See more : NatWest Group plc (RYS1.DE) Income Statement Analysis – Financial Results

Complete financial analysis of Mack-Cali Realty Corporation (CLI) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Mack-Cali Realty Corporation, a leading company in the REIT – Office industry within the Real Estate sector.

- Yagi & Co.,Ltd. (7460.T) Income Statement Analysis – Financial Results

- Prakash Pipes Limited (PPL.BO) Income Statement Analysis – Financial Results

- First Republic Bank (FRC-PN) Income Statement Analysis – Financial Results

- SungEel HiTech Co., Ltd. (365340.KQ) Income Statement Analysis – Financial Results

- AVITA Medical, Inc. (AVHHL) Income Statement Analysis – Financial Results

Mack-Cali Realty Corporation (CLI)

About Mack-Cali Realty Corporation

One of the country's leading real estate investment trusts (REITs), Mack-Cali Realty Corporation is an owner, manager and developer of premier office and multifamily properties in select waterfront and transit-oriented markets throughout the Northeast. Mack-Cali is headquartered in Jersey City, New Jersey, and is the visionary behind the city's flourishing waterfront, where the company is leading development, improvement and place-making initiatives for Harborside, a master-planned destination comprised of class A office, luxury apartments, diverse retail and restaurants, and public spaces. A fully-integrated and self-managed company, Mack-Cali has provided world-class management, leasing, and development services throughout New Jersey and the surrounding region for two decades. By regularly investing in its properties and innovative lifestyle amenity packages, Mack-Cali creates environments that empower tenants and residents to reimagine the way they work and live.

| Metric | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 313.56M | 350.94M | 530.61M | 616.20M | 613.40M | 594.88M | 636.80M | 667.03M | 704.74M | 724.28M | 787.48M | 764.53M | 777.97M | 808.35M | 740.31M | 643.41M | 588.99M | 586.25M | 569.61M | 584.35M | 576.15M | 551.48M | 493.70M | 249.80M | 95.47M | 62.30M | 16.90M |

| Cost of Revenue | 141.41M | 147.44M | 224.15M | 254.74M | 267.22M | 272.19M | 302.33M | 292.14M | 280.14M | 202.38M | 342.32M | 297.32M | 317.49M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 172.15M | 203.50M | 306.45M | 361.47M | 346.18M | 322.70M | 334.47M | 374.90M | 424.61M | 521.90M | 445.16M | 467.21M | 460.48M | 808.35M | 740.31M | 643.41M | 588.99M | 586.25M | 569.61M | 584.35M | 576.15M | 551.48M | 493.70M | 249.80M | 95.47M | 62.30M | 16.90M |

| Gross Profit Ratio | 54.90% | 57.99% | 57.76% | 58.66% | 56.44% | 54.25% | 52.52% | 56.20% | 60.25% | 72.06% | 56.53% | 61.11% | 59.19% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 73.64M | 59.80M | 53.99M | 50.95M | 51.98M | 49.15M | 73.17M | 47.68M | 47.87M | 35.54M | 35.00M | 39.81M | 43.98M | 52.16M | 49.08M | 33.09M | 31.79M | 31.46M | 27.05M | 28.49M | 23.28M | 25.48M | 25.57M | 15.86M | 5.80M | 3.70M | 1.20M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 73.64M | 59.80M | 53.99M | 50.95M | 51.98M | 49.15M | 73.17M | 47.68M | 47.87M | 35.54M | 35.00M | 39.81M | 43.98M | 52.16M | 49.08M | 33.09M | 31.79M | 31.46M | 27.05M | 28.49M | 23.28M | 25.48M | 25.57M | 15.86M | 5.80M | 3.70M | 1.20M |

| Other Expenses | 122.04M | 132.02M | 174.85M | 205.17M | 186.68M | 170.40M | 172.49M | 182.77M | 189.01M | 281.06M | 191.17M | 202.54M | 194.64M | 539.66M | 471.17M | 382.44M | 318.92M | 302.99M | 277.64M | 266.16M | 301.37M | 255.86M | 228.62M | 158.49M | 45.47M | -36.50M | -10.00M |

| Operating Expenses | 195.68M | 191.81M | 228.84M | 256.12M | 238.66M | 219.55M | 245.66M | 230.45M | 236.88M | 316.60M | 226.17M | 242.35M | 238.62M | 591.82M | 520.25M | 415.53M | 350.72M | 334.45M | 304.70M | 294.65M | 324.65M | 281.34M | 254.19M | 174.36M | 51.27M | -32.80M | -8.80M |

| Cost & Expenses | 337.09M | 339.25M | 452.99M | 510.85M | 505.88M | 491.74M | 547.99M | 522.58M | 517.01M | 518.98M | 568.49M | 539.67M | 556.11M | 591.82M | 520.25M | 415.53M | 350.72M | 334.45M | 304.70M | 294.65M | 324.65M | 281.34M | 254.19M | 174.36M | 51.27M | -32.80M | -8.80M |

| Interest Income | 43.00K | 2.41M | 3.39M | 2.77M | 1.61M | 794.00K | 3.62M | 2.90M | 35.00K | 39.00K | 86.00K | 571.00K | 1.39M | 4.67M | 3.05M | 856.00K | 1.37M | 1.10M | 2.30M | 2.19M | 0.00 | 0.00 | 2.40M | 0.00 | 0.00 | 300.00K | 100.00K |

| Interest Expense | 80.99M | 90.57M | 83.75M | 93.39M | 94.89M | 103.05M | 112.88M | 123.70M | 122.37M | 125.98M | 149.33M | 141.27M | 128.15M | 126.67M | 136.36M | 119.34M | 109.65M | 116.31M | 107.82M | 112.00M | 105.39M | 0.00 | 88.04M | 0.00 | 12.68M | 8.70M | 1.80M |

| Depreciation & Amortization | 118.35M | 128.15M | 170.28M | 198.67M | 186.55M | 172.11M | 173.85M | 191.52M | 192.16M | 193.01M | 190.67M | 196.60M | 188.73M | 424.00K | 160.86M | 156.10M | 130.25M | 119.16M | 109.51M | 91.47M | 92.09M | 87.21M | 78.92M | 36.83M | 15.81M | 12.10M | 3.80M |

| EBITDA | 147.95M | 330.58M | 338.15M | 315.25M | 398.66M | 149.41M | 315.29M | 300.31M | 355.45M | 390.40M | 394.90M | 392.44M | 370.60M | 237.56M | 441.88M | 370.92M | 342.36M | 378.52M | 357.06M | 335.13M | 382.82M | 206.95M | 283.54M | 38.23M | 60.43M | 34.40M | 9.50M |

| EBITDA Ratio | 47.18% | 94.20% | 63.73% | 51.16% | 64.99% | 25.12% | 49.51% | 45.02% | 50.44% | 53.90% | 50.15% | 51.33% | 47.64% | 29.39% | 59.69% | 57.65% | 58.13% | 64.57% | 62.68% | 57.35% | 66.44% | 37.53% | 57.43% | 15.30% | 63.30% | 55.22% | 56.21% |

| Operating Income | -23.52M | 11.69M | 77.62M | 105.35M | 107.52M | 103.15M | 88.81M | 144.45M | 187.73M | 205.30M | 218.99M | 224.86M | 221.86M | 216.53M | 220.06M | 227.87M | 238.28M | 251.79M | 264.92M | 289.70M | 251.50M | 270.14M | 239.51M | 75.45M | 44.20M | 95.10M | 25.70M |

| Operating Income Ratio | -7.50% | 3.33% | 14.63% | 17.10% | 17.53% | 17.34% | 13.95% | 21.66% | 26.64% | 28.35% | 27.81% | 29.41% | 28.52% | 26.79% | 29.73% | 35.42% | 40.45% | 42.95% | 46.51% | 49.58% | 43.65% | 48.98% | 48.51% | 30.20% | 46.29% | 152.65% | 152.07% |

| Total Other Income/Expenses | -92.00M | 240.87M | 28.78M | -71.63M | 22.78M | -245.20M | -57.42M | -234.13M | -141.45M | 2.02M | -11.00M | -161.13M | -29.55M | -127.28M | 20.14M | 4.46M | 637.00K | 0.00 | 2.76M | -11.86M | 0.00 | -14.50M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Income Before Tax | -115.52M | 252.55M | 106.40M | 33.72M | 130.29M | -142.05M | 31.39M | -89.69M | 46.28M | 207.32M | 207.99M | 63.73M | 192.30M | 89.26M | 240.20M | 232.33M | 238.91M | 0.00 | 267.68M | 277.84M | 0.00 | 255.64M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Income Before Tax Ratio | -36.84% | 71.97% | 20.05% | 5.47% | 21.24% | -23.88% | 4.93% | -13.45% | 6.57% | 28.62% | 26.41% | 8.34% | 24.72% | 11.04% | 32.45% | 36.11% | 40.56% | 0.00% | 46.99% | 47.55% | 0.00% | 46.36% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | -11.01M | 331.44M | 112.54M | 21.76M | 117.67M | -142.15M | 55.46M | -110.43M | -19.08M | 128.00M | 138.33M | -19.86M | 98.59M | -605.00K | 156.49M | 123.79M | 110.29M | 116.31M | 110.58M | 100.14M | 105.39M | -14.50M | 88.04M | 0.00 | 12.68M | 8.70M | 1.80M |

| Net Income | -51.39M | 111.86M | 84.11M | 23.19M | 117.22M | -125.75M | 28.57M | -14.91M | 40.92M | 71.42M | 54.90M | 54.57M | 53.73M | 110.47M | 144.67M | 95.49M | 102.45M | 143.05M | 139.72M | 131.66M | 185.34M | 119.74M | 116.58M | 1.41M | 31.94M | 13.60M | 3.90M |

| Net Income Ratio | -16.39% | 31.88% | 15.85% | 3.76% | 19.11% | -21.14% | 4.49% | -2.24% | 5.81% | 9.86% | 6.97% | 7.14% | 6.91% | 13.67% | 19.54% | 14.84% | 17.39% | 24.40% | 24.53% | 22.53% | 32.17% | 21.71% | 23.61% | 0.56% | 33.46% | 21.83% | 23.08% |

| EPS | -0.51 | 1.11 | 0.84 | 0.26 | 1.31 | -1.41 | 0.32 | -0.17 | 0.47 | 0.83 | 0.69 | 0.73 | 0.82 | 1.65 | 2.32 | 1.55 | 1.70 | 2.48 | 2.44 | 2.33 | 3.18 | 2.05 | 2.09 | 0.04 | 1.73 | 1.23 | 0.38 |

| EPS Diluted | -0.51 | 1.11 | 0.84 | 0.23 | 1.17 | -1.25 | 0.29 | -0.15 | 0.41 | 0.72 | 0.59 | 0.62 | 0.67 | 1.34 | 1.86 | 1.29 | 1.49 | 2.17 | 2.14 | 2.03 | 2.54 | 1.78 | 1.82 | 0.03 | 1.73 | 1.22 | 0.38 |

| Weighted Avg Shares Out | 100.26M | 100.69M | 100.72M | 90.01M | 89.75M | 89.29M | 88.73M | 87.76M | 87.74M | 86.05M | 79.22M | 74.32M | 65.49M | 67.03M | 62.24M | 61.48M | 60.35M | 57.72M | 57.23M | 56.54M | 58.34M | 58.39M | 55.84M | 39.27M | 18.46M | 11.06M | 10.26M |

| Weighted Avg Shares Out (Dil) | 100.26M | 100.69M | 100.72M | 100.70M | 100.50M | 100.22M | 100.04M | 99.79M | 100.00M | 98.96M | 92.48M | 88.39M | 80.65M | 82.50M | 77.90M | 74.19M | 68.74M | 65.99M | 65.43M | 64.78M | 73.07M | 67.13M | 63.89M | 44.16M | 18.46M | 11.15M | 10.26M |

Mack-Cali Realty Corporation Reports Third Quarter 2020 Results

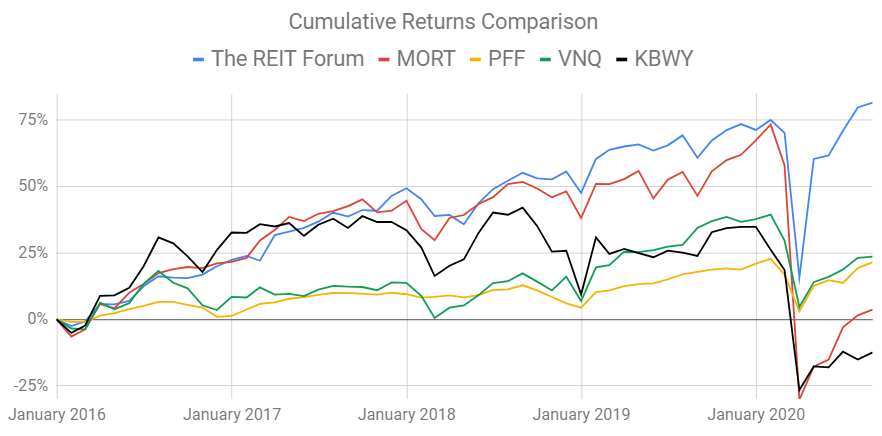

REITs Rally Despite October Surprise

Here's Why My REITs Beat Your REITs

Nisa Investment Advisors LLC Raises Holdings in Mack Cali Realty Corp (NYSE:CLI)

Coronavirus update: U.S. death toll climbs to 155,000, as COVID-19 enters ‘dangerous new phase’

Mack-Cali Realty Corp (CLI) Q2 2020 Earnings Call Transcript | The Motley Fool

Mack-Cali Realty misses FFO expectations, reports surprise revenue decline

Mack Cali Realty Corp (NYSE:CLI) Shares Sold by Royal Bank of Canada

Is This the New Vivian Meier? In a Secret Room, a Woman Discovered 8,000 Remarkable Photos Taken by Her Grandfather

Source: https://incomestatements.info

Category: Stock Reports