See more : Pan African Resources PLC (PAFRY) Income Statement Analysis – Financial Results

Complete financial analysis of Colony Credit Real Estate, Inc. (CLNC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Colony Credit Real Estate, Inc., a leading company in the REIT – Diversified industry within the Real Estate sector.

- Platinum Studios, Inc (PDOS) Income Statement Analysis – Financial Results

- L&F Acquisition Corp. (LNFA-UN) Income Statement Analysis – Financial Results

- Aroway Energy Inc. (ARWJF) Income Statement Analysis – Financial Results

- Tembo Gold Corp. (TBGPF) Income Statement Analysis – Financial Results

- SBI Cards and Payment Services Limited (SBICARD.NS) Income Statement Analysis – Financial Results

Colony Credit Real Estate, Inc. (CLNC)

About Colony Credit Real Estate, Inc.

Colony Credit Real Estate, Inc. operates as a real estate investment trust. The company is headquartered in Los Angeles, California. The company is focused on originating and acquiring a diversified portfolio of CRE debt and net lease real estate investments. Its diversified portfolio consists of senior mortgage loans, mezzanine loans, preferred equity, CRE debt securities and net leased properties. The company operates through four segments: Commercial Real Estate Debt, which is focused on originating, acquiring and asset managing CRE debt investments, including mortgage loans, subordinate interests and mezzanine loans, as well as preferred equity interests; Commercial Real Estate Equity, which is focused on the ownership in real estate and real estate assets, and Commercial Real Estate Securities, which is focused on investing in commercial mortgage-backed securities, unsecured REIT debt, collateralized debt obligation (CDO) notes and other securities.

| Metric | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|

| Revenue | 424.35M | 549.33M | 473.36M | 163.96M | 141.67M | 112.71M |

| Cost of Revenue | 211.98M | 310.50M | 253.10M | 29.00M | 26.94M | 1.99M |

| Gross Profit | 212.37M | 238.83M | 220.26M | 134.97M | 114.73M | 110.73M |

| Gross Profit Ratio | 50.05% | 43.48% | 46.53% | 82.32% | 80.99% | 98.24% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 66.27M | 81.52M | 106.62M | 15.24M | 17.20M | 15.32M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 66.27M | 81.52M | 106.62M | 15.24M | 17.20M | 15.32M |

| Other Expenses | 136.49M | 321.46M | 201.25M | 8.86M | 3.00M | 721.00K |

| Operating Expenses | 202.76M | 402.98M | 307.87M | 24.10M | 20.20M | 16.04M |

| Cost & Expenses | 414.74M | 713.47M | 560.97M | 53.10M | 47.14M | 18.02M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 48.86M | 55.42M | 43.44M | 5.10M | 0.00 | 18.95M |

| Depreciation & Amortization | 59.85M | 103.32M | 90.99M | 9.14M | 146.00K | 5.06M |

| EBITDA | -255.49M | -252.60M | 2.98M | 104.94M | 77.72M | 99.75M |

| EBITDA Ratio | -60.21% | -45.98% | 0.63% | 64.00% | 54.86% | 88.50% |

| Operating Income | 9.61M | -164.14M | -87.61M | 110.86M | 94.53M | 94.69M |

| Operating Income Ratio | 2.26% | -29.88% | -18.51% | 67.61% | 66.73% | 84.01% |

| Total Other Income/Expenses | -260.92M | -332.27M | -76.46M | -5.49M | -56.00K | -12.83M |

| Income Before Tax | -251.31M | -496.42M | -164.07M | 105.38M | 94.48M | 81.86M |

| Income Before Tax Ratio | -59.22% | -90.37% | -34.66% | 64.27% | 66.69% | 72.62% |

| Income Tax Expense | -10.90M | 3.17M | 37.06M | 2.21M | 1.52M | 247.00K |

| Net Income | -353.30M | -414.51M | -168.50M | 88.50M | 76.05M | 80.55M |

| Net Income Ratio | -83.26% | -75.46% | -35.60% | 53.98% | 53.68% | 71.47% |

| EPS | -2.75 | -3.23 | -1.40 | 0.69 | 0.59 | 0.63 |

| EPS Diluted | -2.75 | -3.23 | -1.40 | 0.69 | 0.59 | 0.63 |

| Weighted Avg Shares Out | 128.55M | 128.39M | 120.68M | 127.89M | 127.89M | 127.89M |

| Weighted Avg Shares Out (Dil) | 128.55M | 128.39M | 120.68M | 127.89M | 127.89M | 127.89M |

Rosen Law Firm Announces Investigation of Potential Breaches of Fiduciary Duties by Management of Colony Capital, Inc. and Colony Credit Real Estate, Inc. – CLNY, CLNC

Rosen Law Firm Announces Investigation of Potential Breaches of Fiduciary Duties by Management of Colony Capital, Inc. and Colony Credit Real Estate, Inc.

Mortgage REITs: Back From The Brink

TriCo Bancshares Announces Quarterly Results

Energía en México: Civil War • Forbes México

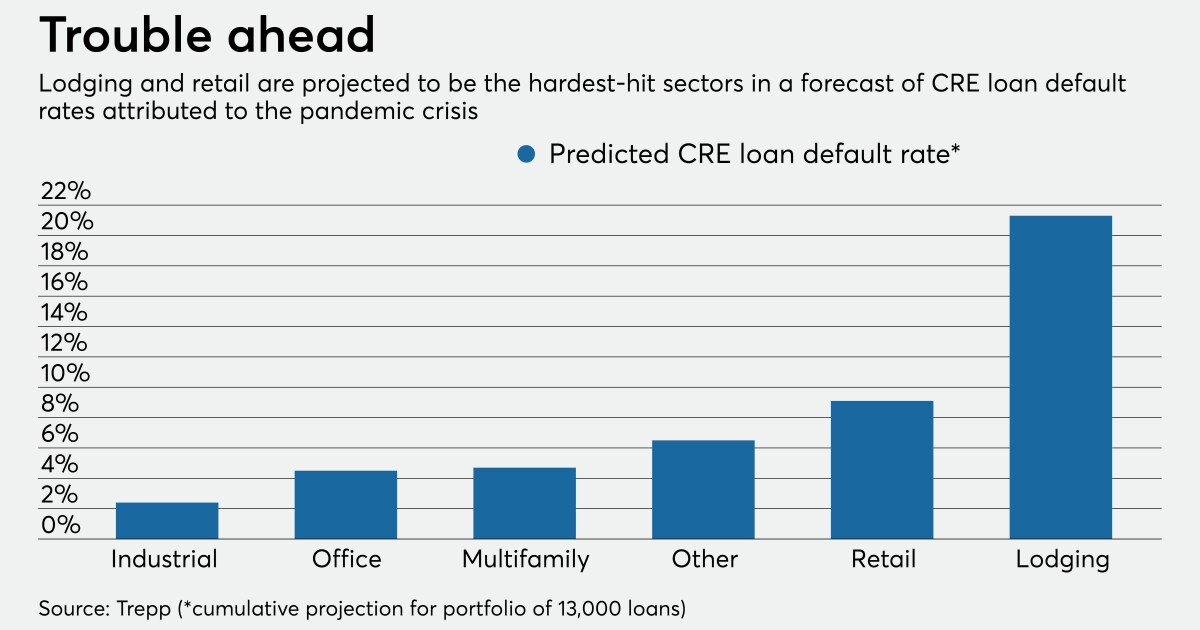

Does Congress have cure for what's ailing CRE borrowers?

Leveraged mREIT ETNs Offer Very High Current Yields

Stock Yards Bancorp Reports Second Quarter Earnings of $13.4 Million or $0.59 Per Diluted Share

Council Post: Why Reopening Efforts Must Begin And End With Trust

Source: https://incomestatements.info

Category: Stock Reports