See more : West Leisure Resorts Limited (WESTLEIRES.BO) Income Statement Analysis – Financial Results

Complete financial analysis of DTE Energy Co (DTP) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of DTE Energy Co, a leading company in the industry within the sector.

You may be interested

- News Corporation (0K7U.L) Income Statement Analysis – Financial Results

- OceanaGold Corporation (OCANF) Income Statement Analysis – Financial Results

- Genius Metals Inc. (GNSMF) Income Statement Analysis – Financial Results

- NZX Limited (NZSTF) Income Statement Analysis – Financial Results

- Power Root Berhad (7237.KL) Income Statement Analysis – Financial Results

DTE Energy Co (DTP)

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 12.75B | 30.34B | 14.96B | 12.18B | 12.67B | 14.21B | 12.61B | 10.63B | 10.34B | 12.30B | 9.66B | 8.79B | 8.90B | 8.56B | 8.01B | 9.33B | 8.51B | 9.02B | 9.02B | 7.11B | 7.04B | 6.75B | 7.85B | 5.60B | 4.73B | 4.22B | 3.76B | 3.65B | 3.64B | 3.52B | 3.56B | 3.56B | 3.59B | 3.31B | 3.20B | 3.10B | 2.86B | 2.87B | 2.79B |

| Cost of Revenue | 8.42B | 15.56B | 11.63B | 8.30B | 9.27B | 11.06B | 9.50B | 7.83B | 7.78B | 9.23B | 7.03B | 6.19B | 3.54B | 3.19B | 3.12B | 4.31B | 3.55B | 3.06B | 3.53B | 2.01B | 2.24B | 2.10B | 3.95B | 2.23B | 1.34B | 1.06B | 837.00M | 845.70M | 849.60M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 4.33B | 14.78B | 3.34B | 3.87B | 3.40B | 3.15B | 3.11B | 2.80B | 2.56B | 3.08B | 2.63B | 2.60B | 5.36B | 5.37B | 4.90B | 5.02B | 4.95B | 5.97B | 5.49B | 5.11B | 4.80B | 4.65B | 3.90B | 3.36B | 3.39B | 3.16B | 2.93B | 2.80B | 2.79B | 3.52B | 3.56B | 3.56B | 3.59B | 3.31B | 3.20B | 3.10B | 2.86B | 2.87B | 2.79B |

| Gross Profit Ratio | 33.95% | 48.71% | 22.29% | 31.81% | 26.83% | 22.16% | 24.65% | 26.32% | 24.78% | 25.00% | 27.20% | 29.61% | 60.25% | 62.72% | 61.09% | 53.84% | 58.23% | 66.13% | 60.87% | 71.79% | 68.17% | 68.90% | 49.68% | 60.10% | 71.76% | 74.82% | 77.76% | 76.80% | 76.63% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 0.00 | 0.00 | 12.09B | 1.85B | 1.65B | 1.50B | 1.40B | 1.33B | 1.22B | 1.50B | 1.43B | 1.32B | 3.94B | 3.91B | 3.65B | 3.76B | 3.32B | 5.14B | 4.94B | 4.26B | 4.05B | 3.55B | 3.20B | 2.53B | 2.49B | 2.22B | 1.93B | 1.96B | 1.76B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 2.08B | 1.92B | 12.09B | 1.85B | 1.65B | 1.50B | 1.40B | 1.33B | 1.22B | 1.50B | 1.43B | 1.32B | 3.94B | 3.91B | 3.65B | 3.76B | 3.32B | 5.14B | 4.94B | 4.26B | 4.05B | 3.55B | 3.20B | 2.53B | 2.49B | 2.22B | 1.93B | 1.96B | 1.76B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cost & Expenses | 10.50B | 17.48B | 12.09B | 10.16B | 10.92B | 12.56B | 10.90B | 9.16B | 8.99B | 10.72B | 8.46B | 7.51B | 7.47B | 7.10B | 6.77B | 8.07B | 6.87B | 8.19B | 8.47B | 6.27B | 6.29B | 5.64B | 7.15B | 4.77B | 3.83B | 3.28B | 2.76B | 2.81B | 2.61B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Income | -57.00M | -46.00M | -22.00M | 38.00M | 17.00M | 12.00M | 12.00M | 20.00M | 13.00M | 10.00M | 9.00M | 10.00M | 10.00M | 12.00M | 19.00M | -19.00M | -25.00M | -47.00M | -57.00M | -55.00M | -37.00M | -29.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 791.00M | 675.00M | 630.00M | 720.00M | 641.00M | 559.00M | 536.00M | 472.00M | 450.00M | 429.00M | 436.00M | 440.00M | 494.00M | 549.00M | 545.00M | 503.00M | 533.00M | 526.00M | 519.00M | 518.00M | 546.00M | 548.00M | 335.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 1.33B | 1.47B | 1.11B | 1.44B | 1.26B | 1.12B | 1.03B | 976.00M | 852.00M | 1.15B | 1.09B | 995.00M | 995.00M | 1.03B | 1.02B | 901.00M | 932.00M | 1.01B | 869.00M | 744.00M | 687.00M | 759.00M | 691.00M | -353.00M | -358.00M | -340.00M | -327.00M | -304.60M | -333.50M | -3.13B | -3.06B | -3.00B | -3.06B | -2.79B | -2.78B | -3.34B | -2.30B | -2.39B | -2.35B |

| EBITDA | 3.96B | 3.26B | 3.07B | 3.70B | 3.23B | 2.90B | 2.88B | 2.59B | 2.26B | 2.84B | 1.35B | 1.34B | 1.47B | 1.49B | 1.32B | 834.00M | 1.34B | 570.00M | 739.00M | 596.00M | 398.00M | 573.00M | 222.00M | 477.00M | 543.00M | 597.00M | 674.00M | 531.90M | 695.60M | 390.20M | 491.10M | 557.50M | 535.20M | 514.50M | 426.00M | -235.30M | 555.00M | 477.10M | 437.50M |

| EBITDA Ratio | 31.09% | 10.73% | 20.54% | 30.37% | 25.46% | 20.41% | 22.80% | 24.34% | 21.85% | 23.11% | 13.98% | 15.20% | 16.54% | 17.41% | 16.52% | 8.94% | 15.69% | 6.32% | 8.19% | 8.38% | 5.65% | 8.49% | 2.83% | 8.52% | 11.48% | 14.14% | 17.91% | 14.59% | 19.13% | 11.09% | 13.81% | 15.67% | 14.90% | 15.56% | 13.30% | -7.58% | 19.43% | 16.63% | 15.69% |

| Operating Income | 2.24B | 1.79B | 1.96B | 1.99B | 1.71B | 1.59B | 1.65B | 1.45B | 1.24B | 1.59B | 1.20B | 1.28B | 1.42B | 1.46B | 1.25B | 1.26B | 1.64B | 828.00M | 556.00M | 846.00M | 747.00M | 1.11B | 696.00M | 830.00M | 901.00M | 937.00M | 1.00B | 836.50M | 1.03B | 3.52B | 3.56B | 3.56B | 3.59B | 3.31B | 3.20B | 3.10B | 2.86B | 2.87B | 2.79B |

| Operating Income Ratio | 17.60% | 5.89% | 13.12% | 16.31% | 13.47% | 11.22% | 13.06% | 13.59% | 11.99% | 12.93% | 12.45% | 14.55% | 15.99% | 17.11% | 15.59% | 13.54% | 19.22% | 9.18% | 6.16% | 11.89% | 10.61% | 16.37% | 8.87% | 14.83% | 19.06% | 22.20% | 26.59% | 22.95% | 28.31% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Total Other Income/Expenses | -677.00M | -675.00M | -839.00M | -448.00M | -383.00M | -378.00M | -359.00M | -340.00M | -289.00M | -315.00M | -281.00M | -319.00M | -436.00M | -514.00M | -467.00M | -449.00M | -484.00M | -254.00M | 222.00M | -238.00M | -390.00M | -532.00M | -477.00M | -353.00M | -358.00M | -340.00M | -327.00M | -304.60M | -333.50M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Income Before Tax | 1.57B | 1.11B | 656.00M | 1.54B | 1.32B | 1.22B | 1.29B | 1.11B | 950.00M | 1.28B | 922.00M | 960.00M | 987.00M | 950.00M | 782.00M | 814.00M | 1.15B | 574.00M | 778.00M | 608.00M | 357.00M | 573.00M | 219.00M | 477.00M | 543.00M | 597.00M | 674.00M | 531.90M | 695.60M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Income Before Tax Ratio | 12.29% | 3.67% | 4.38% | 12.63% | 10.45% | 8.56% | 10.21% | 10.40% | 9.19% | 10.37% | 9.54% | 10.92% | 11.09% | 11.10% | 9.76% | 8.73% | 13.53% | 6.36% | 8.62% | 8.55% | 5.07% | 8.49% | 2.79% | 8.52% | 11.48% | 14.14% | 17.91% | 14.59% | 19.13% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 169.00M | 29.00M | 431.00M | 167.00M | 152.00M | 98.00M | 175.00M | 271.00M | 230.00M | 364.00M | 254.00M | 286.00M | 267.00M | 311.00M | 247.00M | 288.00M | 364.00M | 137.00M | 202.00M | 165.00M | -123.00M | -59.00M | -110.00M | 9.00M | 60.00M | 154.00M | 257.00M | 222.60M | 289.70M | 3.13B | 3.06B | 3.00B | 3.06B | 2.79B | 2.78B | 3.34B | 2.30B | 2.39B | 2.35B |

| Net Income | 1.40B | 1.08B | 225.00M | 1.37B | 1.17B | 1.12B | 1.13B | 868.00M | 727.00M | 905.00M | 661.00M | 610.00M | 711.00M | 630.00M | 532.00M | 546.00M | 971.00M | 433.00M | 537.00M | 431.00M | 521.00M | 632.00M | 332.00M | 468.00M | 483.00M | 443.00M | 417.00M | 309.30M | 405.90M | 390.20M | 491.10M | 557.50M | 535.20M | 514.50M | 426.00M | -235.30M | 555.00M | 477.10M | 437.50M |

| Net Income Ratio | 10.96% | 3.57% | 1.50% | 11.23% | 9.23% | 7.88% | 9.00% | 8.17% | 7.03% | 7.36% | 6.84% | 6.94% | 7.99% | 7.36% | 6.64% | 5.85% | 11.42% | 4.80% | 5.95% | 6.06% | 7.40% | 9.36% | 4.23% | 8.36% | 10.22% | 10.50% | 11.08% | 8.48% | 11.16% | 11.09% | 13.81% | 15.67% | 14.90% | 15.56% | 13.30% | -7.58% | 19.43% | 16.63% | 15.69% |

| EPS | 6.78 | 5.53 | 1.16 | 7.05 | 6.03 | 5.77 | 5.88 | 4.50 | 3.77 | 4.69 | 3.42 | 3.16 | 3.68 | 3.26 | 2.76 | 2.83 | 5.03 | 2.24 | 2.78 | 2.23 | 2.70 | 3.27 | 1.72 | 2.42 | 2.50 | 2.30 | 2.16 | 1.60 | 2.10 | 2.02 | 2.54 | 2.89 | 2.77 | 2.67 | 2.21 | -1.22 | 2.88 | 2.47 | 2.27 |

| EPS Diluted | 6.78 | 5.53 | 1.16 | 7.05 | 6.03 | 5.77 | 5.85 | 4.47 | 3.75 | 4.66 | 3.41 | 3.14 | 3.66 | 3.25 | 2.74 | 2.81 | 5.01 | 2.23 | 2.77 | 2.22 | 2.69 | 3.26 | 1.71 | 2.41 | 2.49 | 2.28 | 2.15 | 1.59 | 2.09 | 2.01 | 2.53 | 2.87 | 2.76 | 2.65 | 2.20 | -1.21 | 2.86 | 2.46 | 2.26 |

| Weighted Avg Shares Out | 206.00M | 196.00M | 194.00M | 194.00M | 194.00M | 194.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M | 193.00M |

| Weighted Avg Shares Out (Dil) | 206.00M | 196.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M | 194.00M |

Dividend Champion And Contender Highlights: Week Of September 13

A weekly summary of dividend activity for Dividend Champions and Contenders. Companies which changed their dividends.

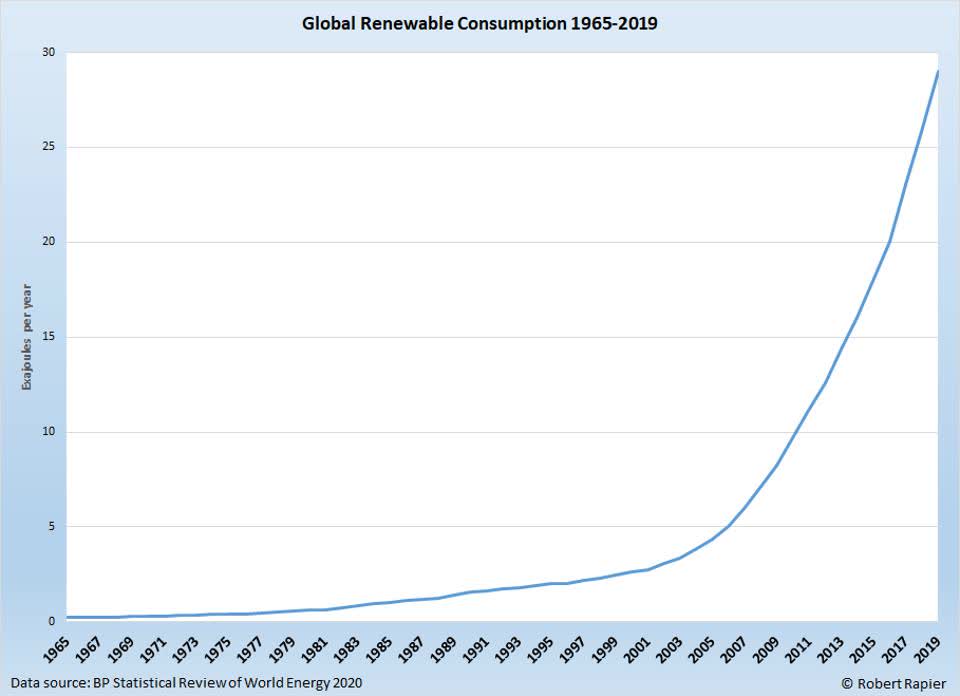

Renewable Energy Is Set For Exponential Growth In The Years Ahead

The world is changing right before our eyes. Twenty years ago, renewable energy sources like wind and solar were expensive, inefficient, and generally avoided by the for-profit sector.

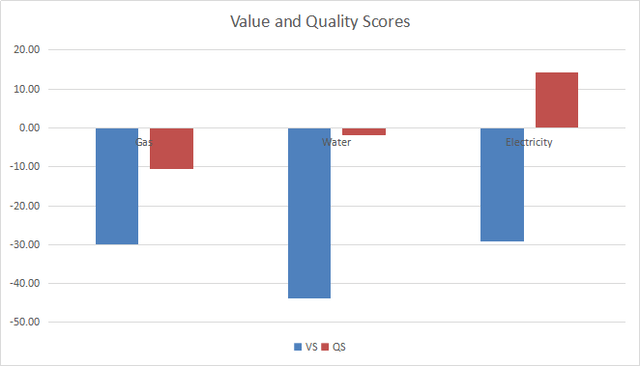

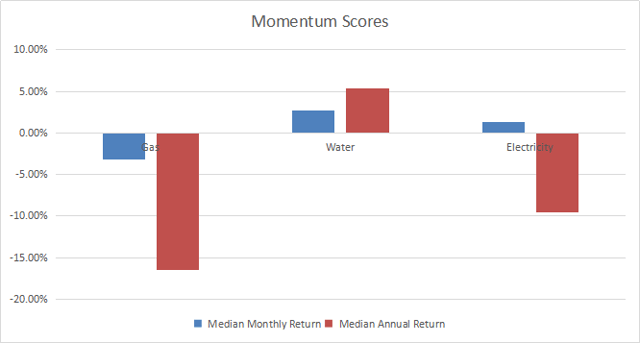

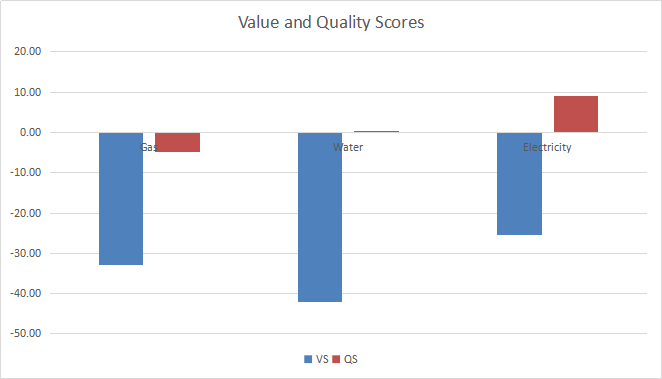

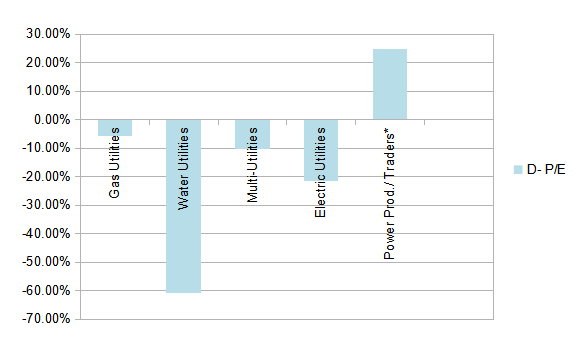

Utilities Dashboard For August

A dashboard with metrics of value, quality and momentum. Value and quality scores relative to historical averages.

DTE Energy Company (DTE) CEO Jerry Norcia on Q2 2020 Results - Earnings Call Transcript

DTE Energy Company (NYSE:DTE) Q2 2020 Earnings Conference Call July 28, 2020, 09:00 AM ET Company Participants Barbara Tuckfield - Director-IR Jerry Norcia - President and CEO David Ruud - SVP and CFO Conference Call Participants Shar Pourreza - Guggenheim...

DTE Energy Company 2020 Q2 - Results - Earnings Call Presentation

The following slide deck was published by DTE Energy Company in conjunction with their 2020 Q2 earnings call.

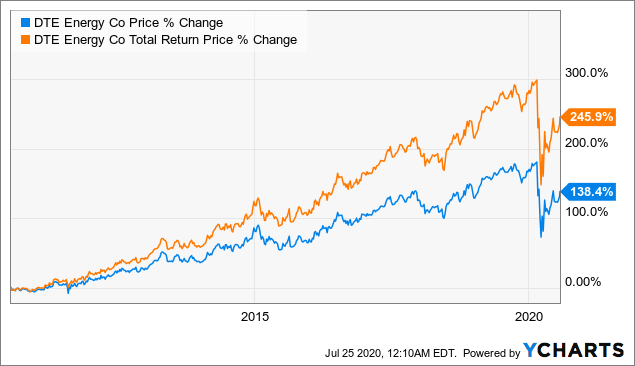

DTE Energy: EPS Growth Should Continue Thanks To Its Capital Projects

DTE Energy has a plan to invest $19 billion of capital in the next five years to grow its business in Michigan.

Utilities Dashboard - July Edition

A dashboard with metrics of value, quality and momentum. Value and quality scores relative to historical averages.

Utilities Dashboard - June Edition

A dashboard in utilities with metrics of value, quality and momentum. Value and quality scores relative to historical averages. The best and the worst in value,

DTE Energy's (DTE) CEO Jerry Norcia on Q1 2020 Results - Earnings Call Transcript

DTE Energy Company (NYSE:DTE) Q4 2019 Earnings Conference Call April 28, 2020 9:00 AM ET Company Participants Barbara Tuckfield – Director-Investor Relations Je

Utilities Dashboard - April Edition

Valuation metrics in utilities. Evolution since last month. A list of stocks looking cheap in their industries.

Source: https://incomestatements.info

Category: Stock Reports