See more : AIB Group plc (AIBG.L) Income Statement Analysis – Financial Results

Complete financial analysis of CMS Energy Corporation (CMS) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of CMS Energy Corporation, a leading company in the Regulated Electric industry within the Utilities sector.

- Anhui Sinonet & Xinlong Science & Technology Co., Ltd. (002298.SZ) Income Statement Analysis – Financial Results

- Gansu Jingyuan Coal Industry & Electricity Power Co., Ltd (000552.SZ) Income Statement Analysis – Financial Results

- YiChang HEC ChangJiang Pharmaceutical Co., Ltd. (1558.HK) Income Statement Analysis – Financial Results

- ENEOS Holdings, Inc. (5020.T) Income Statement Analysis – Financial Results

- Calcom Vision Limited (CALCOM.BO) Income Statement Analysis – Financial Results

CMS Energy Corporation (CMS)

About CMS Energy Corporation

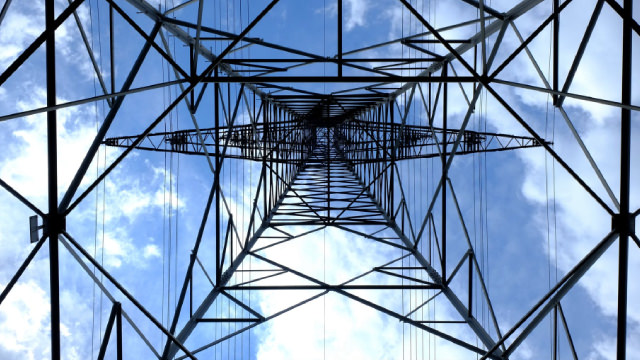

CMS Energy Corporation operates as an energy company primarily in Michigan. The company operates through three segments: Electric Utility; Gas Utility; and Enterprises. The Electric Utility segment is involved in the generation, purchase, transmission, distribution, and sale of electricity. This segment generates electricity through coal, wind, gas, renewable energy, oil, and nuclear sources. Its distribution system comprises 208 miles of high-voltage distribution overhead lines; 4 miles of high-voltage distribution underground lines; 4,428 miles of high-voltage distribution overhead lines; 19 miles of high-voltage distribution underground lines; 82,474 miles of electric distribution overhead lines; 9,395 miles of underground distribution lines; 1,093 substations; and 3 battery facilities. The Gas Utility segment engages in the purchase, transmission, storage, distribution, and sale of natural gas, which includes 2,392 miles of transmission lines; 15 gas storage fields; 28,065 miles of distribution mains; and 8 compressor stations. The Enterprises segment is involved in the independent power production and marketing, including the development and operation of renewable generation. It serves 1.9 million electric and 1.8 million gas customers, including residential, commercial, and diversified industrial customers. The company was incorporated in 1987 and is headquartered in Jackson, Michigan.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 7.46B | 8.60B | 7.33B | 6.68B | 6.85B | 6.87B | 6.58B | 6.40B | 6.46B | 7.18B | 6.57B | 6.25B | 6.50B | 6.43B | 6.21B | 6.82B | 6.46B | 6.81B | 6.29B | 5.47B | 5.51B | 8.69B | 9.60B | 9.00B | 6.10B | 5.14B | 4.79B | 4.33B | 3.89B | 3.62B | 3.48B | 3.07B | 2.94B | 2.98B | 2.96B | 2.94B | 2.80B | 3.11B | 3.30B |

| Cost of Revenue | 4.60B | 5.83B | 4.68B | 3.91B | 4.28B | 4.48B | 4.08B | 4.01B | 4.28B | 5.09B | 4.56B | 4.42B | 3.51B | 3.52B | 3.57B | 4.21B | 4.10B | 4.15B | 1.07B | 1.14B | 1.40B | 3.54B | 2.86B | 2.95B | 4.04B | 3.49B | 3.18B | 2.84B | 2.49B | 2.36B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 2.86B | 2.76B | 2.65B | 2.77B | 2.56B | 2.40B | 2.50B | 2.39B | 2.18B | 2.09B | 2.00B | 1.83B | 2.99B | 2.91B | 2.64B | 2.61B | 2.36B | 2.66B | 5.22B | 4.34B | 4.11B | 5.15B | 6.74B | 6.05B | 2.06B | 1.65B | 1.61B | 1.50B | 1.40B | 1.26B | 3.48B | 3.07B | 2.94B | 2.98B | 2.96B | 2.94B | 2.80B | 3.11B | 3.30B |

| Gross Profit Ratio | 38.35% | 32.13% | 36.14% | 41.45% | 37.46% | 34.89% | 38.02% | 37.33% | 33.69% | 29.10% | 30.52% | 29.25% | 45.99% | 45.30% | 42.47% | 38.25% | 36.54% | 39.09% | 83.05% | 79.22% | 74.61% | 59.31% | 70.24% | 67.23% | 33.77% | 32.09% | 33.59% | 34.57% | 36.02% | 34.79% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 180.00M | 205.00M | 165.00M | 118.00M | 91.00M | 90.00M | 24.00M | 41.00M | 15.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 1.45B | 7.37B | 6.18B | 5.32B | 5.61B | 70.00M | -14.00M | -36.00M | 29.00M | -16.00M | 12.00M | -22.00M | 1.99B | 1.94B | 1.94B | 1.82B | 2.45B | 2.79B | 5.62B | 3.74B | 3.68B | 5.05B | 6.44B | 5.32B | 1.15B | 912.00M | 862.00M | 821.00M | 798.00M | 755.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 1.63B | 7.37B | 6.18B | 5.32B | 5.61B | 5.71B | 5.25B | 5.10B | 5.29B | 6.03B | 5.42B | 827.00M | 1.99B | 1.94B | 1.94B | 1.82B | 2.45B | 2.79B | 5.62B | 3.74B | 3.68B | 5.05B | 6.44B | 5.32B | 1.15B | 912.00M | 862.00M | 821.00M | 798.00M | 755.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cost & Expenses | 6.23B | 7.37B | 6.18B | 5.32B | 5.61B | 5.71B | 5.25B | 5.10B | 5.29B | 6.03B | 5.42B | 5.25B | 5.50B | 5.45B | 5.51B | 6.04B | 6.55B | 6.94B | 6.68B | 4.88B | 5.08B | 8.59B | 9.30B | 8.27B | 5.19B | 4.40B | 4.04B | 3.66B | 3.29B | 3.12B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Income | 0.00 | 5.00M | 3.00M | 11.00M | 7.00M | 11.00M | 12.00M | 6.00M | 12.00M | 5.00M | 3.00M | 5.00M | 9.00M | 19.00M | 24.00M | 30.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 643.00M | 519.00M | 500.00M | 561.00M | 519.00M | 458.00M | 438.00M | 435.00M | 396.00M | 407.00M | 398.00M | 389.00M | 415.00M | 431.00M | 435.00M | 400.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 1.18B | 1.13B | 1.11B | 1.04B | 992.00M | 933.00M | 881.00M | 811.00M | 750.00M | 685.00M | 628.00M | 598.00M | 546.00M | 576.00M | 570.00M | 589.00M | 545.00M | 576.00M | 525.00M | 431.00M | 462.00M | 515.00M | 524.00M | 637.00M | 630.00M | 544.00M | 533.00M | 493.00M | 475.00M | 444.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA | 2.78B | 2.55B | 2.44B | 2.36B | 2.34B | 2.17B | 2.21B | 2.07B | 1.94B | 1.82B | 1.78B | 1.61B | 1.57B | 1.60B | 1.34B | 1.43B | 457.00M | 354.00M | 24.00M | 1.02B | 893.00M | 468.00M | 503.00M | 1.34B | 1.49B | 1.28B | 1.23B | 1.17B | 1.10B | 948.00M | 3.48B | 3.07B | 2.94B | 2.98B | 2.96B | 2.94B | 2.80B | 3.11B | 3.30B |

| EBITDA Ratio | 37.22% | 16.53% | 18.05% | 21.65% | 19.69% | 17.93% | 20.11% | 19.71% | 18.46% | 15.82% | 17.58% | 25.59% | 24.10% | 24.63% | 20.79% | 19.79% | 5.18% | 3.55% | 0.29% | 15.88% | 13.48% | 7.05% | 8.77% | 14.47% | 25.10% | 24.94% | 26.72% | 27.00% | 27.71% | 26.20% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Operating Income | 1.24B | 295.00M | 209.00M | 398.00M | 356.00M | 1.16B | 1.34B | 1.30B | 1.16B | 1.15B | 1.14B | 1.00B | 1.00B | 978.00M | 696.00M | 786.00M | -88.00M | -126.00M | -395.00M | 591.00M | 431.00M | 99.00M | 301.00M | 727.00M | 912.00M | 738.00M | 746.00M | 677.00M | 603.00M | 504.00M | 3.48B | 3.07B | 2.94B | 2.98B | 2.96B | 2.94B | 2.80B | 3.11B | 3.30B |

| Operating Income Ratio | 16.55% | 3.43% | 2.85% | 5.96% | 5.20% | 16.91% | 20.33% | 20.27% | 18.01% | 16.05% | 17.39% | 16.04% | 15.42% | 15.21% | 11.22% | 11.52% | -1.36% | -1.85% | -6.28% | 10.80% | 7.82% | 1.14% | 3.14% | 8.08% | 14.94% | 14.36% | 15.58% | 15.62% | 15.50% | 13.93% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Total Other Income/Expenses | -281.00M | -322.00M | -323.00M | -421.00M | -286.00M | -388.00M | -452.00M | -430.00M | -382.00M | -423.00M | -386.00M | -381.00M | -397.00M | -388.00M | -363.00M | -346.00M | -233.00M | -195.00M | 74.00M | -469.00M | -416.00M | -386.00M | -383.00M | -615.00M | -537.00M | -382.00M | -364.00M | -315.00M | -281.00M | -221.00M | -3.48B | -3.07B | -2.94B | -2.98B | -2.96B | -2.94B | -2.80B | -3.11B | -3.30B |

| Income Before Tax | 954.00M | 902.00M | 823.00M | 885.00M | 829.00M | 774.00M | 886.00M | 826.00M | 796.00M | 729.00M | 756.00M | 622.00M | 606.00M | 590.00M | 335.00M | 442.00M | -321.00M | -243.00M | -266.00M | 122.00M | 15.00M | -403.00M | -404.00M | 101.00M | 341.00M | 342.00M | 385.00M | 379.00M | 334.00M | 283.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Income Before Tax Ratio | 12.78% | 10.49% | 11.23% | 13.25% | 12.11% | 11.26% | 13.46% | 12.91% | 12.33% | 10.15% | 11.51% | 9.95% | 9.32% | 9.17% | 5.40% | 6.48% | -4.97% | -3.57% | -4.23% | 2.23% | 0.27% | -4.64% | -4.21% | 1.12% | 5.59% | 6.65% | 8.04% | 8.75% | 8.59% | 7.82% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 147.00M | 93.00M | 95.00M | 133.00M | 147.00M | 115.00M | 424.00M | 273.00M | 271.00M | 250.00M | 302.00M | 245.00M | 191.00M | 224.00M | 115.00M | 142.00M | -195.00M | -158.00M | -168.00M | -5.00M | 58.00M | 13.00M | -73.00M | 60.00M | 64.00M | 100.00M | 117.00M | 139.00M | 130.00M | 104.00M | -155.00M | 297.00M | 262.00M | 494.00M | -312.10M | -271.60M | -186.90M | -177.80M | 269.80M |

| Net Income | 887.00M | 837.00M | 728.00M | 755.00M | 680.00M | 657.00M | 460.00M | 551.00M | 523.00M | 477.00M | 452.00M | 382.00M | 415.00M | 340.00M | 229.00M | 300.00M | -215.00M | -79.00M | -84.00M | 121.00M | -44.00M | -620.00M | -545.00M | 36.00M | 277.00M | 285.00M | 268.00M | 240.00M | 204.00M | 179.00M | 155.00M | -297.00M | -262.00M | -494.00M | 312.10M | 271.60M | 186.90M | 177.80M | -269.80M |

| Net Income Ratio | 11.89% | 9.74% | 9.93% | 11.30% | 9.93% | 9.56% | 6.99% | 8.61% | 8.10% | 6.64% | 6.88% | 6.11% | 6.38% | 5.29% | 3.69% | 4.40% | -3.33% | -1.16% | -1.34% | 2.21% | -0.80% | -7.14% | -5.68% | 0.40% | 4.54% | 5.54% | 5.60% | 5.54% | 5.24% | 4.95% | 4.45% | -9.66% | -8.91% | -16.59% | 10.54% | 9.23% | 6.67% | 5.72% | -8.18% |

| EPS | 3.01 | 2.86 | 2.52 | 2.65 | 2.40 | 2.33 | 1.64 | 1.99 | 1.90 | 1.76 | 1.71 | 1.43 | 1.65 | 1.40 | 0.96 | 1.25 | -0.97 | -0.36 | -0.39 | 0.65 | -0.29 | -4.46 | -4.19 | 0.04 | 2.18 | 2.45 | 2.63 | 2.45 | 2.27 | 2.09 | 1.90 | -3.72 | -3.26 | -6.07 | 3.80 | 3.31 | 2.19 | 0.74 | -3.06 |

| EPS Diluted | 3.01 | 2.85 | 2.51 | 2.64 | 2.39 | 2.32 | 1.64 | 1.98 | 1.89 | 1.74 | 1.66 | 1.39 | 1.57 | 1.28 | 0.91 | 1.20 | -0.97 | -0.36 | -0.39 | 0.64 | -0.29 | -4.46 | -4.17 | 0.04 | 2.17 | 2.45 | 2.61 | 2.44 | 2.26 | 2.08 | 1.90 | -3.72 | -3.26 | -6.07 | 3.80 | 3.31 | 2.19 | 0.74 | -3.06 |

| Weighted Avg Shares Out | 291.20M | 289.50M | 289.00M | 285.00M | 283.00M | 282.20M | 280.00M | 278.00M | 276.00M | 271.00M | 265.00M | 260.70M | 250.80M | 231.50M | 227.20M | 225.70M | 222.55M | 219.51M | 213.64M | 169.23M | 153.33M | 138.89M | 130.00M | 111.00M | 110.10M | 107.75M | 92.78M | 91.43M | 89.87M | 85.65M | 81.58M | 79.84M | 80.37M | 81.38M | 82.13M | 82.05M | 85.34M | 87.84M | 88.14M |

| Weighted Avg Shares Out (Dil) | 291.70M | 290.00M | 289.50M | 286.30M | 284.30M | 282.90M | 280.80M | 279.00M | 276.00M | 275.00M | 272.00M | 268.60M | 263.40M | 252.90M | 237.90M | 236.20M | 222.55M | 219.51M | 213.64M | 171.88M | 153.33M | 138.89M | 130.77M | 111.92M | 114.70M | 108.78M | 93.49M | 91.80M | 90.27M | 86.06M | 81.58M | 79.84M | 80.37M | 81.38M | 82.13M | 82.05M | 85.34M | 87.84M | 88.14M |

CMS Energy Eliminates More Than 72K Outages With Smart Technology

Wix Recognized as the Most Accessible Website Platform CMS and Best SEO Performer

Creative Realities' Clarity™: Purpose-built CMS Tech Stack Powers Digital Menu Boards Transformation for Fast Growing QSR Brands like 7 Brew and Steele Brands

ECS-CMS Team Receives Agency Honor Award

HeartSciences' AI-ECG Algorithms Assigned CMS Medicare and Medicaid Reimbursement

CMS Energy Declares Quarterly Dividend on Cumulative Redeemable Perpetual Preferred Stock

Consumers Energy, the Principal Subsidiary of CMS Energy, Declares Quarterly Dividend on Preferred Stock

Limaca's Precision-GI™ Granted CMS Transitional Pass-Through (TPT) Payment

CMS Decision And O&P Network Build Out Make Myomo A Buy

Profound Medical Announces TULSA Reimbursement Raised to Urology APC Level 7 Under CMS Outpatient Prospective Payment System (OPPS) Final Rule for CY2025

Source: https://incomestatements.info

Category: Stock Reports