See more : M LAKHAMSI INDUSTRIES LIMITED (MLINDLTD.BO) Income Statement Analysis – Financial Results

Complete financial analysis of Cvent Holding Corp. (CVT) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Cvent Holding Corp., a leading company in the Software – Application industry within the Technology sector.

- Synvista Therapeutics, Inc. (SYNI) Income Statement Analysis – Financial Results

- BlueBet Holdings Ltd (BBT.AX) Income Statement Analysis – Financial Results

- ASM International NV (ASM.AS) Income Statement Analysis – Financial Results

- Blue Chip India Limited (BLUECHIP.NS) Income Statement Analysis – Financial Results

- SA Catana Group (CATG.PA) Income Statement Analysis – Financial Results

Cvent Holding Corp. (CVT)

About Cvent Holding Corp.

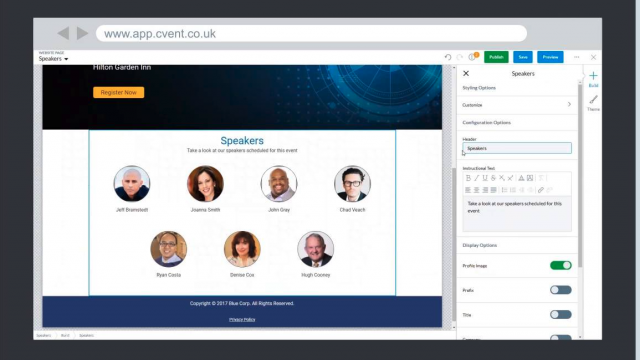

Cvent Holding Corp. provides a cloud-based enterprise event marketing, management, and hospitality platform for meetings and events value ecosystem in North America and internationally. The company's Event Cloud solutions consists of event marketing and management services that enables marketers and planners to maximize engagement and ROI from their virtual in-person or hybrid events. Its Hospitality Cloud solutions provides hotels, venues, and destinations with online marketing solutions for marketing their events business to planners; and software solutions that automate the events sales cycle and enhancing collaboration with planners to design and manage events. In addition, company provides hospitality cloud online marketing solutions, which enables suppliers to advertise and market on venue sourcing networks, including CSN, Cvent SpeedRFP, and Cvent Wedding Spot; hospitality cloud software solutions, such as hotels, destinations, and venues software solutions to automate and enhance how they sell and execute events; and network effect. The company sells its platform primarily through a direct inside sales team. Cvent Holding Corp. was founded in 1999 and is headquartered in Tysons, Virginia.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|

| Revenue | 630.56M | 518.81M | 498.70M | 567.60M | 480.02M |

| Cost of Revenue | 247.85M | 191.45M | 176.25M | 211.86M | 165.18M |

| Gross Profit | 382.70M | 327.36M | 322.45M | 355.75M | 314.83M |

| Gross Profit Ratio | 60.69% | 63.10% | 64.66% | 62.68% | 65.59% |

| Research & Development | 130.62M | 96.63M | 87.87M | 96.01M | 78.45M |

| General & Administrative | 102.54M | 88.21M | 80.56M | 92.02M | 76.16M |

| Selling & Marketing | 176.96M | 135.62M | 128.39M | 155.80M | 126.53M |

| SG&A | 279.50M | 223.82M | 208.95M | 247.82M | 202.69M |

| Other Expenses | 48.64M | 51.48M | 53.84M | 57.69M | 60.49M |

| Operating Expenses | 458.76M | 371.93M | 350.66M | 401.52M | 341.63M |

| Cost & Expenses | 706.61M | 563.38M | 526.91M | 613.37M | 506.81M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 9.87M | 29.07M | 35.56M | 47.88M | 45.96M |

| Depreciation & Amortization | 130.11M | 132.71M | 138.10M | 129.12M | 108.57M |

| EBITDA | 54.30M | 89.91M | 107.43M | 79.22M | 80.39M |

| EBITDA Ratio | 8.61% | 17.33% | 21.54% | 13.96% | 16.75% |

| Operating Income | -75.81M | -42.80M | -30.68M | -49.90M | -26.79M |

| Operating Income Ratio | -12.02% | -8.25% | -6.15% | -8.79% | -5.58% |

| Total Other Income/Expenses | -12.84M | -34.47M | -47.66M | -52.01M | -47.35M |

| Income Before Tax | -88.90M | -79.04M | -75.87M | -97.77M | -74.15M |

| Income Before Tax Ratio | -14.10% | -15.23% | -15.21% | -17.23% | -15.45% |

| Income Tax Expense | 11.37M | 7.04M | 7.87M | -6.01M | -20.11M |

| Net Income | -100.27M | -86.08M | -83.73M | -91.76M | -54.04M |

| Net Income Ratio | -15.90% | -16.59% | -16.79% | -16.17% | -11.26% |

| EPS | -0.21 | -0.20 | -0.17 | -0.19 | -0.11 |

| EPS Diluted | -0.21 | -0.20 | -0.17 | -0.19 | -0.11 |

| Weighted Avg Shares Out | 483.05M | 420.69M | 481.12M | 481.12M | 481.12M |

| Weighted Avg Shares Out (Dil) | 483.05M | 420.69M | 481.12M | 481.12M | 481.12M |

MERGER ALERT (CVT) - Andrews & Springer LLC Is Seeking More Cash for Shareholders of Cvent Holding Corp.

SHAREHOLDER ALERT: Weiss Law Investigates Cvent Holding Corp.

CVENT HOLDING INVESTOR ALERT by the Former Attorney General of Louisiana: Kahn Swick & Foti, LLC Investigates Adequacy of Price and Process in Proposed Sale of Cvent Holding Corp. - CVT

SHAREHOLDER ALERT: Levi & Korsinsky, LLP Notifies Investors of an Investigation into the Fairness of the Acquisition of Cvent Holding Corp. by Blackstone Inc.

INVESTOR ACTION NOTICE: The Schall Law Firm Announces it is Investigating Claims Against Cvent Holding Corp. and Encourages Investors with Losses to Contact the Firm

Cvent To Be Acquired By Blackstone For $4.6 Billion (CVT)

INVESTIGATION ALERT: The Schall Law Firm Announces it is Investigating Claims Against Cvent Holding Corp. and Encourages Investors with Losses to Contact the Firm

INVESTIGATION ALERT: The Schall Law Firm Announces it is Investigating Claims Against Cvent Holding Corp. and Encourages Investors with Losses to Contact the Firm

Cvent to go private again in $4.6B Blackstone deal

Shareholder Alert: Ademi LLP investigates whether Cvent Holding Corp. has obtained a Fair Price in its transaction with Blackstone

Source: https://incomestatements.info

Category: Stock Reports