See more : Assura Plc (ARSSF) Income Statement Analysis – Financial Results

Complete financial analysis of Commercial Metals Company (CMC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Commercial Metals Company, a leading company in the Steel industry within the Basic Materials sector.

- Zhejiang Heda Technology Co., Ltd. (688296.SS) Income Statement Analysis – Financial Results

- Kafrit Industries (1993) Ltd (KAFR.TA) Income Statement Analysis – Financial Results

- Presidio Property Trust, Inc. (SQFTW) Income Statement Analysis – Financial Results

- Monolithic Power Systems, Inc. (MPWR) Income Statement Analysis – Financial Results

- Cenntro Electric Group Limited (CENN) Income Statement Analysis – Financial Results

Commercial Metals Company (CMC)

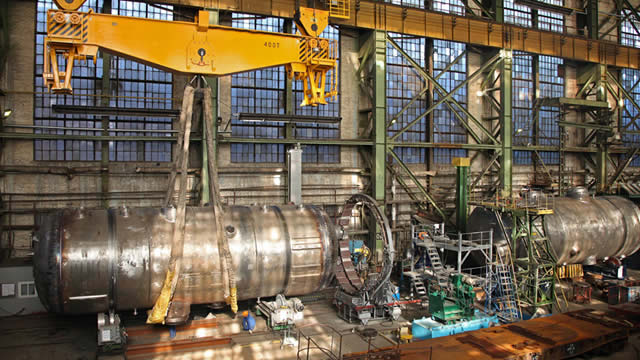

About Commercial Metals Company

Commercial Metals Company manufactures, recycles, and fabricates steel and metal products, and related materials and services in the United States, Poland, China, and internationally. The company processes and sells ferrous and nonferrous scrap metals to steel mills and foundries, aluminum sheet and ingot manufacturers, brass and bronze ingot makers, copper refineries and mills, secondary lead smelters, specialty steel mills, high temperature alloy manufacturers, and other consumers. It also manufactures and sells finished long steel products, including rebar, merchant bar, light structural, and other special sections, as well as semi-finished billets for re-rolling and forging applications. In addition, the company provides fabricated steel products used to reinforce concrete primarily in the construction of commercial and non-commercial buildings, hospitals, convention centers, industrial plants, power plants, highways, bridges, arenas, stadiums, and dams; sells and rents construction-related products and equipment to concrete installers and other businesses; and manufactures and sells strength bars for the truck trailer industry, special bar steels for the energy market, and armor plates for military vehicles. Further, it manufactures rebars, merchant bars, and wire rods; and sells fabricated rebars, wire meshes, fabricated meshes, assembled rebar cages, and other fabricated rebar by-products to fabricators, manufacturers, distributors, and construction companies. The company was founded in 1915 and is headquartered in Irving, Texas.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 7.93B | 8.80B | 8.91B | 6.73B | 5.48B | 5.83B | 4.64B | 4.57B | 4.61B | 5.99B | 7.04B | 6.89B | 7.83B | 7.92B | 6.31B | 6.79B | 10.43B | 8.33B | 7.56B | 6.59B | 4.77B | 2.88B | 2.45B | 2.44B | 2.66B | 2.25B | 2.37B | 2.26B | 2.32B | 2.12B | 1.67B | 1.57B | 1.17B | 1.16B | 1.14B | 1.30B | 1.13B | 872.80M | 885.40M | 1.02B |

| Cost of Revenue | 6.57B | 6.99B | 7.06B | 5.62B | 4.53B | 5.03B | 4.02B | 3.32B | 3.02B | 4.83B | 6.10B | 5.95B | 7.11B | 7.30B | 5.91B | 6.01B | 9.33B | 7.17B | 6.48B | 5.69B | 4.16B | 2.59B | 2.13B | 2.14B | 2.27B | 1.90B | 2.04B | 1.96B | 2.03B | 1.85B | 1.47B | 1.40B | 1.02B | 1.02B | 978.50M | 1.15B | 1.00B | 781.80M | 789.80M | 937.20M |

| Gross Profit | 1.36B | 1.81B | 1.86B | 1.11B | 944.80M | 803.49M | 622.17M | 1.25B | 1.59B | 1.16B | 943.76M | 937.71M | 719.50M | 616.62M | 395.04M | 780.06M | 1.10B | 1.16B | 1.08B | 899.21M | 607.60M | 289.04M | 317.40M | 297.32M | 394.07M | 354.90M | 332.10M | 298.00M | 295.50M | 262.40M | 191.70M | 171.20M | 148.00M | 140.70M | 158.70M | 151.10M | 127.60M | 91.00M | 95.60M | 82.00M |

| Gross Profit Ratio | 17.14% | 20.59% | 20.83% | 16.43% | 17.25% | 13.78% | 13.40% | 27.29% | 34.46% | 19.39% | 13.41% | 13.61% | 9.19% | 7.79% | 6.26% | 11.48% | 10.57% | 13.94% | 14.28% | 13.64% | 12.74% | 10.05% | 12.97% | 12.18% | 14.81% | 15.76% | 14.03% | 13.20% | 12.72% | 12.40% | 11.51% | 10.91% | 12.70% | 12.12% | 13.96% | 11.60% | 11.30% | 10.43% | 10.80% | 8.05% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 486.61M | 537.11M | 524.14M | 671.20M | 707.79M | 583.81M | 495.03M | 424.99M | 367.55M | 243.31M | 235.55M | 222.15M | 226.92M | 208.10M | 198.40M | 178.60M | 165.10M | 144.30M | 111.40M | 99.30M | 92.10M | 90.20M | 88.20M | 82.90M | 74.20M | 60.20M | 61.40M | 56.20M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 665.08M | 643.54M | 544.98M | 505.12M | 503.78M | 463.27M | 401.45M | 387.35M | 383.75M | 414.09M | 444.94M | 439.57M | 486.61M | 537.11M | 524.14M | 671.20M | 707.79M | 583.81M | 495.03M | 424.99M | 367.55M | 243.31M | 235.55M | 222.15M | 226.92M | 208.10M | 198.40M | 178.60M | 165.10M | 144.30M | 111.40M | 99.30M | 92.10M | 90.20M | 88.20M | 82.90M | 74.20M | 60.20M | 61.40M | 56.20M |

| Other Expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 66.58M | 52.10M | 47.50M | 43.70M | 41.60M | 38.10M | 30.10M | 27.40M | 25.60M | 23.60M | 22.20M | 20.20M | 19.00M | 16.50M | 15.60M | 12.10M |

| Operating Expenses | 665.08M | 649.82M | 290.54M | 519.93M | 512.18M | 463.66M | 415.82M | 411.76M | 435.26M | 423.93M | 452.25M | 418.06M | 486.61M | 537.11M | 524.14M | 671.20M | 707.79M | 583.81M | 495.03M | 424.99M | 367.55M | 243.31M | 235.55M | 222.15M | 293.50M | 260.20M | 245.90M | 222.30M | 206.70M | 182.40M | 141.50M | 126.70M | 117.70M | 113.80M | 110.40M | 103.10M | 93.20M | 76.70M | 77.00M | 68.30M |

| Cost & Expenses | 7.23B | 7.64B | 7.35B | 6.14B | 5.04B | 5.49B | 4.44B | 3.73B | 3.46B | 5.25B | 6.55B | 6.37B | 7.60B | 7.84B | 6.44B | 6.68B | 10.03B | 7.75B | 6.97B | 6.12B | 4.53B | 2.83B | 2.36B | 2.37B | 2.56B | 2.16B | 2.28B | 2.18B | 2.23B | 2.04B | 1.62B | 1.52B | 1.14B | 1.13B | 1.09B | 1.26B | 1.09B | 858.50M | 866.80M | 1.01B |

| Interest Income | 0.00 | 40.13M | 50.71M | 51.90M | 61.84M | 71.37M | 0.00 | 0.00 | 0.00 | 1.30M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 47.89M | 40.13M | 50.71M | 51.90M | 61.84M | 71.37M | 40.96M | 44.05M | 62.23M | 77.76M | 77.74M | 69.61M | 69.50M | 70.81M | 75.51M | 77.00M | 58.26M | 36.33M | 0.00 | 0.00 | 28.10M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 280.37M | 218.83M | 175.02M | 167.61M | 165.76M | 158.67M | 131.66M | 125.07M | 126.94M | 132.78M | 136.00M | 136.55M | 137.31M | 159.58M | 168.93M | 154.68M | 135.07M | 107.31M | 85.38M | 76.61M | 71.04M | 61.20M | 61.58M | 67.27M | 66.58M | 52.10M | 47.50M | 43.70M | 41.60M | 38.10M | 30.10M | 27.40M | 25.60M | 23.60M | 22.20M | 20.20M | 19.00M | 16.50M | 15.60M | 12.10M |

| EBITDA | 963.93M | 1.39B | 1.49B | 753.54M | 598.37M | 498.50M | 352.37M | 259.08M | 317.40M | 315.54M | 385.30M | 346.18M | 376.62M | 136.44M | 40.29M | 263.54M | 528.94M | 684.52M | 669.44M | 550.83M | 311.10M | 106.94M | 143.43M | 141.55M | 167.16M | 146.80M | 133.70M | 119.40M | 130.40M | 118.10M | 80.30M | 71.90M | 55.90M | 50.50M | 70.50M | 68.20M | 53.40M | 30.80M | 34.20M | 25.80M |

| EBITDA Ratio | 12.16% | 15.76% | 16.68% | 11.33% | 10.54% | 7.28% | 7.59% | 5.67% | 6.88% | 5.27% | 5.47% | 5.02% | 4.73% | 3.02% | 0.63% | 3.88% | 5.07% | 8.22% | 8.86% | 8.36% | 6.52% | 3.72% | 5.86% | 6.51% | 6.28% | 6.52% | 5.65% | 5.29% | 5.61% | 6.21% | 4.82% | 4.58% | 4.79% | 4.35% | 6.20% | 4.80% | 4.06% | 2.72% | 2.97% | 1.99% |

| Operating Income | 693.60M | 1.17B | 1.31B | 600.74M | 441.02M | 340.22M | 220.71M | 134.00M | 190.46M | 182.76M | 249.30M | 209.63M | 232.90M | 79.50M | -129.10M | 108.86M | 393.87M | 577.22M | 584.06M | 474.22M | 240.05M | 45.73M | 81.85M | 75.17M | 100.57M | 94.70M | 86.20M | 75.70M | 88.80M | 80.00M | 50.20M | 44.50M | 30.30M | 26.90M | 48.30M | 48.00M | 34.40M | 14.30M | 18.60M | 13.70M |

| Operating Income Ratio | 8.75% | 13.28% | 14.71% | 8.93% | 8.05% | 5.84% | 4.75% | 2.93% | 4.13% | 3.05% | 3.54% | 3.04% | 2.97% | 1.00% | -2.05% | 1.60% | 3.78% | 6.93% | 7.73% | 7.19% | 5.03% | 1.59% | 3.35% | 3.08% | 3.78% | 4.21% | 3.64% | 3.35% | 3.82% | 3.78% | 3.01% | 2.84% | 2.60% | 2.32% | 4.25% | 3.68% | 3.05% | 1.64% | 2.10% | 1.34% |

| Total Other Income/Expenses | -57.93M | -46.41M | 203.74M | -66.72M | -67.01M | -71.76M | -55.33M | -68.55M | -114.48M | -86.30M | -84.34M | -46.93M | -72.09M | -189.60M | -75.51M | -106.93M | -58.26M | -36.33M | -29.23M | -31.19M | -28.10M | -15.34M | -18.71M | -35.87M | -27.32M | -19.70M | -18.10M | -14.70M | -15.90M | -22.00M | -9.30M | -9.40M | -10.00M | -8.60M | -8.50M | -4.60M | 3.40M | 3.20M | 3.90M | 1.30M |

| Income Before Tax | 635.67M | 1.12B | 1.52B | 534.02M | 370.78M | 268.46M | 165.38M | 65.45M | 75.98M | 96.46M | 164.96M | 162.70M | 162.79M | -110.10M | -204.61M | 31.86M | 335.61M | 540.88M | 554.49M | 443.03M | 211.95M | 30.39M | 63.14M | 39.30M | 73.26M | 75.00M | 68.10M | 61.00M | 72.90M | 58.00M | 40.90M | 35.10M | 20.30M | 18.30M | 39.80M | 43.40M | 37.80M | 17.50M | 22.50M | 15.00M |

| Income Before Tax Ratio | 8.02% | 12.75% | 17.00% | 7.94% | 6.77% | 4.61% | 3.56% | 1.43% | 1.65% | 1.61% | 2.34% | 2.36% | 2.08% | -1.39% | -3.24% | 0.47% | 3.22% | 6.49% | 7.34% | 6.72% | 4.44% | 1.06% | 2.58% | 1.61% | 2.75% | 3.33% | 2.88% | 2.70% | 3.14% | 2.74% | 2.45% | 2.24% | 1.74% | 1.58% | 3.50% | 3.33% | 3.35% | 2.01% | 2.54% | 1.47% |

| Income Tax Expense | 150.18M | 262.21M | 297.89M | 121.15M | 93.18M | 69.68M | 30.15M | 15.28M | 13.98M | 33.46M | 47.35M | 57.98M | -46.19M | 19.33M | -38.12M | 12.73M | 103.89M | 172.77M | 187.94M | 158.00M | 65.06M | 11.49M | 22.61M | 14.96M | 27.00M | 27.90M | 25.40M | 22.40M | 26.90M | 19.80M | 14.70M | 13.40M | 7.80M | 6.30M | 13.90M | 14.90M | 13.00M | 7.30M | 8.30M | 5.70M |

| Net Income | 485.49M | 859.76M | 1.22B | 412.87M | 279.50M | 198.09M | 138.51M | 46.33M | 54.76M | 63.00M | 115.55M | 104.72M | 207.48M | -129.62M | -205.34M | 20.80M | 231.97M | 355.43M | 356.35M | 285.78M | 132.02M | 18.90M | 40.53M | 24.34M | 46.26M | 47.10M | 42.70M | 38.60M | 46.00M | 38.20M | 26.20M | 21.70M | 12.50M | 12.00M | 25.90M | 28.50M | 24.80M | 10.20M | 14.20M | 9.30M |

| Net Income Ratio | 6.13% | 9.77% | 13.66% | 6.13% | 5.10% | 3.40% | 2.98% | 1.01% | 1.19% | 1.05% | 1.64% | 1.52% | 2.65% | -1.64% | -3.26% | 0.31% | 2.22% | 4.27% | 4.72% | 4.33% | 2.77% | 0.66% | 1.66% | 1.00% | 1.74% | 2.09% | 1.80% | 1.71% | 1.98% | 1.80% | 1.57% | 1.38% | 1.07% | 1.03% | 2.28% | 2.19% | 2.20% | 1.17% | 1.60% | 0.91% |

| EPS | 4.19 | 7.34 | 10.09 | 3.43 | 2.33 | 1.68 | 1.19 | 0.43 | 0.54 | 0.54 | 1.00 | 0.90 | 1.79 | -1.13 | -1.81 | 0.19 | 2.02 | 3.01 | 3.02 | 1.21 | 1.13 | 0.17 | 0.36 | 0.23 | 0.42 | 0.41 | 0.36 | 0.32 | 0.05 | 0.32 | 0.22 | 0.02 | 0.01 | 0.01 | 0.02 | 0.02 | 0.01 | 0.01 | 0.01 | 0.00 |

| EPS Diluted | 4.14 | 7.25 | 9.95 | 3.38 | 2.31 | 1.66 | 1.17 | 0.43 | 0.53 | 0.53 | 0.99 | 0.89 | 1.78 | -1.13 | -1.81 | 0.18 | 1.97 | 2.92 | 2.89 | 1.16 | 0.28 | 0.04 | 0.09 | 0.06 | 0.20 | 0.40 | 0.35 | 0.32 | 0.05 | 0.32 | 0.22 | 0.02 | 0.01 | 0.01 | 0.02 | 0.02 | 0.01 | 0.01 | 0.01 | 0.00 |

| Weighted Avg Shares Out | 115.84M | 117.08M | 120.65M | 120.34M | 118.92M | 117.83M | 116.82M | 115.65M | 115.21M | 116.53M | 117.50M | 116.68M | 115.86M | 115.00M | 113.52M | 112.39M | 115.05M | 118.08M | 118.00M | 118.66M | 114.42M | 113.14M | 216.06M | 104.23M | 113.93M | 115.94M | 118.61M | 122.06M | 120.77M | 121.27M | 119.77M | 117.98M | 113.77M | 112.83M | 114.84M | 120.40M | 121.02M | 127.91M | 126.49M | 124.20M |

| Weighted Avg Shares Out (Dil) | 117.15M | 118.61M | 122.37M | 121.98M | 120.31M | 119.12M | 118.15M | 117.36M | 116.62M | 117.95M | 118.61M | 117.55M | 116.78M | 115.00M | 113.52M | 113.88M | 117.69M | 121.72M | 123.30M | 124.04M | 118.68M | 114.58M | 223.23M | 104.96M | 116.11M | 117.02M | 121.13M | 122.06M | 120.77M | 121.27M | 119.77M | 117.98M | 113.77M | 112.83M | 114.84M | 120.40M | 121.02M | 127.91M | 126.49M | 124.20M |

CMC Recognized as One of America's Most Responsible Companies by Newsweek for 2025

Top 3 US steel stocks that will benefit from Trump 2.0

Commercial Metals initiated with a Buy at Goldman Sachs

CMC Announces New Mineral Resource Estimate for the Silver Hart Project

CMC Metals Releases Additional High Grade CRD-Style Silver-Lead-Zinc Samples, A proposed Drill Plan and Expands its Amy Property, North- Central British Columbia

CMC Metals Ltd. Options the Silverknife Property to Coeur Mining, Inc.

Bear of the Day: Commercial Metals (CMC)

New Strong Sell Stocks for November 12th

Longeveron® Appoints Devin Blass as Chief Technology Officer and SVP of Chemistry, Manufacturing and Controls (CMC)

CMC Metals Announces Results of AGM and Granting of Options

Source: https://incomestatements.info

Category: Stock Reports