See more : Legato Merger Corp. (LEGOW) Income Statement Analysis – Financial Results

Complete financial analysis of Check Point Software Technologies Ltd. (CHKP) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Check Point Software Technologies Ltd., a leading company in the Software – Infrastructure industry within the Technology sector.

- Nelcast Limited (NELCAST.NS) Income Statement Analysis – Financial Results

- LGI Limited (LGI.AX) Income Statement Analysis – Financial Results

- BCAL Diagnostics Limited (BDX.AX) Income Statement Analysis – Financial Results

- Icon Offshore Bhd (5255.KL) Income Statement Analysis – Financial Results

- Covanta Holding Corporation (CVA) Income Statement Analysis – Financial Results

Check Point Software Technologies Ltd. (CHKP)

About Check Point Software Technologies Ltd.

Check Point Software Technologies Ltd. develops, markets, and supports a range of products and services for IT security worldwide. The company offers a portfolio of network security, endpoint security, data security, and management solutions. It provides Check Point Infinity Architecture, a cyber security architecture that protects against 5th and 6th generation cyber-attacks across various networks, endpoint, cloud, workloads, Internet of Things, and mobile. The company also offers security gateways and software platforms that support small and medium sized business (SMB) to large enterprise data center and telco-grade environments; and threat prevention technologies and zero-day protections. In addition, the company provides cloud network security, security and posture management, cloud workload protection, and cloud web application protection for web applications and APIs; and Check Point Harmony that delivers endpoint and secure connectivity for remote user access. Further, the company provides technical customer support programs and plans; professional services in implementing, upgrading, and optimizing Check Point products comprising design planning and security implementation; and certification and educational training services on Check Point products. It sells its products through multiple distribution channels, including distributors, resellers, system integrators, original equipment manufacturers, and managed security service providers. Check Point Software Technologies Ltd. was incorporated in 1993 and is headquartered in Tel Aviv, Israel.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 2.41B | 2.33B | 2.17B | 2.06B | 1.99B | 1.92B | 1.85B | 1.74B | 1.63B | 1.50B | 1.39B | 1.34B | 1.25B | 1.10B | 924.42M | 808.49M | 730.88M | 575.14M | 579.35M | 515.36M | 432.57M | 426.99M | 527.64M | 425.28M | 219.57M | 141.90M | 82.90M | 31.90M |

| Cost of Revenue | 282.60M | 304.40M | 258.10M | 226.50M | 215.40M | 201.38M | 212.96M | 202.00M | 189.06M | 176.54M | 162.63M | 159.16M | 175.68M | 163.97M | 133.27M | 92.61M | 82.30M | 36.43M | 30.54M | 27.78M | 18.92M | 20.69M | 26.57M | 28.16M | 18.82M | 9.10M | 4.90M | 1.40M |

| Gross Profit | 2.13B | 2.03B | 1.91B | 1.84B | 1.78B | 1.72B | 1.64B | 1.54B | 1.44B | 1.32B | 1.23B | 1.18B | 1.07B | 933.90M | 791.15M | 715.88M | 648.58M | 538.71M | 548.81M | 487.58M | 413.65M | 406.30M | 501.07M | 397.13M | 200.75M | 132.80M | 78.00M | 30.50M |

| Gross Profit Ratio | 88.30% | 86.94% | 88.09% | 89.03% | 89.20% | 89.49% | 88.52% | 88.40% | 88.40% | 88.20% | 88.33% | 88.15% | 85.91% | 85.06% | 85.58% | 88.55% | 88.74% | 93.67% | 94.73% | 94.61% | 95.63% | 95.15% | 94.96% | 93.38% | 91.43% | 93.59% | 94.09% | 95.61% |

| Research & Development | 368.90M | 349.90M | 292.70M | 252.80M | 239.20M | 211.52M | 192.39M | 178.37M | 149.28M | 133.30M | 121.76M | 111.91M | 110.15M | 105.75M | 89.74M | 91.63M | 80.98M | 62.21M | 50.54M | 43.19M | 29.31M | 28.71M | 33.22M | 30.31M | 18.92M | 10.60M | 6.20M | 0.00 |

| General & Administrative | 117.00M | 116.10M | 110.70M | 111.50M | 105.70M | 88.95M | 91.97M | 88.13M | 91.98M | 78.56M | 72.74M | 69.74M | 65.18M | 57.24M | 56.41M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 747.10M | 675.20M | 597.80M | 569.90M | 552.70M | 500.85M | 433.43M | 420.53M | 359.80M | 306.36M | 276.07M | 255.35M | 253.80M | 235.30M | 220.88M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 864.10M | 791.30M | 708.50M | 681.40M | 658.40M | 589.80M | 525.39M | 508.66M | 451.79M | 384.92M | 348.80M | 325.09M | 318.98M | 292.55M | 277.29M | 267.75M | 271.02M | 200.62M | 166.58M | 161.07M | 128.65M | 122.58M | 131.09M | 130.41M | 81.30M | 50.90M | 32.00M | 15.80M |

| Other Expenses | 0.00 | 0.00 | 12.00M | 11.00M | 215.40M | 11.00K | 212.96M | 202.00M | 189.06M | 176.54M | 38.50M | 39.80M | 36.82M | 21.26M | 22.90M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.60M | 4.50M | 1.20M | 600.00K |

| Operating Expenses | 1.23B | 1.14B | 1.00B | 934.20M | 897.60M | 801.32M | 717.78M | 687.03M | 601.06M | 518.22M | 470.57M | 437.00M | 429.13M | 398.29M | 367.03M | 359.38M | 352.00M | 262.83M | 217.12M | 204.26M | 157.97M | 151.28M | 164.31M | 160.72M | 103.82M | 66.00M | 39.40M | 16.40M |

| Cost & Expenses | 1.52B | 1.45B | 1.26B | 1.16B | 1.11B | 1.00B | 930.74M | 889.03M | 790.12M | 694.76M | 633.20M | 596.16M | 604.81M | 562.27M | 500.30M | 451.99M | 434.30M | 299.26M | 247.66M | 232.04M | 176.89M | 171.98M | 190.88M | 188.88M | 122.64M | 75.10M | 44.30M | 17.80M |

| Interest Income | 92.40M | 44.00M | 42.10M | 66.60M | 80.60M | 65.07M | 47.03M | 44.40M | 34.07M | 28.76M | 34.93M | 40.33M | 68.35M | 29.38M | 32.06M | 51.78M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 2.30M | 44.00M | 4.00M | 2.20M | 2.30M | 2.33M | 2.13M | 1.97M | 3.42M | 2.16M | 1.48M | 1.90M | 39.02M | 30.16M | 41.35M | 10.90M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 47.40M | 36.20M | 30.70M | 27.10M | 24.00M | 20.79M | 16.64M | 14.74M | 13.97M | 11.28M | 11.57M | 14.89M | 51.55M | 58.77M | 59.54M | 48.89M | 48.28M | 15.69M | 22.06M | 27.28M | 23.68M | 14.96M | 10.35M | 7.11M | 3.60M | 4.50M | 1.20M | 600.00K |

| EBITDA | 1.02B | 920.50M | 938.20M | 931.30M | 905.80M | 934.56M | 940.55M | 867.01M | 853.69M | 812.34M | 772.47M | 761.42M | 734.76M | 623.16M | 505.34M | 402.13M | 344.85M | 354.16M | 353.75M | 332.28M | 279.37M | 269.97M | 347.12M | 243.51M | 100.53M | 71.34M | 39.45M | 14.60M |

| EBITDA Ratio | 42.37% | 39.51% | 43.30% | 45.10% | 45.41% | 48.76% | 50.71% | 49.79% | 52.38% | 54.31% | 55.41% | 56.71% | 55.63% | 54.19% | 53.44% | 52.49% | 49.36% | 51.11% | 61.06% | 64.75% | 64.58% | 63.23% | 65.09% | 57.17% | 45.70% | 45.10% | 43.06% | 40.13% |

| Operating Income | 899.10M | 884.30M | 907.50M | 904.20M | 881.80M | 913.77M | 923.92M | 852.27M | 839.72M | 801.05M | 760.91M | 746.54M | 642.17M | 535.01M | 415.02M | 356.50M | 279.58M | 274.82M | 331.69M | 260.22M | 255.68M | 255.01M | 336.76M | 229.30M | 96.92M | 66.80M | 38.60M | 14.10M |

| Operating Income Ratio | 37.23% | 37.95% | 41.88% | 43.79% | 44.20% | 47.68% | 49.82% | 48.94% | 51.52% | 53.55% | 54.58% | 55.60% | 51.50% | 48.73% | 44.89% | 44.09% | 38.25% | 47.78% | 57.25% | 50.49% | 59.11% | 59.72% | 63.82% | 53.92% | 44.14% | 47.08% | 46.56% | 44.20% |

| Total Other Income/Expenses | 76.50M | 44.00M | 42.10M | 66.60M | 80.60M | 65.07M | 47.03M | 44.40M | 34.07M | 28.76M | 34.93M | 40.33M | 41.04M | 29.38M | 30.78M | 29.66M | 49.73M | 63.65M | 54.18M | 44.78M | 43.51M | 49.31M | 44.76M | 29.15M | 12.96M | 7.00M | 3.20M | 1.30M |

| Income Before Tax | 975.60M | 928.30M | 949.60M | 970.80M | 962.40M | 978.84M | 970.95M | 896.67M | 873.79M | 829.82M | 795.84M | 786.87M | 683.21M | 564.39M | 445.80M | 386.16M | 329.30M | 338.47M | 385.87M | 305.00M | 299.19M | 304.33M | 381.52M | 258.44M | 109.89M | 73.80M | 42.50M | 15.60M |

| Income Before Tax Ratio | 40.40% | 39.84% | 43.82% | 47.01% | 48.25% | 51.08% | 52.35% | 51.49% | 53.61% | 55.48% | 57.09% | 58.60% | 54.79% | 51.41% | 48.22% | 47.76% | 45.06% | 58.85% | 66.60% | 59.18% | 69.17% | 71.27% | 72.31% | 60.77% | 50.05% | 52.01% | 51.27% | 48.90% |

| Income Tax Expense | 135.30M | 131.40M | 134.00M | 124.20M | 136.70M | 157.54M | 168.02M | 171.83M | 187.92M | 170.25M | 143.04M | 166.87M | 139.25M | 111.57M | 88.28M | 62.19M | 48.24M | 60.44M | 66.18M | 56.60M | 55.31M | 49.25M | 59.60M | 37.23M | 14.10M | 3.90M | 2.30M | 400.00K |

| Net Income | 840.30M | 796.90M | 815.60M | 846.60M | 825.70M | 821.31M | 802.92M | 724.85M | 685.87M | 659.57M | 652.80M | 620.00M | 543.97M | 452.83M | 357.52M | 323.97M | 281.06M | 278.03M | 319.68M | 248.39M | 243.88M | 255.08M | 321.92M | 221.21M | 95.78M | 69.90M | 40.20M | 15.20M |

| Net Income Ratio | 34.80% | 34.20% | 37.64% | 41.00% | 41.39% | 42.85% | 43.29% | 41.63% | 42.08% | 44.09% | 46.83% | 46.18% | 43.62% | 41.25% | 38.68% | 40.07% | 38.46% | 48.34% | 55.18% | 48.20% | 56.38% | 59.74% | 61.01% | 52.02% | 43.62% | 49.26% | 48.49% | 47.65% |

| EPS | 7.19 | 6.36 | 6.13 | 6.03 | 5.48 | 5.24 | 4.93 | 4.26 | 3.83 | 3.50 | 3.40 | 3.04 | 2.63 | 2.18 | 1.71 | 1.51 | 1.26 | 1.18 | 1.30 | 0.99 | 0.98 | 1.04 | 1.34 | 0.42 | 0.05 | 0.11 | 0.02 | 0.01 |

| EPS Diluted | 7.10 | 6.31 | 6.08 | 5.96 | 5.43 | 5.15 | 4.82 | 4.18 | 3.74 | 3.43 | 3.27 | 2.96 | 2.54 | 2.13 | 1.68 | 1.50 | 1.25 | 1.17 | 1.27 | 0.95 | 0.96 | 1.00 | 1.25 | 0.37 | 0.04 | 0.10 | 0.02 | 0.01 |

| Weighted Avg Shares Out | 116.91M | 125.21M | 133.10M | 140.50M | 150.60M | 156.60M | 162.70M | 170.16M | 179.22M | 188.49M | 192.26M | 203.92M | 206.92M | 208.11M | 209.37M | 214.36M | 222.55M | 235.62M | 245.91M | 250.90M | 248.86M | 244.10M | 222.93M | 523.37M | 2.01B | 637.83M | 205.06M | 196.35M |

| Weighted Avg Shares Out (Dil) | 118.35M | 126.34M | 134.10M | 142.00M | 152.10M | 159.40M | 166.60M | 173.30M | 183.62M | 192.30M | 199.49M | 209.17M | 213.92M | 212.93M | 212.21M | 216.67M | 225.44M | 237.63M | 251.72M | 261.47M | 254.04M | 254.77M | 246.46M | 590.66M | 2.22B | 696.51M | 205.06M | 196.35M |

Check Point Software Technologies Announces $2.0 Billion Expansion of Share Repurchase Authorization

Check Point Securing Profits, Big Money Interest

Buy 5 Nasdaq Composite Laggards of 1H Set to Rebound in 2H

Here's Why Check Point Software (CHKP) is a Strong Growth Stock

OFFSITE, LLC Announces Strategic Partnership with Check Point Software to Enhance Enterprise Security Services

Check Point: A Buy Based On AI Growth Drivers And Earnings Strength

Why Check Point Software (CHKP) is a Top Growth Stock for the Long-Term

Check Point Software Advances API Security Supporting Enterprise Digital Transformation

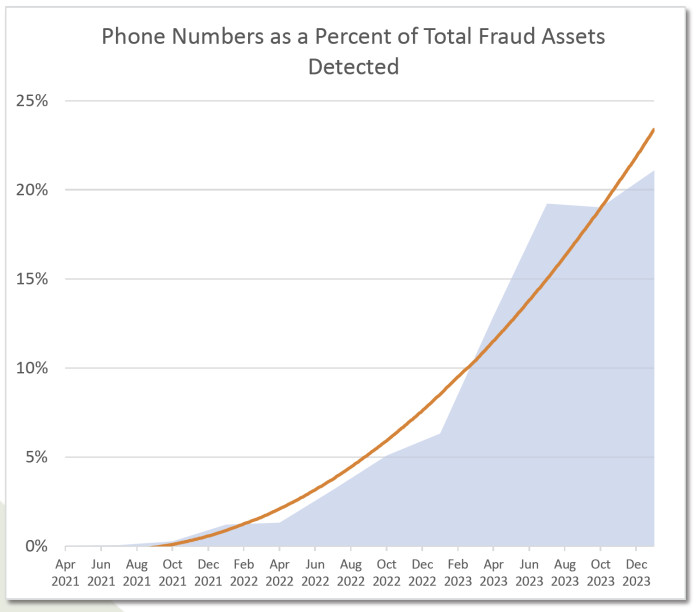

APWG Q1 Report: Phone-Based Phishing Grows Explosively, Shifting the Cybercrime Threatscape

Quadrant Capital Group LLC Buys 247 Shares of Check Point Software Technologies Ltd. (NASDAQ:CHKP)

Source: https://incomestatements.info

Category: Stock Reports