See more : PETRONAS Chemicals Group Berhad (PECGF) Income Statement Analysis – Financial Results

Complete financial analysis of Continental Aktiengesellschaft (CTTAY) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Continental Aktiengesellschaft, a leading company in the Auto – Parts industry within the Consumer Cyclical sector.

- Inseego Corp. (0A52.L) Income Statement Analysis – Financial Results

- Borealis Foods Inc. (BRLS) Income Statement Analysis – Financial Results

- Disruptive Acquisition Corporation I (DISA) Income Statement Analysis – Financial Results

- Vedan International (Holdings) Limited (2317.HK) Income Statement Analysis – Financial Results

- Jointeca Education Solutions Ltd. (JOINTECAED.BO) Income Statement Analysis – Financial Results

Continental Aktiengesellschaft (CTTAY)

About Continental Aktiengesellschaft

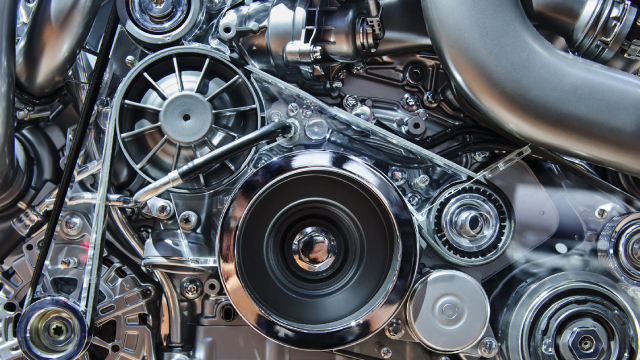

Continental Aktiengesellschaft, a technology company, offers intelligent solutions for vehicles, machines, traffic, and transportation worldwide. It operates through four sectors: Automotive, Tires, ContiTech, and Contract Manufacturing. The company offers safety, brake, chassis, motion, and motion control systems; solutions for assisted and automated driving; and audio and camera solutions for the vehicle interior, as well as intelligent information and communication technology solutions. It also provides tires for cars, trucks, buses, two-wheel and specialist vehicles, bicycles, and motor vehicles, as well as digital tire monitoring and management systems. In addition, the company develops and manufactures cross-material, environmentally friendly, and intelligent products and systems for automotive, railway engineering, mining, agriculture, and other industries, as well as provides contract manufacturing services. It sells its products through 944 company owned tire outlets and approximately 5,200 franchise locations The company was formerly known as Continental-Caoutchouc- und Gutta-Percha Compagnie. Continental Aktiengesellschaft was founded in 1871 and is headquartered in Hanover, Germany.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 41.42B | 39.41B | 33.77B | 37.72B | 44.48B | 44.40B | 44.01B | 40.55B | 39.23B | 34.51B | 33.33B | 32.74B | 30.50B | 26.05B | 20.10B | 24.24B | 16.62B | 14.89B | 13.84B | 12.60B |

| Cost of Revenue | 32.61B | 31.10B | 26.02B | 29.13B | 33.89B | 33.30B | 32.64B | 29.78B | 29.06B | 25.84B | 25.53B | 25.68B | 24.11B | 20.27B | 16.08B | 19.48B | 12.60B | 11.21B | 10.33B | 9.45B |

| Gross Profit | 8.81B | 8.31B | 7.74B | 8.59B | 10.59B | 11.10B | 11.37B | 10.77B | 10.18B | 8.67B | 7.80B | 7.06B | 6.40B | 5.78B | 4.01B | 4.75B | 4.02B | 3.68B | 3.51B | 3.14B |

| Gross Profit Ratio | 21.26% | 21.08% | 22.92% | 22.77% | 23.80% | 25.01% | 25.85% | 26.55% | 25.94% | 25.11% | 23.41% | 21.55% | 20.97% | 22.19% | 19.97% | 19.61% | 24.21% | 24.73% | 25.36% | 24.96% |

| Research & Development | 4.13B | 4.17B | 2.59B | 3.38B | 3.36B | 4.28B | 3.10B | 2.81B | 2.45B | 2.14B | 1.88B | 1.77B | 1.61B | 1.45B | 1.36B | 1.50B | 834.80M | 677.00M | 589.40M | 523.80M |

| General & Administrative | 1.35B | 1.09B | 1.00B | 1.16B | 1.11B | 1.15B | 1.14B | 1.01B | 925.50M | 762.80M | 698.70M | 684.50M | 651.60M | 1.96B | 1.73B | 1.95B | 452.90M | 442.50M | 432.60M | 394.30M |

| Selling & Marketing | 2.53B | 2.60B | 2.39B | 2.42B | 2.72B | 2.49B | 2.43B | 2.25B | 2.18B | 1.84B | 1.66B | 1.59B | 1.43B | 1.31B | 0.00 | 0.00 | 912.90M | 853.90M | 840.00M | 780.00M |

| SG&A | 3.88B | 3.69B | 3.40B | 3.57B | 3.83B | 3.64B | 3.57B | 3.26B | 3.10B | 2.60B | 2.36B | 2.27B | 2.08B | 1.96B | 1.73B | 1.95B | 1.37B | 1.30B | 1.27B | 1.17B |

| Other Expenses | 0.00 | -8.20M | -10.40M | -1.21B | -116.30M | -318.70M | -183.90M | -63.70M | -78.10M | -117.70M | -79.10M | -49.50M | 3.50M | 517.70M | 1.90B | 1.61B | 172.70M | 132.70M | 157.30M | 302.10M |

| Operating Expenses | 8.01B | 7.85B | 5.98B | 6.96B | 7.08B | 6.69B | 6.47B | 6.36B | 5.67B | 4.82B | 4.31B | 3.85B | 3.89B | 3.92B | 4.99B | 5.06B | 2.37B | 2.11B | 2.02B | 2.00B |

| Cost & Expenses | 40.76B | 38.95B | 32.01B | 36.09B | 40.97B | 39.99B | 39.10B | 36.15B | 34.72B | 30.66B | 29.84B | 29.53B | 28.00B | 24.19B | 21.07B | 24.54B | 14.97B | 13.31B | 12.35B | 11.45B |

| Interest Income | 103.40M | 87.40M | 108.30M | 100.40M | 147.20M | 122.90M | 94.40M | 101.40M | 96.90M | 94.50M | 81.80M | 27.80M | 29.20M | 22.60M | 30.30M | 80.00M | 57.50M | 36.50M | 48.30M | 17.10M |

| Interest Expense | 419.40M | 238.60M | 186.00M | 284.10M | 317.30M | 276.20M | 281.50M | 308.80M | 333.30M | 380.30M | 622.20M | 563.90M | 764.70M | 719.80M | 751.10M | 786.70M | 211.70M | 147.10M | 152.70M | 135.10M |

| Depreciation & Amortization | 2.23B | 2.24B | 2.33B | 2.87B | 2.74B | 2.19B | 2.08B | 1.90B | 1.89B | 1.79B | 1.83B | 1.78B | 1.63B | 1.65B | 2.63B | 3.07B | 814.80M | 699.60M | 741.80M | 667.20M |

| EBITDA | 4.26B | 4.01B | 4.29B | 3.40B | 4.97B | 6.33B | 6.67B | 6.25B | 6.09B | 5.25B | 4.91B | 4.83B | 4.26B | 3.61B | 1.62B | 2.85B | 2.55B | 2.34B | 2.30B | 1.84B |

| EBITDA Ratio | 10.29% | 11.52% | 12.46% | 9.10% | 11.21% | 14.37% | 15.50% | 16.20% | 16.23% | 16.24% | 15.78% | 14.76% | 13.96% | 13.84% | 8.07% | 11.76% | 15.33% | 15.70% | 16.60% | 14.62% |

| Operating Income | 765.00M | 1.33B | 1.79B | -317.60M | -261.50M | 4.03B | 4.56B | 4.10B | 4.12B | 3.34B | 3.26B | 3.07B | 2.51B | 1.85B | -975.90M | -305.00M | 1.65B | 1.58B | 1.49B | 1.14B |

| Operating Income Ratio | 1.85% | 3.37% | 5.31% | -0.84% | -0.59% | 9.07% | 10.36% | 10.10% | 10.49% | 9.69% | 9.79% | 9.39% | 8.22% | 7.12% | -4.86% | -1.26% | 9.93% | 10.58% | 10.77% | 9.08% |

| Total Other Income/Expenses | 853.00M | 542.20M | 892.00M | -298.30M | -2.66B | -177.80M | -262.30M | -566.00M | -604.70M | -701.10M | -942.20M | -465.70M | -735.50M | -616.50M | -785.30M | -697.90M | -147.90M | -84.40M | -87.40M | -105.00M |

| Income Before Tax | 1.62B | 556.80M | 1.71B | -930.10M | -588.60M | 3.85B | 4.28B | 3.98B | 3.87B | 3.08B | 2.46B | 2.67B | 1.86B | 1.24B | -1.76B | -1.00B | 1.52B | 1.49B | 1.40B | 1.04B |

| Income Before Tax Ratio | 3.91% | 1.41% | 5.06% | -2.47% | -1.32% | 8.67% | 9.72% | 9.81% | 9.86% | 8.92% | 7.38% | 8.15% | 6.10% | 4.75% | -8.76% | -4.14% | 9.16% | 10.02% | 10.14% | 8.25% |

| Income Tax Expense | 424.10M | 444.60M | 359.50M | -11.30M | 582.40M | 891.60M | 1.23B | 1.10B | 1.09B | 622.00M | 449.60M | 698.70M | 536.20M | 592.10M | -154.30M | 75.00M | 471.70M | 486.70M | 450.50M | 300.40M |

| Net Income | 1.16B | 112.20M | 1.44B | -918.80M | -1.17B | 2.90B | 2.98B | 2.80B | 2.73B | 2.38B | 1.92B | 1.91B | 1.24B | 576.00M | -1.65B | -1.12B | 1.02B | 981.90M | 929.60M | 716.20M |

| Net Income Ratio | 2.79% | 0.28% | 4.25% | -2.44% | -2.63% | 6.52% | 6.78% | 6.91% | 6.95% | 6.88% | 5.77% | 5.82% | 4.07% | 2.21% | -8.21% | -4.64% | 6.14% | 6.60% | 6.72% | 5.69% |

| EPS | 5.78 | 0.56 | 7.18 | -4.59 | -5.85 | 1.45 | 1.49 | 1.40 | 1.36 | 1.19 | 0.96 | 0.95 | 0.62 | 0.29 | -0.94 | -0.66 | 0.66 | 0.65 | 0.62 | 0.50 |

| EPS Diluted | 5.78 | 0.56 | 7.18 | -4.59 | -5.85 | 1.45 | 1.49 | 1.40 | 1.36 | 1.19 | 0.96 | 0.95 | 0.62 | 0.29 | -0.94 | -0.66 | 0.63 | 0.62 | 0.59 | 0.48 |

| Weighted Avg Shares Out | 200.00M | 200.00M | 200.00M | 200.00M | 200.00M | 2.00B | 2.00B | 2.00B | 2.00B | 2.00B | 2.00B | 2.00B | 2.00B | 2.00B | 1.75B | 1.70B | 1.56B | 1.51B | 1.51B | 1.43B |

| Weighted Avg Shares Out (Dil) | 200.00M | 200.00M | 200.00M | 200.00M | 200.00M | 2.00B | 2.00B | 2.00B | 2.00B | 2.00B | 2.00B | 2.00B | 2.00B | 2.00B | 1.75B | 1.70B | 1.63B | 1.59B | 1.59B | 1.51B |

Continental (CTTAY) Is Attractively Priced Despite Fast-paced Momentum

CTTAY vs. MBLY: Which Stock Is the Better Value Option?

Should Value Investors Buy Continental (CTTAY) Stock?

CTTAY vs. MBLY: Which Stock Should Value Investors Buy Now?

Should Value Investors Buy Continental (CTTAY) Stock?

Continental Aktiengesellschaft (CTTAF) Q3 2024 Earnings Call Transcript

Tire Producers: Healthy Dividends With Defensive History

Continental AG: Spin-Off In Response To Apparent Undervaluation

CTTAY or MOD: Which Is the Better Value Stock Right Now?

Are Investors Undervaluing Continental (CTTAY) Right Now?

Source: https://incomestatements.info

Category: Stock Reports