See more : Jaguar Global Growth Corporation I (JGGC) Income Statement Analysis – Financial Results

Complete financial analysis of Compañía Cervecerías Unidas S.A. (CCU) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Compañía Cervecerías Unidas S.A., a leading company in the Beverages – Alcoholic industry within the Consumer Defensive sector.

- Monarch Networth Capital Limited (MONARCH.BO) Income Statement Analysis – Financial Results

- Tigbur – Temporary Professional Personnel Ltd. (TIGBUR.TA) Income Statement Analysis – Financial Results

- RICECURRY INC (195A.T) Income Statement Analysis – Financial Results

- Shionogi & Co., Ltd. (4507.T) Income Statement Analysis – Financial Results

- China Shineway Pharmaceutical Group Limited (CSWYF) Income Statement Analysis – Financial Results

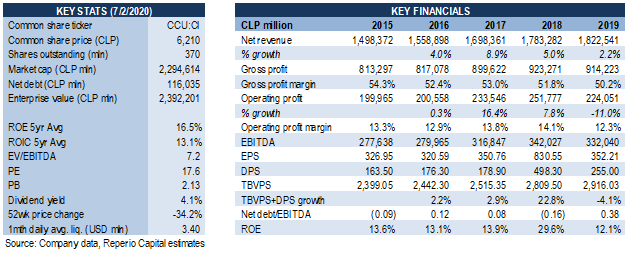

Compañía Cervecerías Unidas S.A. (CCU)

About Compañía Cervecerías Unidas S.A.

Compañía Cervecerías Unidas S.A. operates as a beverage company in Chile, Argentina, Bolivia, Colombia, Paraguay, and Uruguay. The company operates through three segments: Chile, International Business, and Wine. It produces and sells alcoholic and non-alcoholic beer under proprietary and licensed brands, as well as distributes Pernod Ricard products in non-supermarket retail stores. The company also produces and sells non-alcoholic beverages, including carbonated soft drinks, nectars and juices, sports and energy drinks, and ice tea; and mineral, purified, and flavored bottled water, as well as ready-to-mix products with instant powder drinks. In addition, it is involved in the production and distribution of pisco, cocktails, rum, flavored alcoholic beverages, gin, and cider. The company serves small and medium-sized retail outlets; retail establishments, such as restaurants, hotels, and bars; wholesalers; and supermarket chains. It also exports its products to Europe, Latin America, the United States, Canada, Asia, Oceania, and internationally. The company was founded in 1850 and is based in Santiago, Chile. Compañía Cervecerías Unidas S.A. is a subsidiary of Inversiones y Rentas S.A.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 2,565.56B | 2,711.43B | 2,484.71B | 1,857.59B | 1,822.54B | 1,783.28B | 1,698.36B | 1,558.90B | 1,498.37B | 1,297.97B | 1,197.23B | 1,075.69B | 969.55B | 838.26B | 777.98B | 781.79B | 628.28B | 546.09B | 492.30B | 419.00B | 384.06B | 345.89B | 343.56B | 316.54B | 290.40B | 287.06B |

| Cost of Revenue | 1,378.61B | 1,514.93B | 1,291.56B | 984.04B | 908.32B | 860.01B | 798.74B | 741.82B | 685.08B | 604.54B | 536.70B | 493.09B | 450.56B | 383.81B | 365.75B | 369.74B | 295.28B | 260.03B | 235.83B | 201.83B | 189.20B | 170.62B | 168.54B | 113.91B | 104.87B | 100.05B |

| Gross Profit | 1,186.94B | 1,196.51B | 1,193.15B | 873.56B | 914.22B | 923.27B | 899.62B | 817.08B | 813.30B | 693.43B | 660.53B | 582.60B | 518.99B | 454.45B | 412.23B | 412.05B | 333.00B | 286.06B | 256.47B | 217.17B | 194.86B | 175.27B | 175.03B | 202.63B | 185.53B | 187.01B |

| Gross Profit Ratio | 46.26% | 44.13% | 48.02% | 47.03% | 50.16% | 51.77% | 52.97% | 52.41% | 54.28% | 53.42% | 55.17% | 54.16% | 53.53% | 54.21% | 52.99% | 52.71% | 53.00% | 52.38% | 52.10% | 51.83% | 50.74% | 50.67% | 50.94% | 64.01% | 63.89% | 65.15% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 197.26B | 187.42B | 161.39B | 138.81B | 136.98B | 152.38B | 142.51B | 155.32B | 128.14B | 110.01B | 93.29B | 85.39B | 199.47B | 172.54B | 78.22B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 470.12B | 504.18B | 438.60B | 337.10B | 327.54B | 314.39B | 290.23B | 270.84B | 277.60B | 240.85B | 221.70B | 186.59B | 150.07B | 129.08B | 274.07B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 667.38B | 691.61B | 599.99B | 704.79B | 464.52B | 466.77B | 432.74B | 426.16B | 405.74B | 350.86B | 473.52B | 271.98B | 348.36B | 301.62B | 274.07B | 290.98B | 231.62B | 206.33B | 189.97B | 158.69B | 149.00B | 123.90B | 131.37B | 125.36B | 112.14B | 110.52B |

| Other Expenses | 279.60B | 277.36B | 283.39B | -17.82B | 229.75B | 223.96B | 2.34B | 1.79B | -1.96B | 17.78B | -843.00M | -13.24M | -6.73B | 1.06B | 4.20B | 0.00 | 498.01K | -1.61B | 0.00 | -555.56K | 0.00 | 13.78B | 0.00 | 37.78B | 34.78B | 31.90B |

| Operating Expenses | 946.98B | 968.96B | 883.38B | 686.97B | 694.27B | 682.01B | 669.58B | 620.64B | 614.69B | 538.61B | 469.28B | 407.00B | 328.23B | 292.40B | 274.53B | 290.98B | 231.62B | 204.71B | 189.97B | 158.69B | 149.00B | 137.67B | 131.37B | 163.14B | 146.91B | 142.41B |

| Cost & Expenses | 2,325.59B | 2,483.89B | 2,174.94B | 1,671.00B | 1,602.59B | 1,542.02B | 1,468.31B | 1,362.46B | 1,299.77B | 1,143.15B | 1,005.97B | 900.09B | 778.79B | 676.21B | 640.28B | 660.72B | 526.90B | 464.74B | 425.80B | 360.52B | 338.20B | 308.30B | 299.91B | 277.05B | 251.79B | 242.46B |

| Interest Income | 39.40B | 22.87B | 14.26B | 3.45B | 13.12B | 15.79B | 5.05B | 5.68B | 7.85B | 12.14B | 8.25B | 7.69B | 7.08B | 2.38B | 2.08B | 570.66M | 1.18B | 2.57B | 800.21M | 110.56M | 2.53B | 1.64B | 3.43B | 4.58B | 0.00 | 11.88B |

| Interest Expense | 77.02B | 75.93B | 35.66B | 25.26B | 27.72B | 23.56B | 24.17B | 20.31B | 23.10B | 22.96B | 15.83B | 17.05B | 7.33B | 10.67B | 10.40B | 12.27B | 8.73B | 7.62B | 7.42B | 5.91B | 5.66B | 3.83B | 6.21B | 6.87B | 0.00 | 7.61B |

| Depreciation & Amortization | 104.08B | 126.50B | 124.12B | 109.81B | 105.02B | 93.24B | 92.20B | 83.53B | -14.19B | -117.21M | -535.00M | 6.40B | 22.38B | 6.17B | 4.16B | 59.11B | 48.08B | 45.63B | 43.69B | 41.83B | 42.73B | 45.20B | 42.94B | 40.07B | 34.78B | 31.90B |

| EBITDA | 344.05B | 332.41B | 454.00B | 288.81B | 331.05B | 481.77B | 316.68B | 272.55B | 213.74B | 190.42B | 191.69B | 183.11B | 194.41B | 168.22B | 165.53B | 114.72B | 143.79B | 136.37B | 110.33B | 98.66B | 89.38B | 82.79B | 86.59B | 79.56B | 73.58B | 74.65B |

| EBITDA Ratio | 13.41% | 8.92% | 13.60% | 8.98% | 11.45% | 26.37% | 13.46% | 12.72% | 13.30% | 14.16% | 15.93% | 17.02% | 19.79% | 20.07% | 18.23% | 23.18% | 22.89% | 23.51% | 22.41% | 23.55% | 23.27% | 24.78% | 22.83% | 26.76% | 21.43% | 26.00% |

| Operating Income | 239.97B | 218.76B | 330.47B | 175.18B | 233.97B | 472.75B | 227.18B | 192.31B | 213.45B | 183.96B | 191.26B | 176.71B | 169.45B | 162.05B | 137.65B | 121.07B | 101.38B | 79.73B | 66.50B | 58.48B | 45.86B | 37.59B | 43.65B | 39.50B | 38.62B | 44.60B |

| Operating Income Ratio | 9.35% | 8.07% | 13.30% | 9.43% | 12.84% | 26.51% | 13.38% | 12.34% | 14.25% | 14.17% | 15.97% | 16.43% | 17.48% | 19.33% | 17.69% | 15.49% | 16.14% | 14.60% | 13.51% | 13.96% | 11.94% | 10.87% | 12.71% | 12.48% | 13.30% | 15.54% |

| Total Other Income/Expenses | -136.81B | -83.01B | -28.79B | -31.58B | -48.34B | -14.54B | -30.70B | -21.98B | -22.81B | -16.49B | -21.62B | -12.98B | -15.83B | -14.26B | 15.44B | -15.24B | -3.34B | -9.87B | -3.74B | -6.12B | 17.33B | -8.09B | 1.87B | -8.59B | 7.97B | 1.45B |

| Income Before Tax | 103.16B | 135.75B | 301.68B | 143.60B | 185.62B | 458.21B | 196.47B | 170.33B | 190.64B | 167.47B | 167.61B | 161.11B | 179.69B | 147.59B | 153.37B | 99.90B | 98.05B | 69.87B | 57.24B | 52.36B | 59.50B | 29.50B | 45.52B | 30.91B | 48.37B | 45.03B |

| Income Before Tax Ratio | 4.02% | 5.01% | 12.14% | 7.73% | 10.18% | 25.69% | 11.57% | 10.93% | 12.72% | 12.90% | 14.00% | 14.98% | 18.53% | 17.61% | 19.71% | 12.78% | 15.61% | 12.79% | 11.63% | 12.50% | 15.49% | 8.53% | 13.25% | 9.76% | 16.66% | 15.69% |

| Income Tax Expense | -15.27B | 263.94M | 82.63B | 35.41B | 39.98B | 136.13B | 48.37B | 30.25B | 50.11B | 46.67B | 34.71B | 37.13B | 44.89B | 27.66B | 11.67B | 14.09B | 16.67B | 14.24B | 9.12B | 5.88B | 4.98B | 7.44B | 7.15B | 5.15B | 7.19B | 4.75B |

| Net Income | 105.65B | 118.17B | 199.16B | 96.15B | 130.14B | 306.89B | 129.61B | 118.46B | 120.81B | 106.24B | 123.04B | 114.43B | 122.75B | 110.70B | 128.26B | 82.63B | 79.20B | 55.86B | 48.20B | 45.22B | 54.09B | 22.06B | 38.38B | 25.76B | 41.18B | 40.28B |

| Net Income Ratio | 4.12% | 4.36% | 8.02% | 5.18% | 7.14% | 17.21% | 7.63% | 7.60% | 8.06% | 8.18% | 10.28% | 10.64% | 12.66% | 13.21% | 16.49% | 10.57% | 12.61% | 10.23% | 9.79% | 10.79% | 14.08% | 6.38% | 11.17% | 8.14% | 14.18% | 14.03% |

| EPS | 285.93 | 319.80 | 539.00 | 260.22 | 352.21 | 1.66K | 701.52 | 641.18 | 653.90 | 575.04 | 741.62 | 716.69 | 768.79 | 693.39 | 799.54 | 566.26 | 528.50 | 331.62 | 316.99 | 293.41 | 359.75 | 138.11 | 242.59 | 159.86 | 251.33 | 268.81 |

| EPS Diluted | 285.93 | 319.80 | 539.00 | 260.22 | 352.21 | 1.66K | 701.52 | 641.18 | 653.90 | 575.04 | 741.62 | 716.69 | 768.79 | 693.39 | 799.54 | 566.26 | 528.50 | 331.62 | 316.99 | 293.41 | 359.75 | 138.11 | 242.59 | 159.86 | 251.33 | 268.81 |

| Weighted Avg Shares Out | 369.50M | 369.50M | 369.50M | 369.50M | 369.50M | 184.75M | 184.75M | 184.75M | 184.75M | 184.75M | 165.90M | 159.67M | 159.67M | 159.67M | 160.42M | 159.67M | 159.67M | 159.67M | 159.67M | 159.67M | 159.67M | 159.67M | 159.67M | 159.67M | 158.92M | 153.28M |

| Weighted Avg Shares Out (Dil) | 369.50M | 369.50M | 369.50M | 369.50M | 369.50M | 184.75M | 184.75M | 184.75M | 184.75M | 184.75M | 165.90M | 159.67M | 159.67M | 159.67M | 160.42M | 159.67M | 159.67M | 159.67M | 159.67M | 159.67M | 159.67M | 159.67M | 159.67M | 159.67M | 158.92M | 153.28M |

Compania Cervecerias Unidas S.A.: A Fairly Valued Beverage Company

Macquarie Group Ltd. Decreases Stake in Compania Cervecerias Unidas, S.A. (NYSE:CCU)

Franklin Resources Inc. Sells 462,970 Shares of Compania Cervecerias Unidas, S.A. (NYSE:CCU)

Jane Street Group LLC Invests $316,000 in Compania Cervecerias Unidas, S.A. (NYSE:CCU)

Macquarie Group Ltd. Has $13.14 Million Holdings in Compania Cervecerias Unidas, S.A. (NYSE:CCU)

Source: https://incomestatements.info

Category: Stock Reports