See more : Inspira Technologies Oxy B.H.N. Ltd. (IINN) Income Statement Analysis – Financial Results

Complete financial analysis of Cytek Biosciences, Inc. (CTKB) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Cytek Biosciences, Inc., a leading company in the Medical – Devices industry within the Healthcare sector.

- Otsuka Corporation (4768.T) Income Statement Analysis – Financial Results

- Odyssey Group International, Inc. (ODYY) Income Statement Analysis – Financial Results

- Border Petroleum Limited (BOPFF) Income Statement Analysis – Financial Results

- I.E.S Holdings Ltd (IES.TA) Income Statement Analysis – Financial Results

- Guodian Nanjing Automation Co., Ltd. (600268.SS) Income Statement Analysis – Financial Results

Cytek Biosciences, Inc. (CTKB)

About Cytek Biosciences, Inc.

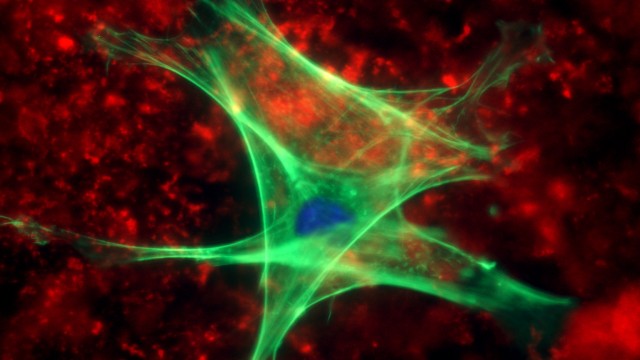

Cytek Biosciences, Inc., a cell analysis solutions company, provides cell analysis tools that facilitates scientific advances in biomedical research and clinical applications. It offers aurora and northern lights systems, which are spectrum flow cytometers that delivers cell analysis by utilizing the fluorescence signatures from multiple lasers to distinguish fluorescent tags on single cells; and aurora cell sorter system, which leverages full spectrum profiling technology to further broaden potential applications across cell analysis. The company also provides reagents and kits, including cFluor reagents, which are fluorochrome conjugated antibodies used to identify cells of interest for analysis on its instruments, as well as 25-color immunoprofiling assay that provides turnkey solutions for identifying major human immune subpopulations for TBNK cells, monocytes, dendritic cells, and basophils. In addition, it offers automated micro-sampling system and automated sample loader system, which are automated plate loaders to integrate seamlessly into the aurora and northern lights systems; SpectroFlo software that provides intuitive workflow from quality control to data analysis for aurora and northern lights systems; and customer support tools. The company serves pharmaceutical and biopharma companies, academic research centers, and clinical research organizations. It distributes its products through direct sales force and support organizations in North America, Europe, China, and the Asia-Pacific region; and through distributors or sales agents in European, Latin American, the Middle Eastern, and the Asia-Pacific countries. The company was formerly known as Cytoville, Inc. and changed its name to Cytek Biosciences, Inc. in August 2015. Cytek Biosciences, Inc. was founded in 1992 and is headquartered in Fremont, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|

| Revenue | 193.02M | 164.04M | 127.95M | 92.84M | 57.88M |

| Cost of Revenue | 83.59M | 63.06M | 48.81M | 41.13M | 29.21M |

| Gross Profit | 109.43M | 100.97M | 79.14M | 51.71M | 28.67M |

| Gross Profit Ratio | 56.69% | 61.56% | 61.86% | 55.70% | 49.54% |

| Research & Development | 44.15M | 34.86M | 24.44M | 13.69M | 8.93M |

| General & Administrative | 43.97M | 34.69M | 20.83M | 9.37M | 6.74M |

| Selling & Marketing | 49.15M | 33.23M | 24.71M | 14.99M | 10.24M |

| SG&A | 91.62M | 67.92M | 45.54M | 24.36M | 16.98M |

| Other Expenses | 0.00 | 1.02M | -1.53M | 994.00K | 252.00K |

| Operating Expenses | 137.27M | 102.78M | 69.98M | 38.05M | 25.91M |

| Cost & Expenses | 220.86M | 165.84M | 118.78M | 79.18M | 55.12M |

| Interest Income | 6.41M | 4.62M | 49.00K | 110.00K | 711.00K |

| Interest Expense | 2.07M | 2.57M | 1.74M | 333.00K | 1.00K |

| Depreciation & Amortization | 9.23M | 5.70M | 1.24M | 603.00K | 309.00K |

| EBITDA | -4.41M | 9.54M | 10.40M | 15.37M | -15.98M |

| EBITDA Ratio | -2.28% | 2.34% | 6.01% | 16.55% | 6.97% |

| Operating Income | -27.85M | -1.83M | 6.45M | 13.66M | 3.73M |

| Operating Income Ratio | -14.43% | -1.11% | 5.04% | 14.71% | 6.44% |

| Total Other Income/Expenses | 12.14M | 3.06M | -3.22M | 771.00K | 962.00K |

| Income Before Tax | -15.71M | 1.26M | 5.95M | 14.43M | -16.29M |

| Income Before Tax Ratio | -8.14% | 0.77% | 4.65% | 15.54% | -28.15% |

| Income Tax Expense | -3.56M | -1.22M | 1.51M | -4.98M | 533.00K |

| Net Income | -12.15M | 2.58M | 4.42M | 19.41M | -16.83M |

| Net Income Ratio | -6.29% | 1.57% | 3.45% | 20.91% | -29.07% |

| EPS | -0.09 | 0.02 | 0.03 | 0.02 | -0.13 |

| EPS Diluted | -0.09 | 0.02 | 0.03 | 0.02 | -0.13 |

| Weighted Avg Shares Out | 135.28M | 134.51M | 133.75M | 132.99M | 132.99M |

| Weighted Avg Shares Out (Dil) | 135.28M | 138.56M | 133.75M | 132.99M | 132.99M |

Cytek Biosciences to Report First Quarter 2024 Financial Results on May 8, 2024

Cytek Biosciences (CTKB) Is Considered a Good Investment by Brokers: Is That True?

Cytek Biosciences (CTKB) Loses -7.27% in 4 Weeks, Here's Why a Trend Reversal May be Around the Corner

Wall Street Analysts Believe Cytek Biosciences (CTKB) Could Rally 47.61%: Here's is How to Trade

New Strong Buy Stocks for April 2nd

Cytek Biosciences: Undisputed Next-Gen Flow Cytometry Leader

Cytek® Biosciences Names William McCombe Chief Financial Officer

Cytek® Biosciences Opens New Facility to Address Increasing Global Demand for Cutting-Edge Cell Analysis Solutions

Cytek Biosciences, Inc. (CTKB) Q4 2023 Earnings Call Transcript

Cytek Biosciences Reports Fourth Quarter and Full Year 2023 Financial Results and Provides 2024 Outlook

Source: https://incomestatements.info

Category: Stock Reports