See more : SLM Solutions Group AG (0QUC.L) Income Statement Analysis – Financial Results

Complete financial analysis of Lionheart Holdings (CUB) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Lionheart Holdings, a leading company in the None industry within the None sector.

You may be interested

- Döhler S.A. (DOHL4.SA) Income Statement Analysis – Financial Results

- E&E Recycling,Inc. (8440.TWO) Income Statement Analysis – Financial Results

- African Rainbow Minerals Limited (AFBOF) Income Statement Analysis – Financial Results

- Exobox Technologies Corp. (EXBX) Income Statement Analysis – Financial Results

- Assura Plc (AGR.L) Income Statement Analysis – Financial Results

Lionheart Holdings (CUB)

| Metric | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 1.48B | 1.50B | 1.20B | 1.49B | 1.46B | 1.43B | 1.40B | 1.36B | 1.38B | 1.29B | 1.19B | 1.02B | 881.14M | 889.87M | 821.39M | 804.37M | 722.01M | 634.06M | 564.31M | 508.72M | 531.52M | 510.80M | 414.10M | 388.20M | 407.60M | 370.10M | 260.60M | 221.40M | 344.20M | 307.80M | 352.80M | 349.40M | 364.90M | 357.60M | 337.80M | 331.70M |

| Cost of Revenue | 1.02B | 1.07B | 835.39M | 1.12B | 1.12B | 1.09B | 1.08B | 1.06B | 1.05B | 977.97M | 941.99M | 805.52M | 709.48M | 727.54M | 687.21M | 672.54M | 549.17M | 493.38M | 426.01M | 385.57M | 442.86M | 396.00M | 314.00M | 288.00M | 305.80M | 277.90M | 190.60M | 169.10M | 251.70M | 221.00M | 241.80M | 250.10M | 272.30M | 265.70M | 263.10M | 248.30M |

| Gross Profit | 456.59M | 431.42M | 367.51M | 363.72M | 344.76M | 339.72M | 315.82M | 301.40M | 335.26M | 307.24M | 252.20M | 211.14M | 171.65M | 162.33M | 134.17M | 131.83M | 172.84M | 140.68M | 138.30M | 123.15M | 88.65M | 114.80M | 100.10M | 100.20M | 101.80M | 92.20M | 70.00M | 52.30M | 92.50M | 86.80M | 111.00M | 99.30M | 92.60M | 91.90M | 74.70M | 83.40M |

| Gross Profit Ratio | 30.93% | 28.83% | 30.55% | 24.48% | 23.59% | 23.74% | 22.58% | 22.15% | 24.27% | 23.91% | 21.12% | 20.77% | 19.48% | 18.24% | 16.33% | 16.39% | 23.94% | 22.19% | 24.51% | 24.21% | 16.68% | 22.47% | 24.17% | 25.81% | 24.98% | 24.91% | 26.86% | 23.62% | 26.87% | 28.20% | 31.46% | 28.42% | 25.38% | 25.70% | 22.11% | 25.14% |

| Research & Development | 44.57M | 50.13M | 52.40M | 52.65M | 31.98M | 17.99M | 17.96M | 24.45M | 28.72M | 25.26M | 18.98M | 8.17M | 12.23M | 5.18M | 6.11M | 8.08M | 5.49M | 4.82M | 8.38M | 9.76M | 7.00M | 7.70M | 10.80M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 274.70M | 270.06M | 258.64M | 258.09M | 269.59M | 212.52M | 181.67M | 164.88M | 163.69M | 154.96M | 120.85M | 111.83M | 99.96M | 95.05M | 97.17M | 110.64M | 113.14M | 87.89M | 85.46M | 76.05M | 74.02M | 75.70M | 79.90M | 76.80M | 76.50M | 69.70M | 59.50M | 45.90M | 74.40M | 58.60M | 64.90M | 61.90M | 66.50M | 68.60M | 66.90M | 55.90M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 274.70M | 270.06M | 258.64M | 258.09M | 269.59M | 212.52M | 181.67M | 164.88M | 163.69M | 154.96M | 120.85M | 111.83M | 99.96M | 95.05M | 97.17M | 110.64M | 113.14M | 87.89M | 85.46M | 76.05M | 74.02M | 75.70M | 79.90M | 76.80M | 76.50M | 69.70M | 59.50M | 45.90M | 74.40M | 58.60M | 64.90M | 61.90M | 66.50M | 68.60M | 66.90M | 55.90M |

| Other Expenses | 59.31M | 42.11M | 27.06M | 33.00M | 34.12M | 27.55M | 22.60M | 16.68M | 14.83M | 14.68M | 6.85M | 6.43M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.64M | 11.38M | 10.20M | 11.10M | 9.00M | 10.50M | 12.50M | 9.90M | 9.40M | 9.90M | 9.70M | 10.00M | 10.90M | 10.60M | 9.50M | 8.10M | 6.60M |

| Operating Expenses | 378.58M | 362.30M | 338.11M | 343.74M | 335.69M | 258.06M | 222.23M | 206.00M | 207.24M | 194.90M | 146.67M | 126.43M | 112.19M | 100.23M | 103.28M | 118.73M | 118.63M | 92.71M | 93.84M | 88.45M | 92.39M | 93.60M | 101.80M | 85.80M | 87.00M | 82.20M | 69.40M | 55.30M | 84.30M | 68.30M | 74.90M | 72.80M | 77.10M | 78.10M | 75.00M | 62.50M |

| Cost & Expenses | 1.40B | 1.43B | 1.17B | 1.47B | 1.45B | 1.35B | 1.30B | 1.27B | 1.25B | 1.17B | 1.09B | 931.95M | 821.67M | 827.77M | 790.49M | 791.27M | 667.80M | 586.08M | 519.85M | 474.01M | 535.26M | 489.60M | 415.80M | 373.80M | 392.80M | 360.10M | 260.00M | 224.40M | 336.00M | 289.30M | 316.70M | 322.90M | 349.40M | 343.80M | 338.10M | 310.80M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 27.69M | 20.45M | 10.42M | 15.03M | 11.20M | 4.40M | 4.08M | 3.42M | 1.55M | 1.46M | 1.76M | 2.03M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 88.48M | 64.74M | 46.60M | 51.10M | 45.48M | 37.66M | 30.44M | 25.36M | 22.86M | 22.34M | 14.47M | 15.59M | 9.69M | 8.85M | 8.49M | 8.63M | 7.47M | 6.48M | 6.54M | 12.80M | 11.38M | 10.20M | 11.10M | 9.00M | 10.50M | 12.50M | 9.90M | 9.40M | 9.90M | 9.70M | 10.00M | 10.90M | 10.60M | 9.50M | 8.10M | 6.60M |

| EBITDA | 106.57M | 145.93M | 76.43M | 69.98M | 49.20M | 113.94M | 123.85M | 62.78M | 154.49M | 141.14M | 122.15M | 102.86M | 66.93M | 74.10M | 44.82M | 20.71M | 63.77M | 61.52M | 47.46M | 43.90M | 11.62M | 31.70M | 12.20M | 27.80M | 28.20M | 21.30M | 14.40M | 31.20M | 19.90M | 32.10M | 48.30M | 41.30M | 27.30M | 22.60M | 8.90M | 32.30M |

| EBITDA Ratio | 7.22% | 9.75% | 6.35% | 4.71% | 3.37% | 7.96% | 8.86% | 4.61% | 11.18% | 10.98% | 10.23% | 10.12% | 7.60% | 8.33% | 5.46% | 2.57% | 8.83% | 9.70% | 8.41% | 8.63% | 2.19% | 6.21% | 2.95% | 7.16% | 6.92% | 5.76% | 5.53% | 14.09% | 5.78% | 10.43% | 13.69% | 11.82% | 7.48% | 6.32% | 2.63% | 9.74% |

| Operating Income | 78.00M | 69.11M | 29.40M | 19.98M | 9.07M | 81.66M | 93.58M | 95.40M | 128.02M | 112.34M | 105.53M | 84.71M | 59.47M | 62.10M | 30.90M | 13.10M | 54.21M | 47.98M | 44.46M | 34.71M | -3.74M | 21.20M | -1.70M | 14.40M | 14.80M | 10.00M | 600.00K | -3.00M | 8.20M | 18.50M | 36.10M | 26.50M | 15.50M | 13.80M | -300.00K | 20.90M |

| Operating Income Ratio | 5.28% | 4.62% | 2.44% | 1.34% | 0.62% | 5.71% | 6.69% | 7.01% | 9.27% | 8.74% | 8.84% | 8.33% | 6.75% | 6.98% | 3.76% | 1.63% | 7.51% | 7.57% | 7.88% | 6.82% | -0.70% | 4.15% | -0.41% | 3.71% | 3.63% | 2.70% | 0.23% | -1.36% | 2.38% | 6.01% | 10.23% | 7.58% | 4.25% | 3.86% | -0.09% | 6.30% |

| Total Other Income/Expenses | -81.45M | -16.77M | -14.51M | -16.13M | -16.55M | -9.75M | -4.17M | -61.21M | 2.27M | 5.31M | 396.00K | 532.00K | -2.23M | 3.15M | 5.43M | -1.02M | 2.10M | 7.06M | -3.54M | -3.60M | 3.98M | 300.00K | 2.80M | 4.40M | 2.90M | -1.20M | 2.70M | 4.70M | 1.80M | 3.90M | 2.20M | 400.00K | 1.20M | -700.00K | 1.10M | 4.80M |

| Income Before Tax | -3.45M | 52.35M | 14.89M | 3.85M | -7.48M | 71.91M | 89.41M | 34.19M | 130.29M | 117.65M | 105.92M | 85.24M | 57.24M | 65.25M | 36.33M | 12.08M | 56.31M | 55.03M | 40.92M | 31.11M | 241.00K | 21.50M | 1.10M | 18.80M | 17.70M | 8.80M | 3.30M | 1.70M | 10.00M | 22.40M | 38.30M | 26.90M | 16.70M | 13.10M | 800.00K | 25.70M |

| Income Before Tax Ratio | -0.23% | 3.50% | 1.24% | 0.26% | -0.51% | 5.03% | 6.39% | 2.51% | 9.43% | 9.15% | 8.87% | 8.38% | 6.50% | 7.33% | 4.42% | 1.50% | 7.80% | 8.68% | 7.25% | 6.11% | 0.05% | 4.21% | 0.27% | 4.84% | 4.34% | 2.38% | 1.27% | 0.77% | 2.91% | 7.28% | 10.86% | 7.70% | 4.58% | 3.66% | 0.24% | 7.75% |

| Income Tax Expense | -6.38M | 11.04M | 7.09M | 15.06M | -9.21M | 49.00M | 19.83M | 14.21M | 38.18M | 32.57M | 35.29M | 29.55M | 20.39M | 23.66M | 12.20M | 453.00K | 19.39M | 18.51M | 11.48M | 10.27M | -433.00K | 7.50M | 200.00K | 6.60M | 6.60M | 3.40M | 800.00K | -500.00K | 3.00M | 8.40M | 15.30M | 9.30M | 4.50M | 5.20M | -300.00K | 11.00M |

| Net Income | -3.22M | 49.69M | 12.31M | -11.21M | 1.74M | 22.89M | 69.49M | 19.80M | 91.90M | 84.77M | 70.64M | 55.69M | 36.85M | 41.59M | 24.13M | 11.63M | 36.91M | 36.52M | 29.44M | 20.84M | 674.00K | 14.00M | 900.00K | 12.20M | 11.10M | 5.40M | 3.70M | 22.30M | 7.00M | 14.00M | 23.00M | 21.10M | 12.20M | 7.90M | 1.10M | 14.70M |

| Net Income Ratio | -0.22% | 3.32% | 1.02% | -0.75% | 0.12% | 1.60% | 4.97% | 1.45% | 6.65% | 6.60% | 5.91% | 5.48% | 4.18% | 4.67% | 2.94% | 1.45% | 5.11% | 5.76% | 5.22% | 4.10% | 0.13% | 2.74% | 0.22% | 3.14% | 2.72% | 1.46% | 1.42% | 10.07% | 2.03% | 4.55% | 6.52% | 6.04% | 3.34% | 2.21% | 0.33% | 4.43% |

| EPS | -0.10 | 1.62 | 0.45 | -0.41 | 0.06 | 0.85 | 2.59 | 0.74 | 3.44 | 3.17 | 2.64 | 2.08 | 1.38 | 1.56 | 0.90 | 0.44 | 1.38 | 1.37 | 1.10 | 0.78 | 0.03 | 0.52 | 0.03 | 0.45 | 0.41 | 0.20 | 0.14 | 0.81 | 0.25 | 0.48 | 0.74 | 0.65 | 0.36 | 0.23 | 0.03 | 0.42 |

| EPS Diluted | -0.10 | 1.62 | 0.45 | -0.41 | 0.06 | 0.85 | 2.59 | 0.74 | 3.44 | 3.17 | 2.64 | 2.08 | 1.38 | 1.56 | 0.90 | 0.44 | 1.38 | 1.37 | 1.10 | 0.78 | 0.03 | 0.52 | 0.03 | 0.45 | 0.41 | 0.20 | 0.14 | 0.81 | 0.25 | 0.48 | 0.74 | 0.65 | 0.36 | 0.23 | 0.03 | 0.42 |

| Weighted Avg Shares Out | 31.30M | 30.61M | 27.35M | 27.11M | 26.98M | 26.87M | 26.79M | 26.74M | 26.74M | 26.74M | 26.74M | 26.73M | 26.73M | 26.72M | 26.72M | 26.72M | 26.72M | 26.72M | 26.72M | 26.72M | 26.72M | 26.72M | 26.75M | 26.93M | 26.94M | 26.94M | 27.10M | 27.45M | 28.41M | 29.40M | 31.25M | 32.49M | 33.92M | 34.38M | 36.70M | 35.32M |

| Weighted Avg Shares Out (Dil) | 31.30M | 30.61M | 27.35M | 27.11M | 27.04M | 26.94M | 26.85M | 26.76M | 26.74M | 26.74M | 26.74M | 26.73M | 26.73M | 26.72M | 26.72M | 26.72M | 26.72M | 26.72M | 26.72M | 26.72M | 26.72M | 26.72M | 26.75M | 26.97M | 26.94M | 26.94M | 27.10M | 27.45M | 28.41M | 29.40M | 31.25M | 32.49M | 33.92M | 34.38M | 36.70M | 35.32M |

Raymond James Trust N.A. Has $410,000 Stock Holdings in CMS Energy Co. (NYSE:CMS)

Raymond James Trust N.A. increased its position in shares of CMS Energy Co. (NYSE:CMS) by 3.1% during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 6,669...

Medicare must speed coverage for breakthrough digital therapeutics

Assigning digital therapeutics a benefit category would include them in a proposed rule to speed coverage of "breakthrough" technologies.

Cubic Wins Contract to Supply F-35 P5 Ground Subsystem for UK Ministry of Defence Training

SAN DIEGO--(BUSINESS WIRE)--Cubic Corporation (NYSE:CUB) today announced its Cubic Mission and Performance Solutions (CMPS) business division was awarded a contract to deliver a P5 Combat Training System (P5CTS) ground subsystem with live monitoring to support Royal Air Force (RAF) training...

Georgia Can Partially Expand Medicaid With Work Requirements, Premiums

The Centers for Medicare and Medicaid Services approved a waiver request from Georgia to expand its Medicaid program with restrictions that narrow the number of residents who will be eligible.

CAP Calls on Medicare to Cease Implementation of Payment Cuts for COVID-19 Tests

The CAP strongly objected to Medicare cuts to fees for certain COVID-19 tests, which the CMS announced late yesterday.

CMS: Seniors Will Get COVID Vaccine For Free

The Centers For Medicare and Medicaid Services is also adding additional telehealth services to coverage.

HealthSync West Florida, a Navvis and Florida Medical Clinic Joint Venture, Achieves Top-Tier ACO Performance

HealthSync West Florida, a Navvis and Florida Medical Clinic Joint Venture, Achieves Top-Tier ACO Performance

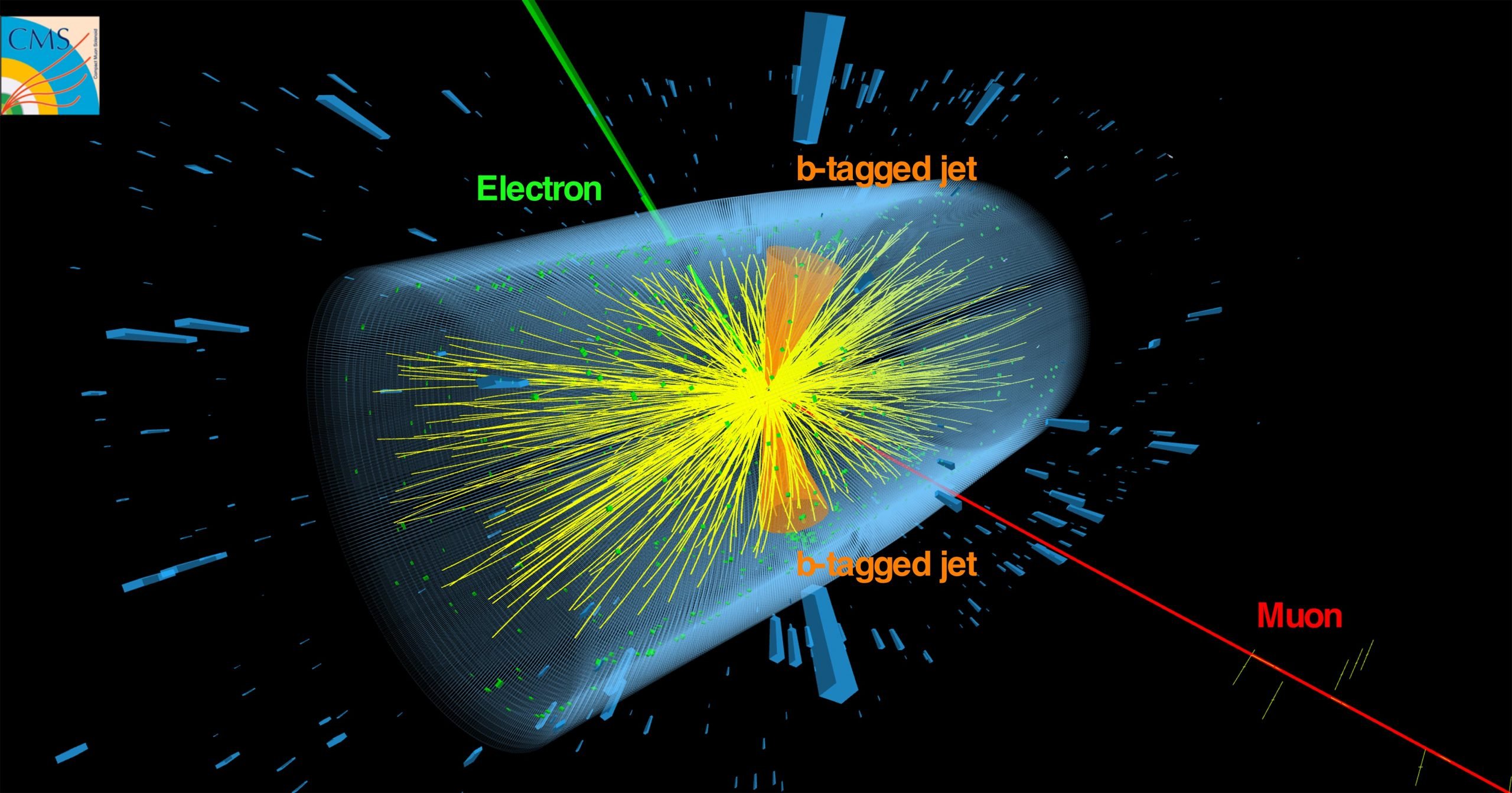

Extreme State of Matter: Evidence of Top Quarks in Collisions at the Large Hadron Collider

The result opens the path to study in a new and unique way the extreme state of matter that is thought to have existed shortly after the Big Bang. The CMS collaboration has seen evidence of top quarks in collisions...

Source: https://incomestatements.info

Category: Stock Reports