See more : Acer Gaming Inc. (6908.TWO) Income Statement Analysis – Financial Results

Complete financial analysis of Coastal Financial Corporation (CCB) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Coastal Financial Corporation, a leading company in the Banks – Regional industry within the Financial Services sector.

- PT Prodia Widyahusada Tbk (PRDA.JK) Income Statement Analysis – Financial Results

- Intumit Inc. (7547.TWO) Income Statement Analysis – Financial Results

- Foresight Solar Fund Limited (FSFL.L) Income Statement Analysis – Financial Results

- Ever Fortune.AI Co., Ltd. (6841.TWO) Income Statement Analysis – Financial Results

- iStar Inc. (STAR-PD) Income Statement Analysis – Financial Results

Coastal Financial Corporation (CCB)

About Coastal Financial Corporation

Coastal Financial Corporation operates as the bank holding company for Coastal Community Bank that provides various banking products and services to small to medium-sized businesses, professionals, and individuals in the Puget Sound region in Washington. It accepts a range of deposit products, including demand and savings accounts, time deposits, and money market accounts. The company offers commercial and industrial loans, including term loans, small business administration loans, commercial lines of credit, working capital loans, equipment financing, borrowing base loans, and other loan products; owner-occupied and non-owner-occupied real estate loans, and multi-family residential loans; construction and land development loans; residential real estate loans; and consumer and other loans, including automobile, boat and recreational vehicle, and secured term loans, as well as overdraft protection. It also provides remote deposit capture, online and mobile banking, and direct and reciprocal deposit services, as well as debit cards. In addition, the company offers business accounts and cash management services, including business checking and savings accounts, and treasury services, as well as banking as a service (BaaS), a platform that allows broker dealers and digital financial service providers to offer their clients banking services. It operates 14 full-service banking locations. Coastal Financial Corporation was founded in 1997 and is headquartered in Everett, Washington.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2014 | 2013 |

|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 330.37M | 213.59M | 101.81M | 65.57M | 50.27M | 40.28M | 33.39M | 30.91M | 21.77M | 17.62M |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 330.37M | 213.59M | 101.81M | 65.57M | 50.27M | 40.28M | 33.39M | 30.91M | 21.77M | 17.62M |

| Gross Profit Ratio | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 74.67M | 56.80M | 42.77M | 24.97M | 20.57M | 17.35M | 14.57M | 13.19M | 2.03M | 1.79M |

| Selling & Marketing | 517.00K | 2.46M | 451.00K | 317.00K | 393.00K | 373.00K | 446.00K | 437.00K | 976.00K | 461.00K |

| SG&A | 75.19M | 59.26M | 43.22M | 25.29M | 20.97M | 17.72M | 15.02M | 13.63M | 15.19M | 12.27M |

| Other Expenses | 276.65M | -106.08M | -110.65M | -71.71M | -54.57M | -43.83M | -35.44M | -34.56M | 0.00 | 0.00 |

| Operating Expenses | 351.84M | 351.00K | -67.43M | -46.43M | -33.61M | -24.12M | -20.43M | -20.93M | 18.30M | 14.45M |

| Cost & Expenses | 351.84M | 351.00K | -67.43M | -46.43M | -33.61M | -24.12M | -20.43M | -20.93M | 18.30M | 14.45M |

| Interest Income | 329.98M | 191.83M | 82.80M | 62.80M | 48.41M | 38.59M | 32.11M | 28.46M | 0.00 | 0.00 |

| Interest Expense | 91.64M | 20.40M | 3.65M | 5.65M | 6.58M | 3.93M | 2.88M | 2.52M | 0.00 | 0.00 |

| Depreciation & Amortization | 2.33M | 1.81M | 1.59M | 1.36M | 1.24M | 1.07M | 993.00K | 895.00K | -4.41M | -3.60M |

| EBITDA | 59.46M | 0.00 | 35.96M | 20.50M | 17.90M | 13.31M | 11.08M | 8.35M | -933.00K | -430.00K |

| EBITDA Ratio | 18.00% | 34.10% | 35.32% | 31.26% | 35.61% | 42.79% | 41.80% | 35.18% | -4.28% | -2.44% |

| Operating Income | 57.13M | 71.02M | 34.38M | 19.14M | 16.66M | 16.17M | 12.96M | 9.98M | 4.41M | 3.60M |

| Operating Income Ratio | 17.29% | 33.25% | 33.77% | 29.19% | 33.15% | 40.14% | 38.82% | 32.28% | 20.24% | 20.45% |

| Total Other Income/Expenses | 0.00 | 0.00 | 0.00 | 0.00 | -1.24M | 0.00 | -2.57M | -2.88M | -3.11M | -2.18M |

| Income Before Tax | 57.13M | 50.62M | 34.38M | 19.14M | 16.66M | 12.24M | 10.09M | 7.46M | 3.47M | 3.17M |

| Income Before Tax Ratio | 17.29% | 23.70% | 33.77% | 29.19% | 33.15% | 30.39% | 30.21% | 24.12% | 15.95% | 18.01% |

| Income Tax Expense | 12.55M | 10.00M | 7.37M | 4.00M | 3.46M | 2.54M | 4.65M | 2.45M | 1.13M | 1.13M |

| Net Income | 44.58M | 40.63M | 27.01M | 15.15M | 13.20M | 9.70M | 5.44M | 5.00M | 2.35M | 2.04M |

| Net Income Ratio | 13.49% | 19.02% | 26.52% | 23.10% | 26.26% | 24.08% | 16.28% | 16.18% | 10.78% | 11.59% |

| EPS | 3.36 | 3.14 | 2.25 | 1.27 | 1.08 | 0.93 | 0.59 | 0.54 | 0.25 | 0.06 |

| EPS Diluted | 3.27 | 3.01 | 2.16 | 1.24 | 1.08 | 0.91 | 0.59 | 0.54 | 0.25 | 0.06 |

| Weighted Avg Shares Out | 13.26M | 12.95M | 12.02M | 11.92M | 11.90M | 10.44M | 9.23M | 9.26M | 9.21M | 36.45M |

| Weighted Avg Shares Out (Dil) | 13.64M | 13.51M | 12.52M | 12.21M | 12.20M | 10.61M | 11.40M | 11.40M | 9.21M | 36.45M |

Michael Patterson Joins Coastal Financial Corporation Board of Directors

Coastal Financial Corporation Announces Second Quarter 2021 Results

Coastal Financial Corporation Announces First Quarter 2021 Results

Coastal Financial Corporation awarded Raymond James Community Bankers Cup for 2020

Coastal Community Bank to sell Freeland branch to SaviBank

Coastal Financial (CCB) Investor Presentation - Slideshow

Deutsche Bank AG Sells 1,115 Shares of Coastal Financial Corporation (NYSE:CCB)

Younger Adults May Be To Blame For King County's Spike In Cases

Coronavirus undermines de novo bank effort in Florida

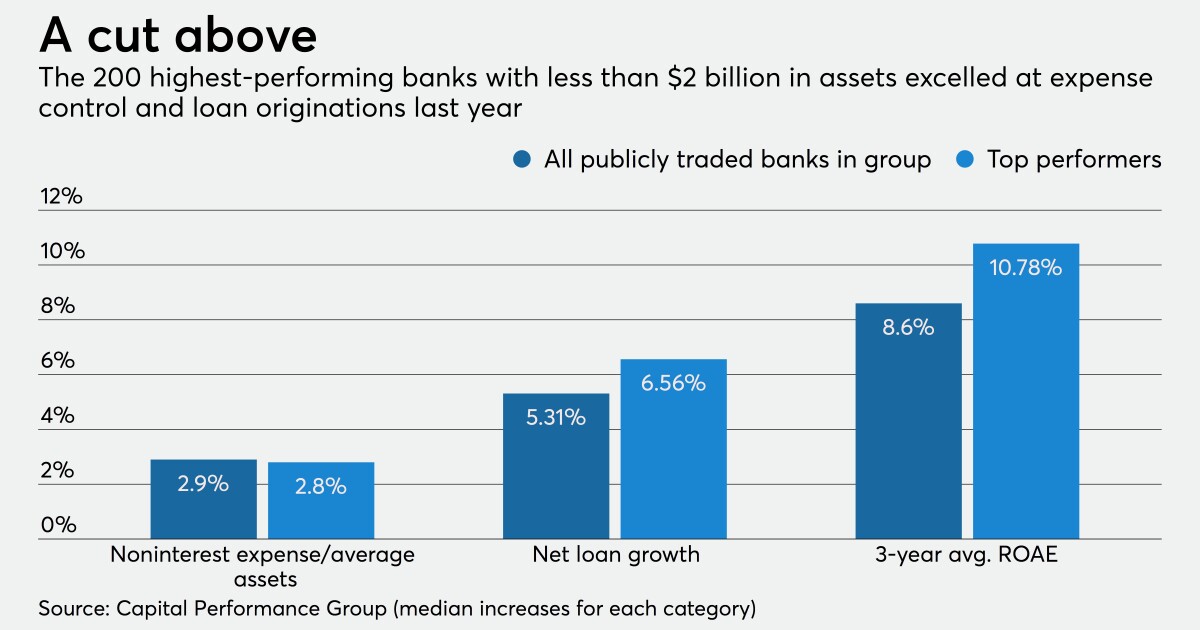

Will pandemic reshuffle the top 200 publicly traded community banks?

Source: https://incomestatements.info

Category: Stock Reports