See more : TORQ Inc. (8077.T) Income Statement Analysis – Financial Results

Complete financial analysis of Cedar Realty Trust, Inc. (CDR) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Cedar Realty Trust, Inc., a leading company in the REIT – Retail industry within the Real Estate sector.

- Jayride Group Limited (JAY.AX) Income Statement Analysis – Financial Results

- PT Kirana Megatara Tbk (KMTR.JK) Income Statement Analysis – Financial Results

- Embry Holdings Limited (1388.HK) Income Statement Analysis – Financial Results

- The Beachbody Company, Inc. (BODY) Income Statement Analysis – Financial Results

- Asahi Kasei Corporation (3407.T) Income Statement Analysis – Financial Results

Cedar Realty Trust, Inc. (CDR)

About Cedar Realty Trust, Inc.

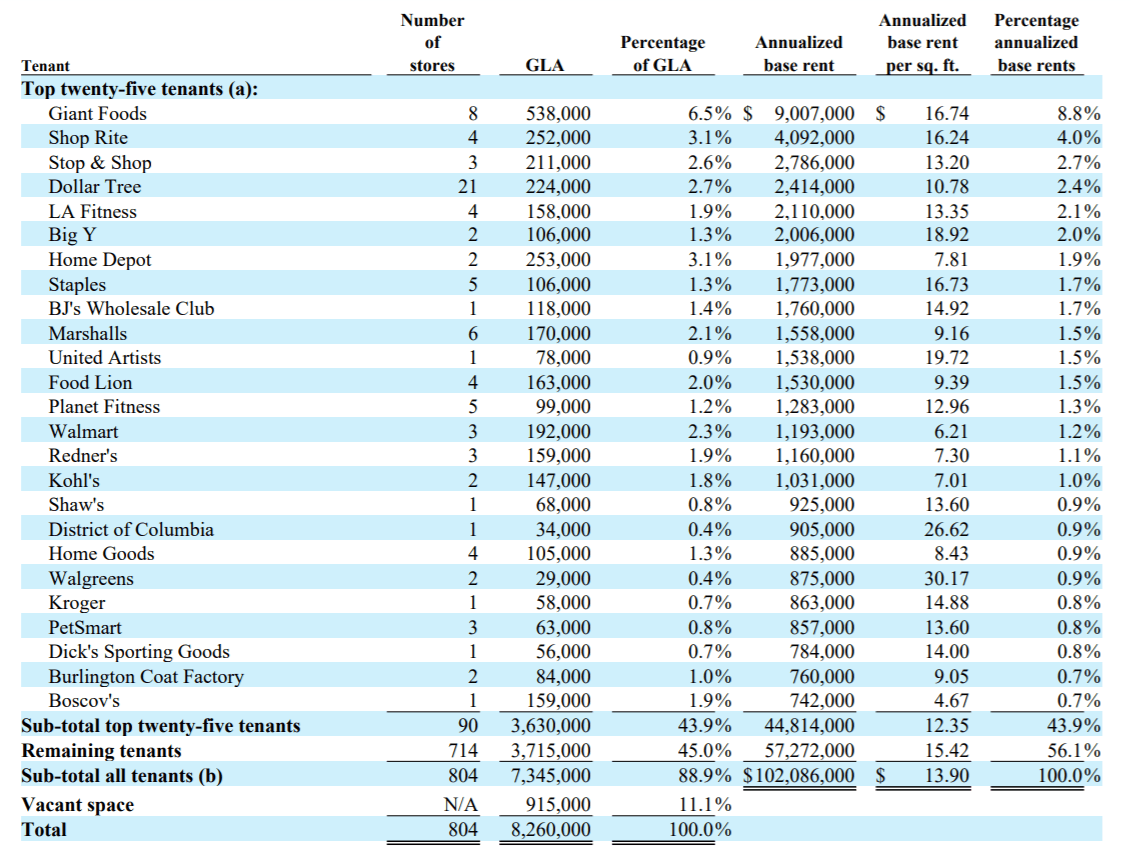

Cedar Realty Trust, Inc. is a fully-integrated real estate investment trust which focuses on the ownership, operation and redevelopment of grocery-anchored shopping centers in high-density urban markets from Washington, D.C. to Boston. The Company's portfolio (excluding properties treated as "held for sale") comprises 54 properties, with approximately 8.1 million square feet of gross leasable area.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 102.00M | 76.65M | 61.31M | 61.00M | 63.16M | 65.71M | 58.54M | 44.16M | 27.73M | 17.16M | 8.71M | 2.43M | 4.91M | 4.72M | 4.50M |

| Cost of Revenue | 34.87M | 25.73M | 19.62M | 18.89M | 19.13M | 18.47M | 16.32M | 13.47M | 9.46M | 4.31M | 1.71M | 519.22K | 1.52M | 1.24M | 1.18M |

| Gross Profit | 67.13M | 50.91M | 41.69M | 42.12M | 44.04M | 47.24M | 42.22M | 30.70M | 18.27M | 12.84M | 6.99M | 1.91M | 3.39M | 3.47M | 3.32M |

| Gross Profit Ratio | 65.81% | 66.43% | 68.00% | 69.04% | 69.72% | 71.89% | 72.13% | 69.51% | 65.88% | 74.86% | 80.32% | 78.67% | 69.12% | 73.65% | 73.76% |

| Research & Development | 0.00 | -0.11 | -0.15 | 0.00 | -0.13 | -0.27 | -0.24 | -0.29 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 11.75M | 8.62M | 7.14M | 5.83M | 6.66M | 8.30M | 6.86M | 7.52M | 9.33M | 5.37M | 5.30M | 1.31M | 321.18K | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 319.00K | 119.00K | 117.00K | 276.00K | 261.00K | 237.00K | 228.02K | 218.18K | 184.23K | 45.83K | 0.00 | 51.67K | 33.41K | 30.06K |

| SG&A | 11.75M | 8.62M | 7.14M | 5.83M | 6.66M | 8.30M | 7.36M | 9.92M | 13.48M | 5.56M | 5.30M | 1.31M | 372.85K | 33.41K | 30.06K |

| Other Expenses | 25.97M | 19.54M | 14.80M | 17.29M | 21.32M | 27.99M | 29.14M | 21.22M | 16.95M | 8.43M | 3.57M | 847.15K | 1.69M | 1.58M | 1.53M |

| Operating Expenses | 37.72M | 28.16M | 21.94M | 23.12M | 27.98M | 36.08M | 36.42M | 30.99M | 30.36M | 13.99M | 8.87M | 2.15M | 2.06M | 1.61M | 1.56M |

| Cost & Expenses | 72.59M | 53.89M | 41.56M | 42.01M | 47.10M | 54.55M | 52.73M | 44.45M | 39.82M | 18.30M | 10.58M | 2.67M | 3.58M | 2.86M | 2.74M |

| Interest Income | 484.00K | 65.00K | 34.00K | 1.00K | 2.00K | 4.00K | 1.44M | 691.94K | 118.76K | 23.32K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 32.31M | 30.11M | 33.03M | 17.09M | 18.99M | 20.23M | 17.17M | 13.36M | 9.04M | 6.81M | 2.50M | 966.11K | 1.88M | 1.76M | 1.59M |

| Depreciation & Amortization | 28.50M | 56.59M | 38.03M | 43.14M | 45.54M | 51.63M | 55.97M | 39.16M | 16.88M | 9.09M | 3.47M | 833.71K | 1.50M | 1.47M | 1.38M |

| EBITDA | 59.16M | 41.18M | 34.57M | 34.67M | 32.17M | 41.25M | 36.27M | 20.38M | 5.05M | 1.31M | 1.59M | 582.61K | 2.84M | 3.33M | 3.15M |

| EBITDA Ratio | 58.00% | 54.36% | 57.01% | 57.78% | 59.18% | 58.22% | 57.19% | 47.64% | 17.28% | 46.33% | 18.25% | 24.41% | 57.79% | 70.69% | 69.83% |

| Operating Income | 29.41M | 24.60M | 19.51M | 18.42M | 16.06M | 6.39M | 542.00K | -291.14K | -12.33M | -4.93M | -1.88M | -239.54K | 1.33M | 1.86M | 1.76M |

| Operating Income Ratio | 28.83% | 32.09% | 31.82% | 30.19% | 25.43% | 9.73% | 0.93% | -0.66% | -44.47% | -28.74% | -21.56% | -9.84% | 27.15% | 39.45% | 39.17% |

| Total Other Income/Expenses | -23.28M | -33.07M | -28.86M | -18.13M | -18.98M | -20.22M | -15.72M | -12.66M | -8.93M | -5.58M | -2.05M | -966.11K | -805.97K | 0.00 | 0.00 |

| Income Before Tax | 6.13M | -8.47M | -9.35M | 287.00K | -8.13M | -13.83M | -14.16M | -12.96M | -21.38M | -11.75M | -4.38M | -1.21M | 0.00 | 0.00 | 0.00 |

| Income Before Tax Ratio | 6.01% | -11.05% | -15.25% | 0.47% | -12.87% | -21.05% | -24.19% | -29.34% | -77.08% | -68.45% | -50.25% | -49.53% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 48.00K | 13.04M | 2.00K | 16.10M | 15.00K | 40.00K | 137.00K | 107.46K | 5.19M | 5.62M | -714.97K | -43.88K | 1.88M | 1.76M | 1.59M |

| Net Income | -4.69M | -21.51M | -9.35M | -15.81M | -8.14M | -16.50M | -12.09M | -11.20M | -17.52M | -10.55M | -3.66M | -1.16M | -543.46K | 98.16K | 179.01K |

| Net Income Ratio | -4.60% | -28.06% | -15.25% | -25.91% | -12.89% | -25.11% | -20.66% | -25.37% | -63.17% | -61.48% | -42.04% | -47.73% | -11.07% | 2.08% | 3.97% |

| EPS | -49.42 | -22.04 | -9.63 | -16.30 | -8.42 | -17.83 | -13.97 | -13.30 | -21.16 | -31.03 | -10.77 | -4.93 | -1.32 | 0.24 | 0.43 |

| EPS Diluted | -1.64K | -22.04 | -9.63 | -16.30 | -8.42 | -17.83 | -13.97 | -13.30 | -21.16 | -114.80 | -63.37 | -5.12 | -1.32 | 0.24 | 0.43 |

| Weighted Avg Shares Out | 591.60K | 976.07K | 971.19K | 969.83K | 967.18K | 925.62K | 865.42K | 842.04K | 827.89K | 340.00K | 340.00K | 235.82K | 412.69K | 412.69K | 412.69K |

| Weighted Avg Shares Out (Dil) | 17.78K | 976.07K | 971.19K | 969.83K | 967.18K | 925.62K | 865.42K | 842.04K | 827.89K | 91.91K | 57.76K | 226.98K | 412.69K | 412.69K | 412.69K |

Cedar Realty Trust (CDR) Q4 FFO and Revenues Surpass Estimates

Cedar Realty Trust Declares Dividends On Common And Preferred Stock

Check Out These +7% Yield Preferred Stocks: Cedar Realty

2024 Bond Yield +20%: Washington Prime

Cedar Realty Trust Announces 1-for-6.6 Reverse Stock Split

Cedar Realty Trust, Inc. (CDR) CEO Bruce Schanzer on Q3 2020 Results - Earnings Call Transcript

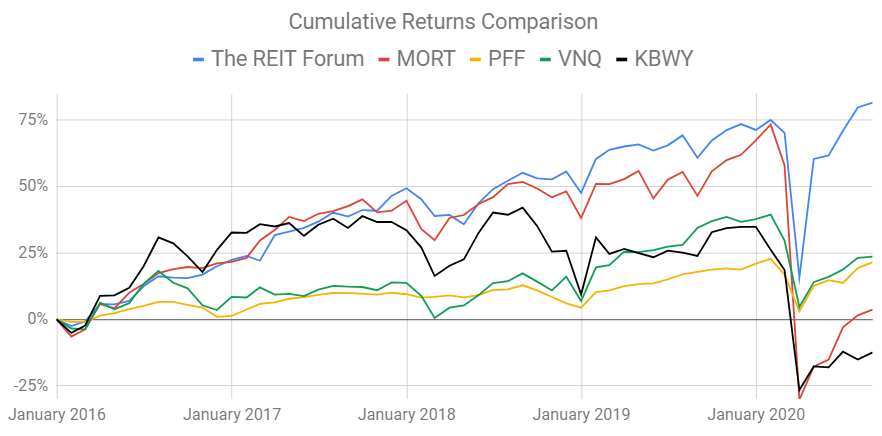

Here's Why My REITs Beat Your REITs

Shopping Center REITs: An 'Essential' Bargain

3 Overlooked REIT Preferred Stock Options Offering Double-Digit Return Potential

Royal Bank of Canada Has $66,000 Stock Position in Cedar Realty Trust Inc (NYSE:CDR)

Source: https://incomestatements.info

Category: Stock Reports