See more : Ginni Filaments Limited (GINNIFILA.NS) Income Statement Analysis – Financial Results

Complete financial analysis of BNY Mellon Strategic Municipal Bond Fund, Inc. (DSM) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of BNY Mellon Strategic Municipal Bond Fund, Inc., a leading company in the Asset Management – Bonds industry within the Financial Services sector.

- Tsubota Laboratory Incorporated (4890.T) Income Statement Analysis – Financial Results

- Bang Overseas Limited (BANG.NS) Income Statement Analysis – Financial Results

- PARMESHWARI SILK MILLS LIMITED (PARMSILK.BO) Income Statement Analysis – Financial Results

- ADM Tronics Unlimited, Inc. (ADMT) Income Statement Analysis – Financial Results

- Ross Stores Inc (RSO.DE) Income Statement Analysis – Financial Results

BNY Mellon Strategic Municipal Bond Fund, Inc. (DSM)

Industry: Asset Management - Bonds

Sector: Financial Services

About BNY Mellon Strategic Municipal Bond Fund, Inc.

BNY Mellon Strategic Municipal Bond Fund, Inc. is a closed ended fixed income mutual fund launched and managed by BNY Mellon Investment Adviser, Inc. The fund invests in the fixed income markets of the United States. It primarily invests in investment grade municipal bonds which are exempt from federal income tax. The fund seeks to maintain a weighted average maturity of greater than 10 years. It was formerly known as Dreyfus Strategic Municipal Bond Fund, Inc. BNY Mellon Strategic Municipal Bond Fund, Inc. was formed on November 22, 1989 and is domiciled in the United States.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 20.43M | -70.38M | 26.16M | 16.54M | 42.43M | 2.77M | 32.19M | 10.26M | 30.10M | 30.05M | 30.68M | 31.24M | 32.20M | 33.37M | 35.13M | 35.85M | 35.81M | 36.39M | 35.00M | 34.86M | 36.29M | 39.18M | 39.92M | 38.71M | 32.79M | 31.91M | 32.40M | 33.03M | 33.71M | 33.31M | 35.09M | 33.62M | 32.39M | 30.41M | 0.00 |

| Cost of Revenue | 0.00 | 2.90M | 3.21M | 3.16M | 3.22M | 3.27M | 3.60M | 3.70M | 3.38M | 3.35M | 3.46M | 3.50M | 3.19M | 3.36M | 3.13M | 3.83M | 4.31M | 1.03M | 460.00K | 490.00K | 490.00K | 490.00K | 490.00K | 510.00K | 90.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 20.43M | -73.28M | 22.95M | 13.38M | 39.21M | -503.27K | 28.59M | 6.56M | 26.72M | 26.70M | 27.22M | 27.74M | 29.01M | 30.01M | 32.00M | 32.02M | 31.50M | 35.36M | 34.54M | 34.37M | 35.80M | 38.69M | 39.43M | 38.20M | 32.70M | 31.91M | 32.40M | 33.03M | 33.71M | 33.31M | 35.09M | 33.62M | 32.39M | 30.41M | 0.00 |

| Gross Profit Ratio | 100.00% | 104.12% | 87.73% | 80.91% | 92.41% | -18.17% | 88.81% | 63.95% | 88.78% | 88.85% | 88.72% | 88.80% | 90.09% | 89.93% | 91.09% | 89.32% | 87.96% | 97.17% | 98.69% | 98.59% | 98.65% | 98.75% | 98.77% | 98.68% | 99.73% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 0.00% |

| Research & Development | 0.00 | -7.98 | 1.15 | 0.83 | 1.50 | 0.19 | 0.85 | 0.53 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 2.81M | 1.46M | 1.60M | 1.57M | 1.59M | 1.74M | 1.80M | 3.92M | 3.85M | 3.81M | 4.17M | 1.72M | 1.62M | 1.68M | 1.68M | 1.74M | 1.79M | 4.92M | 4.93M | 4.85M | 4.84M | 4.82M | 4.90M | 4.87M | 3.83M | 3.63M | 3.54M | 3.53M | 3.53M | 3.58M | 3.69M | 3.48M | 3.44M | 3.06M | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -3.92M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 2.81M | 1.46M | 1.60M | 1.57M | 1.59M | 1.74M | 1.80M | 0.53 | 3.85M | 3.81M | 4.17M | 1.72M | 1.62M | 1.68M | 1.68M | 1.74M | 1.79M | 4.92M | 4.93M | 4.85M | 4.84M | 4.82M | 4.90M | 4.87M | 3.83M | 3.63M | 3.54M | 3.53M | 3.53M | 3.58M | 3.69M | 3.48M | 3.44M | 3.06M | 0.00 |

| Other Expenses | 0.00 | -386.28K | -455.33K | -443.94K | -439.51K | -450.86K | -497.75K | 49.17M | 56.76K | 80.00K | 50.00K | 60.00K | 110.00K | 90.00K | 50.00K | 70.00K | 60.00K | 50.00K | 60.00K | 30.00K | 40.00K | 40.00K | 40.00K | 40.00K | 10.00K | 20.00K | 20.00K | 20.00K | 30.00K | 100.00K | 70.00K | 70.00K | 40.00K | 70.00K | 130.00K |

| Operating Expenses | 2.81M | 1.07M | 1.15M | 1.12M | 1.15M | 1.29M | 1.31M | 22.90M | 3.89M | 29.43M | 68.91M | 1.78M | 1.73M | 1.77M | 1.73M | 1.81M | 1.85M | 4.97M | 4.99M | 4.88M | 4.88M | 4.86M | 4.94M | 4.91M | 3.84M | 3.65M | 3.56M | 3.55M | 3.56M | 3.68M | 3.76M | 3.55M | 3.48M | 3.13M | 130.00K |

| Cost & Expenses | 2.81M | 1.07M | 1.15M | 1.12M | 1.15M | 1.29M | 1.31M | 6.56M | 3.89M | 29.43M | 68.91M | 5.28M | 4.92M | 5.13M | 4.86M | 5.64M | 6.16M | 6.00M | 5.45M | 5.37M | 5.37M | 5.35M | 5.43M | 5.42M | 3.93M | 3.65M | 3.56M | 3.55M | 3.56M | 3.68M | 3.76M | 3.55M | 3.48M | 3.13M | 130.00K |

| Interest Income | 20.43M | 21.58M | 22.74M | 25.55M | 27.47M | 29.73M | 29.50M | 904.34K | 0.00 | 659.19K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 5.08M | 1.98M | 1.05M | 2.38M | 3.64M | 2.91M | 1.46M | 904.34K | 646.30K | 33.24M | 464.57K | 60.27M | 11.59M | -4.68M | 49.42M | -90.66M | -28.52M | 15.88M | 6.51M | -3.01M | 17.01M | -12.48M | 4.96M | 3.37M | -43.97M | 2.38M | 0.00 | -3.56M | 41.26M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | -17.61M | -18.49M | -19.27M | -22.19M | -24.05M | -26.14M | -25.67M | -25.31M | -26.25M | -26.24M | -26.51M | 121.24M | 23.70M | -8.80M | 99.38M | -180.74M | -56.42M | 32.39M | 13.64M | -5.97M | 34.02M | -24.96M | 9.92M | 6.74M | -87.94M | 4.77M | -540.00K | -7.12M | 82.52M | -53.17M | 6.85M | 8.09M | 8.07M | 1.41M | 0.00 |

| EBITDA | 0.00 | -69.46M | 0.00 | -4.39M | 0.00 | 0.00 | 5.22M | 4.83M | 0.00 | 0.00 | 0.00 | 147.20M | 50.99M | 19.44M | 129.64M | -150.53M | -26.77M | 62.77M | 43.19M | 23.52M | 64.94M | 8.87M | 44.41M | 40.03M | -59.09M | 33.03M | 28.29M | 22.36M | 112.67M | -23.54M | 38.18M | 38.16M | 36.98M | 28.69M | 130.00K |

| EBITDA Ratio | 0.00% | 98.70% | 95.62% | 93.20% | 97.29% | 158.49% | 100.47% | 47.06% | -2.71% | 108.08% | -213.29% | 471.19% | 158.35% | 58.26% | 369.03% | -419.89% | -74.76% | 172.49% | 123.40% | 67.47% | 178.95% | 22.64% | 111.25% | 103.41% | -180.21% | 103.51% | 87.31% | 67.70% | 334.23% | -70.67% | 108.81% | 113.50% | 114.17% | 94.34% | 0.00% |

| Operating Income | 17.61M | -69.46M | 25.02M | 15.42M | 41.28M | 4.39M | 32.34M | 25.31M | 26.25M | 26.24M | 26.51M | 25.96M | 27.29M | 28.24M | 30.26M | 30.21M | 29.65M | 30.38M | 29.55M | 29.49M | 30.92M | 33.83M | 34.49M | 33.29M | 28.85M | 28.26M | 28.83M | 29.48M | 30.15M | 29.63M | 31.33M | 30.07M | 28.91M | 27.28M | 130.00K |

| Operating Income Ratio | 86.22% | 98.70% | 95.62% | 93.20% | 97.29% | 158.49% | 100.47% | 246.76% | 87.22% | 87.32% | 86.40% | 83.10% | 84.75% | 84.63% | 86.14% | 84.27% | 82.80% | 83.48% | 84.43% | 84.60% | 85.20% | 86.35% | 86.40% | 86.00% | 87.98% | 88.56% | 88.98% | 89.25% | 89.44% | 88.95% | 89.28% | 89.44% | 89.26% | 89.71% | 0.00% |

| Total Other Income/Expenses | -8.52M | -71.45M | 5.74M | -6.77M | 17.23M | -24.65M | 5.22M | -19.88M | -689.43K | 32.58M | -65.20M | 60.97M | 12.11M | -4.12M | 49.96M | -90.08M | -27.90M | 16.51M | 7.13M | -2.96M | 17.01M | -12.48M | 4.96M | 3.37M | -43.97M | 2.39M | -540.00K | -3.56M | 41.26M | -53.17M | 6.85M | 8.09M | 8.07M | 1.41M | 0.00 |

| Income Before Tax | 9.09M | -71.45M | 25.02M | 15.42M | 41.28M | 1.48M | 30.88M | 5.43M | 25.57M | 58.82M | -38.70M | 86.93M | 39.40M | 24.12M | 80.22M | -59.87M | 1.75M | 46.89M | 36.68M | 26.53M | 47.93M | 21.35M | 39.45M | 36.66M | -15.12M | 30.65M | 28.29M | 25.92M | 71.41M | -23.54M | 38.18M | 38.16M | 36.98M | 28.69M | 130.00K |

| Income Before Tax Ratio | 44.50% | 101.52% | 95.62% | 93.20% | 97.29% | 53.49% | 95.95% | 52.94% | 84.93% | 195.73% | -126.14% | 278.27% | 122.36% | 72.28% | 228.35% | -167.00% | 4.89% | 128.85% | 104.80% | 76.10% | 132.07% | 54.49% | 98.82% | 94.70% | -46.11% | 96.05% | 87.31% | 78.47% | 211.84% | -70.67% | 108.81% | 113.50% | 114.17% | 94.34% | 0.00% |

| Income Tax Expense | 0.00 | 18.49M | 18.22M | 19.81M | 20.41M | 26.14M | 25.67M | 6.34M | -689.43K | 32.58M | -65.20M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Net Income | 9.09M | -71.45M | 25.02M | 15.42M | 41.28M | 1.48M | 30.88M | 6.34M | 25.44M | 58.72M | -38.93M | 86.93M | 39.40M | 24.12M | 80.22M | -59.87M | 1.75M | 46.89M | 36.68M | 26.53M | 47.93M | 21.35M | 39.45M | 36.66M | -15.12M | 30.65M | 28.29M | 25.92M | 71.41M | -23.54M | 38.18M | 38.16M | 36.98M | 28.69M | 130.00K |

| Net Income Ratio | 44.50% | 101.52% | 95.62% | 93.20% | 97.29% | 53.49% | 95.95% | 61.76% | 84.52% | 195.40% | -126.89% | 278.27% | 122.36% | 72.28% | 228.35% | -167.00% | 4.89% | 128.85% | 104.80% | 76.10% | 132.07% | 54.49% | 98.82% | 94.70% | -46.11% | 96.05% | 87.31% | 78.47% | 211.84% | -70.67% | 108.81% | 113.50% | 114.17% | 94.34% | 0.00% |

| EPS | 0.15 | -1.45 | 0.51 | 0.30 | 0.81 | 0.03 | 0.60 | 1.17 | 0.52 | 1.20 | -0.79 | 1.77 | 0.81 | 0.50 | 1.65 | -1.23 | 0.04 | 0.97 | 0.76 | 0.55 | 1.00 | 0.44 | 0.82 | 0.77 | -0.32 | 0.65 | 0.61 | 0.56 | 1.56 | -0.51 | 0.87 | 0.88 | 0.88 | 0.71 | 0.00 |

| EPS Diluted | 0.15 | -1.45 | 0.51 | 0.30 | 0.81 | 0.03 | 0.60 | 64.85M | 0.52 | 1.20 | -0.79 | 1.77 | 0.81 | 0.50 | 1.65 | -1.23 | 0.04 | 0.97 | 0.76 | 0.55 | 1.00 | 0.44 | 0.82 | 0.77 | -0.32 | 0.65 | 0.61 | 0.56 | 1.56 | -0.51 | 0.87 | 0.88 | 0.88 | 0.71 | 0.00 |

| Weighted Avg Shares Out | 49.43M | 49.43M | 49.42M | 49.42M | 49.40M | 49.37M | 49.34M | 5.43M | 49.08M | 49.08M | 49.08M | 48.99M | 48.75M | 48.57M | 48.50M | 48.50M | 48.50M | 48.28M | 48.25M | 48.18M | 48.11M | 48.03M | 47.99M | 47.78M | 47.78M | 47.15M | 46.39M | 46.20M | 45.75M | 46.16M | 43.88M | 43.36M | 42.03M | 40.41M | 35.01M |

| Weighted Avg Shares Out (Dil) | 49.43M | 49.43M | 49.42M | 49.42M | 49.40M | 49.37M | 49.43M | 0.10 | 49.08M | 49.08M | 49.08M | 48.99M | 48.75M | 48.57M | 48.50M | 48.50M | 48.50M | 48.28M | 48.25M | 48.18M | 48.11M | 48.03M | 47.99M | 47.78M | 47.78M | 47.15M | 46.39M | 46.20M | 45.75M | 46.16M | 43.88M | 43.36M | 42.03M | 40.41M | 35.01M |

BNY Mellon gana 787 millones en el segundo trimestre, un 7% menos

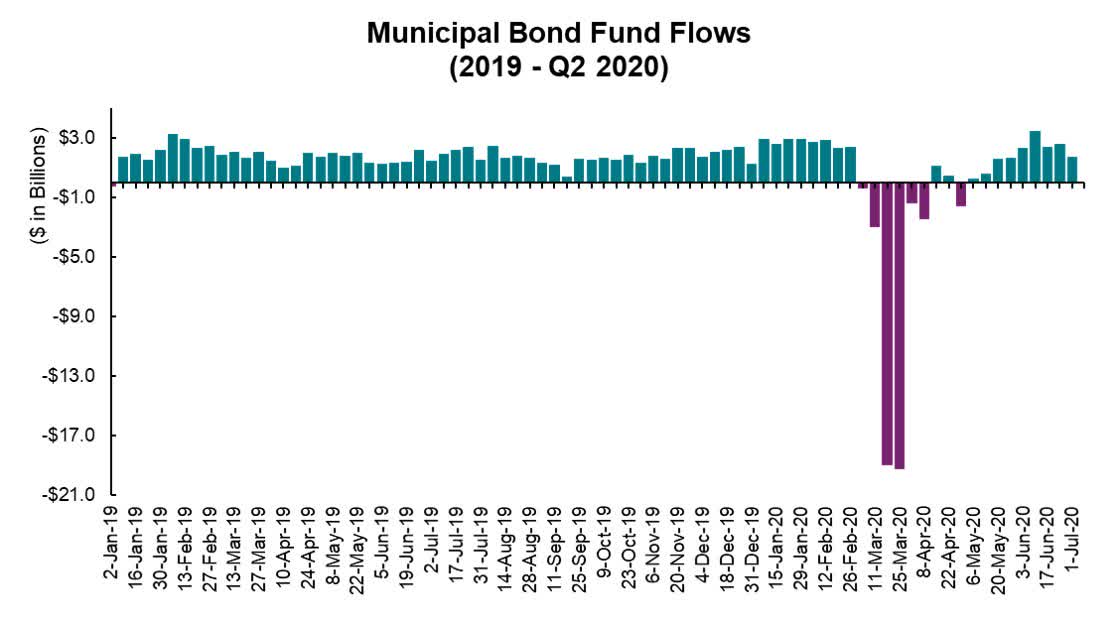

2020 Muni Market Midyear Update

Fee War Hit Its Limit With Fund That Paid You to Invest

Explainer: Dollar peg is critical to Hong Kong amid U.S. threats, China worries

BNY Mellon IM nomme un nouveau CEO

Source: https://incomestatements.info

Category: Stock Reports