67M | 72.92M | 68.13M | 65.01M | 61.05M | 53.60M | 47.60M | 43.10M | 9.87M | 8.95M |

| Gross Profit Ratio | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 168.25M | 180.66M | 167.17M | 143.15M | 161.98M | 124.23M | 117.46M | 101.90M | 78.81M | 74.30M | 76.57M | 78.40M | 57.35M | 65.87M | 61.53M | 57.56M | 45.67M | 34.61M | 28.49M | 23.83M | 22.31M | 21.00M | 21.07M | 19.08M | 17.60M | 16.10M | 14.60M | 13.87M | 12.55M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 168.25M | 180.66M | 167.17M | 143.15M | 161.98M | 124.23M | 117.46M | 101.90M | 78.81M | 74.30M | 76.57M | 78.40M | 57.35M | 65.87M | 61.53M | 57.56M | 45.67M | 34.61M | 28.49M | 23.83M | 22.31M | 21.00M | 21.07M | 19.08M | 17.60M | 16.10M | 14.60M | 13.87M | 12.55M |

| Other Expenses | 0.00 | -98.09M | -413.85M | -416.14M | -431.18M | -277.07M | -267.68M | -237.79M | -183.81M | -172.44M | -182.28M | -194.33M | -153.96M | -167.86M | -562.73M | -193.68M | -44.04M | -26.15M | -37.75M | -39.78M | -39.72M | -32.56M | -15.63M | -8.37M | -18.40M | -14.20M | -11.80M | 19.34M | 17.09M |

| Operating Expenses | 285.53M | 6.13M | -246.68M | -272.99M | -269.20M | -152.85M | -150.22M | -135.89M | -105.00M | -98.14M | -105.71M | -115.93M | -96.61M | -101.99M | -501.20M | -136.12M | 1.63M | 8.46M | -9.26M | -15.95M | -17.41M | -11.56M | 5.44M | 10.71M | -800.00K | 1.90M | 2.80M | 33.21M | 29.64M |

| Cost & Expenses | 441.84M | 6.13M | -246.68M | -272.99M | -269.20M | -152.85M | -150.22M | -135.89M | -105.00M | -98.14M | -105.71M | -115.93M | -96.61M | -101.99M | -501.20M | -136.12M | 1.63M | 8.46M | -9.26M | -15.95M | -17.41M | -11.56M | 5.44M | 10.71M | -800.00K | 1.90M | 2.80M | 33.21M | 29.64M |

| Interest Income | 479.37M | 359.99M | 298.80M | 326.60M | 356.23M | 286.03M | 224.30M | 164.89M | 118.02M | 108.08M | 108.70M | 116.92M | 132.82M | 156.18M | 184.59M | 220.48M | 201.90M | 146.37M | 116.30M | 85.92M | 73.85M | 76.09M | 89.99M | 93.24M | 72.30M | 67.10M | 63.80M | 61.20M | 54.49M |

| Interest Expense | 159.92M | 36.55M | 28.10M | 43.66M | 69.01M | 44.63M | 20.94M | 10.23M | 6.21M | 6.50M | 8.63M | 14.77M | 22.43M | 39.03M | 70.11M | 97.15M | 100.41M | 69.85M | 45.34M | 30.04M | 25.62M | 30.49M | 46.44M | 50.48M | 34.90M | 33.00M | 31.10M | 30.03M | 26.52M |

| Depreciation & Amortization | 22.71M | 22.11M | 22.88M | 22.28M | 21.43M | 15.41M | 13.82M | 11.73M | 3.19M | 2.88M | 3.13M | 3.32M | 3.54M | 4.09M | 4.36M | 14.15M | 8.05M | 5.46M | 4.72M | 3.53M | 3.53M | 4.20M | 5.72M | 6.05M | 4.50M | 3.90M | 3.50M | 3.36M | 2.80M |

| EBITDA | 0.00 | -20.22M | -31.71M | -20.72M | -29.64M | -11.85M | -13.10M | 88.15M | 68.59M | 58.76M | 51.44M | 41.61M | 53.91M | 42.97M | -378.73M | 0.00 | 63.90M | 60.84M | 54.61M | 45.25M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA Ratio | 0.00% | 49.74% | 41.66% | 34.45% | 35.67% | 58.53% | 49.63% | 42.81% | 42.35% | 40.66% | 36.93% | 33.36% | 45.06% | 45.58% | -175.39% | 32.14% | 106.76% | 113.26% | 95.19% | 84.41% | 80.97% | 89.20% | 117.17% | 127.46% | 106.90% | 112.18% | 114.62% | 470.51% | 462.25% |

| Operating Income | 0.00 | 212.31M | 156.82M | 128.21M | 134.44M | 178.55M | 137.62M | 93.94M | 71.61M | 62.38M | 56.93M | 53.07M | 72.79M | 77.92M | -320.78M | 43.63M | 144.82M | 113.44M | 85.24M | 63.72M | 55.51M | 56.57M | 70.45M | 71.77M | 52.80M | 49.50M | 45.90M | 43.08M | 38.59M |

| Operating Income Ratio | 0.00% | 47.15% | 38.87% | 31.96% | 33.31% | 53.88% | 47.81% | 40.87% | 40.55% | 38.86% | 35.00% | 31.40% | 42.97% | 43.31% | -177.80% | 24.27% | 101.13% | 108.06% | 90.20% | 79.98% | 76.12% | 83.04% | 108.37% | 117.55% | 98.51% | 103.99% | 106.50% | 436.52% | 430.97% |

| Total Other Income/Expenses | 153.90M | -25.65M | -31.71M | -27.95M | -24.14M | -11.85M | -15.37M | -7.04M | -5.55M | -4.96M | -5.42M | -7.16M | -9.06M | -10.28M | -208.16M | -53.52M | 0.00 | 0.00 | 0.00 | 0.00 | -25.62M | -30.49M | -46.44M | -50.48M | -34.90M | -33.00M | -31.10M | -30.03M | -26.52M |

| Income Before Tax | 153.90M | 161.74M | 156.82M | 128.21M | 134.44M | 133.93M | 108.11M | 76.42M | 59.70M | 50.31M | 42.84M | 32.85M | 44.84M | 32.69M | -398.78M | -53.52M | 44.41M | 43.59M | 39.89M | 33.68M | 29.89M | 26.08M | 24.02M | 21.29M | 17.90M | 16.50M | 14.80M | 13.05M | 12.07M |

| Income Before Tax Ratio | 302.82% | 35.92% | 38.87% | 31.96% | 33.31% | 40.41% | 37.56% | 33.25% | 33.81% | 31.34% | 26.34% | 19.44% | 26.47% | 18.17% | -221.03% | -29.77% | 31.01% | 41.52% | 42.22% | 42.27% | 40.99% | 38.28% | 36.94% | 34.87% | 33.40% | 34.66% | 34.34% | 132.20% | 134.84% |

| Income Tax Expense | 31.34M | 33.43M | 33.37M | 27.86M | 31.49M | 35.00M | 45.39M | 26.72M | 20.70M | 17.53M | 14.11M | 10.50M | 14.97M | 9.46M | -75.67M | -15.57M | 12.93M | 14.70M | 12.96M | 11.22M | 10.03M | 8.17M | 8.36M | 7.24M | 5.40M | 5.10M | 4.40M | 3.74M | 3.30M |

| Net Income | 122.57M | 128.31M | 123.45M | 100.34M | 102.95M | 98.93M | 62.73M | 49.69M | 39.01M | 32.77M | 28.73M | 22.36M | 29.87M | 23.23M | -323.11M | -37.95M | 31.48M | 28.89M | 26.93M | 22.45M | 19.86M | 17.90M | 15.65M | 14.05M | 12.50M | 11.40M | 10.40M | 9.31M | 8.78M |

| Net Income Ratio | 241.16% | 28.50% | 30.59% | 25.01% | 25.51% | 29.85% | 21.79% | 21.62% | 22.09% | 20.42% | 17.66% | 13.23% | 17.63% | 12.91% | -179.09% | -21.11% | 21.98% | 27.52% | 28.50% | 28.18% | 27.24% | 26.28% | 24.08% | 23.02% | 23.32% | 23.95% | 24.13% | 94.30% | 98.00% |

| EPS | 2.21 | 2.32 | 2.23 | 1.84 | 1.88 | 2.02 | 1.47 | 1.42 | 1.32 | 1.11 | 0.87 | 0.66 | 0.87 | 0.81 | -27.06 | -3.18 | 3.39 | 4.05 | 3.87 | 3.30 | 2.92 | 2.64 | 2.32 | 2.10 | 1.84 | 1.66 | 1.50 | 1.37 | 1.27 |

| EPS Diluted | 2.18 | 2.29 | 2.20 | 1.83 | 1.87 | 2.01 | 1.45 | 1.40 | 1.32 | 1.11 | 0.86 | 0.66 | 0.87 | 0.81 | -23.20 | -3.18 | 3.39 | 4.05 | 3.87 | 3.27 | 2.90 | 2.62 | 2.30 | 2.06 | 1.80 | 1.62 | 1.48 | 1.34 | 1.27 |

| Weighted Avg Shares Out | 55.43M | 55.39M | 55.37M | 54.57M | 54.85M | 48.85M | 42.67M | 35.00M | 29.02M | 28.87M | 28.92M | 28.88M | 28.20M | 22.30M | 11.94M | 11.95M | 9.29M | 7.13M | 6.96M | 6.80M | 6.80M | 6.78M | 6.75M | 6.69M | 6.79M | 6.87M | 6.93M | 6.79M | 6.93M |

| Weighted Avg Shares Out (Dil) | 56.26M | 56.14M | 56.01M | 54.83M | 55.13M | 49.22M | 43.13M | 35.41M | 29.10M | 29.10M | 29.02M | 28.88M | 28.44M | 22.30M | 13.93M | 11.95M | 9.29M | 7.13M | 6.96M | 6.87M | 6.85M | 6.83M | 6.81M | 6.82M | 6.94M | 7.04M | 7.03M | 6.94M | 6.93M |

$0.56 EPS Expected for First Busey Co. (NASDAQ:BUSE) This Quarter

Brewers bench coach Murphy recovering from heart attack

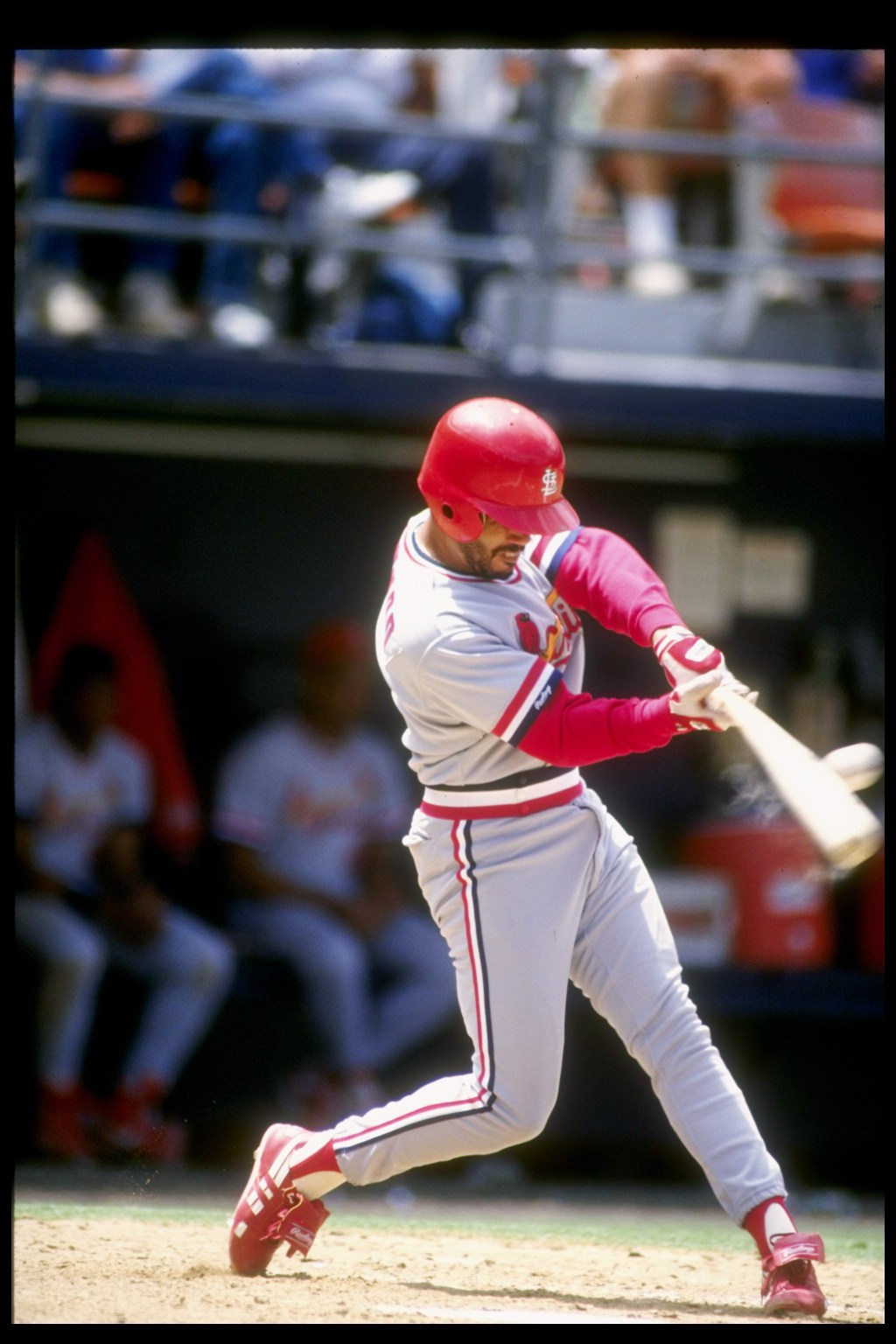

Cardinals-Brewers game called off as coronavirus outbreak rocks MLB

Dividend Challenger Highlights: Week Of July 26

Dividend Challenger Highlights: Week Of July 19

Simulation: Can Giants beat Cards in replay of 1987 NLCS?

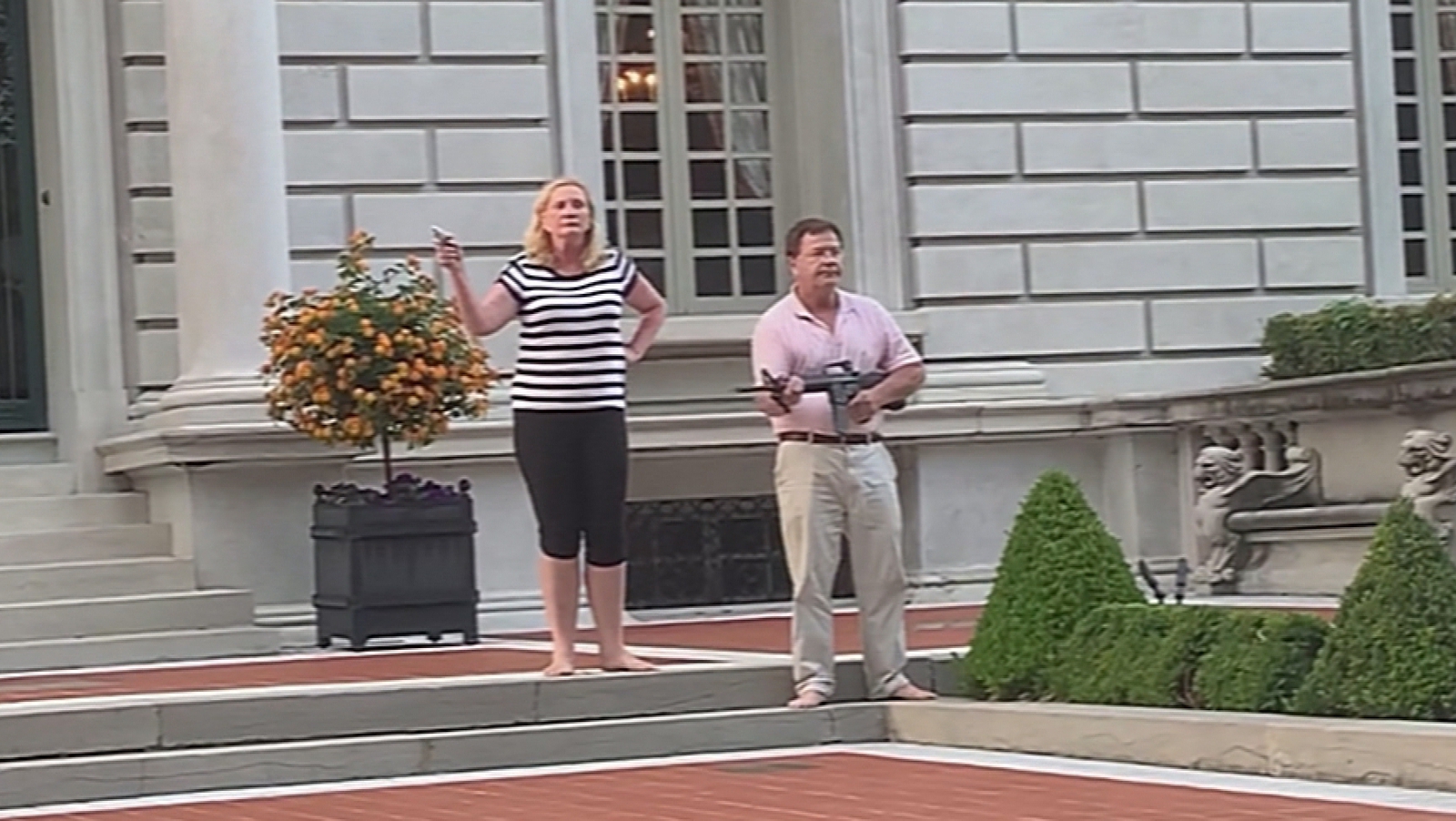

Armed St Louis couple claim 500 BLM protesters threatened to kill them

Opinion: The International Stupid Stakes are back – and Britain and the US are neck and neck

White couple who pointed gun at protesters say they support Black Lives Matter

US couple draw guns on protesters passing their home

Source: https://incomestatements.info

Category: Stock Reports