See more : Primary Health Properties PLC (PHP.L) Income Statement Analysis – Financial Results

Complete financial analysis of Crane Company (CR) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Crane Company, a leading company in the Industrial – Machinery industry within the Industrials sector.

- Canadian Solar Inc. (CSIQ) Income Statement Analysis – Financial Results

- Kaiser Reef Limited (KAU.AX) Income Statement Analysis – Financial Results

- Yadong Group Holdings Limited (1795.HK) Income Statement Analysis – Financial Results

- China Southern Power Grid Technology Co.,Ltd (688248.SS) Income Statement Analysis – Financial Results

- Prism Johnson Limited (PRSMJOHNSN.BO) Income Statement Analysis – Financial Results

Crane Company (CR)

About Crane Company

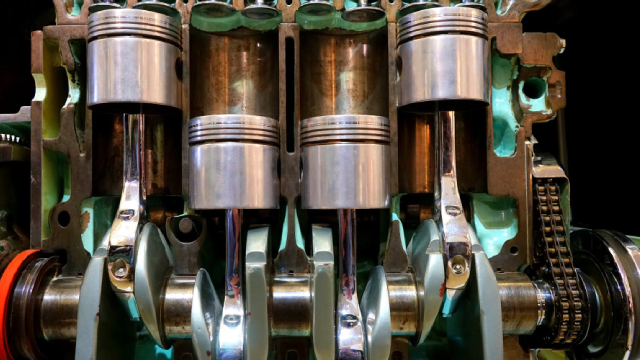

Crane Company, together with its subsidiaries, manufactures and sells engineered industrial products in the Americas, Europe, the Middle East, Asia, and Australia. The company has four business segments: Aerospace & Electronics, Process Flow Technologies, Payment & Merchandising Technologies, and Engineered Materials. The Aerospace & Electronics segment supplies critical components and systems, including original equipment and aftermarket parts, primarily for the commercial aerospace, and the military aerospace, defense, and space markets. This segment also offers pressure sensors for aircraft engine control, aircraft braking systems for fighter jets, power conversion solutions for spacecraft, and lubrication systems. The Process Flow Technologies segment provides engineered fluid handling equipment for mission critical applications. It offers process valves and related products, commercial valves, and pumps and systems. The Payment & Merchandising Technologies segment provides electronic equipment and associated software leveraging extensive, and proprietary core capabilities, including payment verification and authentication, as well as automation solutions, field service solutions, remote diagnostics, and productivity enhancing software solutions. The Engineered Materials segment manufactures fiberglass-reinforced plastic panels and coils, primarily for use in the manufacturing of recreational vehicles and in commercial and industrial buildings applications. It provides products and solutions to customers across end markets, including aerospace, defense, chemical and pharmaceutical, water and wastewater, payment automation, non-residential and municipal construction, energy, and banknote design and production, as well as for a range of general industrial and consumer applications. The company was formerly known as Crane Holdings, Co. Crane Company was founded in 1855 and is based in Stamford, Connecticut.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 2.09B | 3.37B | 3.18B | 2.94B | 3.28B | 3.35B | 2.79B | 2.75B | 2.74B | 2.92B | 2.60B | 2.58B | 2.55B | 2.22B | 2.20B | 2.60B | 2.62B | 2.26B | 2.06B | 1.89B | 1.64B | 1.52B | 1.59B | 1.49B | 1.55B | 2.27B | 2.04B | 1.85B | 1.78B | 1.65B | 1.31B | 1.31B | 1.30B | 1.44B | 1.46B | 1.31B | 1.28B | 1.20B | 1.10B |

| Cost of Revenue | 1.28B | 2.04B | 1.94B | 1.94B | 2.35B | 2.16B | 1.77B | 1.76B | 1.78B | 1.90B | 1.71B | 1.71B | 1.68B | 1.47B | 1.47B | 1.75B | 1.78B | 1.53B | 1.42B | 1.34B | 1.11B | 1.15B | 1.05B | 988.52M | 1.05B | 1.62B | 1.48B | 1.34B | 1.32B | 1.25B | 1.02B | 1.01B | 1.00B | 1.10B | 1.14B | 1.03B | 993.20M | 932.00M | 854.70M |

| Gross Profit | 805.00M | 1.34B | 1.24B | 1.00B | 931.10M | 1.19B | 1.02B | 989.70M | 957.10M | 1.02B | 883.52M | 870.83M | 862.77M | 745.22M | 730.31M | 853.27M | 843.01M | 731.26M | 642.59M | 551.46M | 529.83M | 361.80M | 541.47M | 502.67M | 500.90M | 643.80M | 559.80M | 503.00M | 466.00M | 400.10M | 293.70M | 301.00M | 299.70M | 338.50M | 319.50M | 282.40M | 290.80M | 272.20M | 244.10M |

| Gross Profit Ratio | 38.58% | 39.70% | 39.03% | 34.07% | 28.36% | 35.55% | 36.44% | 36.02% | 34.92% | 35.00% | 34.04% | 33.77% | 33.89% | 33.60% | 33.25% | 32.76% | 32.19% | 32.40% | 31.17% | 29.17% | 32.39% | 23.86% | 34.12% | 33.71% | 32.24% | 28.38% | 27.48% | 27.22% | 26.15% | 24.20% | 22.42% | 23.03% | 23.01% | 23.54% | 21.95% | 21.51% | 22.65% | 22.60% | 22.22% |

| Research & Development | 55.90M | 49.20M | 81.40M | 74.10M | 74.00M | 89.10M | 58.50M | 61.50M | 62.80M | 68.00M | 52.70M | 66.90M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 523.39M | 531.21M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 465.30M | 807.90M | 738.80M | 737.60M | 720.70M | 713.40M | 592.40M | 597.00M | 566.20M | 604.12M | 535.65M | 539.76M | 548.54M | 523.39M | 531.21M | 615.08M | 579.60M | 483.32M | 428.97M | 405.16M | 360.81M | 322.13M | 295.18M | 263.37M | 270.10M | 343.40M | 307.80M | 287.40M | 274.30M | 245.50M | 178.40M | 187.80M | 192.40M | 195.20M | 193.20M | 167.00M | 158.10M | 153.20M | 143.00M |

| Other Expenses | 0.00 | 22.00M | 20.40M | 14.90M | 4.40M | 18.70M | -800.00K | -1.60M | -700.00K | 2.38M | 2.73M | -884.00K | 0.00 | 0.00 | 0.00 | 0.00 | 390.15M | -2.23B | 0.00 | -40.00M | 0.00 | 0.00 | 74.61M | 55.28M | 61.30M | 61.50M | 55.40M | 49.40M | 48.80M | 44.70M | 29.40M | 28.50M | 28.40M | 30.10M | 21.30M | 19.70M | 28.30M | 27.60M | 30.70M |

| Operating Expenses | 521.20M | 807.90M | 738.80M | 737.60M | 720.70M | 713.40M | 592.40M | 789.40M | 577.80M | 682.60M | 535.65M | 560.39M | 820.51M | 583.23M | 589.41M | 2.41B | 969.75M | -1.75B | 428.97M | 365.16M | 360.81M | 322.13M | 369.79M | 318.65M | 331.40M | 404.90M | 363.20M | 336.80M | 323.10M | 290.20M | 207.80M | 216.30M | 220.80M | 225.30M | 214.50M | 186.70M | 186.40M | 180.80M | 173.70M |

| Cost & Expenses | 1.80B | 2.84B | 2.68B | 2.67B | 3.07B | 2.87B | 2.36B | 2.55B | 2.36B | 2.58B | 2.25B | 2.27B | 2.50B | 2.06B | 2.06B | 2.41B | 2.75B | -220.05M | 1.85B | 1.70B | 1.47B | 1.48B | 1.42B | 1.31B | 1.38B | 2.03B | 1.84B | 1.68B | 1.64B | 1.54B | 1.22B | 1.22B | 1.22B | 1.33B | 1.35B | 1.22B | 1.18B | 1.11B | 1.03B |

| Interest Income | 5.10M | 3.40M | 1.40M | 2.00M | 2.70M | 2.30M | 2.50M | 1.90M | 1.90M | 1.71M | 1.87M | 1.88M | 1.64M | 1.18M | 2.82M | 10.26M | 6.26M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 22.70M | 52.20M | 46.90M | 55.30M | 46.80M | 50.90M | 36.10M | 36.50M | 37.60M | 39.22M | 26.46M | 26.83M | 26.26M | 26.84M | 27.14M | 25.80M | 27.40M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 39.30M | 39.60M | 119.50M | 123.80M | 107.90M | 120.00M | 72.70M | 67.40M | 67.00M | 75.77M | 54.84M | 57.26M | 62.94M | 59.84M | 58.20M | 57.16M | 61.31M | 54.29M | 55.72M | 55.72M | 54.03M | 49.79M | 74.61M | 55.28M | 61.30M | 61.50M | 55.40M | 49.40M | 48.80M | 44.70M | 29.40M | 28.50M | 28.40M | 30.10M | 21.30M | 19.70M | 28.30M | 27.60M | 30.70M |

| EBITDA | 329.00M | 321.10M | 643.60M | 380.90M | 298.60M | 618.70M | 495.80M | 432.90M | 454.90M | 431.10M | 425.50M | 368.70M | 103.96M | 295.75M | 270.27M | 266.61M | -30.18M | 2.53B | 269.34M | 242.02M | 223.04M | 89.46M | 246.29M | 239.31M | 230.80M | 267.90M | 227.70M | 215.60M | 191.70M | 154.60M | 115.30M | 113.20M | 107.30M | 143.30M | 126.30M | 115.40M | 132.70M | 119.00M | 101.10M |

| EBITDA Ratio | 15.77% | 20.04% | 20.24% | 13.87% | 10.08% | 18.44% | 17.84% | 9.75% | 16.33% | 14.39% | 15.69% | 14.30% | 4.20% | 13.35% | 12.26% | 10.25% | 11.49% | 111.99% | 12.92% | 28.29% | 13.57% | 5.94% | 16.51% | 14.23% | 14.58% | 13.08% | 12.22% | 11.54% | 10.45% | 9.23% | 8.73% | 11.45% | 8.02% | 9.55% | 8.29% | 8.43% | 10.14% | 9.20% | 10.58% |

| Operating Income | 283.80M | 557.30M | 502.30M | 262.90M | 210.40M | 441.30M | 401.90M | 200.30M | 372.90M | 316.29M | 347.88M | 310.44M | -42.26M | 235.16M | 208.27M | 197.49M | -107.66M | 247.94M | 213.62M | 186.30M | 169.01M | 39.67M | 171.68M | 184.03M | 169.50M | 238.90M | 196.60M | 166.20M | 142.90M | 109.90M | 85.90M | 84.70M | 78.90M | 113.20M | 105.00M | 95.70M | 104.40M | 91.40M | 70.40M |

| Operating Income Ratio | 13.60% | 16.51% | 15.80% | 8.95% | 6.41% | 13.19% | 14.43% | 7.29% | 13.61% | 10.81% | 13.40% | 12.04% | -1.66% | 10.60% | 9.48% | 7.58% | -4.11% | 10.99% | 10.36% | 9.86% | 10.33% | 2.62% | 10.82% | 12.34% | 10.91% | 10.53% | 9.65% | 8.99% | 8.02% | 6.65% | 6.56% | 6.48% | 6.06% | 7.87% | 7.21% | 7.29% | 8.13% | 7.59% | 6.41% |

| Total Other Income/Expenses | -16.80M | -285.90M | -25.10M | -38.40M | -39.70M | -29.90M | -20.90M | -22.60M | -36.40M | -35.10M | -21.88M | -25.84M | -21.81M | -24.23M | -23.34M | -13.84M | -11.24M | -8.60M | -17.10M | -354.47M | -17.85M | -15.22M | -35.87M | 6.33M | -13.70M | 2.60M | -800.00K | -21.20M | -21.50M | -18.70M | -6.10M | -46.00M | -6.50M | -10.70M | -13.40M | -14.20M | -17.40M | -19.20M | -44.20M |

| Income Before Tax | 267.00M | 575.20M | 477.20M | 224.50M | 170.70M | 411.50M | 367.50M | 164.10M | 336.30M | 281.16M | 326.02M | 284.61M | 20.45M | 210.93M | 184.93M | 183.85M | -118.90M | 239.33M | 196.52M | -168.17M | 151.16M | 24.45M | 135.82M | 190.36M | 155.80M | 214.60M | 175.90M | 145.00M | 121.40M | 91.20M | 79.80M | 38.70M | 72.40M | 102.50M | 91.60M | 81.50M | 87.00M | 72.20M | 26.20M |

| Income Before Tax Ratio | 12.80% | 17.04% | 15.01% | 7.64% | 5.20% | 12.30% | 13.19% | 5.97% | 12.27% | 9.61% | 12.56% | 11.04% | 0.80% | 9.51% | 8.42% | 7.06% | -4.54% | 10.60% | 9.53% | -8.90% | 9.24% | 1.61% | 8.56% | 12.77% | 10.03% | 9.46% | 8.64% | 7.85% | 6.81% | 5.52% | 6.09% | 2.96% | 5.56% | 7.13% | 6.29% | 6.21% | 6.78% | 6.00% | 2.38% |

| Income Tax Expense | 63.20M | 164.60M | 82.90M | 43.40M | 37.10M | 75.90M | 195.00M | 40.30M | 106.50M | 87.59M | 105.07M | 88.42M | -6.06M | 56.74M | 50.85M | 48.69M | -56.55M | 73.45M | 60.49M | -62.75M | 46.86M | 7.83M | 47.20M | 66.63M | 54.90M | 76.20M | 63.10M | 52.90M | 45.10M | 35.30M | 30.90M | 14.40M | 27.40M | 39.80M | 35.70M | 32.30M | 36.70M | 33.80M | 8.60M |

| Net Income | 255.90M | 401.10M | 435.40M | 181.00M | 133.30M | 335.60M | 171.80M | 122.80M | 228.90M | 192.67M | 219.50M | 216.99M | 26.32M | 154.17M | 133.86M | 135.16M | -62.34M | 165.89M | 136.04M | -105.42M | 104.30M | -11.45M | 88.62M | 123.73M | 114.60M | 138.40M | 112.80M | 92.10M | 76.30M | 55.90M | 48.90M | 24.30M | 45.00M | 62.70M | 55.90M | 62.50M | 50.30M | 38.40M | 17.60M |

| Net Income Ratio | 12.27% | 11.88% | 13.69% | 6.16% | 4.06% | 10.03% | 6.17% | 4.47% | 8.35% | 6.59% | 8.46% | 8.41% | 1.03% | 6.95% | 6.09% | 5.19% | -2.38% | 7.35% | 6.60% | -5.58% | 6.38% | -0.75% | 5.58% | 8.30% | 7.38% | 6.10% | 5.54% | 4.98% | 4.28% | 3.38% | 3.73% | 1.86% | 3.45% | 4.36% | 3.84% | 4.76% | 3.92% | 3.19% | 1.60% |

| EPS | 4.51 | 7.11 | 7.46 | 3.10 | 2.23 | 5.63 | 2.89 | 2.10 | 3.94 | 3.28 | 3.79 | 3.78 | 0.45 | 2.59 | 2.28 | 2.27 | -1.04 | 2.72 | 2.27 | -1.78 | 1.75 | -0.19 | 1.48 | 2.03 | 1.71 | 2.02 | 1.64 | 1.35 | 1.12 | 0.83 | 0.73 | 0.35 | 0.63 | 0.87 | 0.77 | 0.82 | 0.66 | 0.55 | 0.25 |

| EPS Diluted | 4.45 | 7.01 | 7.35 | 3.08 | 2.20 | 5.50 | 2.84 | 2.07 | 3.89 | 3.23 | 3.73 | 3.72 | 0.44 | 2.59 | 2.28 | 2.24 | -1.04 | 2.67 | 2.25 | -1.78 | 1.75 | -0.19 | 1.47 | 2.02 | 1.70 | 2.00 | 1.63 | 1.34 | 1.11 | 0.82 | 0.73 | 0.35 | 0.63 | 0.86 | 0.77 | 0.82 | 0.63 | 0.50 | 0.25 |

| Weighted Avg Shares Out | 56.70M | 56.40M | 58.40M | 58.30M | 59.80M | 59.60M | 59.40M | 58.50M | 58.10M | 58.77M | 57.90M | 57.44M | 58.12M | 58.60M | 58.47M | 59.67M | 60.04M | 60.91M | 59.82M | 59.25M | 59.34M | 59.73M | 59.83M | 60.92M | 66.98M | 68.56M | 68.78M | 68.22M | 68.13M | 67.83M | 66.99M | 69.43M | 71.43M | 72.07M | 72.60M | 76.22M | 76.21M | 45.06M | 45.96M |

| Weighted Avg Shares Out (Dil) | 57.50M | 57.20M | 59.20M | 58.80M | 60.60M | 61.00M | 60.40M | 59.30M | 58.80M | 59.60M | 58.84M | 58.29M | 59.20M | 59.56M | 58.81M | 60.30M | 60.04M | 62.10M | 60.41M | 59.25M | 59.60M | 59.73M | 60.36M | 61.40M | 67.46M | 69.37M | 69.20M | 68.73M | 68.74M | 68.06M | 66.99M | 69.43M | 71.43M | 72.91M | 72.60M | 76.22M | 79.84M | 45.06M | 45.96M |

Crane NXT, Co. Announces Appointment of Dr. Aleta Richards as President of Crane Currency

Crane NXT, Co. Announces Dates For Third Quarter 2024 Earnings Release and Earnings Call

Crane Company Announces Date for Third Quarter 2024 Earnings Release and Teleconference

Constellation to Launch Crane Clean Energy Center, Restoring Jobs and Carbon-free Power to the Grid

Crane (CR) Is Up 7.51% in One Week: What You Should Know

Here's Why Crane (CR) is a Strong Momentum Stock

Manitex International Signs Dealership Agreement With First Fleet Truck Sales in Support of Its North American PM Crane Sales Expansion

Buy 5 High-Flying Old Economy Stocks With Solid Estimate Revisions

Manitex International Signs Dealership Agreement With Bruckner's Truck & Equipment in Support of Its North American PM Crane Sales Expansion

GRC or CR: Which Is the Better Value Stock Right Now?

Source: https://incomestatements.info

Category: Stock Reports