See more : NuZee, Inc. (NUZE) Income Statement Analysis – Financial Results

Complete financial analysis of The Crypto Company (CRCW) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of The Crypto Company, a leading company in the Information Technology Services industry within the Technology sector.

- Sky Gold Corp. (SRKZF) Income Statement Analysis – Financial Results

- V.I.P. Industries Limited (VIPIND.BO) Income Statement Analysis – Financial Results

- Wesco Holdings Inc. (6091.T) Income Statement Analysis – Financial Results

- Altus Holdings Limited (8149.HK) Income Statement Analysis – Financial Results

- ITT Inc. (ITT) Income Statement Analysis – Financial Results

The Crypto Company (CRCW)

Industry: Information Technology Services

Sector: Technology

Website: https://www.thecryptocompany.com

About The Crypto Company

The Crypto Company, through its subsidiaries, provides consulting and education services for distributed ledger technologies for the building of technological infrastructure and enterprise blockchain technology solutions. The company is based in Malibu, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 |

|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 405.40K | 619.54K | 434.55K | 14.40K | 65.74K | 5.00K | 787.37K | 0.00 | 308.00 | 1.19K |

| Cost of Revenue | 313.76K | 369.31K | 273.80K | 0.00 | 30.50K | 0.00 | 0.00 | 2.01K | 74.00 | 287.00 |

| Gross Profit | 91.64K | 250.23K | 160.76K | 14.40K | 35.24K | 5.00K | 787.37K | -2.01K | 234.00 | 905.00 |

| Gross Profit Ratio | 22.61% | 40.39% | 36.99% | 100.00% | 53.61% | 100.00% | 100.00% | 0.00% | 75.97% | 75.92% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.52K | 5.91K |

| General & Administrative | 2.39M | 3.97M | 2.21M | 3.07M | 1.75M | 9.03M | 10.20M | 36.30K | 861.00 | 3.27K |

| Selling & Marketing | 0.00 | 31.78K | 33.97K | 0.00 | 49.32K | 30.84K | 24.07K | 0.00 | 0.00 | 8.90K |

| SG&A | 2.39M | 3.97M | 2.21M | 3.07M | 1.75M | 9.03M | 10.20M | 36.30K | 861.00 | 12.17K |

| Other Expenses | 43.33K | 130.55K | 32.50K | 307.52K | -88.87K | -14.84K | 10.34M | 13.78K | 4.89K | 290.00 |

| Operating Expenses | 2.44M | 4.10M | 2.24M | 3.07M | 1.75M | 9.03M | 10.34M | 36.30K | 861.00 | 12.17K |

| Cost & Expenses | 2.75M | 4.47M | 2.51M | 3.07M | 1.78M | 9.03M | 10.34M | 36.30K | 935.00 | 12.46K |

| Interest Income | 0.00 | 1.76M | 16.37K | 68.04K | 87.57K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 2.57M | 1.76M | 16.37K | 68.04K | 87.57K | 0.00 | 1.78M | 344.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 43.33K | 130.55K | 32.50K | 22.56K | 22.56K | 1.04M | 4.68K | 50.08K | 4.88K | 11.27K |

| EBITDA | -2.30M | -3.78M | -736.76K | -2.75M | -1.78M | -7.83M | -10.09M | -344.00 | -627.00 | 0.00 |

| EBITDA Ratio | -568.51% | -597.25% | -437.56% | -19,095.01% | -2,710.16% | -156,254.14% | -759.17% | 0.00% | -203.57% | -945.47% |

| Operating Income | -2.35M | -3.85M | -2.08M | -3.06M | -1.72M | -9.03M | -5.98M | -50.08K | -5.51K | -11.27K |

| Operating Income Ratio | -578.56% | -621.27% | -478.45% | -21,230.58% | -2,609.29% | -180,550.68% | -759.76% | 0.00% | -1,788.96% | -945.05% |

| Total Other Income/Expenses | -2.57M | -1.81M | 1.29M | 239.49K | -176.45K | -14.84K | -135.23K | -344.00 | 0.00 | 0.00 |

| Income Before Tax | -4.92M | -5.66M | -785.63K | -2.82M | -1.89M | -9.04M | -7.77M | -50.42K | -5.51K | -11.27K |

| Income Before Tax Ratio | -1,212.43% | -914.05% | -180.79% | -19,567.48% | -2,877.68% | -180,847.56% | -986.42% | 0.00% | -1,788.96% | -945.05% |

| Income Tax Expense | 0.00 | 75.13K | 161.56K | 68.04K | 1.60K | 1.60K | 800.00 | -13.43K | -4.88K | -11.27K |

| Net Income | -4.92M | -5.74M | -947.19K | -2.89M | -1.89M | -25.42M | -7.77M | -50.42K | -5.51K | -11.27K |

| Net Income Ratio | -1,212.43% | -926.18% | -217.97% | -20,039.95% | -2,880.11% | -508,402.18% | -986.52% | 0.00% | -1,788.96% | -945.05% |

| EPS | -0.04 | -0.25 | -0.04 | -0.13 | -0.09 | -1.21 | -0.46 | 0.00 | 0.00 | 0.00 |

| EPS Diluted | -0.04 | -0.25 | -0.04 | -0.13 | -0.09 | -1.20 | -0.46 | 0.00 | 0.00 | 0.00 |

| Weighted Avg Shares Out | 134.93M | 23.19M | 22.06M | 21.40M | 21.22M | 21.03M | 16.75M | 10.27M | 10.00M | 10.00M |

| Weighted Avg Shares Out (Dil) | 134.93M | 23.19M | 22.06M | 21.40M | 21.22M | 21.10M | 16.75M | 10.27M | 10.00M | 10.00M |

Crypto traders thrilled about Trump: Coinbase exec.

Silver eyes $50 in 2025 as industrial demand grows and gold-silver ratio narrows

Mercury Insurance and Los Angeles Kings Come Together to Spice Up the Season for Fans Inside and Outside Crypto.com Arena

Crypto Bulls: About to Go LMBO, or About to Get REKT?

5 Crypto-Related Stocks With Upside as Bitcoin Hits All-Time High

2 Crypto Stocks Rallying as Bitcoin Breaks Records

Bitcoin Hits a Record as Crypto Investors Root for a Trump Win

Crypto firms including Robinhood, Kraken launch global stablecoin network

A Look Back at Crypto ETFs

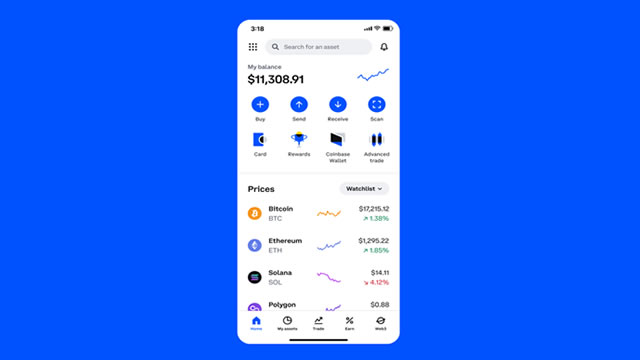

Coinbase Wants to Turn Every FinTech Into a Crypto Company

Source: https://incomestatements.info

Category: Stock Reports