See more : Federal Agricultural Mortgage Corporation (AGM-PD) Income Statement Analysis – Financial Results

Complete financial analysis of Comstock Holding Companies, Inc. (CHCI) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Comstock Holding Companies, Inc., a leading company in the Real Estate – Diversified industry within the Real Estate sector.

- Gas2Grid Limited (GGX.AX) Income Statement Analysis – Financial Results

- Liberty Broadband Corporation (LBRDK) Income Statement Analysis – Financial Results

- Fujian Holdings Limited (0181.HK) Income Statement Analysis – Financial Results

- Talga Group Ltd (TLGRF) Income Statement Analysis – Financial Results

- BAIYU Holdings, Inc. (BYU) Income Statement Analysis – Financial Results

Comstock Holding Companies, Inc. (CHCI)

About Comstock Holding Companies, Inc.

Comstock Holding Companies, Inc. develops, operates, and manages of mixed-use and transit-oriented properties primarily in the Washington, D.C. metropolitan area. The company operates a portfolio of 34 operating assets, which include 14 commercial assets totaling approximately 2.2 million square feet; 6 multifamily assets totaling 1,636 units; and 14 commercial garages with approximately 11,000 parking spaces. It also has 18 development pipeline assets consisting of approximately 2.0 million square feet of additional planned commercial development; approximately 1,900 multifamily units; and 2 hotel assets. In addition, the company provides real estate development and management services. It primarily serves private and institutional owners; investors in commercial, residential, and mixed-use real estate; and various governmental bodies. The company was formerly known as Comstock Homebuilding Companies, Inc. and changed its name to Comstock Holding Companies, Inc. in June 2012. Comstock Holding Companies, Inc. was founded in 1985 and is headquartered in Reston, Virginia.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 44.72M | 39.31M | 31.09M | 28.73M | 25.32M | 56.75M | 45.43M | 41.58M | 61.38M | 47.97M | 54.61M | 14.30M | 22.21M | 23.85M | 25.07M | 46.66M | 266.16M | 245.88M | 224.31M | 96.05M | 55.52M | 34.75M | 50.93M |

| Cost of Revenue | 33.04M | 29.37M | 24.65M | 22.54M | 21.17M | 57.18M | 42.88M | 38.66M | 52.13M | 38.51M | 42.40M | 13.18M | 19.99M | 23.20M | 21.73M | 39.27M | 245.31M | 216.66M | 157.71M | 63.99M | 0.00 | 0.00 | 0.00 |

| Gross Profit | 11.68M | 9.94M | 6.44M | 6.18M | 4.15M | -431.00K | 2.55M | 2.92M | 9.24M | 9.46M | 12.21M | 1.13M | 2.22M | 654.00K | 3.34M | 7.39M | 20.85M | 29.22M | 66.60M | 32.05M | 55.52M | 34.75M | 50.93M |

| Gross Profit Ratio | 26.12% | 25.29% | 20.72% | 21.53% | 16.37% | -0.76% | 5.61% | 7.02% | 15.06% | 19.72% | 22.36% | 7.87% | 10.01% | 2.74% | 13.31% | 15.83% | 7.83% | 11.89% | 29.69% | 33.37% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 2.96M | 1.49M | 1.26M | 5.30M | 5.59M | 7.41M | 7.76M | 6.74M | 8.03M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 661.00K | 383.00K | 1.01M | 1.49M | 1.61M | 2.08M | 2.13M | 1.98M | 624.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 2.31M | 1.78M | 1.29M | 3.62M | 1.87M | 2.27M | 6.79M | 7.19M | 9.49M | 9.89M | 8.71M | 8.66M | 7.44M | 5.61M | 8.07M | 16.40M | 34.67M | 37.50M | 24.19M | 11.94M | 5.71M | 3.73M | 3.90M |

| Other Expenses | 212.00K | 206.00K | 94.00K | 112.00K | 225.00K | 135.00K | 66.00K | 157.00K | 861.00K | 407.00K | 267.00K | 18.00K | 0.00 | 0.00 | 0.00 | -3.99M | 78.26M | 57.43M | 0.00 | 0.00 | 41.76M | 0.00 | 40.85M |

| Operating Expenses | 2.52M | 1.99M | 1.38M | 3.62M | 1.87M | 2.27M | 6.79M | 7.19M | 9.49M | 9.89M | 8.71M | 8.66M | 7.44M | 5.61M | 8.07M | 12.41M | 112.94M | 94.93M | 24.19M | 11.94M | 47.47M | 3.73M | 44.75M |

| Cost & Expenses | 35.56M | 31.36M | 26.03M | 26.16M | 23.04M | 59.45M | 49.67M | 45.86M | 61.62M | 48.40M | 51.11M | 21.83M | 27.43M | 28.80M | 29.80M | 51.68M | 358.24M | 311.58M | 181.90M | 75.93M | 47.47M | 3.73M | 44.75M |

| Interest Income | 0.00 | 222.00K | 235.00K | 344.00K | 474.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 222.00K | 235.00K | 379.00K | 474.00K | 171.00K | 41.00K | 886.00K | 547.00K | 26.00K | 408.00K | 2.14M | 3.10M | 2.22M | 4.14M | 3.99M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 212.00K | 206.00K | 94.00K | 100.00K | 217.00K | 185.00K | 181.00K | 181.00K | 164.00K | 100.00K | 553.00K | 122.00K | 196.00K | 98.00K | 843.00K | 896.00K | 6.99M | 3.47M | 2.52M | 106.00K | 44.00K | 26.81M | 302.00K |

| EBITDA | 9.38M | 8.16M | 5.16M | 2.75M | 2.49M | 478.00K | -4.56M | -6.53M | -2.53M | -2.65M | 3.23M | -9.52M | 1.83M | -7.59M | -13.30M | -9.01M | -89.35M | -62.23M | 44.13M | 20.22M | 8.05M | 31.03M | 6.18M |

| EBITDA Ratio | 20.97% | 20.76% | 16.61% | 10.11% | 8.52% | -4.22% | -8.79% | -9.85% | -0.13% | -0.05% | 6.90% | -51.69% | 67.00% | -20.35% | 9.59% | 46.29% | -3.27% | -2.56% | 19.38% | 22.00% | 14.58% | 89.25% | 12.72% |

| Operating Income | 9.16M | 7.95M | 5.07M | 2.57M | 2.28M | -5.10M | -4.81M | -6.86M | -3.56M | -3.15M | 2.74M | -12.03M | -8.32M | -8.72M | -31.81M | -32.72M | -92.09M | -65.70M | 42.41M | 20.11M | 8.05M | 4.21M | 6.18M |

| Operating Income Ratio | 20.49% | 20.23% | 16.29% | 8.94% | 8.99% | -8.99% | -10.58% | -16.51% | -5.79% | -6.57% | 5.02% | -84.08% | -37.47% | -36.58% | -126.91% | -70.12% | -34.60% | -26.72% | 18.91% | 20.94% | 14.50% | 12.11% | 12.13% |

| Total Other Income/Expenses | -1.01M | -99.00K | -243.00K | -488.00K | -809.00K | 52.00K | 66.00K | 157.00K | 861.00K | 230.00K | 267.00K | -2.48M | 33.00K | 11.00K | -22.95M | -8.01M | 2.02M | 1.34M | 1.55M | -6.05M | 183.00K | -1.29M | -1.66M |

| Income Before Tax | 8.15M | 7.85M | 4.82M | 2.30M | 1.47M | -4.97M | -4.74M | -6.71M | -2.70M | -2.75M | 3.01M | -12.01M | 1.63M | -7.69M | -27.68M | -17.01M | -90.06M | -64.37M | 43.93M | 14.06M | 8.24M | 2.92M | 4.52M |

| Income Before Tax Ratio | 18.23% | 19.98% | 15.51% | 8.01% | 5.79% | -8.75% | -10.43% | -16.13% | -4.39% | -5.73% | 5.51% | -83.95% | 7.34% | -32.23% | -110.43% | -36.45% | -33.84% | -26.18% | 19.58% | 14.64% | 14.83% | 8.40% | 8.87% |

| Income Tax Expense | 368.00K | 125.00K | -11.22M | 25.00K | 2.00K | -920.00K | 38.00K | 55.00K | -732.00K | 368.00K | 346.00K | -2.48M | 33.00K | 11.00K | -929.00K | 48.00K | -2.55M | -24.52M | 16.37M | -241.00K | 2.07M | 633.00K | 1.36M |

| Net Income | 7.78M | 7.35M | 13.61M | 2.08M | 1.46M | -4.52M | -5.03M | -8.99M | -4.57M | -6.84M | -2.03M | -5.67M | 1.11M | -7.70M | -26.75M | -17.06M | -87.51M | -39.85M | 27.56M | 14.30M | 5.94M | 3.58M | 4.52M |

| Net Income Ratio | 17.41% | 18.69% | 43.77% | 7.25% | 5.78% | -7.96% | -11.06% | -21.63% | -7.44% | -14.26% | -3.72% | -39.61% | 4.98% | -32.28% | -106.73% | -36.56% | -32.88% | -16.20% | 12.29% | 14.89% | 10.70% | 10.31% | 8.87% |

| EPS | 0.81 | 0.82 | 1.66 | 0.26 | 0.22 | -1.22 | -1.49 | -2.71 | -1.43 | -2.27 | -0.70 | -1.99 | 0.35 | -2.94 | -10.60 | -6.84 | -37.95 | -18.41 | 14.98 | 13.65 | 5.88 | 4.13 | 5.18 |

| EPS Diluted | 0.77 | 0.77 | 1.50 | 0.24 | 0.22 | -1.18 | -1.49 | -2.71 | -1.43 | -2.27 | -0.69 | -1.99 | 0.35 | -2.94 | -10.60 | -6.84 | -37.95 | -18.41 | 14.84 | 13.65 | 5.88 | 4.13 | 4.13 |

| Weighted Avg Shares Out | 9.63M | 8.97M | 8.21M | 8.06M | 6.62M | 3.71M | 3.37M | 3.32M | 3.19M | 3.01M | 2.90M | 2.85M | 2.90M | 2.62M | 2.52M | 2.49M | 2.31M | 2.16M | 1.84M | 1.05M | 1.01M | 867.71K | 867.71K |

| Weighted Avg Shares Out (Dil) | 10.11M | 9.58M | 9.10M | 8.54M | 6.80M | 3.84M | 3.37M | 3.32M | 3.20M | 3.01M | 2.95M | 2.85M | 2.96M | 2.62M | 2.52M | 2.49M | 2.31M | 2.16M | 1.86M | 1.05M | 1.01M | 867.71K | 1.09M |

Lendio Facilitates $8 Billion in Paycheck Protection Program Loans to 100,000 Small Businesses (Infographic)

5 Upcoming Open Houses In The Washington DC Area

The Joint Corp. Opens Two Corporately Managed Greenfield Clinics

5 New Properties For Sale In The Washington DC Area

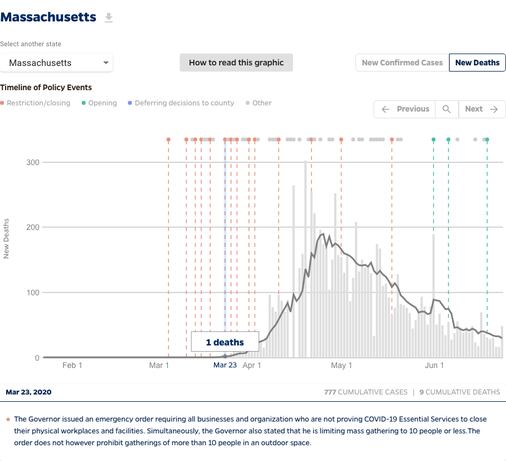

This chart shows how the coronavirus attacked Mass. and has been fended off — at least for now - The Boston Globe

Washington burned in the 60s, but with the new Black Lives Matter protests, there is hope

The Washington Post Names Comstock Companies a 2020 Top Washington-Area Workplace

Source: https://incomestatements.info

Category: Stock Reports