See more : Anhui Heli Co.,Ltd. (600761.SS) Income Statement Analysis – Financial Results

Complete financial analysis of DiDi Global Inc. (DIDIY) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of DiDi Global Inc., a leading company in the Software – Application industry within the Technology sector.

- Cymat Technologies Ltd. (CYM.V) Income Statement Analysis – Financial Results

- Inner Mongolia Yitai Coal Co., Ltd. (3948.HK) Income Statement Analysis – Financial Results

- Danske Invest Danmark Akk (DKIDKA.CO) Income Statement Analysis – Financial Results

- Diamond Offshore Drilling, Inc. (DO) Income Statement Analysis – Financial Results

- Phoenix Apps Inc. (PXPP) Income Statement Analysis – Financial Results

DiDi Global Inc. (DIDIY)

About DiDi Global Inc.

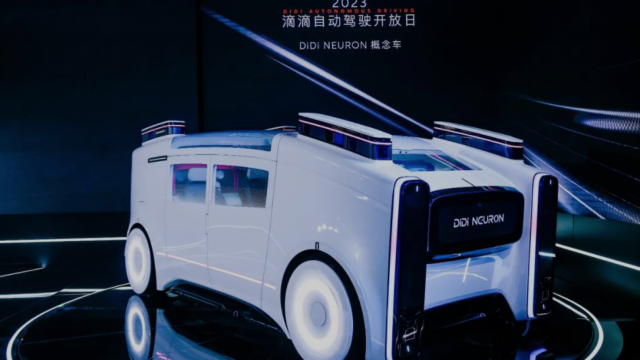

DiDi Global Inc. operates a mobility technology platform that provides ride hailing and other services in the People's Republic of China, Brazil, Mexico, and internationally. It offers ride hailing, taxi hailing, chauffeur, hitch, and other forms of shared mobility services; auto solutions comprising leasing, refueling, and maintenance and repair services; electric vehicle leasing services; and bike and e-bike sharing, intra-city freight, food delivery, and financial services. The company was formerly known as Xiaoju Kuaizhi Inc. and changed its name to DiDi Global Inc. in June 2021. DiDi Global Inc. was founded in 2012 and is headquartered in Beijing, China.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|

| Revenue | 192.38B | 140.79B | 173.83B | 141.74B | 154.79B | 135.29B |

| Cost of Revenue | 170.35B | 115.80B | 156.86B | 125.82B | 139.66B | 127.84B |

| Gross Profit | 22.03B | 24.99B | 16.96B | 15.91B | 15.12B | 7.45B |

| Gross Profit Ratio | 11.45% | 17.75% | 9.76% | 11.23% | 9.77% | 5.50% |

| Research & Development | 8.92B | 9.54B | 9.42B | 6.32B | 5.35B | 4.38B |

| General & Administrative | 8.41B | 17.00B | 28.72B | 7.55B | 6.21B | 4.24B |

| Selling & Marketing | 10.43B | 9.76B | 16.96B | 11.14B | 7.49B | 7.60B |

| SG&A | 18.84B | 26.76B | 45.68B | 18.69B | 13.71B | 11.85B |

| Other Expenses | 0.00 | 6.52B | 7.53B | 4.70B | 4.08B | -338.18M |

| Operating Expenses | 27.77B | 42.82B | 62.62B | 29.70B | 23.13B | 19.89B |

| Cost & Expenses | 198.12B | 158.62B | 219.48B | 155.52B | 162.80B | 147.73B |

| Interest Income | 2.17B | 1.31B | 819.00M | 1.23B | 1.36B | 1.46B |

| Interest Expense | 115.58M | 197.33M | 278.00M | 136.35M | 70.32M | 44.10M |

| Depreciation & Amortization | 4.25B | 5.14B | 6.05B | 5.27B | 4.01B | 2.78B |

| EBITDA | 4.99B | -18.44B | -39.61B | -7.32B | -6.00B | -12.66B |

| EBITDA Ratio | 2.59% | -8.98% | -26.43% | -5.16% | -2.63% | -6.88% |

| Operating Income | -5.74B | -17.82B | -45.65B | -13.79B | -8.01B | -12.44B |

| Operating Income Ratio | -2.98% | -12.66% | -26.26% | -9.73% | -5.18% | -9.20% |

| Total Other Income/Expenses | 6.37B | -5.95B | -726.51M | 2.88B | -2.07B | -3.05B |

| Income Before Tax | 624.81M | -23.78B | -49.17B | -10.91B | -10.08B | -15.49B |

| Income Before Tax Ratio | 0.32% | -16.89% | -28.29% | -7.70% | -6.51% | -11.45% |

| Income Tax Expense | 89.75M | 3.92M | 166.00M | -303.20M | -348.01M | -513.92M |

| Net Income | 493.51M | -23.78B | -49.33B | -10.61B | -9.73B | -14.98B |

| Net Income Ratio | 0.26% | -16.89% | -28.38% | -7.48% | -6.29% | -11.07% |

| EPS | -0.10 | -4.91 | -18.75 | -23.13 | -21.22 | -3.60 |

| EPS Diluted | -0.10 | -4.91 | -18.74 | -23.13 | -21.22 | -3.60 |

| Weighted Avg Shares Out | 4.81B | 4.84B | 2.63B | 458.69M | 458.69M | 4.16B |

| Weighted Avg Shares Out (Dil) | 4.90B | 4.84B | 2.63B | 458.69M | 458.69M | 4.16B |

3 Hidden Penny Stocks Ready to Explode Next Month

China's Didi, GAC Aion to mass produce robotaxis next year

DiDi Global: It's Not Too Late To Jump On Board

China's Didi swings to profit in fourth quarter

Chinese ride-hailing company Didi Global must face US investor lawsuit over IPO

Buy DiDi Global As Turnaround Has Not Been Recognized By Investors

DiDi Global: Multiple Re-Rating Catalysts

Didi's autonomous vehicle arm raises $149M from state investors

DiDi's Comeback: Navigating Regulatory Storms And Eyeing Global Growth

XPeng: Investors Overreact To DiDi Deal

Source: https://incomestatements.info

Category: Stock Reports