See more : RocketFuel Blockchain, Inc. (RKFL) Income Statement Analysis – Financial Results

Complete financial analysis of China Automotive Systems, Inc. (CAAS) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of China Automotive Systems, Inc., a leading company in the Auto – Parts industry within the Consumer Cyclical sector.

- Winchester Holding Group (WCHS) Income Statement Analysis – Financial Results

- Como Co.,Ltd. (2224.T) Income Statement Analysis – Financial Results

- West Coast Ventures Group Corp. (WCVC) Income Statement Analysis – Financial Results

- Shanti Educational Initiatives Limited (SEIL.BO) Income Statement Analysis – Financial Results

- Aplus Biotechnology Corporation Limited (6918.TWO) Income Statement Analysis – Financial Results

China Automotive Systems, Inc. (CAAS)

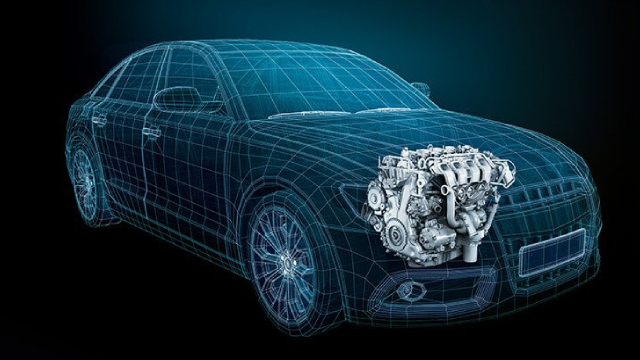

About China Automotive Systems, Inc.

China Automotive Systems, Inc., through its subsidiaries, manufactures and sells automotive systems and components in the People's Republic of China. It produces rack and pinion power steering gears for cars and light-duty vehicles; integral power steering gears for heavy-duty vehicles; power steering parts for light duty vehicles; sensor modules; automobile steering systems and columns; and automobile electronic and hydraulic power steering systems and parts. The company also offers automotive motors and electromechanical integrated systems; polymer materials; and intelligent automotive technology research and development services. In addition, it provides after sales services, and research and development support services, as well as markets automotive parts in North America and Brazil. The company primarily sells its products to the original equipment manufacturing customers. China Automotive Systems, Inc. was incorporated in 1999 and is headquartered in Jingzhou, the People's Republic of China.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 576.35M | 529.55M | 497.99M | 417.64M | 431.43M | 496.16M | 499.06M | 462.05M | 443.53M | 466.77M | 415.16M | 336.01M | 347.97M | 345.93M | 255.60M | 163.18M | 133.60M | 95.77M | 63.57M | 58.19M | 55.33M | 0.00 | 13.50K | 0.00 |

| Cost of Revenue | 472.60M | 446.16M | 425.91M | 362.30M | 368.08M | 430.75M | 414.43M | 381.13M | 363.99M | 379.30M | 338.53M | 275.25M | 279.88M | 265.62M | 182.93M | 115.92M | 88.27M | 62.86M | 41.11M | 35.04M | 30.40M | 0.00 | 0.00 | 0.00 |

| Gross Profit | 103.75M | 83.39M | 72.08M | 55.34M | 63.35M | 65.41M | 84.63M | 80.92M | 79.55M | 87.47M | 76.63M | 60.75M | 68.10M | 80.30M | 72.67M | 47.26M | 45.32M | 32.91M | 22.47M | 23.14M | 24.93M | 0.00 | 13.50K | 0.00 |

| Gross Profit Ratio | 18.00% | 15.75% | 14.47% | 13.25% | 14.68% | 13.18% | 16.96% | 17.51% | 17.93% | 18.74% | 18.46% | 18.08% | 19.57% | 23.21% | 28.43% | 28.96% | 33.93% | 34.36% | 35.34% | 39.78% | 45.05% | 0.00% | 100.00% | 0.00% |

| Research & Development | 29.18M | 36.11M | 28.23M | 25.72M | 27.99M | 33.55M | 33.54M | 27.71M | 22.34M | 22.97M | 20.89M | 14.89M | 10.01M | 7.99M | 2.56M | 2.26M | 1.67M | 1.07M | 966.78K | 1.52M | 1.02M | 0.00 | 0.00 | 0.00 |

| General & Administrative | 19.40M | 26.12M | 17.03M | 27.58M | 16.59M | 19.76M | 14.68M | 12.59M | 13.13M | 12.57M | 10.37M | 9.94M | 16.22M | 10.03M | 12.24M | 12.10M | 9.03M | 0.00 | 7.60M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 15.61M | 16.91M | 18.28M | 14.51M | 14.27M | 18.95M | 19.91M | 17.16M | 15.00M | 15.74M | 13.33M | 9.56M | 9.97M | 9.36M | 18.09M | 10.87M | 9.67M | 0.00 | 2.72M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 35.01M | 43.03M | 35.31M | 42.09M | 30.86M | 38.71M | 34.59M | 29.75M | 28.13M | 28.30M | 23.70M | 19.49M | 26.20M | 19.39M | 30.33M | 22.97M | 18.70M | 15.58M | 10.83M | 10.01M | 11.76M | 9.92M | 9.13K | 5.94K |

| Other Expenses | 313.00K | -3.70M | -1.90M | -4.32M | -3.78M | 1.17M | 678.00K | 1.12M | 844.00K | 1.02M | 1.10M | 461.00K | 2.32M | -688.01K | 2.96M | 5.11M | 3.69M | 3.50M | 2.65M | 848.01K | 1.37M | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 63.49M | 75.44M | 61.63M | 63.49M | 55.08M | 68.32M | 65.36M | 57.90M | 49.90M | 43.04M | 39.91M | 32.95M | 36.20M | 27.38M | 35.84M | 30.34M | 24.06M | 20.15M | 14.44M | 12.37M | 14.14M | 9.92M | 9.13K | 5.94K |

| Cost & Expenses | 537.11M | 521.60M | 487.55M | 425.79M | 423.15M | 499.07M | 479.79M | 439.03M | 413.88M | 422.34M | 378.44M | 308.21M | 316.08M | 293.01M | 218.77M | 146.26M | 112.33M | 83.00M | 55.55M | 47.42M | 44.54M | 9.92M | 9.13K | 5.94K |

| Interest Income | 1.52M | 10.75M | 1.24M | 1.66M | 2.09M | 2.16M | 3.44M | 2.08M | 3.42M | 2.96M | 2.84M | 1.42M | 726.93K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 1.23M | 1.45M | 1.44M | 1.59M | 3.03M | 2.93M | 1.75M | 656.00K | 1.34M | 1.79M | 1.57M | 3.12M | 3.98M | 2.92M | 3.81M | 1.24M | 566.99K | 832.84K | 0.00 | 730.96K | 344.72K | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 18.71M | 25.17M | 27.11M | 22.06M | 17.85M | 16.80M | 14.70M | 13.90M | 15.27M | 15.52M | 14.59M | 13.91M | 13.50M | 9.50M | 8.68M | 9.92M | 7.35M | 6.48M | 4.91M | 2.01M | 1.37M | 0.00 | 0.00 | 0.00 |

| EBITDA | 68.18M | 49.99M | 37.34M | 11.72M | 28.83M | 17.24M | 37.31M | 40.07M | 48.66M | 63.39M | 54.40M | 44.08M | 69.57M | 83.82M | 15.40 | 28.86M | 28.62M | 19.24M | 13.44M | 11.12M | 13.42M | -9.92M | 4.37K | -5.94K |

| EBITDA Ratio | 11.83% | 9.38% | 7.71% | 2.74% | 6.45% | 3.48% | 7.67% | 8.56% | 10.97% | 13.60% | 13.13% | 12.85% | 13.05% | 13.03% | 17.52% | 14.77% | 20.98% | 19.70% | 21.48% | 19.12% | 21.00% | 0.00% | 32.38% | 0.00% |

| Operating Income | 39.25M | 24.49M | 11.30M | -10.61M | 9.98M | -2.91M | 19.27M | 23.02M | 29.65M | 44.43M | 36.72M | 27.80M | 33.38M | 54.05M | 37.66M | 16.92M | 21.27M | 12.76M | 8.02M | 10.77M | 10.79M | -9.92M | 4.37K | -5.94K |

| Operating Income Ratio | 6.81% | 4.62% | 2.27% | -2.54% | 2.31% | -0.59% | 3.86% | 4.98% | 6.69% | 9.52% | 8.84% | 8.27% | 9.59% | 15.62% | 14.74% | 10.37% | 15.92% | 13.33% | 12.62% | 18.51% | 19.50% | 0.00% | 32.38% | 0.00% |

| Total Other Income/Expenses | 8.99M | -1.45M | -2.90M | -4.05M | 2.79M | 407.00K | 1.11M | 1.89M | 2.40M | 1.65M | 1.52M | -743.00K | 21.00M | 17.35M | -0.50 | 769.11K | -528.52K | -738.59K | -655.37K | 920.60K | 199.25K | 9.91M | 0.00 | 0.00 |

| Income Before Tax | 48.24M | 23.04M | 8.40M | -12.20M | 7.56M | -2.50M | 20.38M | 24.90M | 32.05M | 46.08M | 38.24M | 27.06M | 52.10M | 71.40M | 36.40M | 17.69M | 20.74M | 12.03M | 7.37M | 11.69M | 10.98M | -9.92K | 0.00 | 0.00 |

| Income Before Tax Ratio | 8.37% | 4.35% | 1.69% | -2.92% | 1.75% | -0.50% | 4.08% | 5.39% | 7.23% | 9.87% | 9.21% | 8.05% | 14.97% | 20.64% | 14.24% | 10.84% | 15.52% | 12.56% | 11.59% | 20.09% | 19.84% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 5.14M | 3.08M | 4.00M | 2.16M | 586.00K | -1.47M | 41.63M | 2.48M | 4.49M | 6.79M | 5.48M | 4.39M | -4.35M | 8.48M | 5.11M | 185.88K | 2.23M | 1.67M | 1.37M | 618.40K | 1.75M | 9.91M | -2.19K | 2.97K |

| Net Income | 37.66M | 21.18M | 4.40M | -14.36M | 6.97M | 2.38M | -19.35M | 22.51M | 27.39M | 33.54M | 26.79M | 20.74M | 40.79M | 51.74M | 23.41M | 12.44M | 8.86M | 4.81M | 3.32M | 6.87M | 3.87M | -9.92M | 2.19K | -2.97K |

| Net Income Ratio | 6.53% | 4.00% | 0.88% | -3.44% | 1.62% | 0.48% | -3.88% | 4.87% | 6.17% | 7.19% | 6.45% | 6.17% | 11.72% | 14.96% | 9.16% | 7.62% | 6.63% | 5.02% | 5.22% | 11.80% | 7.00% | 0.00% | 16.19% | 0.00% |

| EPS | 1.25 | 0.69 | 0.14 | -0.46 | 0.22 | 0.08 | -0.61 | 0.70 | 0.85 | 1.15 | 0.96 | 0.70 | 1.30 | 1.65 | -0.98 | 0.48 | 0.37 | 0.21 | 0.15 | 0.30 | 0.18 | -0.47 | 0.10 | 0.00 |

| EPS Diluted | 1.25 | 0.69 | 0.14 | -0.46 | 0.22 | 0.08 | -0.61 | 0.70 | 0.85 | 1.15 | 0.95 | 0.70 | 0.69 | 1.10 | -0.98 | 0.46 | 0.37 | 0.21 | 0.15 | 0.30 | 0.18 | -0.47 | 0.10 | 0.00 |

| Weighted Avg Shares Out | 30.19M | 30.64M | 30.85M | 31.08M | 31.46M | 31.64M | 31.64M | 31.95M | 32.12M | 29.06M | 28.04M | 28.21M | 27.93M | 27.10M | 26.99M | 25.71M | 23.95M | 23.20M | 22.57M | 22.57M | 21.77M | 20.91M | 20.00M | 18.50M |

| Weighted Avg Shares Out (Dil) | 30.19M | 30.64M | 30.86M | 31.08M | 31.46M | 31.65M | 31.65M | 31.96M | 32.13M | 29.08M | 28.06M | 28.22M | 31.51M | 31.57M | 26.99M | 29.67M | 23.96M | 23.21M | 22.59M | 22.58M | 22.08M | 20.91M | 20.00M | 18.50M |

China Automotive Systems Shares Increase Over 7% Pre-Market: Why It Happened

China Automotive Systems Reports 45.0% Net Sales Increase in the Second Quarter of 2021

China Automotive Systems to Announce Unaudited 2021 Second Quarter Financial Results on August 12, 2021

China Automotive Systems (CAAS) to Report Q2 Results: Wall Street Expects Earnings Growth

China Automotive Systems Announces Annual Meeting Conference Call on July 28, 2021

China Automotive Develops New Steering System For Alfa Romeo's Hybrid SUV

China Automotive Systems Develops New Steering System for Alfa Romeo's First Subcompact Crossover EV

China Automotive Systems Purchases 40% of European Vehicle Technology Leader and Officially Enters Autonomous Driving

China Automotive Systems' (CAAS) Shares March Higher, Can It Continue?

China Automotive Systems, Inc. (CAAS) CEO Qizhou Wu on Q1 2021 Results - Earnings Call Transcript

Source: https://incomestatements.info

Category: Stock Reports