See more : Tu Yi Holding Company Limited (1701.HK) Income Statement Analysis – Financial Results

Complete financial analysis of CVS Health Corporation (CVS) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of CVS Health Corporation, a leading company in the Medical – Healthcare Plans industry within the Healthcare sector.

- Hana Microelectronics Public Company Limited (HAA1.F) Income Statement Analysis – Financial Results

- Macro Metals Limited (M4M.AX) Income Statement Analysis – Financial Results

- 3Power Energy Group, Inc. (PSPW) Income Statement Analysis – Financial Results

- i-nexus Global plc (INX.L) Income Statement Analysis – Financial Results

- Komputronik S.A. (KOM.WA) Income Statement Analysis – Financial Results

CVS Health Corporation (CVS)

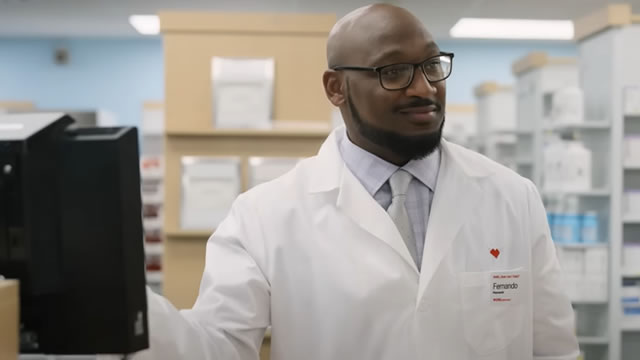

About CVS Health Corporation

CVS Health Corporation provides health services in the United States. The company's Health Care Benefits segment offers traditional, voluntary, and consumer-directed health insurance products and related services. It serves employer groups, individuals, college students, part-time and hourly workers, health plans, health care providers, governmental units, government-sponsored plans, labor groups, and expatriates. Its Pharmacy Services segment offers pharmacy benefit management solutions, including plan design and administration, formulary management, retail pharmacy network management, mail order pharmacy, specialty pharmacy and infusion, clinical, and disease and medical spend management services. It serves employers, insurance companies, unions, government employee groups, health plans, prescription drug plans, Medicaid managed care plans, plans offered on public health insurance and private health insurance exchanges, other sponsors of health benefit plans, and individuals. This segment operates retail specialty pharmacy stores; and specialty mail-order, mail-order dispensing, and compounding pharmacies, as well as branches for infusion and enteral nutrition services. The company's Retail/LTC segment sells prescription and over-the-counter drugs, consumer health and beauty products, and personal care products; and provides health care services through its MinuteClinic walk-in medical clinics. This segment also distributes prescription drugs; and provides related pharmacy consulting and other ancillary services to care facilities and other care settings. As of December 31, 2021, it operated approximately 9,900 retail locations and 1,200 MinuteClinic locations, as well as online retail pharmacy websites, LTC pharmacies, and onsite pharmacies. The company was formerly known as CVS Caremark Corporation and changed its name to CVS Health Corporation in September 2014. CVS Health Corporation was founded in 1963 and is headquartered in Woonsocket, Rhode Island.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 357.78B | 322.47B | 292.11B | 268.71B | 256.78B | 194.58B | 184.79B | 177.55B | 153.29B | 139.37B | 126.76B | 123.12B | 107.08B | 95.78B | 98.22B | 87.47B | 76.33B | 43.82B | 37.01B | 30.59B | 26.59B | 24.18B | 22.24B | 20.09B | 18.10B | 15.27B | 13.75B | 11.83B | 9.76B | 11.29B | 10.44B | 10.43B | 9.89B | 8.69B | 7.55B | 6.78B | 5.93B | 5.26B | 4.77B |

| Cost of Revenue | 303.35B | 267.97B | 239.99B | 219.66B | 211.25B | 163.04B | 156.26B | 148.71B | 126.76B | 114.00B | 102.98B | 100.63B | 86.52B | 75.56B | 77.86B | 69.18B | 60.22B | 32.08B | 27.31B | 22.56B | 19.73B | 18.11B | 16.55B | 14.73B | 13.24B | 11.14B | 10.03B | 8.47B | 6.86B | 7.25B | 6.66B | 6.53B | 6.16B | 5.37B | 4.56B | 4.09B | 3.57B | 3.14B | 2.85B |

| Gross Profit | 54.43B | 54.50B | 52.12B | 49.05B | 45.53B | 31.54B | 28.53B | 28.83B | 26.53B | 25.37B | 23.78B | 22.49B | 20.56B | 20.22B | 20.36B | 18.29B | 16.11B | 11.74B | 9.69B | 8.03B | 6.86B | 6.07B | 5.69B | 5.36B | 4.86B | 4.13B | 3.72B | 3.36B | 2.90B | 4.03B | 3.77B | 3.90B | 3.72B | 3.31B | 2.99B | 2.69B | 2.36B | 2.12B | 1.92B |

| Gross Profit Ratio | 15.21% | 16.69% | 17.82% | 18.25% | 17.73% | 16.21% | 15.45% | 16.26% | 17.31% | 18.20% | 18.76% | 18.28% | 19.20% | 21.01% | 20.64% | 20.91% | 21.10% | 27.25% | 26.76% | 26.25% | 25.81% | 25.10% | 25.59% | 26.69% | 26.86% | 27.03% | 27.04% | 29.08% | 32.46% | 35.74% | 36.14% | 37.42% | 37.65% | 38.15% | 39.58% | 39.74% | 39.84% | 40.31% | 40.23% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 14.23B | 14.09B | 13.93B | 12.24B | 11.31B | 9.30B | 7.68B | 6.08B | 5.10B | 4.55B | 4.25B | 3.74B | 3.45B | 2.95B | 2.78B | 2.49B | 2.18B | 3.22B | 2.96B | 3.34B | 2.91B | 2.54B | 2.23B | 2.02B | 1.77B | 1.57B | 1.41B |

| Other Expenses | 40.69B | 46.55B | 38.81B | 35.14B | 33.54B | 27.52B | 18.99B | 18.45B | 17.05B | 16.57B | 15.75B | 15.28B | 0.00 | -10.00M | 0.00 | -200.00K | 0.00 | 0.00 | 0.00 | 496.80M | 341.70M | 310.30M | 673.30M | 296.60M | 277.90M | 249.70M | 242.60M | 262.80M | 327.70M | 206.30M | 191.60M | 201.00M | 138.50M | 114.40M | 97.80M | 82.20M | 72.00M | 64.10M | 63.10M |

| Operating Expenses | 40.69B | 46.55B | 38.81B | 35.14B | 33.54B | 27.52B | 18.99B | 18.45B | 17.05B | 16.57B | 15.75B | 15.28B | 14.23B | 14.08B | 13.93B | 12.24B | 11.31B | 9.30B | 7.68B | 6.58B | 5.44B | 4.86B | 4.92B | 4.04B | 3.73B | 3.20B | 3.02B | 2.75B | 2.51B | 3.42B | 3.15B | 3.54B | 3.05B | 2.65B | 2.33B | 2.11B | 1.84B | 1.64B | 1.47B |

| Cost & Expenses | 344.03B | 314.51B | 278.80B | 254.80B | 244.79B | 190.56B | 175.25B | 167.16B | 143.82B | 130.57B | 118.72B | 115.91B | 100.75B | 89.64B | 91.79B | 81.43B | 71.54B | 41.38B | 34.99B | 29.14B | 25.16B | 22.98B | 21.47B | 18.76B | 16.96B | 14.34B | 13.05B | 11.23B | 9.37B | 10.67B | 9.81B | 10.07B | 9.22B | 8.02B | 6.89B | 6.19B | 5.41B | 4.78B | 4.33B |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 21.00M | 20.00M | 21.00M | 15.00M | 8.00M | 4.00M | 4.00M | 3.00M | 5.00M | 21.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 2.66B | 2.29B | 2.50B | 2.91B | 3.04B | 2.62B | 1.06B | 1.08B | 859.00M | 615.00M | 517.00M | 561.00M | 588.00M | 539.00M | 530.00M | 530.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 4.37B | 4.22B | 4.49B | 4.44B | 4.37B | 2.72B | 2.48B | 2.48B | 2.09B | 1.93B | 1.87B | 1.75B | 1.57B | 1.47B | 1.39B | 1.27B | 1.09B | 733.30M | 589.10M | 439.90M | 341.70M | 310.30M | 320.80M | 296.60M | 277.90M | 249.70M | 242.60M | 262.80M | 327.70M | 206.30M | 191.60M | 201.00M | 138.50M | 114.40M | 97.80M | 82.20M | 72.00M | 64.10M | 63.10M |

| EBITDA | 18.20B | 12.35B | 17.53B | 17.12B | 16.40B | 6.74B | 11.81B | 12.19B | 11.57B | 10.22B | 9.92B | 8.62B | 7.90B | 7.61B | 7.82B | 7.34B | 5.89B | 3.17B | 2.61B | 1.95B | 1.77B | 1.52B | 1.44B | 1.62B | 1.41B | 1.18B | 946.70M | 867.50M | 723.90M | 817.00M | 814.90M | 561.90M | 808.10M | 778.60M | 758.70M | 671.80M | 595.60M | 547.60M | 512.10M |

| EBITDA Ratio | 5.08% | 6.21% | 6.74% | 6.91% | 6.42% | 6.63% | 6.49% | 7.58% | 7.53% | 7.71% | 7.82% | 7.58% | 7.37% | 7.92% | 7.93% | 8.37% | 7.71% | 7.25% | 7.05% | 6.38% | 2.57% | 6.27% | 8.08% | 8.06% | 7.81% | 8.76% | 10.30% | 5.54% | 14.02% | 7.23% | 7.79% | 5.37% | 8.17% | 9.07% | 10.15% | 9.98% | 10.11% | 10.47% | 10.74% |

| Operating Income | 13.74B | 7.95B | 13.31B | 13.91B | 11.99B | 4.02B | 9.54B | 10.39B | 9.48B | 8.80B | 8.04B | 7.21B | 6.33B | 6.14B | 6.43B | 6.05B | 4.79B | 2.44B | 2.02B | 1.45B | 1.42B | 1.21B | 770.60M | 1.32B | 1.14B | 930.50M | 704.10M | 604.70M | 396.20M | 610.70M | 623.30M | 360.90M | 669.60M | 664.20M | 660.90M | 589.60M | 523.60M | 483.50M | 449.00M |

| Operating Income Ratio | 3.84% | 4.89% | 4.52% | 5.18% | 4.67% | 2.07% | 5.15% | 5.82% | 6.17% | 6.31% | 6.34% | 5.87% | 5.91% | 6.39% | 6.52% | 6.91% | 6.28% | 5.57% | 5.46% | 4.75% | 1.29% | 4.99% | 3.46% | 6.58% | 6.27% | 6.09% | 5.04% | 5.42% | 2.00% | 5.41% | 5.97% | 3.46% | 6.77% | 7.65% | 8.75% | 8.70% | 8.83% | 9.19% | 9.40% |

| Total Other Income/Expenses | -2.57B | -2.12B | -2.77B | -4.14B | -2.99B | -2.62B | -1.27B | -1.75B | -859.00M | -1.12B | -509.00M | -905.00M | -584.00M | -536.00M | -525.00M | -509.00M | -434.60M | -215.80M | -110.50M | -58.30M | -48.10M | -50.40M | -61.00M | -79.30M | -59.10M | -239.50M | -466.50M | 38.70M | -280.00M | -84.50M | -71.10M | -79.20M | -80.00M | -76.90M | -54.80M | -47.10M | -47.50M | -51.30M | -57.80M |

| Income Before Tax | 11.17B | 5.84B | 10.54B | 9.77B | 9.00B | 1.41B | 8.27B | 8.64B | 8.62B | 7.68B | 7.53B | 6.31B | 5.75B | 5.60B | 5.90B | 5.54B | 4.36B | 2.23B | 1.91B | 1.40B | 1.38B | 1.16B | 709.60M | 1.24B | 1.08B | 691.00M | 237.60M | 643.40M | 116.20M | 526.20M | 552.20M | 281.70M | 589.60M | 587.30M | 606.10M | 542.50M | 476.10M | 432.20M | 391.20M |

| Income Before Tax Ratio | 3.12% | 1.81% | 3.57% | 3.64% | 3.50% | 0.72% | 4.47% | 4.87% | 5.62% | 5.51% | 5.94% | 5.14% | 5.37% | 5.84% | 5.99% | 6.33% | 5.71% | 5.08% | 5.16% | 4.56% | 5.17% | 4.78% | 3.19% | 6.19% | 5.95% | 4.66% | 1.22% | 7.30% | -8.23% | 4.66% | 5.29% | 2.70% | 5.96% | 6.76% | 8.02% | 8.00% | 8.03% | 8.21% | 8.19% |

| Income Tax Expense | 2.81B | 1.51B | 2.55B | 2.57B | 2.37B | 2.00B | 1.64B | 3.32B | 3.39B | 3.03B | 2.93B | 2.44B | 2.26B | 2.18B | 2.20B | 2.19B | 1.72B | 856.90M | 684.30M | 477.60M | 528.20M | 439.20M | 296.40M | 497.40M | 441.30M | 306.50M | 149.20M | 271.00M | 58.40M | 218.70M | 220.40M | 125.70M | 242.90M | 202.00M | 208.00M | 188.00M | 190.70M | 193.90M | 171.40M |

| Net Income | 8.34B | 4.31B | 8.00B | 7.18B | 6.63B | -594.00M | 6.62B | 5.32B | 5.24B | 4.64B | 4.59B | 3.86B | 3.46B | 3.43B | 3.70B | 3.21B | 2.64B | 1.37B | 1.22B | 918.80M | 847.30M | 716.60M | 413.20M | 746.00M | 635.10M | 384.50M | 88.80M | 208.20M | -572.80M | 307.50M | 331.80M | 133.40M | 346.70M | 385.30M | 398.10M | 354.50M | 285.40M | 238.30M | 210.20M |

| Net Income Ratio | 2.33% | 1.34% | 2.74% | 2.67% | 2.58% | -0.31% | 3.58% | 3.00% | 3.42% | 3.33% | 3.62% | 3.15% | 3.23% | 3.55% | 3.74% | 3.67% | 3.45% | 3.12% | 3.31% | 3.00% | 3.19% | 2.96% | 1.86% | 3.71% | 3.51% | 2.60% | 0.30% | 1.36% | -6.78% | 2.72% | 3.18% | 1.28% | 3.51% | 4.44% | 5.27% | 5.23% | 4.81% | 4.53% | 4.40% |

| EPS | 6.49 | 3.29 | 6.00 | 5.48 | 5.10 | -0.57 | 6.47 | 4.93 | 4.66 | 3.98 | 3.77 | 3.05 | 2.59 | 2.51 | 2.58 | 2.23 | 1.97 | 1.65 | 1.49 | 1.13 | 1.06 | 0.90 | 0.51 | 0.94 | 0.80 | 0.48 | 0.10 | 0.27 | -1.52 | 0.69 | 0.60 | 0.28 | 0.80 | 0.90 | 0.89 | 0.41 | 0.66 | 0.55 | 0.49 |

| EPS Diluted | 6.47 | 3.26 | 5.95 | 5.46 | 5.08 | -0.57 | 6.44 | 4.90 | 4.63 | 3.96 | 3.74 | 3.03 | 2.57 | 2.49 | 2.55 | 2.18 | 1.92 | 1.60 | 1.45 | 1.10 | 1.03 | 0.88 | 0.50 | 0.92 | 0.78 | 0.48 | 0.10 | 0.26 | -1.52 | 0.69 | 0.60 | 0.28 | 0.80 | 0.90 | 0.89 | 0.41 | 0.66 | 0.55 | 0.49 |

| Weighted Avg Shares Out | 1.29B | 1.31B | 1.32B | 1.31B | 1.30B | 1.04B | 1.02B | 1.07B | 1.12B | 1.16B | 1.22B | 1.27B | 1.34B | 1.37B | 1.43B | 1.43B | 1.33B | 820.60M | 811.40M | 800.53M | 785.57M | 784.60M | 781.37M | 782.25M | 782.60M | 774.20M | 751.00M | 426.40M | 432.00M | 422.55M | 525.00M | 420.36M | 413.63M | 410.44M | 430.67M | 435.81M | 432.27M | 433.09M | 433.20M |

| Weighted Avg Shares Out (Dil) | 1.29B | 1.32B | 1.33B | 1.31B | 1.31B | 1.04B | 1.02B | 1.08B | 1.13B | 1.17B | 1.23B | 1.28B | 1.35B | 1.38B | 1.45B | 1.47B | 1.37B | 853.20M | 841.60M | 822.36M | 808.45M | 810.60M | 797.00M | 799.34M | 817.80M | 810.40M | 790.53M | 426.40M | 432.00M | 422.55M | 529.41M | 420.36M | 413.63M | 410.44M | 430.67M | 435.81M | 432.27M | 433.09M | 433.20M |

And the Winner Isn't—Behold Intel, CVS, and More of the Ugliest Turnaround Attempts of 2024

Cramer's Stop Trading: CVS Health

Analyst: "Buy" Underperforming CVS Health Stock

CVS Health announces Pharmacy and Consumer Wellness leadership appointments

Deutsche upgrades CVS to Buy with earnings, valuation at trough

CVS Health Corporation Announces Cash Tender Offers for Certain of its and Aetna's Outstanding Notes

Is CVS Health Stock a Buy?

Here is What to Know Beyond Why CVS Health Corporation (CVS) is a Trending Stock

3 Key Analyst Upgrades: Why These Stocks Are Getting a Boost

Billionaire Israel Englander Bought This High-Yield Dividend Stock Hand Over Fist in Q3. Should You Buy It Too?

Source: https://incomestatements.info

Category: Stock Reports