See more : Kuen Ling Machinery Refrigerating Co., Ltd. (4527.TWO) Income Statement Analysis – Financial Results

Complete financial analysis of Canacol Energy Ltd (CNNEF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Canacol Energy Ltd, a leading company in the Oil & Gas Exploration & Production industry within the Energy sector.

- Daiwa House Logistics Trust (DHLU.SI) Income Statement Analysis – Financial Results

- Mrs. Bectors Food Specialities Limited (BECTORFOOD.NS) Income Statement Analysis – Financial Results

- KION GROUP AG (KNNGF) Income Statement Analysis – Financial Results

- Samsung Electro-Mechanics Co., Ltd. (009150.KS) Income Statement Analysis – Financial Results

- LS 1x Apple Tracker ETC (AAP1.L) Income Statement Analysis – Financial Results

Canacol Energy Ltd (CNNEF)

About Canacol Energy Ltd

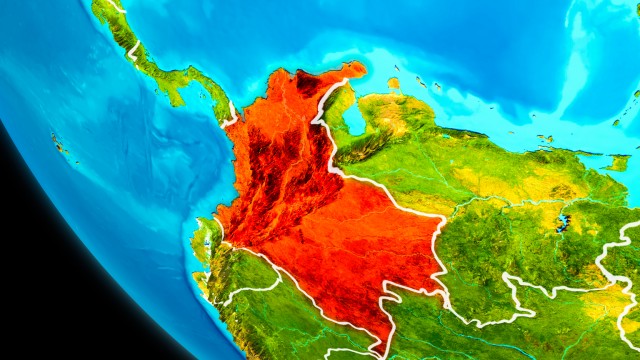

Canacol Energy Ltd., an oil and gas company, engages in the exploration, development, and production of natural gas in Colombia. As of December 31, 2021, it had a total proved developed producing reserves of 236 billion cubic feet (Bcf) conventional natural gas; a total proved plus probable reserves of 607 Bcf conventional natural gas; and a total proved reserves of 368 Bcf conventional natural gas. The company was incorporated in 1970 and is headquartered in Calgary, Canada.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 315.80M | 335.71M | 310.54M | 278.81M | 242.08M | 222.41M | 158.91M | 147.99M | 149.05M | 207.79M | 147.67M | 184.90M | 114.40M | 22.84M | 9.83M | 28.00M | 6.63M | 1.57M | 10.89K | 7.20K | 5.72K | 4.89K | 0.67 | 67.82K | 137.31K | 72.56K |

| Cost of Revenue | 121.51M | 96.14M | 93.95M | 66.71M | 54.28M | 44.25M | 35.78M | 26.51M | 61.26M | 38.74M | 48.24M | 79.49M | 39.21M | 16.17M | 6.35M | 20.55M | 4.90M | 226.49K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 194.30M | 239.57M | 216.59M | 212.10M | 187.80M | 178.17M | 123.13M | 121.47M | 87.79M | 169.05M | 99.43M | 105.41M | 75.19M | 6.67M | 3.47M | 7.46M | 1.73M | 1.34M | 10.89K | 7.20K | 5.72K | 4.89K | 0.67 | 67.82K | 137.31K | 72.56K |

| Gross Profit Ratio | 61.52% | 71.36% | 69.75% | 76.07% | 77.58% | 80.11% | 77.49% | 82.08% | 58.90% | 81.36% | 67.33% | 57.01% | 65.72% | 29.22% | 35.35% | 26.63% | 26.10% | 85.59% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 37.39M | 65.82M | 69.02M | 64.74M | 59.45M | 54.93M | 38.09M | 31.21M | 29.94M | 34.34M | 30.28M | 25.04M | 26.20M | 12.50M | 7.12M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 18.26M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 37.39M | 65.82M | 69.02M | 64.74M | 59.45M | 54.93M | 38.09M | 31.21M | 29.94M | 34.34M | 30.28M | 25.04M | 26.20M | 12.50M | 7.12M | 9.61M | 7.28M | 3.21M | 77.01K | 48.37K | 66.71K | 102.62K | 86.45K | 135.64K | 274.61K | 217.68K |

| Other Expenses | 0.00 | 31.06M | 45.04M | 22.68M | 25.27M | -23.24M | -1.87M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -1.07M | 0.00 | 0.00 | 5.11K | 47.72K | 22.35K | 45.99K | 51.06K | -339.10K | 755.18K | 145.12K |

| Operating Expenses | 239.88M | 96.87M | 114.06M | 87.42M | 84.72M | 103.10M | 100.46M | 69.73M | 92.98M | 96.47M | 157.17M | 88.89M | 67.76M | 22.29M | 11.68M | 14.44M | 9.15M | 3.61M | 77.92K | 50.25K | 73.47K | 114.63K | 102.64K | 135.64K | 274.61K | 217.68K |

| Cost & Expenses | 165.81M | 193.01M | 208.01M | 154.13M | 139.01M | 147.35M | 136.24M | 96.24M | 154.25M | 135.21M | 205.41M | 168.38M | 106.97M | 38.46M | 18.04M | 34.98M | 14.05M | 3.83M | 77.92K | 50.25K | 73.47K | 114.63K | 102.64K | 135.64K | 274.61K | 217.68K |

| Interest Income | 2.93M | 1.60M | 874.00K | 2.13M | 1.28M | 865.00K | 3.10M | 2.37M | 3.14M | 2.24M | 1.72M | 50.00K | 1.57M | 792.00K | 849.30K | 585.58K | 406.46K | 501.52K | 800.79 | 812.39 | 1.58K | 3.18K | 3.18K | 0.00 | 0.00 | 0.00 |

| Interest Expense | 57.07M | 34.06M | 31.49M | 30.79M | 30.79M | 31.85M | 24.32M | 19.72M | 19.90M | 8.92M | 10.60M | 3.17M | 3.41M | 4.69M | 2.61M | 2.60M | 924.54K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 80.31M | 68.79M | 68.78M | 69.41M | 57.08M | 44.25M | 35.78M | 26.51M | 61.26M | 38.74M | 48.24M | 63.85M | 32.46M | 11.82M | 5.63M | 4.83M | 1.87M | 399.40K | 910.89 | 1.87K | 6.79K | 12.01K | 16.19K | -67.82K | 0.00 | 145.12K |

| EBITDA | 196.58M | 169.85M | 158.30M | 185.56M | 156.76M | 95.01M | -55.62M | 77.84M | 53.52M | -17.40M | 79.61M | -97.87M | 39.89M | 7.41M | -5.91M | -10.69M | -5.55M | -5.53M | 175.09K | -66.40K | -41.17K | 12.51K | -97.73K | -203.46K | -135.64K | -205.96K |

| EBITDA Ratio | 62.25% | 58.66% | 51.84% | 64.79% | 62.48% | 42.72% | 34.50% | 52.60% | 35.91% | 55.20% | -9.92% | 43.49% | 34.87% | -16.65% | -26.26% | -6.19% | -83.75% | -118.58% | 1,607.60% | 3,696.99% | -1,053.96% | 1,189.07% | 21,063,500.00% | -300.00% | -200.00% | -100.00% |

| Operating Income | 154.18M | 128.38M | 93.25M | 116.11M | 96.96M | 50.76M | 19.04M | 51.32M | -7.74M | 75.97M | -62.89M | 16.53M | 7.43M | -15.62M | -8.21M | -7.40M | -7.42M | -2.26M | -308.23K | -350.53K | -68.40K | -265.61K | -329.67K | -135.64K | -274.61K | -217.68K |

| Operating Income Ratio | 48.82% | 38.24% | 30.03% | 41.64% | 40.05% | 22.82% | 11.98% | 34.68% | -5.19% | 36.56% | -42.59% | 8.94% | 6.49% | -68.38% | -83.53% | -26.42% | -111.98% | -143.99% | -2,830.13% | -4,866.02% | -1,195.56% | -5,432.11% | -49,395,985.76% | -200.00% | -200.00% | -300.00% |

| Total Other Income/Expenses | -93.25M | -76.62M | -62.82M | -47.28M | -41.31M | -67.72M | -139.07M | -56.02M | -90.82M | -174.52M | -40.62M | -186.44M | 12.88M | -6.99M | -6.79M | -10.68M | -2.14M | 17.61K | -236.09K | 308.51K | 21.69K | 68.40K | 265.61K | 329.67K | 203.46K | 343.27K |

| Income Before Tax | 60.93M | 66.08M | 59.07M | 77.40M | 64.73M | 7.35M | -116.37M | -10.66M | -98.56M | 31.95M | -163.17M | 29.41M | -5.66M | -22.41M | -18.93M | -15.14M | -7.40M | -2.66M | -544.32K | -610.30K | -46.71K | -375.50K | -505.64K | -542.56K | 343.27K | -145.12K |

| Income Before Tax Ratio | 19.29% | 19.68% | 19.02% | 27.76% | 26.74% | 3.30% | -73.23% | -7.21% | -66.12% | 15.38% | -110.50% | 15.90% | -4.94% | -98.12% | -192.66% | -54.06% | -111.62% | -169.04% | -4,997.88% | -8,472.15% | -816.44% | -7,679.38% | -75,762,478.15% | -800.00% | 250.00% | -200.00% |

| Income Tax Expense | -25.30M | -81.19M | 43.89M | 82.14M | 30.49M | 29.18M | 32.45M | -34.08M | 7.47M | 22.02M | -42.56M | 10.79M | 5.21M | -765.00K | 164.52K | 2.13M | 89.16K | 31.94K | 251.57K | 314.13K | -839.59 | 153.17K | 216.67K | 67.82K | 0.00 | -72.56K |

| Net Income | 86.24M | 147.27M | 15.18M | -4.74M | 34.25M | -21.84M | -148.03M | 23.65M | -106.02M | 9.94M | -120.61M | 18.56M | -10.86M | -21.65M | -8.26M | -17.27M | -7.49M | -2.69M | -313.49K | -309.46K | -44.56K | -216.92K | -268.25K | -610.38K | 343.27K | -72.56K |

| Net Income Ratio | 27.31% | 43.87% | 4.89% | -1.70% | 14.15% | -9.82% | -93.15% | 15.98% | -71.13% | 4.78% | -81.68% | 10.04% | -9.50% | -94.77% | -84.06% | -61.69% | -112.97% | -171.07% | -2,878.39% | -4,295.86% | -778.89% | -4,436.27% | -40,192,888.41% | -900.00% | 250.00% | -100.00% |

| EPS | 2.53 | 20.71 | 0.42 | -0.13 | 0.98 | -0.62 | -4.23 | 0.70 | -4.80 | 0.55 | -8.06 | 1.60 | -1.17 | -3.61 | -3.37 | -10.14 | -6.13 | -4.61 | -2.57 | -2.49 | -0.42 | -2.26 | -3.07 | -6.78 | 4.46 | -1.09 |

| EPS Diluted | 2.53 | 20.71 | 0.42 | -0.13 | 0.97 | -0.62 | -4.23 | 0.70 | -4.80 | 0.55 | -8.06 | 1.60 | -1.17 | -3.61 | -3.37 | -10.14 | -6.13 | -4.61 | -2.57 | -2.49 | -0.42 | -2.26 | -3.07 | -6.78 | 4.46 | -1.09 |

| Weighted Avg Shares Out | 34.11M | 6.83M | 35.63M | 36.13M | 35.65M | 35.44M | 34.83M | 33.13M | 22.07M | 17.97M | 14.97M | 11.52M | 9.28M | 6.00M | 2.45M | 1.70M | 1.22M | 583.04K | 122.03K | 122.03K | 106.34K | 95.82K | 87.39K | 87.39K | 76.92K | 66.67K |

| Weighted Avg Shares Out (Dil) | 34.11M | 6.83M | 35.63M | 36.13M | 36.08M | 35.44M | 35.04M | 33.54M | 22.07M | 18.07M | 14.97M | 11.75M | 9.28M | 6.00M | 2.45M | 1.70M | 1.22M | 583.04K | 122.03K | 124.09K | 106.34K | 95.82K | 87.39K | 90.00K | 76.92K | 66.67K |

Canacol Energy Ltd (CNNEF) Q1 2023 Earnings Call Transcript

Canacol Energy Pays A 9%-Plus Yield, Immune To U.S. Natural Gas Prices

Micro-Cap Energy Stocks Ranked By Quality

Canacol Energy Ltd (CNNEF) Q4 2022 Earnings Call Transcript

Canacol Energy: Earn A 10% Yield With Natural Gas

Canacol Energy Ltd (CNNEF) Q3 2022 Earnings Call Transcript

REVISED TIME - Canacol Energy Ltd. Will Hold Conference Call on Friday, November 11, 2022 at 11am ET

Canacol Energy Ltd. To Announce Third Quarter 2022 Financial Results on Thursday, November 10, 2022; Hold Conference Call on Friday, November 11, 2022

Canacol Energy Ltd (CNNEF) CEO Charle Gamba on Q2 2022 Results - Earnings Call Transcript

Canacol Energy Ltd. To Announce Second Quarter 2022 Financial Results on Thursday, August 11, 2022; Hold Conference Call on Friday, August 12, 2022

Source: https://incomestatements.info

Category: Stock Reports