See more : Shanghai YongLi Belting Co., Ltd (300230.SZ) Income Statement Analysis – Financial Results

Complete financial analysis of CorePoint Lodging Inc. (CPLG) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of CorePoint Lodging Inc., a leading company in the REIT – Hotel & Motel industry within the Real Estate sector.

- Premium Income Corporation (PIC-A.TO) Income Statement Analysis – Financial Results

- Ningbo Shimao Energy Co.,Ltd (605028.SS) Income Statement Analysis – Financial Results

- S and T Corporation Limited (STCORP.BO) Income Statement Analysis – Financial Results

- Eastern Power Group Public Company Limited (EP.BK) Income Statement Analysis – Financial Results

- Envista Holdings Corp (NVST) Income Statement Analysis – Financial Results

CorePoint Lodging Inc. (CPLG)

About CorePoint Lodging Inc.

CorePoint Lodging Inc., a real estate investment trust company, owns select-service hotels primarily under the La Quinta brand in the United States. As of December 31, 2020, it had a portfolio of 209 select-service hotels and approximately 27,800 rooms across 35 states in the United States. The company has elected to be taxed as a real estate investment trust. As a result, it would not be subject to corporate income tax on that portion of its net income that is distributed to shareholders. CorePoint Lodging Inc. was incorporated in 2017 and is headquartered in Irving, Texas.

| Metric | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|

| Revenue | 411.00M | 812.00M | 862.00M | 980.63M | 871.00M | 1.03B |

| Cost of Revenue | 355.00M | 575.00M | 576.00M | 27.51M | 529.00M | 23.20M |

| Gross Profit | 56.00M | 237.00M | 286.00M | 953.12M | 342.00M | 1.01B |

| Gross Profit Ratio | 13.63% | 29.19% | 33.18% | 97.19% | 39.27% | 97.75% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 68.00M | 121.00M | 137.00M | 142.94M | 54.00M | 125.70M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 70.61M | 0.00 | 69.81M |

| SG&A | 68.00M | 121.00M | 137.00M | 213.55M | 54.00M | 195.51M |

| Other Expenses | 159.00M | 181.00M | 156.00M | 621.28M | 139.00M | 628.98M |

| Operating Expenses | 227.00M | 302.00M | 293.00M | 834.83M | 193.00M | 824.49M |

| Cost & Expenses | 582.00M | 877.00M | 869.00M | 862.35M | 722.00M | 847.69M |

| Interest Income | 0.00 | 0.00 | 0.00 | 991.00K | 0.00 | 110.00K |

| Interest Expense | 43.00M | 69.00M | 0.00 | 78.56M | 0.00 | 82.80M |

| Depreciation & Amortization | 159.00M | 181.00M | 160.00M | 148.92M | 147.00M | 167.33M |

| EBITDA | 15.00M | 42.00M | -343.00M | 267.89M | 143.00M | 298.99M |

| EBITDA Ratio | 3.65% | 5.17% | -39.79% | 27.32% | 16.42% | 29.03% |

| Operating Income | -149.00M | -172.00M | -157.00M | 120.77M | 47.00M | 128.07M |

| Operating Income Ratio | -36.25% | -21.18% | -18.21% | 12.32% | 5.40% | 12.43% |

| Total Other Income/Expenses | -38.00M | -36.00M | -59.00M | -80.20M | -46.00M | -78.87M |

| Income Before Tax | -187.00M | -208.00M | -216.00M | 40.57M | 1.00M | 49.20M |

| Income Before Tax Ratio | -45.50% | -25.62% | -25.06% | 4.14% | 0.11% | 4.78% |

| Income Tax Expense | -9.00M | 4.00M | 21.00M | -111.56M | -2.00M | 22.49M |

| Net Income | -178.00M | -212.00M | -524.00M | 151.97M | -2.00M | 26.37M |

| Net Income Ratio | -43.31% | -26.11% | -60.79% | 15.50% | -0.23% | 2.56% |

| EPS | -3.14 | -3.71 | -8.94 | 2.58 | -0.03 | 0.45 |

| EPS Diluted | -3.14 | -3.71 | -8.94 | 2.58 | -0.03 | 0.45 |

| Weighted Avg Shares Out | 56.60M | 57.10M | 58.61M | 59.00M | 59.00M | 59.00M |

| Weighted Avg Shares Out (Dil) | 56.60M | 57.10M | 58.61M | 59.00M | 59.00M | 59.00M |

Analysts Anticipate CorePoint Lodging Inc (NYSE:CPLG) Will Announce Quarterly Sales of $146.84 Million

MERIAN GLOBAL INVESTORS UK Ltd Reduces Stock Position in CorePoint Lodging Inc (NYSE:CPLG)

Analysts Set $15.00 Price Target for CorePoint Lodging Inc (NYSE:CPLG)

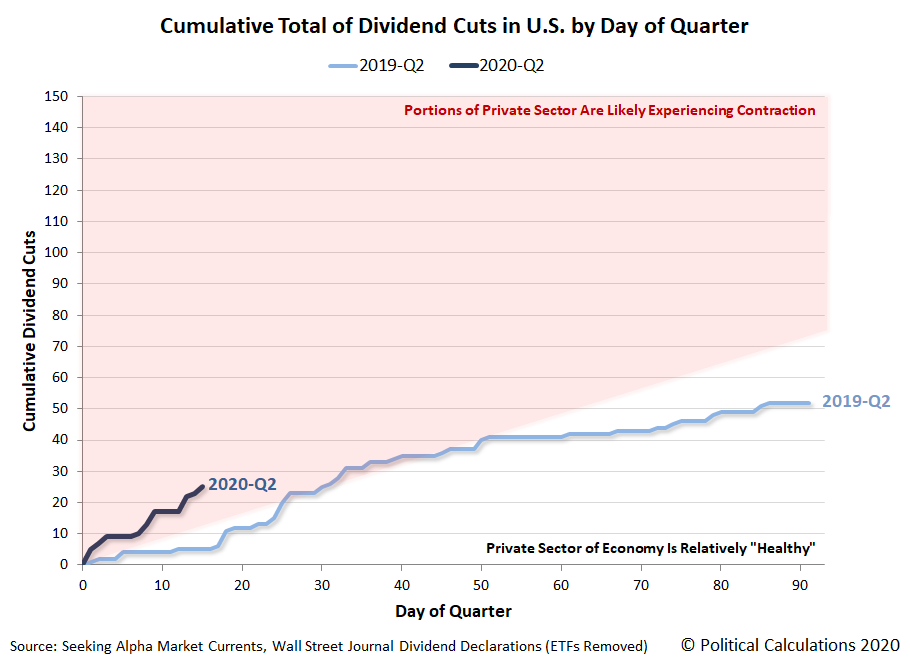

Dividend Cuts At The Midpoint Of April 2020

CorePoint Lodging Inc (NYSE:CPLG) Shares Sold by Goldman Sachs Group Inc.

Bank of New York Mellon Corp Raises Stock Position in CorePoint Lodging Inc (NYSE:CPLG)

Cubist Systematic Strategies LLC Purchases Shares of 32,843 CorePoint Lodging Inc (NYSE:CPLG)

Credit Suisse AG Sells 11,432 Shares of CorePoint Lodging Inc (NYSE:CPLG)

AQR Capital Management LLC Sells 19,136 Shares of CorePoint Lodging Inc (NYSE:CPLG)

CorePoint Lodging Inc (NYSE:CPLG) Receives Average Rating of "Hold" from Brokerages

Source: https://incomestatements.info

Category: Stock Reports