See more : SOL S.p.A. (SOL.MI) Income Statement Analysis – Financial Results

Complete financial analysis of Citizens & Northern Corporation (CZNC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Citizens & Northern Corporation, a leading company in the Banks – Regional industry within the Financial Services sector.

- Caixa Seguridade Participações S.A. (CXSE3.SA) Income Statement Analysis – Financial Results

- Task Group Holdings Limited (TSK.AX) Income Statement Analysis – Financial Results

- ITE (Holdings) Limited (8092.HK) Income Statement Analysis – Financial Results

- Cominar Real Estate Investment Trust (CUF-UN.TO) Income Statement Analysis – Financial Results

- Charmt, Inc. (CHMT) Income Statement Analysis – Financial Results

Citizens & Northern Corporation (CZNC)

About Citizens & Northern Corporation

Citizens & Northern Corporation operates as the bank holding company for Citizens & Northern Bank that provides a range of banking and mortgage services to individual and corporate customers. The company offers lending products include commercial, mortgage, and consumer loans, as well as specialized instruments, such as commercial letters-of-credit; and deposit products, including various types of checking accounts, passbook and statement savings accounts, money market accounts, interest checking accounts, individual retirement accounts, and certificates of deposits. It also offers wealth management services, including administration of trusts and estates, retirement plans, and other employee benefit plans, and investment management services; and a range of personal and commercial insurance products; mutual funds, annuities, educational savings accounts, and other investment products through registered agents. In addition, the company reinsures credit and mortgage, life and accident, and health insurance products. As of December 31, 2021, it had 31 branch offices, including 23 in the Northern tier/Northcentral region of Pennsylvania, 2 in the Southern tier of New York State, 4 in Southeastern Pennsylvania, and 2 in Southcentral Pennsylvania, as well as a lending office in Elmira, New York. The company was founded in 1864 and is based in Wellsboro, Pennsylvania.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 104.63M | 105.96M | 103.82M | 90.85M | 72.69M | 66.02M | 57.07M | 55.94M | 58.18M | 57.41M | 61.32M | 66.60M | 49.92M | 57.62M | 56.19M | 46.73M | 46.88M | 47.04M | 46.77M | 45.12M | 43.08M | 40.48M | 34.35M | 27.88M | 33.33M | 31.80M | 5.01M | 4.02M | 5.21M | 3.40M |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 988.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 104.63M | 105.96M | 103.82M | 90.85M | 72.69M | 65.03M | 57.07M | 55.94M | 58.18M | 57.41M | 61.32M | 66.60M | 49.92M | 57.62M | 56.19M | 46.73M | 46.88M | 47.04M | 46.77M | 45.12M | 43.08M | 40.48M | 34.35M | 27.88M | 33.33M | 31.80M | 5.01M | 4.02M | 5.21M | 3.40M |

| Gross Profit Ratio | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 98.50% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 10.08M | 41.83M | 48.49M | 39.11M | 31.30M | 26.65M | 21.56M | 20.62M | 20.58M | 21.27M | 19.80M | 19.50M | 20.41M | 18.13M | 17.97M | 18.76M | 18.51M | 17.98M | 16.14M | 14.65M | 13.01M | 12.07M | 10.71M | 9.54M | 8.76M | 8.40M | 7.67M | 7.60M | 7.00M | 6.62M |

| Selling & Marketing | 49.55M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 59.63M | 41.83M | 48.49M | 39.11M | 31.30M | 26.65M | 21.56M | 20.62M | 20.58M | 21.27M | 19.80M | 19.50M | 20.41M | 18.13M | 17.97M | 18.76M | 18.51M | 17.98M | 16.14M | 14.65M | 13.01M | 12.07M | 10.71M | 9.54M | 8.76M | 8.40M | 7.67M | 7.60M | 7.00M | 6.62M |

| Other Expenses | 0.00 | -18.29M | -114.62M | -106.74M | -80.58M | -60.80M | -10.28M | -9.27M | 0.00 | 0.00 | 0.00 | -84.13M | -68.33M | 433.00K | 83.84M | -62.37M | -62.81M | -63.05M | -21.44M | -19.45M | -12.69M | -7.54M | -1.62M | 3.03M | -2.68M | -2.90M | 23.91M | 24.24M | 22.63M | 20.61M |

| Operating Expenses | 59.63M | 2.01M | -66.13M | -67.64M | -49.28M | -34.14M | 1.09M | 1.13M | 538.00K | 699.00K | 1.53M | -64.63M | -47.92M | 18.56M | 101.81M | -43.61M | -44.31M | -45.06M | -5.30M | -4.80M | 323.00K | 4.53M | 9.09M | 12.56M | 6.08M | 5.50M | 31.58M | 31.83M | 29.63M | 27.24M |

| Cost & Expenses | 59.63M | 2.01M | -66.13M | -67.64M | -49.28M | -34.14M | 1.09M | 1.13M | 538.00K | 699.00K | 1.53M | -64.63M | -47.92M | 18.56M | 101.81M | -43.61M | -44.31M | -45.06M | -5.30M | -4.80M | 323.00K | 4.53M | 9.09M | 12.56M | 6.08M | 5.50M | 31.58M | 31.83M | 29.63M | 27.24M |

| Interest Income | 113.50M | 92.65M | 84.50M | 77.16M | 64.77M | 50.33M | 45.86M | 44.10M | 44.52M | 46.01M | 48.91M | 56.63M | 61.26M | 62.11M | 67.38M | 74.24M | 70.22M | 64.46M | 61.11M | 57.92M | 55.22M | 57.29M | 55.14M | 52.16M | 48.42M | 48.40M | 48.27M | 47.92M | 45.18M | 42.31M |

| Interest Expense | 33.10M | 9.52M | 6.56M | 9.60M | 10.28M | 4.63M | 3.92M | 3.69M | 4.60M | 5.12M | 5.77M | 9.03M | 13.56M | 19.25M | 24.46M | 31.05M | 33.91M | 30.77M | 25.69M | 22.61M | 23.54M | 26.32M | 28.36M | 30.15M | 24.57M | 22.70M | 23.31M | 23.45M | 24.48M | 20.81M |

| Depreciation & Amortization | 0.00 | 2.83M | 2.67M | 2.52M | 1.97M | 1.76M | 1.64M | 1.60M | 1.91M | 1.98M | 2.23M | 2.11M | 2.19M | 2.53M | 3.14M | 3.44M | 3.29M | 2.78M | 2.48M | 1.67M | 1.31M | 1.05M | 1.32M | -1.41M | -866.00K | 400.00K | 723.00K | 764.00K | 735.00K | 627.00K |

| EBITDA | 0.00 | 34.74M | 39.82M | 25.19M | 25.16M | 28.02M | 22.23M | 22.52M | 23.54M | 24.59M | 26.63M | 0.00 | 34.24M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 27.10M | 28.91M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA Ratio | 0.00% | 41.77% | 38.35% | 27.73% | 34.61% | 49.44% | 45.81% | 47.20% | 48.67% | 52.04% | 53.44% | 63.47% | 95.82% | 80.93% | -61.21% | 100.28% | 107.23% | 102.68% | 93.96% | 93.08% | 103.80% | 113.77% | 130.30% | 140.03% | 115.64% | 118.55% | 745.41% | 910.29% | 683.01% | 919.56% |

| Operating Income | 45.00M | 41.87M | 37.69M | 23.21M | 23.41M | 30.89M | 1.28M | 1.69M | 1.58M | 1.26M | 1.82M | 1.97M | 2.00M | 4.29M | 3.03M | 3.13M | 2.57M | 1.98M | 41.46M | 40.32M | 43.40M | 45.01M | 43.43M | 40.44M | 39.41M | 37.30M | 36.59M | 35.86M | 34.84M | 30.64M |

| Operating Income Ratio | 43.01% | 39.51% | 36.30% | 25.55% | 32.20% | 46.79% | 2.23% | 3.02% | 2.71% | 2.20% | 2.97% | 2.95% | 4.00% | 7.45% | 5.39% | 6.69% | 5.49% | 4.22% | 88.66% | 89.37% | 100.75% | 111.18% | 126.45% | 145.07% | 118.24% | 117.30% | 730.97% | 891.30% | 668.89% | 901.12% |

| Total Other Income/Expenses | -14.52M | -11.78M | -11.74M | -20.42M | -13.25M | -7.73M | -7.60M | -8.44M | -10.55M | -8.30M | -9.35M | -2.97M | -844.00K | -269.00K | -65.02M | -9.34M | 10.50M | 12.78M | -25.69M | -22.61M | -23.54M | -26.32M | -28.36M | -30.15M | -24.57M | -22.70M | -23.31M | -23.45M | -24.48M | -20.81M |

| Income Before Tax | 30.48M | 32.35M | 37.69M | 23.21M | 23.41M | 26.26M | 20.59M | 21.11M | 21.81M | 22.78M | 24.78M | 31.13M | 32.08M | 24.86M | -61.99M | 12.38M | 13.07M | 14.76M | 15.78M | 17.71M | 19.87M | 18.69M | 15.07M | 10.30M | 14.84M | 14.60M | 13.27M | 12.41M | 10.36M | 9.83M |

| Income Before Tax Ratio | 29.13% | 30.53% | 36.30% | 25.55% | 32.20% | 39.78% | 36.08% | 37.74% | 37.48% | 39.68% | 40.41% | 46.74% | 64.27% | 43.14% | -110.32% | 26.49% | 27.87% | 31.37% | 33.74% | 39.26% | 46.11% | 46.18% | 43.89% | 36.93% | 44.52% | 45.91% | 265.19% | 308.38% | 198.91% | 289.21% |

| Income Tax Expense | 6.34M | 5.73M | 7.13M | 3.99M | 3.91M | 4.25M | 7.16M | 5.35M | 5.34M | 5.69M | 6.18M | 8.43M | 8.71M | 5.80M | -22.66M | 2.32M | 2.64M | 2.77M | 2.79M | 2.85M | 3.61M | 3.73M | 3.02M | 1.82M | 3.35M | 3.50M | 3.17M | 3.15M | 2.49M | 2.34M |

| Net Income | 24.15M | 26.62M | 30.55M | 19.22M | 19.50M | 22.01M | 13.43M | 15.76M | 16.47M | 17.09M | 18.59M | 22.71M | 23.37M | 19.06M | -39.34M | 10.06M | 10.42M | 11.99M | 12.98M | 14.86M | 16.26M | 14.96M | 12.05M | 8.48M | 11.49M | 11.10M | 10.11M | 9.26M | 7.87M | 7.49M |

| Net Income Ratio | 23.08% | 25.12% | 29.43% | 21.16% | 26.83% | 33.34% | 23.54% | 28.18% | 28.31% | 29.76% | 30.32% | 34.09% | 46.81% | 33.07% | -70.00% | 21.52% | 22.24% | 25.48% | 27.76% | 32.94% | 37.74% | 36.95% | 35.09% | 30.40% | 34.46% | 34.91% | 201.94% | 230.05% | 151.04% | 220.41% |

| EPS | 1.57 | 1.71 | 1.92 | 1.30 | 1.46 | 1.80 | 1.10 | 1.30 | 1.35 | 1.38 | 1.51 | 1.86 | 1.92 | 1.45 | -4.24 | 1.12 | 1.19 | 1.41 | 1.52 | 1.75 | 1.93 | 1.78 | 1.40 | 0.99 | 1.36 | 1.30 | 1.19 | 1.09 | 0.93 | 0.88 |

| EPS Diluted | 1.57 | 1.71 | 1.92 | 1.30 | 1.46 | 1.80 | 1.10 | 1.30 | 1.35 | 1.38 | 1.50 | 1.85 | 1.92 | 1.45 | -4.24 | 1.12 | 1.19 | 1.41 | 1.51 | 1.74 | 1.92 | 1.77 | 1.40 | 0.99 | 1.35 | 1.29 | 1.19 | 1.09 | 0.93 | 0.88 |

| Weighted Avg Shares Out | 15.24M | 15.46M | 15.77M | 14.74M | 13.30M | 12.23M | 12.12M | 12.03M | 12.15M | 12.39M | 12.35M | 12.24M | 12.16M | 12.13M | 9.27M | 8.96M | 8.76M | 8.53M | 8.55M | 8.51M | 8.42M | 8.42M | 8.61M | 8.52M | 8.44M | 8.53M | 8.46M | 8.46M | 8.47M | 8.47M |

| Weighted Avg Shares Out (Dil) | 15.24M | 15.46M | 15.77M | 14.75M | 13.32M | 12.26M | 12.14M | 12.06M | 12.17M | 12.41M | 12.38M | 12.26M | 12.17M | 12.13M | 9.27M | 8.98M | 8.76M | 8.53M | 8.60M | 8.55M | 8.46M | 8.45M | 8.61M | 8.52M | 8.48M | 8.57M | 8.50M | 8.46M | 8.47M | 8.47M |

9,121 Shares in iShares JP Morgan USD Emerging Markets Bond ETF (NASDAQ:EMB) Bought by Banco Bilbao Vizcaya Argentaria S.A.

Great West Life Assurance Co. Can Has $20.92 Million Stake in iShares Nasdaq Biotechnology ETF (NASDAQ:IBB)

Bert's February Dividend Income Summary

iShares JP Morgan USD Emerging Markets Bond ETF (NASDAQ:EMB) Shares Acquired by Archetype Wealth Partners LLC

Lanny's February Dividend Income Summary - Dividend Diplomats

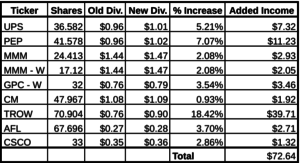

Expected Dividend Increases in February 2019 - Dividend Diplomats

Lanny's Stock Purchases - August 13th through September 9th - Dividend Diplomats

Lanny's Q2 Dividend Portfolio Update - Dividend Diplomats

Lanny's Recent & Accidental Stock Purchase - Citizens & Northern (CZNC) - Dividend Diplomats

Source: https://incomestatements.info

Category: Stock Reports