See more : Recyctec Holding AB ser. B (RECY-B.ST) Income Statement Analysis – Financial Results

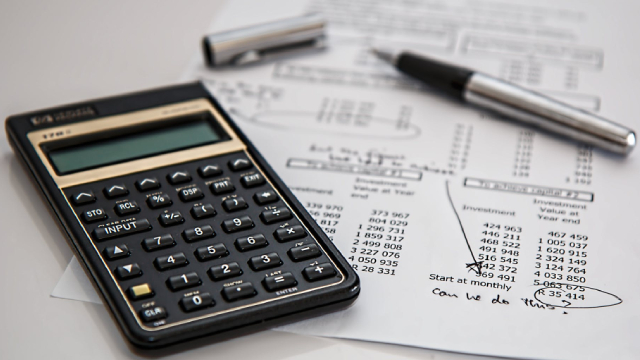

Complete financial analysis of Climb Global Solutions, Inc. (CLMB) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Climb Global Solutions, Inc., a leading company in the Technology Distributors industry within the Technology sector.

- Tata Coffee Limited (TATACOFFEE.BO) Income Statement Analysis – Financial Results

- ICEsoft Technologies Canada Corp. (ISFT.CN) Income Statement Analysis – Financial Results

- Advice Capital Globale (ACIGLO.CO) Income Statement Analysis – Financial Results

- Future plc (FUTR.L) Income Statement Analysis – Financial Results

- Fifth Third Bancorp (0IM1.L) Income Statement Analysis – Financial Results

Climb Global Solutions, Inc. (CLMB)

About Climb Global Solutions, Inc.

Climb Global Solutions Inc. operates as a value-added information technology (IT) distribution and solutions company in the United States, Canada, Europe, the United Kingdom, and internationally. It operates in two segments, Distribution and Solutions. The company distributes technical software and hardware to corporate and value added resellers, consultants, and systems integrators under the names Climb Channel Solutions and Sigma Software Distribution; and software, hardware, and services under the names TechXtend and Grey Matter. It also resells computer software and hardware developed by others, as well as provides technical services to end user customers. In addition, the company offers a line of products from various software vendors; and tools for virtualization/cloud computing, security, networking, storage and infrastructure management, application lifecycle management, and other technically sophisticated domains, as well as computer hardware. Climb Global Solutions Inc. markets its products through its own web sites, local and on-line seminars, events, webinars, and social media, as well as direct email and printed materials. It provides IT distribution and solutions for companies in the security, data management, cloud, connectivity, storage and HCI, virtualization, and software and ALM industries. The company was formerly known as Wayside Technology Group, Inc. and changed its name to Climb Global Solutions Inc. in October 2022. Climb Global Solutions Inc. was incorporated in 1982 and is headquartered in Eatontown, New Jersey.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 352.01M | 304.35M | 282.58M | 251.57M | 208.76M | 181.44M | 449.38M | 418.13M | 382.09M | 340.76M | 300.39M | 297.06M | 250.17M | 206.73M | 146.38M | 174.03M | 179.87M | 182.32M | 137.66M | 103.58M | 69.57M | 65.16M | 89.54M | 216.54M | 244.10M | 234.40M | 176.20M | 127.70M | 93.30M | 71.30M |

| Cost of Revenue | 287.77M | 250.25M | 236.87M | 218.53M | 178.79M | 154.52M | 422.30M | 390.80M | 355.52M | 315.95M | 276.04M | 273.17M | 226.93M | 186.72M | 130.79M | 157.23M | 162.63M | 165.35M | 122.69M | 91.24M | 60.61M | 56.54M | 80.66M | 193.78M | 216.70M | 204.20M | 149.60M | 106.20M | 78.10M | 58.80M |

| Gross Profit | 64.25M | 54.09M | 45.72M | 33.04M | 29.97M | 26.92M | 27.08M | 27.33M | 26.57M | 24.81M | 24.36M | 23.89M | 23.24M | 20.01M | 15.59M | 16.80M | 17.24M | 16.97M | 14.97M | 12.34M | 8.96M | 8.62M | 8.88M | 22.76M | 27.40M | 30.20M | 26.60M | 21.50M | 15.20M | 12.50M |

| Gross Profit Ratio | 18.25% | 17.77% | 16.18% | 13.13% | 14.35% | 14.84% | 6.03% | 6.54% | 6.95% | 7.28% | 8.11% | 8.04% | 9.29% | 9.68% | 10.65% | 9.65% | 9.58% | 9.31% | 10.88% | 11.91% | 12.88% | 13.22% | 9.92% | 10.51% | 11.22% | 12.88% | 15.10% | 16.84% | 16.29% | 17.53% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 32.14M | 25.52M | 9.77M | 9.69M | 9.43M | 9.14M | 8.08M | 7.75M | 7.51M | 7.30M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 11.63M | 10.63M | 9.83M | 9.58M | 9.99M | 8.76M | 8.00M | 8.08M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 44.33M | 34.14M | 32.14M | 25.52M | 21.40M | 20.32M | 19.26M | 18.72M | 18.06M | 16.51M | 15.51M | 15.38M | 14.62M | 13.21M | 11.32M | 12.21M | 12.08M | 12.16M | 12.20M | 10.17M | 8.14M | 8.93M | 13.02M | 25.65M | 24.40M | 22.70M | 18.60M | 17.20M | 12.30M | 10.70M |

| Other Expenses | 0.00 | 2.05M | 1.53M | 704.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 348.00K | 255.00K | 2.57M | 3.10M | 2.00M | 1.80M | 1.30M | 600.00K | 500.00K |

| Operating Expenses | 44.33M | 36.20M | 33.67M | 26.22M | 21.40M | 20.32M | 19.26M | 18.72M | 18.06M | 16.51M | 15.51M | 15.38M | 14.62M | 13.21M | 11.32M | 12.21M | 12.08M | 12.16M | 12.20M | 10.17M | 8.14M | 9.27M | 13.28M | 28.21M | 27.50M | 24.70M | 20.40M | 18.50M | 12.90M | 11.20M |

| Cost & Expenses | 335.52M | 286.45M | 270.53M | 244.75M | 200.19M | 174.84M | 441.57M | 409.52M | 373.58M | 332.46M | 291.54M | 288.54M | 241.55M | 199.93M | 142.11M | 169.44M | 174.71M | 177.51M | 134.89M | 101.42M | 68.75M | 65.81M | 93.93M | 222.00M | 244.20M | 228.90M | 170.00M | 124.70M | 91.00M | 70.00M |

| Interest Income | 0.00 | 121.00K | 372.00K | 73.00K | 500.00K | 907.00K | 699.00K | 318.00K | 368.00K | 472.00K | 562.00K | 557.00K | 368.00K | 405.00K | 521.00K | 741.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 71.00K | 68.00K | 116.00K | 500.00K | 907.00K | 699.00K | 318.00K | 368.00K | 472.00K | 562.00K | 557.00K | 368.00K | 405.00K | 521.00K | 741.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 3.16M | 2.48M | 2.00M | 1.41M | 858.00K | 482.00K | 477.00K | 296.00K | 253.00K | 226.00K | 274.00K | 302.00K | 325.00K | 317.00K | 297.00K | 355.00K | 361.00K | 270.00K | 246.00K | 191.00K | 313.00K | 394.00K | 804.00K | 2.57M | 3.10M | 2.00M | 1.80M | 1.30M | 600.00K | 500.00K |

| EBITDA | 20.28M | 18.59M | 13.59M | 7.53M | 9.32M | 7.08M | 8.29M | 8.91M | 8.76M | 8.52M | 9.12M | 8.82M | 8.94M | 7.12M | 4.57M | 4.95M | 5.52M | 5.08M | 3.01M | 2.36M | 1.13M | -263.00K | -3.59M | -2.89M | 3.00M | 7.50M | 8.00M | 4.30M | 2.90M | 1.80M |

| EBITDA Ratio | 5.76% | 6.63% | 4.96% | 3.09% | 4.11% | 4.96% | 1.73% | 2.13% | 2.23% | 2.44% | 2.95% | 2.86% | 3.57% | 3.44% | 3.12% | 2.84% | 3.07% | 2.78% | 2.20% | 2.32% | 1.48% | -0.14% | -3.35% | 3.05% | 1.02% | 2.94% | 4.26% | 2.90% | 2.57% | 2.38% |

| Operating Income | 16.49M | 17.31M | 12.05M | 5.30M | 8.47M | 4.16M | 7.81M | 8.62M | 8.51M | 8.30M | 8.85M | 8.52M | 8.62M | 6.80M | 4.27M | 4.59M | 5.15M | 4.81M | 2.77M | 2.17M | 817.00K | -657.00K | -4.76M | -5.45M | -100.00K | 5.50M | 6.20M | 3.00M | 2.30M | 1.30M |

| Operating Income Ratio | 4.68% | 5.69% | 4.26% | 2.11% | 4.06% | 2.29% | 1.74% | 2.06% | 2.23% | 2.43% | 2.95% | 2.87% | 3.44% | 3.29% | 2.92% | 2.64% | 2.87% | 2.64% | 2.01% | 2.09% | 1.17% | -1.01% | -5.31% | -2.52% | -0.04% | 2.35% | 3.52% | 2.35% | 2.47% | 1.82% |

| Total Other Income/Expenses | 291.00K | -782.00K | 313.00K | 917.00K | 582.00K | 962.00K | 740.00K | 317.00K | 348.00K | 461.00K | 562.00K | 574.00K | 369.00K | 407.00K | 521.00K | 744.00K | 991.00K | 741.00K | 300.00K | 112.00K | 230.00K | 415.00K | 318.00K | -9.54M | 700.00K | 300.00K | 200.00K | 300.00K | 200.00K | -300.00K |

| Income Before Tax | 16.78M | 16.53M | 12.36M | 6.22M | 9.05M | 5.12M | 8.55M | 8.93M | 8.86M | 8.76M | 9.41M | 9.09M | 8.99M | 7.21M | 4.80M | 5.33M | 6.15M | 5.55M | 3.07M | 2.28M | 1.05M | -242.00K | -4.44M | -14.99M | 600.00K | 5.80M | 6.40M | 3.30M | 2.50M | 1.00M |

| Income Before Tax Ratio | 4.77% | 5.43% | 4.38% | 2.47% | 4.33% | 2.82% | 1.90% | 2.14% | 2.32% | 2.57% | 3.13% | 3.06% | 3.59% | 3.49% | 3.28% | 3.07% | 3.42% | 3.04% | 2.23% | 2.20% | 1.50% | -0.37% | -4.96% | -6.92% | 0.25% | 2.47% | 3.63% | 2.58% | 2.68% | 1.40% |

| Income Tax Expense | 4.46M | 4.04M | 3.17M | 1.75M | 2.26M | 1.58M | 3.49M | 3.03M | 3.03M | 3.00M | 3.02M | 3.60M | 3.45M | 2.79M | 1.93M | 2.17M | 2.44M | 2.28M | 414.00K | -4.04M | 81.00K | -270.00K | 83.00K | 2.48M | 1.30M | 2.40M | 2.40M | 1.00M | -1.70M | -100.00K |

| Net Income | 12.32M | 12.50M | 9.20M | 4.47M | 6.79M | 3.54M | 5.06M | 5.90M | 5.83M | 5.76M | 6.39M | 5.49M | 5.54M | 4.42M | 2.87M | 3.17M | 3.70M | 3.27M | 2.65M | 6.32M | 966.00K | 28.00K | -4.52M | -17.47M | -700.00K | 3.40M | 4.00M | 2.30M | 4.20M | 1.10M |

| Net Income Ratio | 3.50% | 4.11% | 3.25% | 1.78% | 3.25% | 1.95% | 1.13% | 1.41% | 1.53% | 1.69% | 2.13% | 1.85% | 2.21% | 2.14% | 1.96% | 1.82% | 2.06% | 1.79% | 1.93% | 6.10% | 1.39% | 0.04% | -5.05% | -8.07% | -0.29% | 1.45% | 2.27% | 1.80% | 4.50% | 1.54% |

| EPS | 2.73 | 2.81 | 2.09 | 1.01 | 1.51 | 0.81 | 1.13 | 1.25 | 1.26 | 1.24 | 1.44 | 1.23 | 1.26 | 1.01 | 0.65 | 0.72 | 0.84 | 0.78 | 0.67 | 1.65 | 0.26 | 0.01 | -0.91 | -3.51 | -0.14 | 0.72 | 0.84 | 0.48 | 1.14 | 0.35 |

| EPS Diluted | 2.73 | 2.81 | 2.09 | 1.01 | 1.51 | 0.81 | 1.13 | 1.25 | 1.25 | 1.23 | 1.41 | 1.19 | 1.20 | 0.98 | 0.65 | 0.71 | 0.80 | 0.72 | 0.61 | 1.51 | 0.25 | 0.01 | -0.91 | -3.51 | -0.14 | 0.66 | 0.75 | 0.44 | 1.03 | 0.35 |

| Weighted Avg Shares Out | 4.40M | 4.33M | 4.27M | 4.29M | 4.42M | 4.36M | 4.30M | 4.50M | 4.63M | 4.66M | 4.45M | 4.48M | 4.41M | 4.39M | 4.40M | 4.41M | 4.41M | 4.19M | 3.98M | 3.83M | 3.72M | 4.46M | 4.99M | 4.98M | 5.10M | 4.80M | 4.76M | 4.79M | 3.68M | 3.14M |

| Weighted Avg Shares Out (Dil) | 4.40M | 4.33M | 4.27M | 4.29M | 4.42M | 4.36M | 4.30M | 4.50M | 4.65M | 4.70M | 4.53M | 4.63M | 4.61M | 4.50M | 4.43M | 4.46M | 4.66M | 4.52M | 4.38M | 4.18M | 3.90M | 4.48M | 4.99M | 4.98M | 5.10M | 5.25M | 5.33M | 5.23M | 4.08M | 3.14M |

Scality and Climb Channel Solutions Partner to Reimagine Distribution for AI and Cyber-resilient Storage Software

Forget Profit, Bet on 4 Stocks With Increasing Cash Flows

Here's Why Momentum in Climb Global (CLMB) Should Keep going

Here's Why Momentum in Climb Global (CLMB) Should Keep going

3 Reasons Growth Investors Will Love Climb Global (CLMB)

Grab These 4 Top-Ranked Solid Net Profit Margin Stocks to Boost Return

5 Stocks With Recent Price Strength to Enhance Your Portfolio

Scoop Up Big Gains With 4 Stocks Witnessing Rise in Cash Flow

Here is Why Growth Investors Should Buy Climb Global (CLMB) Now

CLMB or QXO: Which Is the Better Value Stock Right Now?

Source: https://incomestatements.info

Category: Stock Reports