See more : Weihai Guangwei Composites Co., Ltd. (300699.SZ) Income Statement Analysis – Financial Results

Complete financial analysis of Compañía de Minas Buenaventura S.A.A. (BVN) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Compañía de Minas Buenaventura S.A.A., a leading company in the Other Precious Metals industry within the Basic Materials sector.

- Corporación Acciona Energías Renovables, S.A. (ANE.MC) Income Statement Analysis – Financial Results

- Amedeo Air Four Plus Limited (AA4.L) Income Statement Analysis – Financial Results

- Creo Co.,Ltd. (9698.T) Income Statement Analysis – Financial Results

- Arqit Quantum Inc. (ARQQW) Income Statement Analysis – Financial Results

- Nala Digital Commerce Ltd (NALA.TA) Income Statement Analysis – Financial Results

Compañía de Minas Buenaventura S.A.A. (BVN)

About Compañía de Minas Buenaventura S.A.A.

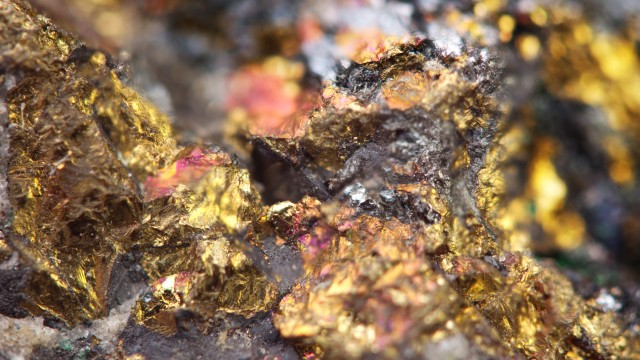

Compañía de Minas Buenaventura S.A.A. engages in the exploration, mining development, processing, and trading of precious and base metals. The company explores for gold, silver, lead, zinc, and copper metals. It operates operating mining units, including Tambomayo located in the Caylloma province, Orcopampa Unit located in the province of Castilla, Uchucchacua located in province of Oyón, Julcani located in province of Angaraes, Peru, as well as San Gabrie located in the province of General Sánchez Cerro, in the Moquegua region. The company also owns interests in Colquijirca, La Zanja, Yanacocha, Cerro Verde, El Brocal, Coimolache, Yumpaq, San Gregorio mines, and Trapiche mining unit. In addition, it produces manganese sulphate monohydrate and other by-products generated from minerals; and operates hydroelectric power plants. The company was incorporated in 1953 and is based in Lima, Peru.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 823.85M | 824.80M | 900.45M | 676.54M | 867.89M | 1.17B | 1.27B | 1.07B | 951.86M | 1.17B | 1.29B | 1.56B | 1.56B | 1.10B | 881.51M | 815.36M | 786.43M | 646.87M | 344.70M | 315.76M | 234.20M | 186.87M | 162.61M | 136.72M | 99.44M | 60.50M | 70.00M | 84.70M |

| Cost of Revenue | 732.60M | 763.47M | 813.11M | 652.61M | 799.58M | 982.96M | 980.25M | 824.97M | 951.80M | 949.53M | 1.02B | 943.22M | 654.76M | 503.98M | 422.53M | 371.80M | 233.04M | 265.31M | 139.84M | 141.62M | 83.69M | 93.99M | 99.45M | 85.34M | 68.25M | 50.60M | 54.30M | 58.30M |

| Gross Profit | 91.25M | 61.33M | 87.34M | 23.93M | 68.31M | 184.42M | 294.12M | 243.82M | 67.00K | 215.64M | 268.66M | 620.31M | 901.87M | 599.79M | 458.98M | 443.56M | 553.39M | 381.56M | 204.86M | 174.14M | 150.52M | 92.88M | 63.16M | 51.38M | 31.19M | 9.90M | 15.70M | 26.40M |

| Gross Profit Ratio | 11.08% | 7.44% | 9.70% | 3.54% | 7.87% | 15.80% | 23.08% | 22.81% | 0.01% | 18.51% | 20.90% | 39.67% | 57.94% | 54.34% | 52.07% | 54.40% | 70.37% | 58.99% | 59.43% | 55.15% | 64.27% | 49.70% | 38.84% | 37.58% | 31.36% | 16.36% | 22.43% | 31.17% |

| Research & Development | 0.00 | 401.00K | 379.00K | 352.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 49.59M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 72.12M | 67.73M | 67.59M | 67.19M | 76.30M | 78.76M | 83.60M | 81.69M | 86.53M | 101.10M | 78.18M | 101.46M | 135.43M | 144.88M | 128.41M | 70.60M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 64.07M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 18.26M | 20.22M | 20.83M | 18.53M | 24.31M | 27.52M | 24.09M | 21.73M | 19.48M | 16.61M | 16.04M | 18.09M | 11.62M | 9.38M | 10.05M | 15.39M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -26.37M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 90.38M | 87.95M | 88.41M | 85.72M | 100.61M | 106.28M | 107.69M | 103.43M | 106.01M | 117.71M | 94.22M | 119.55M | 147.05M | 154.25M | 138.45M | 85.99M | 150.41M | 92.77M | 76.07M | 66.17M | 80.78M | 42.17M | 42.01M | 34.42M | 23.28M | 17.00M | 17.90M | 18.10M |

| Other Expenses | -20.25M | 16.79M | 13.96M | 12.63M | 23.63M | 30.08M | 49.24M | 12.92M | 34.96M | 51.09M | 21.31M | 81.12M | 109.36M | 7.96M | 30.01M | 55.23M | 540.00K | -14.01M | 32.69M | 18.10M | -193.24M | -1.88M | 1.00K | 12.62M | 24.81M | 26.90M | 32.20M | 11.90M |

| Operating Expenses | 70.13M | 105.14M | 102.37M | 98.34M | 124.24M | 136.36M | 153.42M | 111.62M | 136.41M | 154.05M | 129.77M | 198.46M | 196.64M | 162.21M | 168.46M | 141.22M | 150.95M | 78.76M | 108.76M | 84.28M | -112.46M | 40.29M | 42.01M | 47.04M | 48.09M | 43.90M | 50.10M | 30.00M |

| Cost & Expenses | 802.72M | 868.61M | 915.48M | 750.96M | 923.82M | 1.12B | 1.13B | 936.60M | 1.09B | 1.10B | 1.15B | 1.14B | 851.40M | 666.18M | 590.99M | 513.02M | 383.99M | 344.07M | 248.59M | 225.90M | -28.77M | 134.28M | 141.46M | 132.38M | 116.34M | 94.50M | 104.40M | 88.30M |

| Interest Income | 2.11M | 14.44M | 5.95M | 2.41M | 9.68M | 9.69M | 5.52M | 6.83M | 11.03M | 8.41M | 6.62M | 9.49M | 11.83M | 8.20M | 6.12M | 17.85M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 39.56M | 54.14M | 60.63M | 37.82M | 42.17M | 38.46M | 34.62M | 31.58M | 27.62M | 11.32M | 10.97M | 8.29M | 11.82M | 12.27M | 15.09M | 33.93M | 473.85M | 0.00 | 0.00 | 0.00 | 439.80M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 201.61M | 183.26M | 196.49M | 199.99M | 240.55M | 260.28M | 218.10M | 196.76M | 2.58M | 121.00K | 3.96M | 147.45M | 94.50M | 71.69M | 73.54M | 62.99M | 38.55M | 48.74M | 43.01M | 33.41M | 23.16M | 20.70M | 18.80M | 12.62M | 24.81M | 25.90M | 32.20M | 11.90M |

| EBITDA | 173.71M | 178.97M | 101.62M | 103.77M | 180.27M | 321.73M | 327.50M | -230.86M | -298.70M | 55.26M | 95.33M | 969.32M | 1.21B | 950.51M | 809.57M | 268.89M | 458.17M | 351.54M | 144.30M | 134.37M | 286.13M | 73.29M | 39.94M | 16.96M | 7.91M | -6.12M | -4.20M | 5.20M |

| EBITDA Ratio | 21.08% | 37.42% | 22.45% | -11.65% | 0.17% | 4.85% | 12.51% | -21.17% | -31.38% | 4.74% | 2.88% | 66.71% | 82.16% | 85.73% | 93.48% | 37.90% | 105.68% | 58.43% | -45.21% | -24.63% | 194.96% | -20.10% | -13.24% | -60.45% | -58.10% | -117.19% | -97.86% | -28.45% |

| Operating Income | 21.12M | 131.82M | 198.44M | -74.41M | -2.37M | 53.76M | 105.52M | 132.20M | -147.60M | 61.60M | 132.30M | 418.23M | 705.22M | 437.59M | 287.20M | 283.74M | 180.17M | 302.80M | 96.11M | 89.87M | 48.57M | 39.36M | 14.47M | 4.35M | -20.82M | -38.10M | -34.40M | -2.20M |

| Operating Income Ratio | 2.56% | 15.98% | 22.04% | -11.00% | -0.27% | 4.60% | 8.28% | 12.37% | -15.51% | 5.29% | 10.29% | 26.75% | 45.30% | 39.64% | 32.58% | 34.80% | 22.91% | 46.81% | 27.88% | 28.46% | 20.74% | 21.06% | 8.90% | 3.18% | -20.94% | -62.98% | -49.14% | -2.60% |

| Total Other Income/Expenses | 61.40M | 163.45M | 167.09M | 23.18M | 52.43M | -31.27M | -12.89M | -387.43M | -203.61M | -26.07M | -41.67M | -57.81M | -671.00K | 410.63M | 433.75M | -111.78M | 234.95M | 291.71M | 298.27M | 149.24M | -38.32M | 78.31M | 54.72M | 90.46M | 70.27M | 75.54M | 76.30M | 36.00M |

| Income Before Tax | 82.52M | 124.43M | 101.13M | -130.32M | -43.54M | 22.48M | 92.55M | -255.24M | -351.26M | 35.49M | 12.46M | 885.38M | 1.18B | 843.70M | 733.54M | 171.96M | 435.06M | 594.51M | 321.27M | 253.92M | 10.25M | 117.68M | 69.19M | 94.81M | 49.45M | 35.40M | 41.90M | 30.70M |

| Income Before Tax Ratio | 10.02% | 15.09% | 11.23% | -19.26% | -5.02% | 1.93% | 7.26% | -23.88% | -36.90% | 3.05% | 0.97% | 56.63% | 75.58% | 76.44% | 83.21% | 21.09% | 55.32% | 91.91% | 93.20% | 80.42% | 4.38% | 62.97% | 42.55% | 69.34% | 49.73% | 58.51% | 59.86% | 36.25% |

| Income Tax Expense | 42.99M | 41.00K | -23.67M | 25.43M | -25.59M | 26.93M | 18.01M | 53.50M | 14.77M | 66.01M | 86.61M | 142.59M | 212.84M | 116.33M | 64.34M | -26.65M | 43.98M | 64.03M | 24.50M | 31.05M | -54.50M | 7.14M | 7.13M | 5.74M | 4.13M | 3.40M | 1.70M | 4.80M |

| Net Income | 19.86M | 124.39M | 124.80M | -155.75M | -17.95M | -4.45M | 60.82M | -323.49M | -317.21M | -76.07M | -101.68M | 684.69M | 861.43M | 662.93M | 593.56M | 203.33M | 274.76M | 428.06M | 274.49M | 208.71M | 48.14M | 110.53M | 62.07M | 70.96M | 45.32M | 32.00M | 40.20M | 25.90M |

| Net Income Ratio | 2.41% | 15.08% | 13.86% | -23.02% | -2.07% | -0.38% | 4.77% | -30.27% | -33.33% | -6.53% | -7.91% | 43.79% | 55.34% | 60.06% | 67.33% | 24.94% | 34.94% | 66.17% | 79.63% | 66.10% | 20.55% | 59.15% | 38.17% | 51.90% | 45.58% | 52.89% | 57.43% | 30.58% |

| EPS | 0.08 | 0.49 | 0.49 | -0.61 | -0.07 | -0.01 | 0.24 | -1.27 | -1.25 | -0.30 | -0.40 | 2.69 | 3.39 | 2.61 | 2.33 | 0.60 | 1.08 | 1.68 | 1.14 | 0.81 | 0.20 | 0.44 | 0.25 | 0.14 | 0.01 | 0.01 | 0.16 | 0.11 |

| EPS Diluted | 0.08 | 0.49 | 0.49 | -0.61 | -0.07 | -0.01 | 0.24 | -1.27 | -1.25 | -0.30 | -0.40 | 2.69 | 3.39 | 2.61 | 2.33 | 0.60 | 1.08 | 1.68 | 1.14 | 0.81 | 0.20 | 0.44 | 0.25 | 0.14 | 0.01 | 0.01 | 0.16 | 0.11 |

| Weighted Avg Shares Out | 253.99M | 253.99M | 253.99M | 253.99M | 253.99M | 350.06M | 253.99M | 254.11M | 254.19M | 254.19M | 254.19M | 254.23M | 254.44M | 254.00M | 254.75M | 254.44M | 254.41M | 254.44M | 251.42M | 255.03M | 240.69M | 254.44M | 253.22M | 252.50M | 252.50M | 246.15M | 273.65M | 246.67M |

| Weighted Avg Shares Out (Dil) | 253.99M | 253.99M | 253.99M | 253.99M | 253.99M | 350.06M | 253.99M | 254.19M | 254.19M | 254.19M | 254.19M | 254.23M | 254.44M | 254.00M | 254.75M | 254.44M | 254.41M | 254.44M | 251.42M | 255.03M | 240.69M | 254.45M | 253.22M | 252.50M | 252.50M | 246.15M | 273.65M | 246.67M |

Buenaventura Cordially Invites You to Its First Quarter 2023 Earnings Conference Call

Buenaventura Cordially Invites You to Its First Quarter 2023 Earnings Conference Call

Compañía de Minas Buenaventura: Solid Miner Struggling In Challenging Environment

3 Low-Beta Stocks to Buy to Combat the Volatile Market

The 7 Best Gold Stocks to Buy for Portfolio Diversification

Buenaventura Announces Fourth Quarter and Full Year 2022 Results

Buenaventura Announces Fourth Quarter and Full Year 2022 Results

7 Dividend-Paying Stocks to Consider

Buenaventura Announces Fourth Quarter 2022 Production and Volume Sold per Metal Results

Buenaventura Announces Fourth Quarter 2022 Production and Volume Sold per Metal Results

Source: https://incomestatements.info

Category: Stock Reports