See more : Shenzhen Aisidi CO.,LTD. (002416.SZ) Income Statement Analysis – Financial Results

Complete financial analysis of Crown ElectroKinetics Corp. (CRKN) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Crown ElectroKinetics Corp., a leading company in the Chemicals – Specialty industry within the Basic Materials sector.

- i-Scream Media (461300.KQ) Income Statement Analysis – Financial Results

- Wuxi Chemical Equipment Co., Ltd. (001332.SZ) Income Statement Analysis – Financial Results

- Eyebright Medical Technology (Beijing) Co., Ltd. (688050.SS) Income Statement Analysis – Financial Results

- Armm Inc. (ARMM) Income Statement Analysis – Financial Results

- Metals Acquisition Corp (MTAL-UN) Income Statement Analysis – Financial Results

Crown ElectroKinetics Corp. (CRKN)

About Crown ElectroKinetics Corp.

Crown Electrokinetics Corp. develops and sells optical switching films. The company also focuses on commercializing electrokinetic technology for use in the smart glass market. It offers electrokinetic film technology for smart or dynamic glass. The company was formerly known as 3D Nanocolor Corp. and changed its name to Crown ElectroKinetics Corp. in October 2017. Crown ElectroKinetics Corp. was incorporated in 2015 and is based in Corvallis, Oregon.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|---|

| Revenue | 153.00K | 0.00 | 0.00 | 100.00K | 504.79K | 504.79K | 0.00 | 0.00 |

| Cost of Revenue | 886.00K | 0.00 | 0.00 | 620.00K | 614.00K | 614.00K | 0.00 | 0.00 |

| Gross Profit | -733.00K | 0.00 | 0.00 | -520.00K | -109.21K | -109.21K | 0.00 | 0.00 |

| Gross Profit Ratio | -479.08% | 0.00% | 0.00% | -520.00% | -21.64% | -21.64% | 0.00% | 0.00% |

| Research & Development | 2.23M | 4.11M | 3.40M | 1.83M | 712.12K | 712.12K | 276.27K | 689.44K |

| General & Administrative | 0.00 | 0.00 | 0.00 | 5.49M | 1.79M | 0.00 | 912.06K | 545.10K |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 14.96M | 11.00M | 18.72M | 5.49M | 1.79M | 1.79M | 912.06K | 545.10K |

| Other Expenses | 1.38M | -223.00K | 0.00 | 3.32K | 34.81K | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 18.58M | 15.11M | 22.13M | 7.32M | 2.50M | 2.50M | 1.19M | 1.23M |

| Cost & Expenses | 19.46M | 15.11M | 22.13M | 7.94M | 3.12M | 3.12M | 1.19M | 1.23M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 9.42M | 7.00K | 0.00 | 1.50M | 1.12M | 1.12M | 29.73K | 0.00 |

| Depreciation & Amortization | 1.36M | 774.00K | 301.00K | 76.75K | 55.81K | 55.81K | 46.75K | 25.50K |

| EBITDA | -18.34M | -14.61M | -21.82M | -7.76M | -7.76M | -3.12M | -1.14M | -1.21M |

| EBITDA Ratio | -11,984.31% | 0.00% | 0.00% | -7,757.84% | -7,761.16% | -617.83% | 0.00% | 0.00% |

| Operating Income | -19.31M | -15.11M | -22.13M | -19.35M | -7.84M | -2.61M | -1.19M | -1.23M |

| Operating Income Ratio | -12,619.61% | 0.00% | 0.00% | -7,837.91% | -517.53% | 0.00% | 0.00% | |

| Total Other Income/Expenses | -9.68M | 793.00K | -15.03M | -21.40M | -1.77M | -1.68M | -21.98K | 2.40K |

| Income Before Tax | -28.98M | -14.32M | -37.16M | -40.76M | -9.60M | -4.30M | -1.21M | -1.23M |

| Income Before Tax Ratio | -18,943.79% | 0.00% | 0.00% | -851.00% | -851.00% | 0.00% | 0.00% | |

| Income Tax Expense | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Net Income | -28.98M | -14.37M | -37.16M | -40.76M | -9.60M | -4.30M | -1.21M | -1.23M |

| Net Income Ratio | -18,943.79% | 0.00% | 0.00% | -9,603.87% | -9,603.87% | -851.00% | 0.00% | 0.00% |

| EPS | -819.45 | -54.12 | 0.00 | -276.27 | -139.95 | -4.29K | -24.43 | -34.77 |

| EPS Diluted | -819.45 | -54.12 | 0.00 | -276.27 | -139.95 | -4.29K | -25.20 | -34.77 |

| Weighted Avg Shares Out | 36.20K | 265.50K | 0.00 | 147.52K | 68.62K | 1.00K | 48.03K | 35.44K |

| Weighted Avg Shares Out (Dil) | 36.20K | 265.50K | 0.00 | 147.52K | 68.62K | 1.00K | 49.53K | 35.44K |

Crown Fiber Announces Commencement of Work in Oregon Across Four New Customers

Crown Fiber Announces Expansion of Projects in Idaho

Crown Electrokinetics Announces 1-for-150 Reverse Stock Split

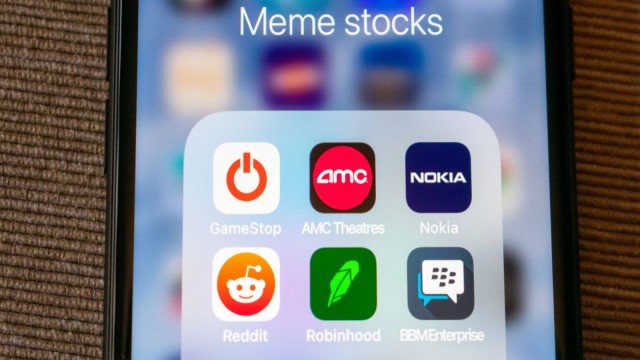

3 Meme Stocks That Could Cost You as Much Money as GameStop and AMC.

Why Is Crown ElectroKinetics (CRKN) Stock Down 37% Today?

Meme Stock Profit-Taking: 3 Companies to Sell While You're Ahead

Crown ElectroKinetics Corp. (CRKN) Q1 2024 Earnings Call Transcript

Crown Electrokinetics' ‘meme' stock rockets again on massive volume

‘An AI-fueled equity bubble' will see big tech lead the charge in coming months

Why Is Crown ElectroKinetics (CRKN) Stock Up 192% Today?

Source: https://incomestatements.info

Category: Stock Reports