See more : Alkali Metals Limited (ALKALI.BO) Income Statement Analysis – Financial Results

Complete financial analysis of DICK’S Sporting Goods, Inc. (DKS) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of DICK’S Sporting Goods, Inc., a leading company in the Specialty Retail industry within the Consumer Cyclical sector.

- TCI GENE Inc. (6879.TWO) Income Statement Analysis – Financial Results

- YanTai Yuancheng Gold Co., Ltd. (600766.SS) Income Statement Analysis – Financial Results

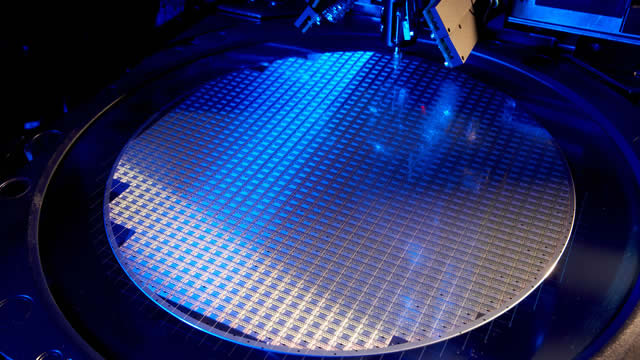

- Sumco Corporation (3436.T) Income Statement Analysis – Financial Results

- ReWalk Robotics Ltd. (RWLK) Income Statement Analysis – Financial Results

- New Work SE (NWO.DE) Income Statement Analysis – Financial Results

DICK'S Sporting Goods, Inc. (DKS)

About DICK'S Sporting Goods, Inc.

DICK'S Sporting Goods, Inc., together with its subsidiaries, operates as a sporting goods retailer primarily in the eastern United States. The company provides hardlines, including sporting goods equipment, fitness equipment, golf equipment, and hunting and fishing gear products; apparel; and footwear and accessories. It also owns and operates Sporting Goods, Golf Galaxy, Field & Stream, Public Lands, Going Going Gone!, and other specialty concept stores; and DICK'S House of Sports and Golf Galaxy Performance Center, as well as GameChanger, a youth sports mobile application for video streaming, scorekeeping, scheduling, and communications. The company sells its product through e-commerce websites and mobile applications. As of January 29, 2022, it operated 730 DICK'S Sporting Goods stores. The company was formerly known as Dick'S Clothing and Sporting Goods, Inc. and changed its name to DICK'S Sporting Goods, Inc. in April 1999. DICK'S Sporting Goods, Inc. was incorporated in 1948 and is headquartered in Coraopolis, Pennsylvania.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 12.98B | 12.37B | 12.29B | 9.58B | 8.75B | 8.44B | 8.59B | 7.92B | 7.27B | 6.81B | 6.21B | 5.84B | 5.21B | 4.87B | 4.41B | 4.13B | 3.89B | 3.11B | 2.62B | 2.11B | 1.47B | 1.27B | 1.07B | 893.40M | 728.34M | 628.86M |

| Cost of Revenue | 8.44B | 8.08B | 7.58B | 6.53B | 6.20B | 6.00B | 6.10B | 5.56B | 5.09B | 4.73B | 4.27B | 4.00B | 3.62B | 3.42B | 3.20B | 2.95B | 2.73B | 2.22B | 1.89B | 1.52B | 1.06B | 935.19M | 811.00M | 684.38M | 564.45M | 490.13M |

| Gross Profit | 4.55B | 4.28B | 4.71B | 3.05B | 2.55B | 2.44B | 2.49B | 2.37B | 2.18B | 2.09B | 1.94B | 1.84B | 1.59B | 1.45B | 1.22B | 1.18B | 1.16B | 896.70M | 737.64M | 586.53M | 407.74M | 337.39M | 263.57M | 209.01M | 163.90M | 138.74M |

| Gross Profit Ratio | 35.01% | 34.64% | 38.33% | 31.83% | 29.19% | 28.90% | 28.97% | 29.86% | 30.02% | 30.62% | 31.29% | 31.48% | 30.60% | 29.75% | 27.58% | 28.67% | 29.78% | 28.79% | 28.10% | 27.81% | 27.72% | 26.51% | 24.53% | 23.40% | 22.50% | 22.06% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 2.70B | 2.39B | 2.25B | 2.01B | 1.83B | 1.66B | 1.65B | 1.57B | 1.34B | 1.25B | 1.16B | 1.10B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 478.10M | 412.20M | 410.90M | 293.40M | 338.70M | 322.20M | 330.10M | 304.90M | 276.30M | 248.70M | 223.90M | 201.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 3.20B | 2.81B | 2.66B | 2.30B | 2.17B | 1.99B | 1.98B | 1.88B | 1.61B | 1.50B | 1.39B | 1.30B | 1.16B | 1.14B | 981.25M | 944.44M | 889.25M | 698.99M | 567.10M | 455.32M | 321.41M | 268.31M | 218.21M | 169.39M | 132.40M | 116.48M |

| Other Expenses | 59.26M | 16.08M | 13.30M | 10.70M | 5.27M | -2.57M | 31.81M | 14.42M | -305.00K | 5.17M | 12.22M | 4.56M | 0.00 | 0.00 | 0.00 | 193.35M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.49M | 5.19M |

| Operating Expenses | 3.26B | 2.82B | 2.68B | 2.31B | 2.18B | 1.99B | 2.01B | 1.92B | 1.65B | 1.53B | 1.41B | 1.31B | 1.16B | 1.14B | 981.25M | 1.14B | 889.25M | 698.99M | 567.10M | 455.32M | 321.41M | 268.31M | 218.21M | 6.47M | 135.89M | 121.66M |

| Cost & Expenses | 11.70B | 10.91B | 10.26B | 8.84B | 8.38B | 7.99B | 8.11B | 7.47B | 6.74B | 6.26B | 5.68B | 5.31B | 4.78B | 4.56B | 4.18B | 4.08B | 3.62B | 2.92B | 2.45B | 1.98B | 1.38B | 1.20B | 1.03B | 690.85M | 700.34M | 611.79M |

| Interest Income | 0.00 | 95.22M | 57.84M | 48.81M | 17.01M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.15M | 141.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 58.02M | 95.22M | 57.84M | 48.81M | 17.01M | 10.25M | 8.05M | 5.86M | 4.01M | 3.22M | 2.93M | 6.03M | 13.87M | 14.02M | 2.40M | 10.96M | 11.29M | 10.03M | 12.96M | 8.01M | 1.83M | 2.86M | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 355.30M | 334.70M | 319.40M | 285.75M | 312.50M | 229.60M | 237.65M | 233.83M | 193.59M | 179.43M | 154.93M | 125.10M | 116.58M | 110.39M | 100.95M | 90.73M | 75.05M | 54.93M | 49.86M | 37.62M | 17.55M | 14.42M | 12.08M | 9.43M | 8.66M | 8.12M |

| EBITDA | 1.73B | 1.81B | 2.37B | 1.05B | 745.81M | 671.77M | 747.04M | 779.19M | 728.48M | 753.89M | 703.96M | 620.96M | 562.48M | 421.92M | 328.67M | 123.61M | 343.87M | 252.64M | 184.45M | 160.47M | 86.33M | 69.08M | 57.44M | 211.97M | 36.67M | 25.19M |

| EBITDA Ratio | 13.34% | 14.91% | 19.32% | 11.34% | 7.56% | 8.13% | 8.70% | 8.81% | 10.02% | 10.84% | 11.33% | 9.05% | 10.53% | 8.61% | 7.63% | 8.33% | 8.84% | 8.11% | 9.77% | 8.40% | 6.82% | 6.75% | 5.35% | 23.73% | 5.03% | 4.01% |

| Operating Income | 1.28B | 1.46B | 2.03B | 741.48M | 375.61M | 444.73M | 477.57M | 449.85M | 535.19M | 554.06M | 536.81M | 523.67M | 432.02M | 309.25M | 225.57M | 30.38M | 268.82M | 197.71M | 132.75M | 110.87M | 86.33M | 69.08M | 45.36M | 33.15M | 28.01M | 17.07M |

| Operating Income Ratio | 9.88% | 11.83% | 16.55% | 7.74% | 4.29% | 5.27% | 5.56% | 5.68% | 7.36% | 8.13% | 8.64% | 8.97% | 8.29% | 6.35% | 5.11% | 0.74% | 6.91% | 6.35% | 5.06% | 5.26% | 5.87% | 5.43% | 4.22% | 3.71% | 3.85% | 2.71% |

| Total Other Income/Expenses | 35.79M | -79.27M | -40.07M | -29.74M | 32.09M | -12.81M | 23.76M | 8.57M | -4.32M | 1.96M | 9.30M | -33.85M | 6.00K | -11.74M | -2.40M | -16.56M | -11.29M | -10.03M | -11.12M | 3.97M | 1.71M | -5.31M | -6.24M | -6.96M | -3.52M | -4.83M |

| Income Before Tax | 1.32B | 1.38B | 1.99B | 711.74M | 407.70M | 431.92M | 501.34M | 458.42M | 530.88M | 556.01M | 546.11M | 489.83M | 432.03M | 297.51M | 223.18M | 21.77M | 257.53M | 187.69M | 121.63M | 114.84M | 88.03M | 63.77M | 39.12M | 26.19M | 24.49M | 12.24M |

| Income Before Tax Ratio | 10.15% | 11.19% | 16.22% | 7.43% | 4.66% | 5.12% | 5.84% | 5.79% | 7.30% | 8.16% | 8.79% | 8.39% | 8.29% | 6.11% | 5.06% | 0.53% | 6.62% | 6.03% | 4.63% | 5.44% | 5.99% | 5.01% | 3.64% | 2.93% | 3.36% | 1.95% |

| Income Tax Expense | 271.63M | 340.61M | 474.57M | 181.48M | 110.24M | 112.06M | 177.89M | 171.03M | 200.48M | 211.82M | 208.51M | 199.12M | 168.12M | 115.43M | 87.82M | 56.87M | 102.49M | 75.07M | 48.65M | 45.94M | 35.21M | 25.51M | 15.65M | 10.48M | 13.31M | 5.92M |

| Net Income | 1.05B | 1.04B | 1.52B | 530.25M | 297.46M | 319.86M | 323.45M | 287.40M | 330.39M | 344.20M | 337.60M | 290.71M | 263.91M | 182.08M | 135.36M | -35.09M | 155.04M | 112.61M | 72.98M | 68.91M | 52.82M | 38.26M | 23.47M | 8.41M | 11.18M | 6.33M |

| Net Income Ratio | 8.06% | 8.43% | 12.36% | 5.53% | 3.40% | 3.79% | 3.77% | 3.63% | 4.54% | 5.05% | 5.43% | 4.98% | 5.06% | 3.74% | 3.07% | -0.85% | 3.99% | 3.62% | 2.78% | 3.27% | 3.59% | 3.01% | 2.18% | 0.94% | 1.53% | 1.01% |

| EPS | 12.72 | 13.43 | 18.27 | 6.29 | 3.40 | 3.27 | 3.02 | 2.59 | 2.87 | 2.89 | 2.75 | 2.39 | 2.19 | 1.57 | 1.20 | -0.31 | 1.42 | 1.10 | 0.74 | 0.72 | 0.59 | 0.54 | 0.37 | 0.08 | -0.57 | -1.21 |

| EPS Diluted | 12.18 | 10.78 | 13.87 | 5.72 | 3.34 | 3.24 | 3.01 | 2.56 | 2.83 | 2.84 | 2.69 | 2.31 | 2.10 | 1.50 | 1.15 | -0.31 | 1.33 | 1.01 | 0.68 | 0.65 | 0.53 | 0.47 | 0.37 | 0.08 | -0.57 | -1.21 |

| Weighted Avg Shares Out | 82.30M | 77.67M | 83.18M | 84.26M | 87.50M | 97.74M | 106.98M | 111.10M | 115.23M | 119.24M | 122.88M | 121.63M | 120.23M | 116.24M | 113.18M | 111.66M | 109.38M | 102.51M | 99.58M | 95.96M | 89.55M | 70.92M | 64.04M | 38.00M | 5.66M | 5.64M |

| Weighted Avg Shares Out (Dil) | 85.93M | 99.27M | 109.58M | 92.64M | 89.07M | 98.78M | 107.59M | 112.22M | 116.79M | 121.24M | 125.63M | 126.00M | 125.77M | 121.72M | 117.96M | 111.66M | 116.50M | 110.79M | 107.96M | 105.84M | 100.56M | 81.92M | 64.04M | 74.01M | 5.66M | 5.64M |

DICK'S Stock Price Increases 42% YTD: Does It Have More Room to Run?

DICK'S Sporting & Synchrony Extend Collaboration: What You Should Know

Synchrony and DICK'S Sporting Goods Extend Partnership

DKS' Omnichannel Efforts Seem Robust: Should You Buy the Stock?

Dick's Sporting Goods (DKS) Sees a More Significant Dip Than Broader Market: Some Facts to Know

Why Dick's Sporting Goods (DKS) is a Top Growth Stock for the Long-Term

Our Top 10 Dividend Growth Stocks - September 2024

Why Dick's Sporting Goods (DKS) is a Top Value Stock for the Long-Term

14 retail stocks that are firing on all cylinders

3 Dividend Growth Stocks That Raised Their Payouts by 400%-Plus in 10 Years

Source: https://incomestatements.info

Category: Stock Reports