See more : EDICO Holdings Limited (8450.HK) Income Statement Analysis – Financial Results

Complete financial analysis of Comcast Corporation (CMCSA) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Comcast Corporation, a leading company in the Telecommunications Services industry within the Communication Services sector.

- ZTO Express (Cayman) Inc. (2057.HK) Income Statement Analysis – Financial Results

- Urbana Corporation (URB-A.CN) Income Statement Analysis – Financial Results

- Karuturi Global Limited (KGL.NS) Income Statement Analysis – Financial Results

- West Red Lake Gold Mines Ltd. (WRLG.V) Income Statement Analysis – Financial Results

- Swiss Steel Holding AG (0QPH.L) Income Statement Analysis – Financial Results

Comcast Corporation (CMCSA)

Industry: Telecommunications Services

Sector: Communication Services

Website: https://corporate.comcast.com

About Comcast Corporation

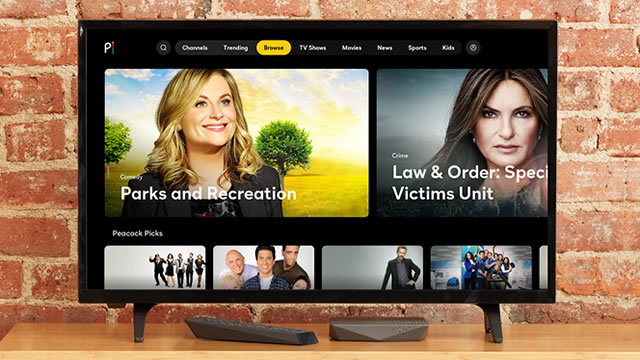

Comcast Corporation operates as a media and technology company worldwide. It operates through Cable Communications, Media, Studios, Theme Parks, and Sky segments. The Cable Communications segment offers broadband, video, voice, wireless, and other services to residential and business customers under the Xfinity brand; and advertising services. The Media segment operates NBCUniversal's television and streaming platforms, including national, regional, and international cable networks, the NBC and Telemundo broadcast, and Peacock networks. The Studios segment operates NBCUniversal's film and television studio production and distribution operations. The Theme Parks segment operates Universal theme parks in Orlando, Florida; Hollywood, California; Osaka, Japan; and Beijing, China. The Sky segment offers direct-to-consumer services, such as video, broadband, voice and wireless phone services, and content business operates entertainment networks, the Sky News broadcast network, and Sky Sports networks. The company also owns the Philadelphia Flyers, as well as the Wells Fargo Center arena in Philadelphia, Pennsylvania; and provides streaming service, such as Peacock. Comcast Corporation was founded in 1963 and is headquartered in Philadelphia, Pennsylvania.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 121.57B | 121.43B | 116.39B | 103.56B | 108.94B | 94.51B | 84.53B | 80.40B | 74.51B | 68.78B | 64.66B | 62.57B | 55.84B | 37.94B | 35.76B | 34.26B | 30.90B | 24.97B | 22.26B | 20.31B | 18.35B | 12.46B | 9.67B | 8.22B | 6.21B | 5.15B | 4.91B | 4.04B | 3.36B | 1.38B | 1.38B | 900.30M | 721.00M | 657.00M | 562.30M | 449.90M | 309.30M | 130.90M | 117.30M |

| Cost of Revenue | 36.76B | 38.21B | 38.45B | 33.12B | 34.44B | 29.69B | 25.38B | 24.46B | 22.55B | 20.91B | 19.67B | 19.93B | 37.49B | 15.25B | 22.04B | 13.47B | 11.18B | 9.01B | 7.97B | 7.46B | 7.04B | 6.30B | 5.42B | 4.50B | 3.40B | 0.00 | 0.00 | 2.06B | 0.00 | 0.00 | 0.00 | 275.50M | 252.10M | 243.90M | 208.00M | 171.40M | 118.10M | 50.10M | 47.70M |

| Gross Profit | 84.81B | 83.21B | 77.94B | 70.44B | 74.50B | 64.82B | 59.14B | 55.94B | 51.96B | 47.86B | 44.99B | 42.64B | 18.36B | 22.69B | 13.71B | 20.78B | 19.72B | 15.96B | 14.29B | 12.85B | 11.31B | 6.16B | 4.25B | 3.72B | 2.81B | 5.15B | 4.91B | 1.98B | 3.36B | 1.38B | 1.38B | 624.80M | 468.90M | 413.10M | 354.30M | 278.50M | 191.20M | 80.80M | 69.60M |

| Gross Profit Ratio | 69.76% | 68.53% | 66.96% | 68.02% | 68.39% | 68.58% | 69.97% | 69.57% | 69.74% | 69.59% | 69.58% | 68.15% | 32.87% | 59.80% | 38.35% | 60.67% | 63.83% | 63.91% | 64.19% | 63.25% | 61.63% | 49.41% | 43.98% | 45.28% | 45.19% | 100.00% | 100.00% | 49.00% | 100.00% | 100.00% | 100.00% | 69.40% | 65.03% | 62.88% | 63.01% | 61.90% | 61.82% | 61.73% | 59.34% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 39.19B | 38.26B | 35.62B | 33.11B | 32.81B | 28.09B | 25.01B | 23.41B | 21.34B | 19.86B | 18.58B | 17.86B | 12.49B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 7.97B | 8.51B | 7.70B | 6.74B | 7.62B | 7.04B | 6.32B | 6.11B | 5.94B | 5.08B | 4.97B | 4.81B | 4.24B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 47.16B | 8.51B | 7.70B | 6.74B | 7.62B | 7.04B | 6.32B | 6.11B | 5.94B | 5.08B | 4.97B | 4.81B | 16.73B | 8.09B | 7.65B | 7.65B | 7.93B | 6.51B | 5.79B | 5.31B | 4.92B | 2.47B | 1.55B | 1.25B | 926.00M | 0.00 | 0.00 | 771.60M | 0.00 | 0.00 | 0.00 | 227.70M | 159.60M | 141.90M | 130.50M | 101.60M | 78.90M | 34.20M | 32.20M |

| Other Expenses | 14.34B | 52.08B | 49.42B | 46.21B | 45.76B | 326.00M | 61.00M | 327.00M | 320.00M | -215.00M | -364.00M | 773.00M | 7.64B | 6.62B | 6.50B | 6.40B | 6.21B | 4.82B | 4.80B | 4.62B | 4.44B | 2.03B | 3.45B | 2.63B | 1.22B | 0.00 | 0.00 | 698.30M | 0.00 | 0.00 | 0.00 | 232.00M | 164.30M | 161.20M | 133.90M | 111.50M | 66.10M | 17.80M | 15.60M |

| Operating Expenses | 61.50B | 60.59B | 57.12B | 52.95B | 53.38B | 45.81B | 41.16B | 39.08B | 35.96B | 32.96B | 31.42B | 30.46B | 7.64B | 14.71B | 6.50B | 27.52B | 14.14B | 11.34B | 10.60B | 9.94B | 9.35B | 4.50B | 5.00B | 3.88B | 2.14B | 0.00 | 0.00 | 1.47B | 0.00 | 0.00 | 0.00 | 459.70M | 323.90M | 303.10M | 264.40M | 213.10M | 145.00M | 52.00M | 47.80M |

| Cost & Expenses | 98.26B | 98.80B | 95.57B | 86.07B | 87.82B | 75.50B | 66.54B | 63.54B | 58.51B | 53.87B | 51.09B | 50.39B | 45.12B | 29.96B | 28.54B | 27.52B | 25.32B | 20.35B | 18.57B | 17.40B | 16.39B | 10.80B | 10.42B | 8.38B | 5.55B | 0.00 | 0.00 | 3.53B | 0.00 | 0.00 | 0.00 | 735.20M | 576.00M | 547.00M | 472.40M | 384.50M | 263.10M | 102.10M | 95.50M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 4.09B | 3.90B | 4.28B | 4.59B | 4.57B | 3.54B | 3.09B | 2.94B | 2.70B | 2.62B | 2.57B | 2.52B | 2.51B | 2.16B | 2.35B | 2.44B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 14.34B | 13.82B | 13.80B | 13.10B | 12.95B | 11.02B | 10.13B | 9.56B | 8.68B | 8.02B | 16.12B | 17.25B | 7.64B | 6.62B | 6.50B | 6.40B | 6.21B | 4.96B | 4.80B | 4.62B | 4.44B | 2.03B | 3.45B | 2.63B | 1.22B | 939.60M | 936.40M | 698.30M | 689.10M | 336.50M | 341.50M | 232.00M | 164.30M | 161.20M | 133.90M | 111.50M | 66.10M | 17.80M | 15.60M |

| EBITDA | 38.90B | 36.45B | 34.62B | 30.59B | 34.08B | 30.17B | 27.71B | 26.85B | 24.68B | 23.16B | 29.81B | 21.93B | 25.14B | 14.88B | 13.95B | 12.90B | 11.79B | 10.48B | 8.33B | 7.45B | 1.95B | 2.84B | 2.70B | 2.47B | 1.88B | 6.08B | 5.85B | 1.05B | 4.05B | 1.71B | 1.72B | 397.10M | 309.30M | 271.20M | 223.80M | 176.90M | 112.30M | 46.60M | 37.40M |

| EBITDA Ratio | 32.00% | 29.57% | 31.65% | 29.68% | 31.08% | 31.73% | 33.63% | 33.13% | 33.11% | 33.16% | 45.21% | 49.81% | 32.81% | 38.10% | 38.18% | 38.33% | 35.05% | 33.72% | 38.52% | 32.82% | 34.91% | 34.45% | 14.77% | -24.14% | 8.14% | 118.26% | 119.06% | 29.50% | 120.49% | 124.47% | 124.83% | 50.22% | 48.17% | 49.27% | 54.99% | 36.92% | 29.29% | 28.27% | 16.45% |

| Operating Income | 23.31B | 22.08B | 20.82B | 17.49B | 21.13B | 19.01B | 17.99B | 16.86B | 16.00B | 14.90B | 13.56B | 12.18B | 10.72B | 7.98B | 7.21B | 6.73B | 5.58B | 4.62B | 3.69B | 2.91B | 1.95B | 1.66B | -746.20M | -161.00M | 664.00M | 5.15B | 4.91B | 508.90M | 3.36B | 1.38B | 1.38B | 165.10M | 145.00M | 110.00M | 89.90M | 65.40M | 46.20M | 28.80M | 21.80M |

| Operating Income Ratio | 19.18% | 18.19% | 17.89% | 16.89% | 19.39% | 20.11% | 21.28% | 20.97% | 21.47% | 21.67% | 20.98% | 19.46% | 19.20% | 21.03% | 20.18% | 19.65% | 18.05% | 18.50% | 16.58% | 14.32% | 10.65% | 13.31% | -7.71% | -1.96% | 10.69% | 100.00% | 100.00% | 12.60% | 100.00% | 100.00% | 100.00% | 18.34% | 20.11% | 16.74% | 15.99% | 14.54% | 14.94% | 22.00% | 18.58% |

| Total Other Income/Expenses | -2.84B | -4.76B | -1.72B | -3.43B | -4.13B | -3.77B | -2.67B | -2.48B | -2.63B | -2.44B | -2.45B | -570.00M | -2.51B | -1.88B | -2.11B | -2.67B | -1.23B | -1.03B | -1.80B | -1.17B | -2.09B | -1.48B | 1.44B | 3.65B | 840.60M | -3.54B | -579.10M | -363.30M | -325.50M | -1.38B | -1.38B | -369.00M | -287.80M | -293.10M | -236.80M | -109.80M | -42.50M | -15.40M | 1.50M |

| Income Before Tax | 20.48B | 9.28B | 19.09B | 14.07B | 17.00B | 15.24B | 15.32B | 14.35B | 13.37B | 12.47B | 11.12B | 11.61B | 8.21B | 6.10B | 5.11B | 4.06B | 4.35B | 3.59B | 1.88B | 1.81B | -137.00M | 70.00M | 695.80M | 3.49B | 1.50B | 0.00 | 0.00 | 31.90M | 0.00 | 0.00 | 0.00 | -203.90M | -142.80M | -183.10M | -146.90M | -44.40M | 3.70M | 13.40M | 23.30M |

| Income Before Tax Ratio | 16.84% | 7.65% | 16.41% | 13.58% | 15.60% | 16.13% | 18.13% | 17.85% | 17.95% | 18.12% | 17.19% | 18.55% | 14.70% | 16.09% | 14.28% | 11.85% | 14.08% | 14.40% | 8.45% | 8.91% | -0.75% | 0.56% | 7.19% | 42.42% | 24.23% | 0.00% | 0.00% | 0.79% | 0.00% | 0.00% | 0.00% | -22.65% | -19.81% | -27.87% | -26.12% | -9.87% | 1.20% | 10.24% | 19.86% |

| Income Tax Expense | 5.37B | 4.36B | 5.26B | 3.36B | 3.67B | 3.38B | -7.58B | 5.31B | 4.96B | 3.87B | 3.98B | 3.74B | 3.05B | 2.44B | 1.48B | 1.53B | 1.80B | 1.35B | 933.00M | 826.00M | -16.00M | 134.00M | 470.20M | 1.44B | 723.70M | 4.17B | 5.15B | 84.40M | 3.41B | 1.46B | 1.46B | 14.00M | 12.80M | -4.70M | 1.90M | 3.20M | 13.10M | 12.40M | 8.70M |

| Net Income | 15.39B | 5.37B | 14.16B | 10.53B | 13.06B | 11.73B | 22.71B | 8.70B | 8.16B | 8.38B | 6.82B | 6.20B | 4.16B | 3.64B | 3.64B | 2.55B | 2.59B | 2.53B | 928.00M | 970.00M | 3.24B | -274.00M | 608.60M | 2.02B | 1.07B | 972.10M | -238.70M | -53.50M | -43.90M | -87.00M | -87.00M | -270.20M | -155.60M | -178.40M | -148.80M | -47.60M | -9.40M | 1.00M | 14.60M |

| Net Income Ratio | 12.66% | 4.42% | 12.17% | 10.17% | 11.99% | 12.41% | 26.87% | 10.81% | 10.96% | 12.18% | 10.54% | 9.91% | 7.45% | 9.58% | 10.17% | 7.44% | 8.37% | 10.15% | 4.17% | 4.78% | 17.66% | -2.20% | 6.29% | 24.60% | 17.16% | 18.89% | -4.86% | -1.32% | -1.31% | -6.33% | -6.33% | -30.01% | -21.58% | -27.15% | -26.46% | -10.58% | -3.04% | 0.76% | 12.45% |

| EPS | 3.73 | 1.22 | 3.09 | 2.30 | 2.87 | 2.59 | 4.89 | 1.71 | 1.67 | 1.79 | 1.44 | 1.30 | 0.87 | 0.75 | 0.74 | 0.44 | 0.42 | 0.40 | 0.09 | 0.14 | 0.48 | -0.05 | 0.21 | 0.75 | 0.46 | 0.43 | -0.12 | -0.04 | -0.03 | -0.06 | -0.65 | -0.22 | -0.15 | -0.17 | -0.15 | -0.08 | -0.02 | 0.00 | 0.04 |

| EPS Diluted | 3.71 | 1.21 | 3.04 | 2.28 | 2.83 | 2.53 | 4.75 | 1.71 | 1.62 | 1.60 | 1.28 | 1.14 | 0.75 | 0.65 | 0.63 | 0.43 | 0.42 | 0.40 | 0.09 | 0.14 | 0.48 | -0.05 | 0.21 | 0.71 | 0.44 | 0.40 | -0.12 | -0.04 | -0.03 | -0.06 | -0.65 | -0.22 | -0.15 | -0.17 | -0.15 | -0.08 | -0.02 | 0.00 | 0.04 |

| Weighted Avg Shares Out | 4.12B | 4.41B | 4.58B | 4.57B | 4.55B | 4.53B | 4.64B | 4.88B | 4.88B | 4.67B | 4.74B | 4.76B | 4.80B | 4.85B | 5.76B | 5.92B | 6.20B | 6.32B | 9.89B | 6.72B | 6.76B | 4.99B | 4.27B | 4.27B | 2.25B | 2.21B | 2.00B | 1.48B | 1.46B | 1.37B | 134.82M | 1.21B | 1.06B | 1.07B | 1.00B | 594.70M | 563.72M | 299.85M | 397.98M |

| Weighted Avg Shares Out (Dil) | 4.15B | 4.43B | 4.65B | 4.62B | 4.61B | 4.64B | 4.79B | 5.09B | 5.04B | 5.24B | 5.33B | 5.43B | 5.56B | 5.64B | 5.77B | 5.92B | 6.38B | 6.36B | 9.94B | 6.75B | 6.76B | 4.99B | 4.34B | 4.27B | 2.35B | 2.36B | 2.00B | 1.48B | 1.46B | 1.37B | 134.82M | 1.21B | 1.06B | 1.07B | 1.00B | 594.70M | 563.72M | 299.85M | 397.98M |

Comcast And Their Cable Nets Spin-Off: What's Next

Sky Media reportedly faces financial hit following ad partner blunder

My Top 10 High-Yield Dividend Stocks For November 2024

Why Wall Street is skeptical about Comcast's proposal to ditch its cable networks and pair Peacock with a competitor

Comcast Q3 Earnings: The Long Awaited Catalyst?

Comcast's potential cable networks separation will test the appetite for media reconfiguration

Comcast hints at possible spinoff of cable networks

Comcast Shares Rise on Q3 Earnings Beat, Revenues Increase Y/Y

MNTN CEO Mark Douglas on Comcast exploring cable spinoff

Comcast Considers a Cable TV Spinoff. How That Could Boost the Stock.

Source: https://incomestatements.info

Category: Stock Reports