See more : Iberdrola, S.A. (IBE.MC) Income Statement Analysis – Financial Results

Complete financial analysis of Cheetah Mobile Inc. (CMCM) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Cheetah Mobile Inc., a leading company in the Internet Content & Information industry within the Communication Services sector.

- Vital Healthcare Property Trust (VHP.NZ) Income Statement Analysis – Financial Results

- Chongqing Jianshe Vehicle System Co., Ltd. (200054.SZ) Income Statement Analysis – Financial Results

- Patriot Transportation Holding, Inc. (PATI) Income Statement Analysis – Financial Results

- Jauss Polymers Limited (JAUSPOL.BO) Income Statement Analysis – Financial Results

- GFL Limited (GFLLIMITED.BO) Income Statement Analysis – Financial Results

Cheetah Mobile Inc. (CMCM)

About Cheetah Mobile Inc.

Cheetah Mobile Inc. operates as an internet company in the People's Republic of China, the United States, Japan, and internationally. The company's utility products include Clean Master, a junk file cleaning, memory boosting, and privacy protection tool for mobile devices; Security Master, an anti-virus and security application for mobile devices; and Duba Anti-virus, an internet security application to protect users against known and unknown security threats and malicious applications. In addition, it offers mobile games comprising Piano Tiles 2, Rolling Sky, and Dancing Line; value-added products, such as PC and mobile products, as well as wallpaper, office optimization software, and others; E-Coupon vending robot, a reception and marketing robot; and multi-cloud management platform and overseas advertising agency service. Further, the company provides mobile advertising publisher services; duba.com personal start page that aggregates online resources and provides users access to their online destinations; cloud-based data analytics engines; artificial intelligence and other services; and premium membership services. It serves direct advertisers that include mobile application developers, mobile game developers, and e-commerce companies, as well as search engines and partnering mobile advertising networks. The company was formerly known as Kingsoft Internet Software Holdings Limited and changed its name to Cheetah Mobile Inc. in March 2014. Cheetah Mobile Inc. was incorporated in 2009 and is based in Beijing, the People's Republic of China.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

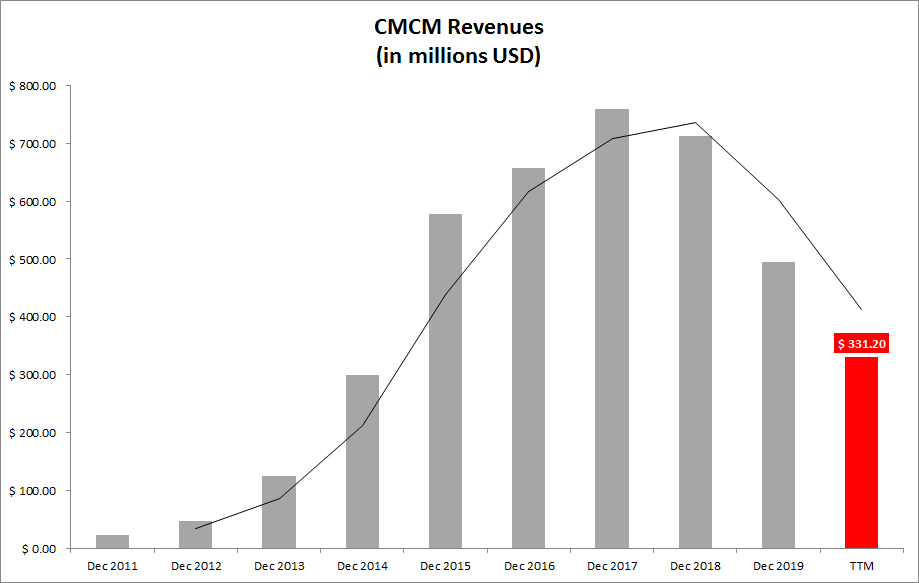

| Revenue | 669.50M | 884.07M | 784.62M | 1.56B | 3.59B | 724.24M | 764.56M | 657.41M | 581.27M | 299.61M | 123.87M | 46.19M | 140.05M |

| Cost of Revenue | 231.94M | 252.56M | 257.66M | 449.03M | 1.24B | 223.98M | 273.58M | 222.34M | 126.03M | 53.06M | 23.21M | 8.57M | 53.74M |

| Gross Profit | 437.56M | 631.51M | 526.96M | 1.11B | 2.35B | 500.26M | 490.98M | 435.07M | 455.23M | 246.55M | 100.66M | 37.62M | 86.32M |

| Gross Profit Ratio | 65.36% | 71.43% | 67.16% | 71.19% | 65.38% | 69.07% | 64.22% | 66.18% | 78.32% | 82.29% | 81.26% | 81.44% | 61.63% |

| Research & Development | 178.21M | 180.96M | 211.59M | 470.41M | 787.33M | 97.25M | 105.26M | 130.46M | 107.08M | 71.46M | 35.98M | 18.34M | 79.11M |

| General & Administrative | 229.55M | 214.34M | 191.87M | 400.79M | 587.46M | 62.63M | 62.61M | 80.92M | 69.00M | 44.34M | 16.16M | 5.52M | 15.30M |

| Selling & Marketing | 242.51M | 476.85M | 370.27M | 763.81M | 1.56B | 277.68M | 254.58M | 237.72M | 231.95M | 96.97M | 33.28M | 9.17M | 28.81M |

| SG&A | 472.06M | 691.19M | 562.14M | 1.16B | 2.15B | 340.32M | 317.20M | 318.64M | 300.95M | 141.31M | 49.44M | 14.69M | 44.11M |

| Other Expenses | -2.87M | -260.47M | -17.21M | 5.68M | -22.09M | 843.73M | 1.26B | 87.93M | 47.17M | 3.49M | 2.24M | 1.28M | 537.00K |

| Operating Expenses | 647.40M | 1.21B | 756.53M | 1.64B | 2.91B | -328.42M | -274.18M | -446.11M | -420.76M | -235.10M | -83.54M | -35.77M | 123.22M |

| Cost & Expenses | 879.34M | 1.47B | 1.01B | 2.09B | 4.15B | -104.45M | -602.00K | -223.77M | -294.73M | -182.04M | -60.33M | -27.20M | 176.95M |

| Interest Income | 60.98M | 35.71M | 25.39M | 35.66M | 110.01M | 12.75M | 3.47M | 1.12M | 2.24M | 4.55M | 1.17M | 523.48K | 3.48M |

| Interest Expense | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 35.26M | 53.03M | 50.82M | 68.55M | 65.47M | 80.11M | 136.30M | 163.36M | -22.62M | -12.84M | -4.27M | -1.74M | 15.04M |

| EBITDA | -174.58M | -172.57M | -178.75M | -462.57M | -490.98M | 547.33M | 583.18M | 153.80M | 413.62M | 180.60M | 118.10M | 21.32M | -21.86M |

| EBITDA Ratio | -26.08% | -19.52% | -25.88% | -36.60% | -0.55% | 11.24% | 12.50% | 3.37% | 10.96% | 9.72% | 15.75% | 7.40% | -15.65% |

| Operating Income | -209.84M | -225.59M | -229.57M | -531.11M | -565.25M | 69.78M | 74.65M | -1.38M | 41.09M | 16.28M | 15.23M | 1.68M | -36.90M |

| Operating Income Ratio | -31.34% | -25.52% | -29.26% | -34.08% | -15.76% | 9.64% | 9.76% | -0.21% | 7.07% | 5.43% | 12.30% | 3.63% | -26.35% |

| Total Other Income/Expenses | -427.81M | -320.19M | -110.00M | 1.04B | 199.56M | 802.50M | 986.39M | -56.45M | -4.37M | -285.39K | 3.05M | 689.20K | 4.07M |

| Income Before Tax | -637.65M | -545.78M | -339.57M | 508.25M | -365.69M | 184.59M | 220.28M | -9.92M | 36.72M | 15.99M | 18.28M | 2.37M | -32.83M |

| Income Before Tax Ratio | -95.24% | -61.74% | -43.28% | 32.61% | -10.19% | 25.49% | 28.81% | -1.51% | 6.32% | 5.34% | 14.76% | 5.13% | -23.44% |

| Income Tax Expense | -43.78M | 25.09M | 13.63M | 97.09M | 7.90M | 17.01M | 8.85M | 1.76M | 9.82M | 4.50M | 8.04M | 788.51K | -2.60M |

| Net Income | -602.90M | -522.19M | -353.20M | 416.73M | -373.59M | 164.16M | 205.13M | -11.60M | 27.16M | 10.35M | 8.70M | 1.42M | -30.24M |

| Net Income Ratio | -90.05% | -59.07% | -45.02% | 26.74% | -10.41% | 22.67% | 26.83% | -1.76% | 4.67% | 3.45% | 7.03% | 3.07% | -21.59% |

| EPS | -20.50 | -18.10 | -12.35 | 15.50 | -13.64 | 5.85 | 7.20 | -0.42 | 0.95 | 0.41 | 0.44 | 0.08 | -1.38 |

| EPS Diluted | -20.47 | -18.09 | -12.35 | 15.00 | -13.64 | 5.70 | 7.20 | -0.42 | 0.95 | 0.39 | 0.38 | 0.07 | -1.33 |

| Weighted Avg Shares Out | 29.42M | 28.86M | 28.60M | 27.99M | 27.38M | 28.06M | 28.50M | 27.75M | 28.54M | 25.21M | 19.58M | 18.82M | 21.87M |

| Weighted Avg Shares Out (Dil) | 29.45M | 28.87M | 28.60M | 27.99M | 27.38M | 28.81M | 28.50M | 27.75M | 28.54M | 26.83M | 22.72M | 20.94M | 22.72M |

Cheetah Mobile Inc. Files Its Annual Report on Form 20-F

Cheetah Mobile Inc.'s (CMCM) CEO Fu Sheng on Q4 2020 Results - Earnings Call Transcript

Cheetah Mobile Announces Fourth Quarter and Full Year 2020 Unaudited Consolidated Financial Results

Cheetah Mobile to Report Fourth Quarter and Full Year 2020 Financial Results on March 23, 2021

Cheetah Mobile Announces Third Quarter 2020 Unaudited Consolidated Financial Results

Cheetah Mobile to Report Third Quarter 2020 Financial Results on November 24, 2020

Simply Avoid Cheetah Mobile

DEADLINE TODAY: The Schall Law Firm Announces the Filing of a Class Action Lawsuit Against Cheetah Mobile Inc. and Encourages Investors with Losses in Excess of $100,000 to Contact the Firm

CMCM FINAL DEADLINE: ROSEN, A TRUSTED AND TOP RANKED FIRM, Reminds Cheetah Mobile Inc. Investors of Important Monday Deadline in Securities Class Action - CMCM

DEADLINE TOMORROW: The Schall Law Firm Announces the Filing of a Class Action Lawsuit Against Cheetah Mobile Inc. and Encourages Investors with Losses in Excess of $100,000 to Contact the Firm

Source: https://incomestatements.info

Category: Stock Reports