See more : Keywords Studios plc (KWS.L) Income Statement Analysis – Financial Results

Complete financial analysis of Coherent, Inc. (COHR) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Coherent, Inc., a leading company in the Hardware, Equipment & Parts industry within the Technology sector.

- Clinical Laserthermia Systems AB (publ) (CLS-B.ST) Income Statement Analysis – Financial Results

- Wharf (Holdings) Limited (WARFF) Income Statement Analysis – Financial Results

- Daou Data Corp. (032190.KQ) Income Statement Analysis – Financial Results

- Aroway Energy Inc. (ARWJF) Income Statement Analysis – Financial Results

- Espe S.p.A. (ESPE.MI) Income Statement Analysis – Financial Results

Coherent, Inc. (COHR)

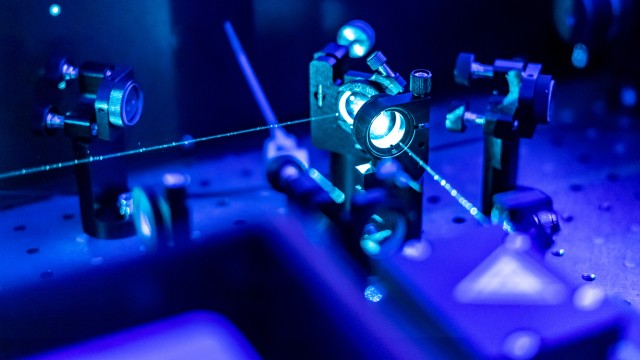

About Coherent, Inc.

Coherent, Inc. provides lasers, laser-based technologies, and laser-based system solutions for a range of commercial, industrial, and scientific research applications. It operates in two segments, Original Equipment Manufacturers (OEM) Laser Sources and Industrial Lasers & Systems. The company designs, manufactures, markets, and services lasers, laser tools, precision optics, and related accessories; and laser measurement and control products. Its products are used for applications in microelectronics, materials processing, OEM components and instrumentation, and scientific research and government programs. The company markets its products through a direct sales force in the United States, as well as through direct sales personnel and independent representatives internationally. Coherent, Inc. was founded in 1966 and is headquartered in Santa Clara, California. As of July 1, 2022, Coherent, Inc. operates as a subsidiary of II-VI Incorporated.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 4.71B | 5.16B | 3.32B | 3.11B | 2.38B | 1.36B | 1.16B | 972.05M | 827.22M | 741.96M | 683.26M | 558.40M | 534.63M | 502.80M | 345.09M | 292.22M | 316.19M | 263.20M | 232.53M | 194.04M | 150.85M | 128.21M | 113.69M | 123.33M | 73.81M | 61.80M | 61.30M | 52.70M | 37.90M | 27.80M | 18.70M | 17.20M | 16.60M | 15.00M | 15.10M | 13.90M | 12.40M | 9.80M | 8.70M |

| Cost of Revenue | 3.25B | 3.54B | 2.05B | 1.89B | 1.56B | 841.15M | 696.59M | 583.69M | 514.40M | 470.36M | 456.55M | 360.83M | 341.89M | 295.90M | 210.49M | 176.10M | 185.99M | 143.75M | 138.99M | 104.88M | 79.56M | 69.41M | 69.73M | 72.18M | 36.55M | 32.00M | 30.10M | 24.40M | 18.10M | 13.80M | 9.50M | 9.60M | 8.70M | 7.90M | 7.10M | 6.00M | 6.30M | 5.40M | 5.90M |

| Gross Profit | 1.46B | 1.62B | 1.27B | 1.22B | 819.55M | 521.35M | 462.20M | 388.35M | 312.81M | 271.60M | 226.72M | 197.57M | 192.74M | 206.90M | 134.60M | 116.12M | 130.21M | 119.44M | 93.54M | 89.16M | 71.29M | 58.80M | 43.96M | 51.15M | 37.26M | 29.80M | 31.20M | 28.30M | 19.80M | 14.00M | 9.20M | 7.60M | 7.90M | 7.10M | 8.00M | 7.90M | 6.10M | 4.40M | 2.80M |

| Gross Profit Ratio | 30.93% | 31.36% | 38.16% | 39.16% | 34.43% | 38.26% | 39.89% | 39.95% | 37.82% | 36.61% | 33.18% | 35.38% | 36.05% | 41.15% | 39.00% | 39.74% | 41.18% | 45.38% | 40.23% | 45.95% | 47.26% | 45.86% | 38.66% | 41.48% | 50.48% | 48.22% | 50.90% | 53.70% | 52.24% | 50.36% | 49.20% | 44.19% | 47.59% | 47.33% | 52.98% | 56.83% | 49.19% | 44.90% | 32.18% |

| Research & Development | 478.79M | 499.60M | 377.11M | 330.11M | 339.07M | 139.16M | 116.88M | 96.81M | 60.35M | 51.26M | 42.52M | 22.69M | 21.41M | 16.08M | 11.81M | 10.21M | 7.73M | 16.07M | 6.89M | 12.63M | 12.10M | 13.10M | 11.35M | 8.12M | 4.04M | 3.30M | 3.30M | 3.00M | 1.70M | 1.40M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 854.00M | 1.04B | 474.10M | 483.99M | 441.00M | 233.52M | 208.57M | 176.00M | 160.65M | 143.54M | 137.71M | 110.18M | 99.39M | 92.05M | 71.11M | 58.07M | 60.81M | 55.06M | 48.08M | 41.90M | 34.36M | 28.51M | 21.25M | 24.77M | 17.89M | 13.60M | 14.30M | 12.70M | 9.90M | 7.30M | 6.50M | 5.60M | 5.00M | 5.00M | 5.00M | 4.60M | 3.60M | 2.80M | 2.60M |

| Other Expenses | 0.00 | -31.57M | -11.23M | 10.37M | -14.00M | 2.56M | 3.78M | 10.06M | 1.22M | 6.18M | 3.63M | 7.16M | 7.17M | 0.00 | 0.00 | 1.40M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 5.00M | 4.60M | 3.90M | 3.20M | 2.50M | 2.00M | 1.80M | 1.80M | 1.60M | 1.50M | 1.30M | 900.00K | 600.00K | 400.00K | 0.00 |

| Operating Expenses | 1.46B | 1.54B | 851.20M | 814.09M | 780.07M | 372.68M | 325.44M | 272.81M | 221.00M | 194.80M | 180.23M | 132.86M | 120.80M | 108.12M | 83.20M | 69.68M | 68.54M | 71.13M | 54.98M | 54.53M | 46.46M | 41.61M | 32.59M | 32.89M | 26.93M | 21.50M | 21.50M | 18.90M | 14.10M | 10.70M | 8.30M | 7.40M | 6.60M | 6.50M | 6.30M | 5.50M | 4.20M | 3.20M | 2.60M |

| Cost & Expenses | 4.59B | 5.08B | 2.90B | 2.70B | 2.34B | 1.21B | 1.02B | 856.51M | 735.40M | 665.16M | 636.78M | 493.69M | 462.69M | 404.03M | 293.69M | 245.78M | 254.53M | 214.88M | 193.97M | 159.41M | 126.02M | 111.01M | 102.32M | 105.07M | 63.48M | 53.50M | 51.60M | 43.30M | 32.20M | 24.50M | 17.80M | 17.00M | 15.30M | 14.40M | 13.40M | 11.50M | 10.50M | 8.60M | 8.50M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 288.48M | 286.87M | 121.25M | 59.90M | 89.41M | 22.42M | 18.35M | 6.81M | 3.08M | 3.86M | 4.48M | 1.16M | 212.00K | 103.00K | 87.00K | 178.00K | 0.00 | 0.00 | 32.66M | 423.00K | 416.00K | 1.44M | 2.27M | 5.09M | 481.00K | 200.00K | 300.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 300.00K | 100.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 559.76M | 681.69M | 286.78M | 270.07M | 220.88M | 92.37M | 80.77M | 63.64M | 56.66M | 53.08M | 53.10M | 40.93M | 34.69M | 25.67M | 21.04M | 15.35M | 15.52M | 16.75M | 15.78M | 12.71M | 9.63M | 9.33M | 8.79M | 8.70M | 5.00M | 4.60M | 3.90M | 3.20M | 2.50M | 2.00M | 1.80M | 1.80M | 1.60M | 1.50M | 1.30M | 900.00K | 600.00K | 400.00K | 100.00K |

| EBITDA | 682.94M | 613.00M | 689.84M | 682.56M | 246.36M | 243.60M | 221.32M | 189.23M | 149.70M | 136.06M | 103.22M | 119.44M | 123.21M | 130.31M | 72.44M | 61.80M | 74.43M | 62.46M | 69.78M | 47.08M | 34.47M | 26.82M | 20.57M | 28.35M | 15.40M | 12.90M | 13.80M | 12.10M | 7.80M | 5.20M | 1.90M | 2.00M | 2.90M | 2.10M | 2.90M | 3.00M | 2.30M | 1.50M | 200.00K |

| EBITDA Ratio | 14.51% | 0.98% | 12.15% | 13.28% | 1.07% | 17.88% | 19.10% | 12.92% | 11.25% | 11.18% | 7.34% | 12.87% | 14.80% | 19.64% | 14.90% | 21.15% | 23.54% | 23.73% | 30.01% | 24.26% | 22.85% | 20.92% | 18.09% | 22.99% | 20.86% | 20.87% | 22.51% | 22.96% | 20.58% | 18.71% | 10.16% | 11.63% | 17.47% | 14.00% | 19.21% | 21.58% | 18.55% | 15.31% | 3.45% |

| Operating Income | 123.18M | 50.42M | 116.28M | 142.42M | -195.40M | 151.23M | 140.55M | 125.60M | 93.04M | 82.98M | 50.12M | 71.86M | 79.11M | 98.78M | 51.40M | 46.44M | 58.91M | 45.71M | 54.00M | 34.37M | 24.83M | 17.49M | 11.78M | 19.65M | 10.40M | 8.30M | 9.90M | 8.90M | 5.30M | 3.20M | 100.00K | 200.00K | 1.30M | 600.00K | 1.60M | 2.10M | 1.70M | 1.10M | 200.00K |

| Operating Income Ratio | 2.62% | 0.98% | 3.51% | 4.59% | -8.21% | 11.10% | 12.13% | 12.92% | 11.25% | 11.18% | 7.34% | 12.87% | 14.80% | 19.64% | 14.90% | 15.89% | 18.63% | 17.37% | 23.22% | 17.71% | 16.46% | 13.64% | 10.36% | 15.93% | 14.09% | 13.43% | 16.15% | 16.89% | 13.98% | 11.51% | 0.53% | 1.16% | 7.83% | 4.00% | 10.60% | 15.11% | 13.71% | 11.22% | 2.30% |

| Total Other Income/Expenses | -270.82M | -437.54M | -132.49M | -49.53M | -103.41M | -22.42M | -14.57M | 3.23M | -1.86M | 2.31M | -845.00K | 6.00M | 6.96M | 2.99M | -364.00K | -178.00K | 31.72M | 4.20M | -17.23M | 1.49M | 734.00K | -1.15M | -1.86M | -3.71M | -415.00K | -201.00K | -100.00K | 1.10M | 700.00K | 200.00K | 1.60M | 0.00 | -300.00K | -100.00K | 200.00K | 600.00K | 300.00K | 100.00K | 100.00K |

| Income Before Tax | -147.65M | -355.56M | 281.81M | 352.59M | -63.93M | 128.81M | 122.19M | 118.79M | 89.96M | 79.11M | 45.64M | 70.70M | 78.90M | 101.76M | 51.32M | 46.27M | 90.63M | 49.91M | 21.34M | 33.95M | 24.42M | 16.05M | 9.51M | 14.56M | 9.92M | 8.10M | 9.60M | 10.00M | 6.00M | 3.40M | 1.70M | 0.00 | 1.00M | 500.00K | 1.80M | 2.70M | 2.00M | 1.20M | 300.00K |

| Income Before Tax Ratio | -3.14% | -6.89% | 8.50% | 11.35% | -2.69% | 9.45% | 10.54% | 12.22% | 10.87% | 10.66% | 6.68% | 12.66% | 14.76% | 20.24% | 14.87% | 15.83% | 28.66% | 18.96% | 9.18% | 17.50% | 16.19% | 12.52% | 8.36% | 11.80% | 13.43% | 13.11% | 15.66% | 18.98% | 15.83% | 12.23% | 9.09% | 0.00% | 6.02% | 3.33% | 11.92% | 19.42% | 16.13% | 12.24% | 3.45% |

| Income Tax Expense | 11.12M | -96.10M | 47.05M | 55.04M | 3.10M | 21.30M | 34.19M | 23.51M | 24.47M | 13.14M | 7.33M | 18.77M | 17.62M | 18.74M | 12.58M | 7.41M | 24.94M | 11.94M | 10.54M | 9.11M | 7.08M | 4.43M | 2.25M | 5.07M | 2.48M | 2.60M | 2.80M | 2.90M | 1.60M | 900.00K | 600.00K | 100.00K | 300.00K | 100.00K | 800.00K | 1.00M | 700.00K | 500.00K | 100.00K |

| Net Income | -279.51M | -259.46M | 234.76M | 297.55M | -67.03M | 107.52M | 88.00M | 95.27M | 65.49M | 65.98M | 38.45M | 50.81M | 60.31M | 82.68M | 38.58M | 36.78M | 64.27M | 37.97M | 10.79M | 24.84M | 17.34M | 11.62M | 7.26M | 9.49M | 7.44M | 5.50M | 6.80M | 7.10M | 4.40M | 2.50M | 1.10M | 100.00K | 700.00K | 400.00K | 1.00M | 1.70M | 1.30M | 700.00K | 200.00K |

| Net Income Ratio | -5.94% | -5.03% | 7.08% | 9.58% | -2.82% | 7.89% | 7.59% | 9.80% | 7.92% | 8.89% | 5.63% | 9.10% | 11.28% | 16.44% | 11.18% | 12.59% | 20.33% | 14.43% | 4.64% | 12.80% | 11.49% | 9.06% | 6.39% | 7.70% | 10.08% | 8.90% | 11.09% | 13.47% | 11.61% | 8.99% | 5.88% | 0.58% | 4.22% | 2.67% | 6.62% | 12.23% | 10.48% | 7.14% | 2.30% |

| EPS | -1.84 | -1.89 | 2.01 | 2.50 | -0.79 | 1.69 | 1.41 | 1.52 | 1.07 | 1.08 | 0.62 | 0.81 | 0.96 | 1.33 | 0.64 | 0.62 | 1.08 | 0.65 | 0.18 | 0.43 | 0.30 | 0.19 | 0.13 | 0.17 | 0.15 | 0.11 | 0.13 | 0.13 | 0.09 | 0.06 | 0.03 | 0.00 | 0.02 | 0.01 | 0.03 | 0.04 | 0.03 | 0.02 | 0.01 |

| EPS Diluted | -1.84 | -1.89 | 2.01 | 2.37 | -0.79 | 1.63 | 1.35 | 1.48 | 1.04 | 1.05 | 0.60 | 0.80 | 0.94 | 1.30 | 0.63 | 0.61 | 1.05 | 0.63 | 0.18 | 0.42 | 0.29 | 0.19 | 0.13 | 0.17 | 0.14 | 0.11 | 0.13 | 0.13 | 0.09 | 0.06 | 0.03 | 0.00 | 0.02 | 0.01 | 0.03 | 0.04 | 0.03 | 0.02 | 0.01 |

| Weighted Avg Shares Out | 151.64M | 137.58M | 116.51M | 115.03M | 84.83M | 63.58M | 62.50M | 62.58M | 61.37M | 61.22M | 62.25M | 62.41M | 62.82M | 62.21M | 60.30M | 59.33M | 59.38M | 58.85M | 58.35M | 58.14M | 56.97M | 59.59M | 55.88M | 54.23M | 51.31M | 50.37M | 51.81M | 52.59M | 50.29M | 41.67M | 36.67M | 40.00M | 40.00M | 40.00M | 40.00M | 42.50M | 40.00M | 31.11M | 26.67M |

| Weighted Avg Shares Out (Dil) | 151.64M | 137.58M | 116.51M | 115.03M | 84.83M | 65.80M | 65.13M | 64.51M | 62.91M | 62.59M | 63.69M | 63.88M | 64.39M | 63.61M | 61.50M | 60.16M | 60.97M | 60.58M | 59.97M | 59.63M | 58.87M | 61.16M | 56.97M | 55.83M | 53.17M | 50.37M | 53.33M | 52.59M | 50.29M | 41.67M | 36.67M | 40.00M | 40.00M | 40.00M | 40.00M | 42.50M | 40.00M | 31.11M | 26.67M |

Coherent (COHR) Q3 Earnings and Revenues Beat Estimates

Coherent Corp. Releases Third-Quarter Fiscal Year 2024 Financial Results

Wall Street's Insights Into Key Metrics Ahead of Coherent (COHR) Q3 Earnings

Coherent Announces Support of DEI-Related Educational Initiatives Through HBCU/MIS and the Optica Foundation

Earth Day 2024: Coherent Corp. Announces Milestones in its Sustainability Journey

Coherent Announces Date of FY2024 Third-Quarter Conference Call

Coherent Secures $15 Million in CHIPS Act Funding Through the CLAWS Hub to Accelerate Commercialization of Wide- and Ultrawide-Bandgap Semiconductors

Coherent Loans James Webb Space Telescope Demonstration Mirror to Space Foundation Discovery Center

Coherent Is Priced To Perfection But Still Has Upside Potential

Coherent to Present a Broad Portfolio of New Products and Technology Innovations at OFC 2024

Source: https://incomestatements.info

Category: Stock Reports