See more : ISMT Limited (ISMTLTD.BO) Income Statement Analysis – Financial Results

Complete financial analysis of Decarbonization Plus Acquisition Corporation II (DCRNU) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Decarbonization Plus Acquisition Corporation II, a leading company in the Shell Companies industry within the Financial Services sector.

- Teligent, Inc. (TLGT) Income Statement Analysis – Financial Results

- Hamai Industries Ltd. (6497.T) Income Statement Analysis – Financial Results

- Omega Healthcare Investors, Inc. (0KBL.L) Income Statement Analysis – Financial Results

- EMP Metals Corp. (EMPPF) Income Statement Analysis – Financial Results

- Chuang’s Consortium International Limited (0367.HK) Income Statement Analysis – Financial Results

Decarbonization Plus Acquisition Corporation II (DCRNU)

Industry: Shell Companies

Sector: Financial Services

Website: https://dcrbplus.com/investor-relations/dcrb-ii/default.aspx

About Decarbonization Plus Acquisition Corporation II

As of January 13, 2022, Decarbonization Plus Acquisition Corporation II was acquired by Tritium Pty Ltd., in a reverse merger transaction. Decarbonization Plus Acquisition Corporation II is a blank check company. It intends to effect a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or similar business combination with a target whose principal effort is developing and advancing a platform that decarbonizes the most carbon-intensive sectors. The company was incorporated in 2020 and is based in Menlo Park, California.

| Metric | 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|---|

| Revenue | 184.54M | 85.82M | 56.16M | 46.97M |

| Cost of Revenue | 188.63M | 89.10M | 60.37M | 49.25M |

| Gross Profit | -4.08M | -3.28M | -4.22M | -2.28M |

| Gross Profit Ratio | -2.21% | -3.82% | -7.51% | -4.86% |

| Research & Development | 15.47M | 14.03M | 10.52M | 9.55M |

| General & Administrative | 70.80M | 72.10M | 28.60M | 21.78M |

| Selling & Marketing | 1.13M | 449.00K | 188.00K | 304.00K |

| SG&A | 71.93M | 72.74M | 29.31M | 22.31M |

| Other Expenses | 0.00 | 36.00K | 171.00K | 3.00K |

| Operating Expenses | 93.82M | 86.77M | 39.83M | 31.85M |

| Cost & Expenses | 283.66M | 175.87M | 100.21M | 81.11M |

| Interest Income | 147.00K | 7.00K | 12.00K | 18.00K |

| Interest Expense | 35.05M | 17.14M | 8.59M | 1.51M |

| Depreciation & Amortization | 2.43M | 2.20M | 2.31M | 1.31M |

| EBITDA | -83.89M | -108.57M | -51.97M | -31.63M |

| EBITDA Ratio | -45.46% | -102.37% | -74.32% | -69.89% |

| Operating Income | -99.12M | -90.05M | -44.05M | -34.14M |

| Operating Income Ratio | -53.71% | -104.93% | -78.44% | -72.68% |

| Total Other Income/Expenses | -22.25M | -38.85M | -19.03M | -307.00K |

| Income Before Tax | -121.37M | -128.90M | -63.08M | -34.44M |

| Income Before Tax Ratio | -65.77% | -150.20% | -112.33% | -73.33% |

| Income Tax Expense | 0.00 | 20.00K | 11.00K | 0.00 |

| Net Income | -121.37M | -128.92M | -63.09M | -34.44M |

| Net Income Ratio | -65.77% | -150.22% | -112.35% | -73.33% |

| EPS | -156.20 | -203.32 | -116.87 | -63.80 |

| EPS Diluted | -156.20 | -203.32 | -116.87 | -63.80 |

| Weighted Avg Shares Out | 777.00K | 634.07K | 539.84K | 539.84K |

| Weighted Avg Shares Out (Dil) | 777.01K | 634.07K | 539.84K | 539.84K |

Over 100 New Tritium Fast Chargers Added to the Osprey Charging Network in the United Kingdom

Tritium Wins Shell Global EV Charging Tender

Tritium Unveils Groundbreaking Line of EV Fast Chargers Designed for More Cost-Effective Operations and Infrastructure Deployment

Tritium Announces Debt Refinancing with a New $90 Million Facility

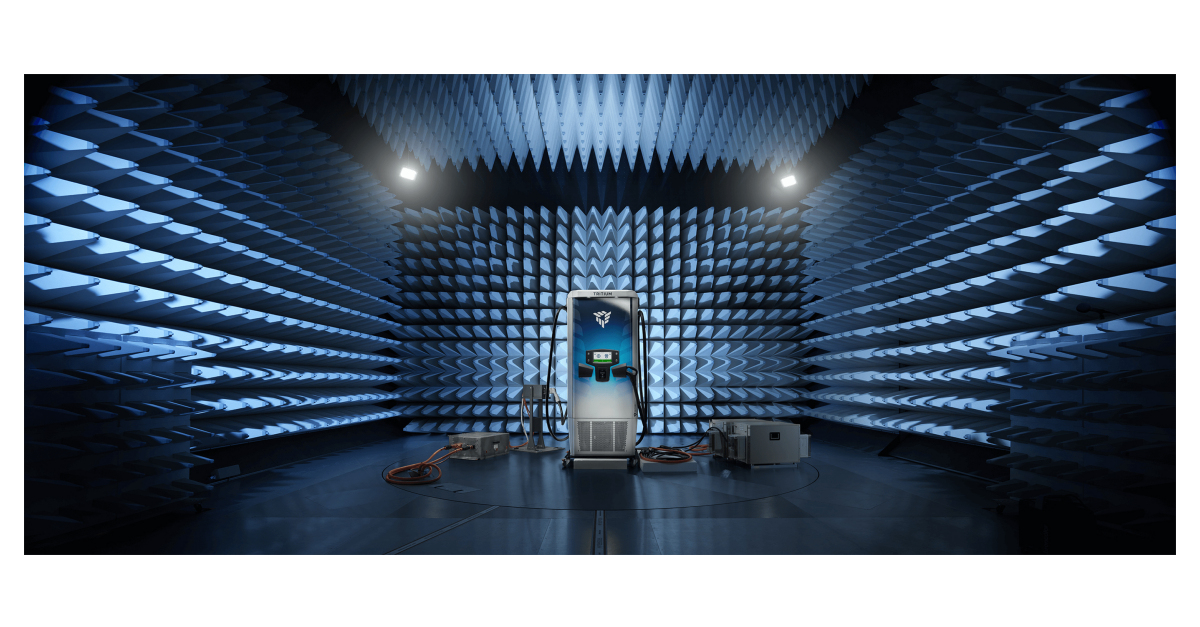

Tritium Opens World-Class EV Charger Testing Facility

Tritium Collaborates With Fast Charging Network Operator EVCS to Deploy Over 500 New EV Fast Chargers

Tritium Named “Chargepoint Manufacturer of the Year”

Tritium Wins Good Design Awards for Excellence in Product and Engineering Design

Tritium Announces AUD$40 million Private Placement Financing by Cigna Investments, Inc.

Decarbonization Plus Acquisition Corporation II Announces the Separate Trading of its Class A Common Stock and Warrants, Commencing March 29, 2021

Source: https://incomestatements.info

Category: Stock Reports