See more : EDGE Technology Inc. (4268.T) Income Statement Analysis – Financial Results

Complete financial analysis of Broadway Financial Corporation (BYFC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Broadway Financial Corporation, a leading company in the Banks – Regional industry within the Financial Services sector.

- Curtis Mathes Corporation (CMCZ) Income Statement Analysis – Financial Results

- PlantX Life Inc. (PLTXF) Income Statement Analysis – Financial Results

- Arbe Robotics Ltd. (ARBE) Income Statement Analysis – Financial Results

- Nexxen International Ltd. (NEXN) Income Statement Analysis – Financial Results

- Beijing Energy International Holding Co., Ltd. (PVLTF) Income Statement Analysis – Financial Results

Broadway Financial Corporation (BYFC)

About Broadway Financial Corporation

Broadway Financial Corporation operates as the holding company for City First Bank, National Association that provides various banking products and services in the United States. It accepts various deposit accounts, including savings accounts, checking accounts, NOW accounts, money market accounts, and fixed-term certificates of deposit. The company also offers mortgage loans, which are secured by multi-family residential properties; single family residential properties; and commercial real estate, including charter schools, community facilities, and churches, as well as commercial business, construction, and consumer loans. In addition, it invests in securities issued by federal government agencies, residential mortgage-backed securities, and other investments. The company operates through three branch offices. Broadway Financial Corporation was founded in 1946 and is headquartered in Los Angeles, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 33.89M | 34.06M | 24.22M | 13.08M | 11.35M | 11.01M | 13.08M | 12.46M | 14.20M | 12.15M | 12.02M | 14.08M | 17.78M | 23.22M | 19.91M | 15.71M | 12.37M | 10.96M | 10.67M | 10.85M | 9.55M | 8.90M | 7.57M | 7.27M | 7.50M | 6.20M | 6.00M | 5.20M |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 33.89M | 34.06M | 24.22M | 13.08M | 11.35M | 11.01M | 13.08M | 12.46M | 14.20M | 12.15M | 12.02M | 14.08M | 17.78M | 23.22M | 19.91M | 15.71M | 12.37M | 10.96M | 10.67M | 10.85M | 9.55M | 8.90M | 7.57M | 7.27M | 7.50M | 6.20M | 6.00M | 5.20M |

| Gross Profit Ratio | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 15.90M | 14.53M | 20.95M | 9.78M | 8.66M | 8.31M | 8.41M | 8.46M | 10.03M | 9.20M | 7.85M | 8.43M | 8.97M | 9.06M | 8.32M | 7.40M | 5.98M | 4.64M | 4.59M | 4.58M | 4.00M | 3.67M | 3.26M | 2.93M | 2.90M | 2.60M | 2.50M | 2.10M |

| Selling & Marketing | 168.00K | 137.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 123.00K | 163.00K | 190.00K | 200.00K | 200.00K | 200.00K | 200.00K |

| SG&A | 16.07M | 14.53M | 20.95M | 9.78M | 8.66M | 8.31M | 8.41M | 8.46M | 10.03M | 9.20M | 7.85M | 8.43M | 8.97M | 9.06M | 8.32M | 7.40M | 5.98M | 4.64M | 4.59M | 4.58M | 4.00M | 3.79M | 3.42M | 3.12M | 3.10M | 2.80M | 2.70M | 2.30M |

| Other Expenses | 0.00 | -37.94M | -50.15M | -23.91M | -20.56M | -13.52M | -13.41M | -15.79M | -15.87M | -14.95M | -15.31M | -14.66M | -26.37M | -19.75M | -29.34M | -8.23M | -6.07M | -5.42M | -5.99M | -8.02M | -7.23M | -5.83M | 0.00 | 0.00 | -4.90M | -4.30M | -3.70M | -4.50M |

| Operating Expenses | 24.77M | -23.41M | -29.20M | -14.13M | -11.90M | -5.21M | -5.00M | -7.33M | -5.84M | -5.75M | -7.46M | -6.23M | -17.40M | -10.69M | -21.02M | -836.00K | -90.00K | -776.00K | -1.40M | -3.45M | -3.23M | -2.04M | 163.00M | 190.00M | -1.80M | -1.50M | -1.00M | -2.20M |

| Cost & Expenses | 24.77M | -23.41M | -29.20M | -14.13M | -11.90M | -5.21M | -5.00M | -7.33M | -5.84M | -5.75M | -7.46M | -6.23M | -17.40M | -10.69M | -21.02M | -836.00K | -90.00K | -776.00K | -1.40M | -3.45M | -3.23M | -2.04M | 163.00M | 190.00M | -1.80M | -1.50M | -1.00M | -2.20M |

| Interest Income | 47.23M | 36.27M | 24.75M | 17.64M | 16.85M | 15.24M | 16.29M | 15.29M | 15.16M | 15.73M | 15.97M | 19.89M | 25.12M | 29.84M | 28.67M | 25.48M | 21.25M | 17.48M | 15.84M | 13.98M | 12.17M | 12.47M | 13.00M | 12.29M | 11.40M | 9.70M | 9.10M | 8.80M |

| Interest Expense | 17.77M | 3.41M | 3.75M | 5.48M | 6.39M | 4.93M | 4.35M | 3.88M | 3.86M | 3.87M | 4.86M | 6.43M | 8.05M | 9.27M | 9.99M | 11.17M | 10.13M | 7.64M | 6.65M | 4.56M | 3.80M | 4.57M | 6.25M | 5.77M | 5.10M | 4.40M | 4.00M | 3.50M |

| Depreciation & Amortization | 775.00K | 811.00K | 680.00K | 121.00K | 227.00K | 241.00K | 256.00K | 251.00K | 238.00K | 241.00K | 214.00K | 306.00K | 501.00K | 611.00K | 520.00K | 430.00K | 376.00K | 541.00K | 637.00K | 338.00K | 938.00K | 269.00K | 178.00K | -21.00K | 700.00K | 200.00K | 300.00K | 200.00K |

| EBITDA | 7.30M | 8.93M | -4.21M | -928.00K | 0.00 | 0.00 | 3.99M | 0.00 | 4.74M | 0.00 | 0.00 | 0.00 | 0.00 | 7.04M | 0.00 | 8.13M | 0.00 | 5.27M | 5.47M | 4.47M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA Ratio | 21.54% | 33.65% | -17.79% | -7.10% | -2.85% | 54.89% | 63.73% | 43.21% | 60.57% | 54.65% | 39.77% | 57.90% | 4.93% | 56.58% | -3.00% | 97.42% | 102.31% | 97.86% | 92.86% | 71.35% | 75.97% | 80.08% | 100.32% | 95.43% | 85.33% | 79.03% | 88.33% | 61.54% |

| Operating Income | 6.52M | 10.65M | -4.99M | -1.05M | -551.00K | 5.80M | 8.08M | 5.13M | 8.36M | 6.40M | 4.57M | 7.84M | 376.00K | 12.53M | -1.12M | 14.87M | 12.28M | 10.18M | 9.27M | 7.40M | 6.31M | 6.86M | 7.41M | 6.96M | 5.70M | 4.70M | 5.00M | 3.00M |

| Operating Income Ratio | 19.25% | 31.26% | -20.59% | -8.02% | -4.85% | 52.70% | 61.77% | 41.20% | 58.89% | 52.67% | 37.99% | 55.72% | 2.12% | 53.95% | -5.61% | 94.68% | 99.27% | 92.92% | 86.89% | 68.24% | 66.14% | 77.05% | 97.97% | 95.72% | 76.00% | 75.81% | 83.33% | 57.69% |

| Total Other Income/Expenses | 0.00 | 0.00 | -2.50M | -649.00K | -50.00K | 0.00 | 1.18M | 0.00 | 0.00 | 365.00K | -1.96M | 2.52M | -8.05M | 0.00 | -9.99M | -8.13M | 0.00 | -5.27M | -5.47M | 0.00 | -3.80M | -4.57M | -6.25M | -5.77M | -5.10M | -4.40M | -4.00M | -3.50M |

| Income Before Tax | 6.52M | 8.12M | -4.89M | -1.05M | -551.00K | 871.00K | 3.73M | 1.26M | 4.50M | 2.53M | -297.00K | 1.42M | -7.68M | 3.26M | -11.11M | 3.71M | 2.14M | 2.54M | 2.62M | 2.85M | 2.51M | 2.29M | 1.16M | 1.18M | 600.00K | 300.00K | 1.00M | -500.00K |

| Income Before Tax Ratio | 19.25% | 23.84% | -20.18% | -8.02% | -4.85% | 7.91% | 28.53% | 10.07% | 31.68% | 20.84% | -2.47% | 10.07% | -43.17% | 14.02% | -55.79% | 23.60% | 17.33% | 23.16% | 24.55% | 26.24% | 26.31% | 25.71% | 15.34% | 16.29% | 8.00% | 4.84% | 16.67% | -9.62% |

| Income Tax Expense | 1.99M | 2.41M | -937.00K | -407.00K | -345.00K | 56.00K | 1.86M | -2.23M | -4.57M | 3.00K | 4.00K | 829.00K | 1.84M | 1.34M | -4.65M | 1.41M | 690.00K | 875.00K | 958.00K | 1.14M | 962.00K | 847.00K | 476.00K | 507.00K | 200.00K | 100.00K | 400.00K | -200.00K |

| Net Income | 4.51M | 5.64M | -3.95M | -642.00K | -206.00K | 815.00K | 1.87M | 3.48M | 9.07M | 2.53M | -301.00K | 588.00K | -9.52M | 1.92M | -6.46M | 2.30M | 1.45M | 1.66M | 1.66M | 1.71M | 1.55M | 1.44M | 685.00K | 677.00K | 400.00K | 200.00K | 600.00K | -300.00K |

| Net Income Ratio | 13.32% | 16.55% | -16.31% | -4.91% | -1.81% | 7.41% | 14.29% | 27.94% | 63.89% | 20.81% | -2.50% | 4.18% | -53.54% | 8.25% | -32.45% | 14.65% | 11.75% | 15.18% | 15.57% | 15.75% | 16.23% | 16.19% | 9.05% | 9.32% | 5.33% | 3.23% | 10.00% | -5.77% |

| EPS | 0.52 | 0.62 | -0.53 | -0.19 | -0.06 | 0.24 | 0.56 | 0.96 | 2.50 | 0.92 | -0.12 | 0.33 | -5.46 | 1.10 | -3.71 | 1.18 | 0.78 | 0.97 | 1.04 | 1.05 | 0.82 | 0.79 | 0.37 | 0.37 | 0.18 | 0.10 | 0.28 | -0.16 |

| EPS Diluted | 0.51 | 0.62 | -0.53 | -0.19 | -0.06 | 0.24 | 0.56 | 0.96 | 2.50 | 0.92 | -0.12 | 0.33 | -5.46 | 1.10 | -3.71 | 1.18 | 0.74 | 0.90 | 1.00 | 0.99 | 0.77 | 0.77 | 0.37 | 0.37 | 0.18 | 0.10 | 0.28 | -0.16 |

| Weighted Avg Shares Out | 8.63M | 9.05M | 7.52M | 3.40M | 3.35M | 3.35M | 3.33M | 3.62M | 3.63M | 2.76M | 2.53M | 1.81M | 1.74M | 1.74M | 1.74M | 1.75M | 1.70M | 1.60M | 1.52M | 1.55M | 1.79M | 1.77M | 1.78M | 1.75M | 2.29M | 2.11M | 2.12M | 1.82M |

| Weighted Avg Shares Out (Dil) | 8.74M | 9.10M | 7.52M | 3.40M | 3.35M | 3.35M | 3.34M | 3.64M | 3.63M | 2.76M | 2.53M | 1.81M | 1.74M | 1.74M | 1.74M | 1.76M | 1.79M | 1.72M | 1.58M | 1.65M | 1.91M | 1.82M | 1.78M | 1.75M | 2.29M | 2.11M | 2.16M | 1.82M |

Broadway Group tekankan ekonomi digital jawab tantangan bisnis kuliner

U.S. stocks lower at close of trade; Dow Jones Industrial Average down 1.51%

Netflix to shift $100 million into Black-run banks, credit unions

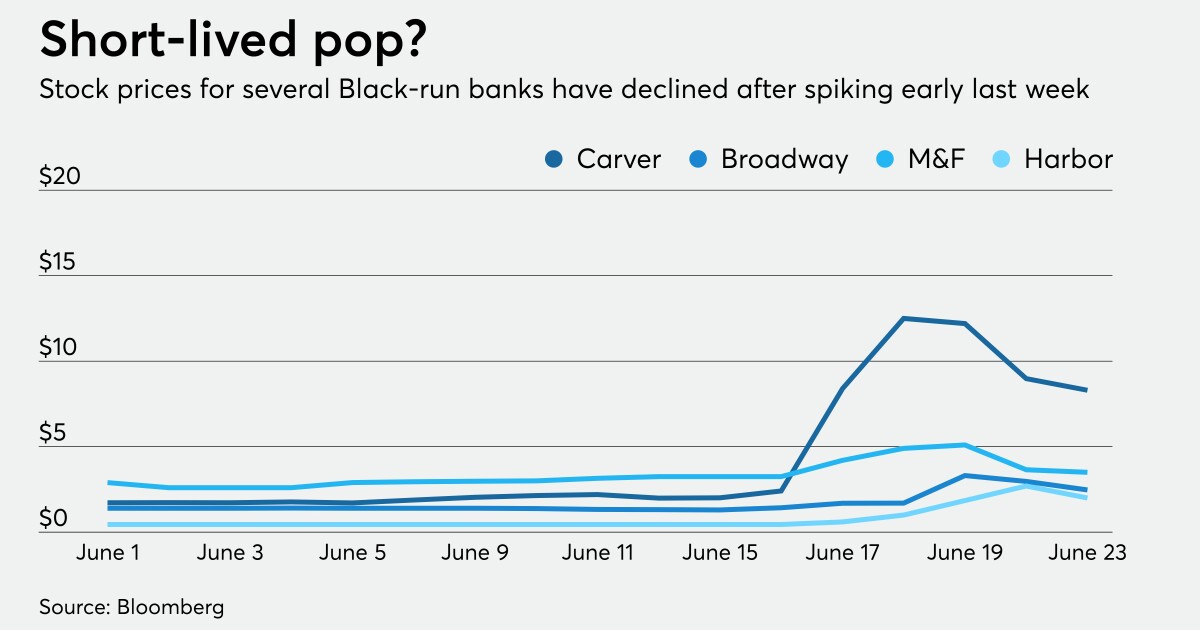

Broadway Financial (NASDAQ:BYFC) Trading Down 18.6%

Em decadência desde a crise financeira, bancos para clientes negros voltam a ganhar visibilidade nos EUA

Is capital haul too much of a good thing for Black-run banks?

El inesperado éxito bursátil de los bancos dedicados a la clientela negra

Aujourd'hui l'économie - Pourquoi les banques américaines dédiées à la clientèle noire cartonnent à la bourse

Nasdaq Grabs Record High, Dow Keeps Climbing - Schaeffer's Investment Research

Source: https://incomestatements.info

Category: Stock Reports