See more : AtlasClear Holdings, Inc. (ATCH) Income Statement Analysis – Financial Results

Complete financial analysis of Cass Information Systems, Inc. (CASS) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Cass Information Systems, Inc., a leading company in the Specialty Business Services industry within the Industrials sector.

- Castillo Copper Limited (CCZ.AX) Income Statement Analysis – Financial Results

- MacDonald Mines Exploration Ltd. (BMK.V) Income Statement Analysis – Financial Results

- Scotch Creek Ventures Inc. (SCVFF) Income Statement Analysis – Financial Results

- Nagarjuna Fertilizers and Chemicals Limited (NAGAFERT.NS) Income Statement Analysis – Financial Results

- Universal Ibogaine Inc. (IBOGF) Income Statement Analysis – Financial Results

Cass Information Systems, Inc. (CASS)

About Cass Information Systems, Inc.

Cass Information Systems, Inc. provides payment and information processing services to manufacturing, distribution, and retail enterprises in the United States. It operates through two segments, Information Services and Banking Services. The company's services include freight invoice rating, payment processing, auditing, and the generation of accounting and transportation information. It also processes and pays facility-related invoices, such as electricity, gas, waste, and telecommunications expenses; and provides telecom expense management solutions. In addition, the company, through its banking subsidiary, Cass Commercial Bank, provides a range of banking products and services, such as checking, savings, and time deposit accounts; commercial, industrial, and real estate loans; and cash management services to privately-owned businesses and faith-related ministries. Further, it provides B2B payment platform for clients that require an agile fintech partner. It operates through its banking facility near downtown St. Louis, Missouri; operating branch in the Bridgeton, Missouri; and leased facilities in Fenton, Missouri and Colorado Springs, Colorado. The company was formerly known as Cass Commercial Corporation and changed its name to Cass Information Systems, Inc. in January 2001. Cass Information Systems, Inc. was founded in 1906 and is headquartered in St. Louis, Missouri.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 213.23M | 183.83M | 154.02M | 144.96M | 157.24M | 148.27M | 135.30M | 120.72M | 120.82M | 117.21M | 114.82M | 111.52M | 106.54M | 96.22M | 23.84B | 93.93M | 89.58M | 83.26M | 72.22M | 66.84M | 66.45M | 57.37M | 55.55M | 52.99M | 47.90M | 48.20M | 46.80M | 45.60M | 46.50M |

| Cost of Revenue | 118.14M | 33.10M | 28.17M | 26.55M | 28.69M | 26.04M | 23.06M | 20.89M | 89.78M | 85.41M | 84.09M | 80.33M | 75.03M | 68.28M | 66.39M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 95.08M | 150.72M | 125.85M | 118.40M | 128.55M | 122.23M | 112.24M | 99.83M | 31.03M | 31.79M | 30.73M | 31.19M | 31.51M | 27.93M | 23.77B | 93.93M | 89.58M | 83.26M | 72.22M | 66.84M | 66.45M | 57.37M | 55.55M | 52.99M | 47.90M | 48.20M | 46.80M | 45.60M | 46.50M |

| Gross Profit Ratio | 44.59% | 81.99% | 81.71% | 81.68% | 81.76% | 82.44% | 82.95% | 82.69% | 25.69% | 27.12% | 26.77% | 27.97% | 29.57% | 29.03% | 99.72% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.23 | 0.22 | 0.20 | 0.23 | 0.24 | 0.25 | 0.25 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 3.56M | 106.47M | 92.16M | 88.06M | 91.08M | 85.88M | 77.34M | 75.88M | 70.31M | 66.10M | 65.72M | 62.56M | 56.57M | 51.37M | 50.61M | 49.72M | 46.97M | 42.68M | 38.04M | 38.20M | 37.15M | 31.41M | 30.47M | 28.50M | 26.00M | 25.00M | 24.00M | 23.90M | 24.70M |

| Selling & Marketing | 3.25M | 2.89M | 2.63M | 2.18M | 3.84M | 3.34M | 2.56M | 2.19M | 2.27M | 2.05M | 2.02M | 2.35M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 6.81M | 106.47M | 92.16M | 88.06M | 91.08M | 85.88M | 77.34M | 78.07M | 70.31M | 66.10M | 65.72M | 62.56M | 56.57M | 51.37M | 50.61M | 49.72M | 46.97M | 42.68M | 38.04M | 38.20M | 37.15M | 31.41M | 30.47M | 28.50M | 26.00M | 25.00M | 24.00M | 23.90M | 24.70M |

| Other Expenses | 0.00 | 139.58M | -212.35M | -202.68M | -210.85M | -196.38M | 100.40M | 93.47M | 89.78M | 85.41M | 84.09M | 80.33M | 75.03M | 68.28M | 66.39M | -114.11M | -102.64M | -95.88M | -89.65M | -90.68M | -90.39M | -76.21M | -71.39M | -65.30M | -59.90M | -57.30M | -55.90M | -55.30M | -57.80M |

| Operating Expenses | 6.81M | 139.58M | -120.20M | -114.62M | -119.77M | -103.27M | 100.40M | 93.47M | 89.78M | 85.41M | 84.09M | 80.33M | 75.03M | 68.28M | 66.39M | -64.39M | -55.68M | -53.20M | -51.60M | -52.48M | -53.23M | -44.80M | -40.92M | -36.80M | -33.90M | -32.30M | -31.90M | -31.40M | -33.10M |

| Cost & Expenses | 124.96M | 172.68M | -120.20M | -114.62M | -119.77M | -103.27M | 123.47M | 114.37M | 179.57M | 170.83M | 168.17M | 160.67M | 150.06M | 136.57M | 132.77M | -64.39M | -55.68M | -53.20M | -51.60M | -52.48M | -53.23M | -44.80M | -40.92M | -36.80M | -33.90M | -32.30M | -31.90M | -31.40M | -33.10M |

| Interest Income | 82.76M | 58.84M | 44.33M | 47.69M | 52.61M | 47.93M | 41.98M | 39.93M | 38.71M | 39.76M | 41.58M | 45.93M | 50.24M | 49.05M | 43.78M | 44.14M | 49.35M | 47.05M | 38.25M | 30.73M | 28.24M | 31.62M | 36.18M | 37.07M | 30.90M | 30.10M | 29.30M | 28.10M | 26.80M |

| Interest Expense | 16.27M | 3.48M | 1.17M | 2.36M | 5.19M | 3.74M | 2.19M | 2.03M | 2.11M | 2.46M | 2.83M | 3.15M | 4.37M | 4.88M | 5.05M | 3.38M | 7.96M | 6.62M | 4.69M | 3.10M | 1.86M | 2.27M | 3.87M | 5.19M | 4.40M | 4.30M | 4.30M | 4.60M | 4.10M |

| Depreciation & Amortization | 4.97M | 144.41M | 121.37M | 117.79M | 125.21M | 115.66M | 102.59M | 94.00M | 8.86M | 8.18M | 7.35M | 6.92M | 4.53M | 4.03M | 4.04M | 4.34M | 3.19M | 2.05M | 2.21M | 3.98M | 4.64M | 4.00M | 3.36M | 2.65M | 2.50M | 2.40M | 2.60M | 2.70M | 2.60M |

| EBITDA | 58.59M | 0.00 | 0.00 | 41.61M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 28.84M | 28.46M | 26.10M | 21.47M | 15.22M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA Ratio | 27.48% | 27.79% | 25.32% | 28.71% | 30.79% | 34.61% | 35.79% | 36.05% | 34.77% | 36.20% | 35.63% | 36.99% | 37.93% | 38.28% | 0.13% | 36.07% | 41.41% | 38.56% | 31.60% | 27.43% | 26.87% | 28.88% | 32.39% | 35.56% | 34.45% | 37.97% | 37.39% | 37.06% | 34.41% |

| Operating Income | 88.27M | 46.38M | 33.82M | 30.34M | 37.47M | 40.08M | -81.49M | -74.44M | -140.86M | -131.07M | -126.60M | -114.73M | -99.82M | -87.52M | -88.99M | 29.54M | 33.91M | 30.05M | 20.62M | 14.36M | 13.22M | 12.57M | 14.64M | 16.19M | 14.00M | 15.90M | 14.90M | 14.20M | 13.40M |

| Operating Income Ratio | 41.40% | 25.23% | 21.96% | 20.93% | 23.83% | 27.03% | -60.23% | -61.66% | -116.59% | -111.83% | -110.26% | -102.88% | -93.70% | -90.96% | -0.37% | 31.45% | 37.85% | 36.10% | 28.55% | 21.49% | 19.89% | 21.91% | 26.35% | 30.56% | 29.23% | 32.99% | 31.84% | 31.14% | 28.82% |

| Total Other Income/Expenses | -50.92M | 153.25M | 136.82M | -22.99M | 133.31M | 126.38M | -19.21M | -17.34M | 1.40M | -16.55M | -16.30M | -3.15M | 131.33M | 115.46M | 110.52M | 0.00 | 0.00 | 0.00 | -3.10M | -71.00K | -1.86M | -2.27M | -3.87M | -5.19M | -4.40M | -4.30M | -4.30M | -4.60M | -4.10M |

| Income Before Tax | 37.36M | 42.90M | 33.82M | 30.34M | 37.47M | 36.35M | 34.90M | 32.06M | 31.03M | 31.79M | 30.73M | 31.19M | 31.51M | 27.93M | 21.53M | 26.17M | 25.94M | 23.83M | 16.23M | 11.27M | 11.36M | 10.30M | 10.76M | 11.01M | 9.60M | 11.60M | 10.60M | 9.60M | 9.30M |

| Income Before Tax Ratio | 17.52% | 23.34% | 21.96% | 20.93% | 23.83% | 24.51% | 25.79% | 26.56% | 25.69% | 27.12% | 26.77% | 27.97% | 29.57% | 29.03% | 0.09% | 27.86% | 28.96% | 28.62% | 22.47% | 16.86% | 17.09% | 17.95% | 19.38% | 20.77% | 20.04% | 24.07% | 22.65% | 21.05% | 20.00% |

| Income Tax Expense | 7.30M | 8.00M | 5.22M | 5.17M | 7.06M | 6.08M | 9.89M | 7.72M | 7.98M | 7.76M | 7.23M | 7.89M | 8.50M | 7.62M | 5.41M | 7.16M | 8.15M | 8.37M | 4.98M | 3.26M | 3.45M | 2.99M | 3.74M | 3.86M | 3.40M | 4.20M | 3.60M | 3.10M | 3.10M |

| Net Income | 30.06M | 34.90M | 28.60M | 25.18M | 30.40M | 30.27M | 25.01M | 24.35M | 23.06M | 24.03M | 23.50M | 23.30M | 23.01M | 20.31M | 16.13M | 19.01M | 17.80M | 15.07M | 10.95M | 8.01M | 7.90M | 7.31M | 7.03M | 7.15M | 6.20M | 7.40M | 7.00M | 6.50M | 6.20M |

| Net Income Ratio | 14.10% | 18.99% | 18.57% | 17.37% | 19.34% | 20.41% | 18.49% | 20.17% | 19.08% | 20.50% | 20.46% | 20.90% | 21.60% | 21.11% | 0.07% | 20.23% | 19.86% | 18.10% | 15.16% | 11.98% | 11.89% | 12.74% | 12.65% | 13.49% | 12.94% | 15.35% | 14.96% | 14.25% | 13.33% |

| EPS | 2.18 | 2.58 | 2.03 | 1.75 | 2.11 | 2.06 | 1.70 | 1.65 | 1.54 | 1.58 | 1.55 | 1.55 | 1.54 | 1.36 | 1.10 | 1.30 | 1.22 | 1.03 | 0.76 | 0.55 | 0.54 | 0.50 | 0.48 | 0.45 | 0.36 | 0.42 | 0.40 | 0.37 | 0.35 |

| EPS Diluted | 2.18 | 2.53 | 2.00 | 1.73 | 2.07 | 2.03 | 1.68 | 1.63 | 1.52 | 1.56 | 1.53 | 1.53 | 1.52 | 1.35 | 1.08 | 1.27 | 1.19 | 1.01 | 0.73 | 0.54 | 0.54 | 0.50 | 0.47 | 0.44 | 0.35 | 0.41 | 0.39 | 0.37 | 0.35 |

| Weighted Avg Shares Out | 13.79M | 13.55M | 14.09M | 14.36M | 14.43M | 14.68M | 14.70M | 14.72M | 14.99M | 15.18M | 15.13M | 15.00M | 14.98M | 14.88M | 14.64M | 14.61M | 14.58M | 14.58M | 14.46M | 17.96M | 14.54M | 14.62M | 14.74M | 15.92M | 17.31M | 17.63M | 17.56M | 17.77M | 17.47M |

| Weighted Avg Shares Out (Dil) | 13.82M | 13.81M | 14.33M | 14.57M | 14.69M | 14.91M | 14.92M | 14.93M | 15.22M | 15.40M | 15.35M | 15.23M | 15.12M | 15.09M | 14.89M | 15.06M | 14.96M | 14.95M | 14.91M | 18.21M | 14.68M | 14.71M | 14.93M | 16.12M | 17.57M | 17.94M | 17.86M | 17.88M | 17.58M |

Cass Information Systems Launches Cass FreightClaim360, a Freight Claims Application for Carriers

Cass Information Systems Launches Cass FreightClaim360, a Freight Claims Application for Carriers

April freight trends jump, 2021 to be ‘extraordinarily strong year'

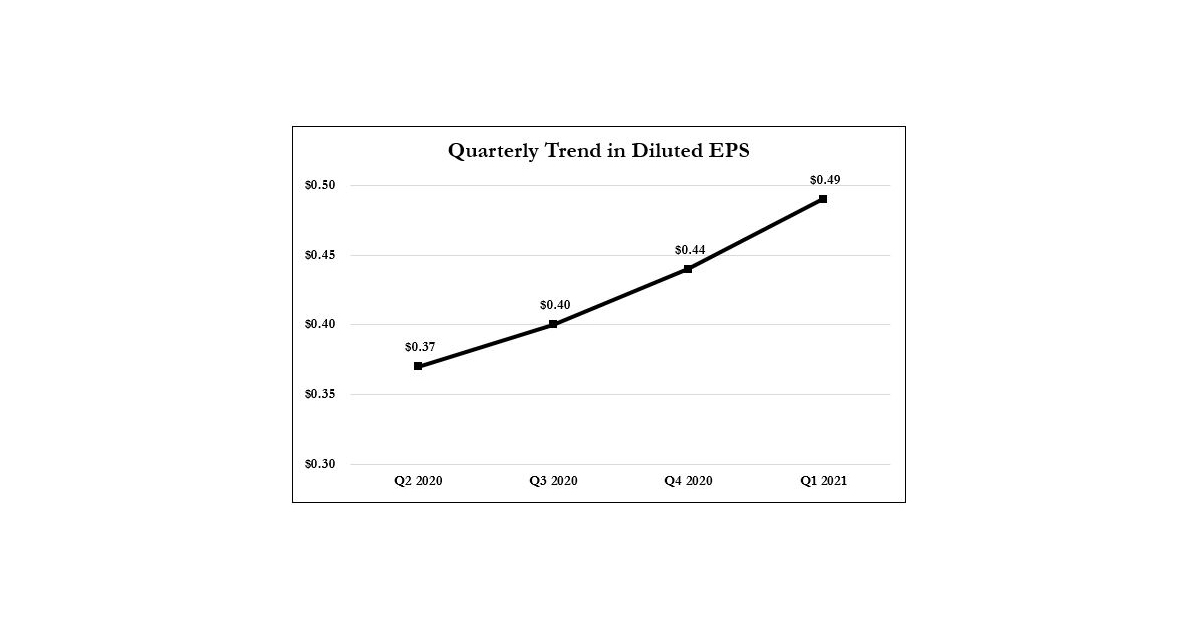

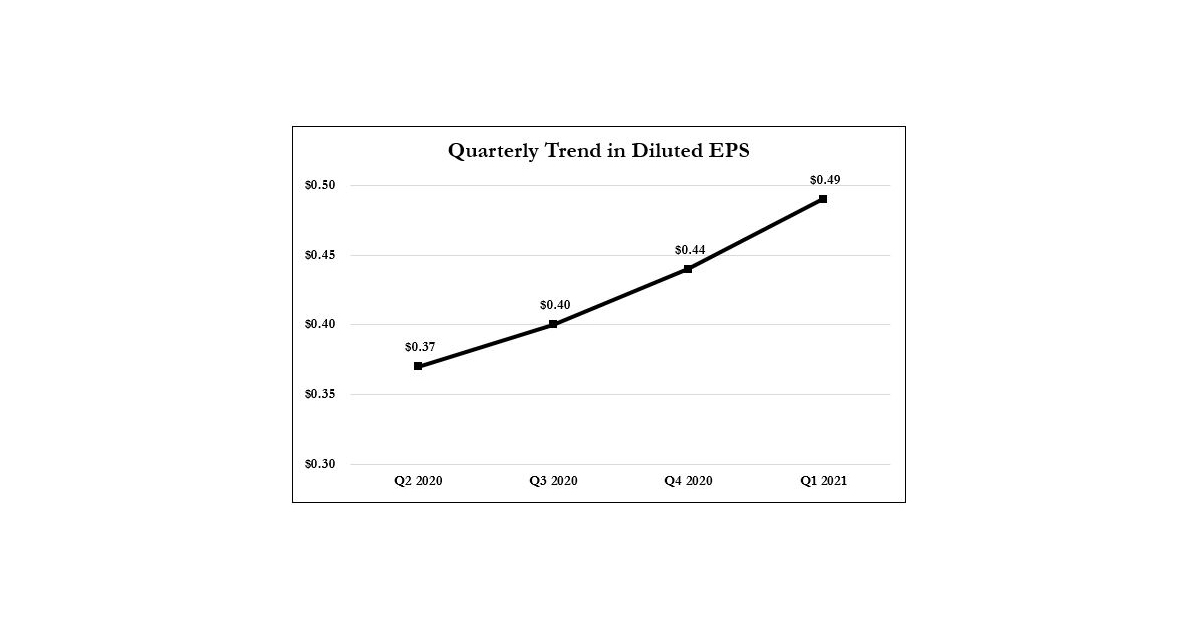

Cass Information Systems, Inc. Reports Continuing Earnings Recovery

Cass Information Systems, Inc. Reports Continuing Earnings Recovery

Cass Information Systems, Inc. Names Michael J. Normile New Chief Financial Officer

Cass Information Systems, Inc. Names Michael J. Normile New Chief Financial Officer

Cass Information Systems, Inc. Reports Fourth Quarter Diluted Earnings Up 2%

Cass Information Systems, Inc. Reports Fourth Quarter Diluted Earnings Up 2%

5 Historical Low Price-Book Companies for 2021

Source: https://incomestatements.info

Category: Stock Reports