See more : Kwality Limited (KWALITY.NS) Income Statement Analysis – Financial Results

Complete financial analysis of Duke Energy Corporation 5.625% (DUKB) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Duke Energy Corporation 5.625% , a leading company in the Regulated Electric industry within the Utilities sector.

- ComfortDelGro Corporation Limited (C52.SI) Income Statement Analysis – Financial Results

- SRJ Technologies Group Plc (SRJ.AX) Income Statement Analysis – Financial Results

- Promax Power Limited (PROMAX.BO) Income Statement Analysis – Financial Results

- China Railway Special Cargo Logistics Co., Ltd. (001213.SZ) Income Statement Analysis – Financial Results

- Deep Yellow Limited (DYL.AX) Income Statement Analysis – Financial Results

Duke Energy Corporation 5.625% (DUKB)

Industry: Regulated Electric

Sector: Utilities

About Duke Energy Corporation 5.625%

Duke Energy Corp. engages in the distribution of natural gas and energy related services. It operates through the following segments: Electric Utilities and Infrastructure, Gas Utilities and Infrastructure, and Other. The Electric Utilities and Infrastructure segment conducts operations in regulated electric utilities in the Carolinas, Florida and the Midwest. The Gas Utilities and Infrastructure segment focuses on Piedmont, natural gas local distribution companies in Ohio and Kentucky, and natural gas storage and midstream pipeline investments. The Other segment includes interest expense on holding company debt, unallocated corporate costs, and Bison which is a wholly owned captive insurance company. The company was founded on April 30, 1904 and is headquartered in Charlotte, NC.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 29.06B | 28.77B | 24.62B | 23.37B | 25.08B | 24.52B | 23.57B | 22.74B | 23.46B | 23.93B | 24.60B | 19.62B | 14.53B | 14.27B | 12.73B | 13.21B | 12.72B | 15.18B | 16.75B | 22.50B | 22.53B | 15.66B | 59.50B | 49.32B | 21.74B | 17.61B | 16.31B | 4.76B | 4.68B | 4.49B | 4.28B | 3.96B | 3.82B | 3.68B | 3.64B | 3.63B | 3.71B | 3.40B | 2.90B |

| Cost of Revenue | 15.30B | 15.79B | 12.66B | 12.01B | 13.52B | 13.99B | 12.77B | 12.98B | 13.73B | 14.32B | 15.09B | 12.57B | 5.15B | 0.00 | 0.00 | 5.02B | 4.50B | 5.23B | 7.86B | 13.43B | 13.66B | 6.95B | 49.50B | 40.45B | 14.91B | 11.18B | 10.41B | 1.14B | 1.21B | 1.26B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 13.76B | 12.98B | 11.96B | 11.35B | 11.56B | 10.53B | 10.80B | 9.77B | 9.73B | 9.60B | 9.50B | 7.05B | 9.38B | 14.27B | 12.73B | 8.19B | 8.22B | 9.95B | 8.88B | 9.07B | 8.87B | 8.71B | 10.00B | 8.87B | 6.84B | 6.43B | 5.90B | 3.62B | 3.46B | 3.23B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit Ratio | 47.34% | 45.11% | 48.57% | 48.59% | 46.09% | 42.94% | 45.81% | 42.95% | 41.48% | 40.13% | 38.64% | 35.93% | 64.59% | 100.00% | 100.00% | 61.99% | 64.60% | 65.54% | 53.05% | 40.31% | 39.39% | 55.60% | 16.81% | 17.98% | 31.44% | 36.51% | 36.18% | 76.10% | 74.07% | 71.97% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 6.69B | 168.00M | 452.00M | 267.00M | 430.00M | 399.00M | 352.00M | 324.00M | 307.00M | 351.00M | 262.00M | 397.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 6.69B | 6.55B | 6.12B | 5.82B | 5.86B | 5.35B | 4.76B | 4.44B | 4.28B | 4.28B | 4.11B | 3.27B | 6.28B | 11.81B | 10.52B | 5.75B | 5.72B | 7.26B | 5.99B | 6.02B | 9.50B | 6.26B | 5.90B | 5.05B | 5.04B | 4.00B | 3.93B | 2.26B | 2.12B | 2.05B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cost & Expenses | 21.96B | 22.34B | 18.78B | 17.83B | 19.37B | 19.35B | 17.53B | 17.41B | 18.01B | 18.60B | 19.20B | 15.85B | 11.43B | 11.81B | 10.52B | 10.77B | 10.22B | 12.49B | 13.86B | 19.46B | 23.15B | 13.21B | 55.40B | 45.51B | 19.95B | 15.18B | 14.34B | 3.40B | 3.33B | 3.31B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Income | 29.00M | 27.00M | 13.00M | 30.00M | 31.00M | 20.00M | 13.00M | 21.00M | 38.00M | 57.00M | 26.00M | 50.00M | 53.00M | 67.00M | 77.00M | 130.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 3.01B | 2.44B | 2.21B | 2.10B | 2.20B | 2.09B | 1.99B | 1.92B | 1.61B | 1.62B | 1.55B | 1.24B | 859.00M | 840.00M | 751.00M | 741.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 6.08B | 5.84B | 5.66B | 5.49B | 4.55B | 4.07B | 3.53B | 3.29B | 3.14B | 3.07B | 2.81B | 2.29B | 1.81B | 1.99B | 1.85B | 1.83B | 1.89B | 2.22B | 1.88B | 2.04B | 1.99B | 1.69B | 1.45B | 1.35B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA | 13.29B | 12.40B | 11.63B | 10.94B | 10.85B | 9.24B | 9.78B | 8.94B | 8.49B | 8.42B | 8.27B | 5.98B | 5.13B | 4.84B | 4.24B | 4.30B | 4.39B | 3.61B | 3.20B | 5.21B | 1.25B | 4.29B | 5.14B | 4.44B | 2.97B | 3.54B | 2.81B | 1.90B | 1.90B | 1.70B | 4.28B | 3.96B | 3.82B | 3.68B | 3.64B | 3.63B | 3.71B | 3.40B | 2.90B |

| EBITDA Ratio | 45.73% | 43.71% | 48.86% | 39.87% | 43.24% | 39.69% | 42.58% | 39.29% | 38.25% | 37.07% | 34.92% | 33.68% | 34.95% | 17.24% | 17.67% | 30.80% | 31.16% | 22.53% | 13.44% | 21.40% | 4.46% | 23.78% | 9.07% | 10.06% | 12.41% | 18.59% | 17.26% | 40.01% | 40.69% | 37.89% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Operating Income | 7.07B | 6.01B | 5.50B | 4.57B | 5.71B | 4.69B | 5.78B | 5.34B | 5.37B | 5.26B | 4.98B | 3.13B | 2.78B | 2.46B | 2.25B | 2.43B | 2.50B | 2.69B | 2.89B | 3.05B | -625.00M | 2.45B | 4.10B | 3.81B | 1.80B | 2.43B | 1.97B | 1.36B | 1.35B | 1.18B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Income Ratio | 24.33% | 20.90% | 22.34% | 19.56% | 22.76% | 19.11% | 24.53% | 23.48% | 22.88% | 21.98% | 20.25% | 15.93% | 19.11% | 17.24% | 17.67% | 18.42% | 19.64% | 17.72% | 17.26% | 13.54% | -2.77% | 15.65% | 6.89% | 7.73% | 8.26% | 13.82% | 12.08% | 28.63% | 28.85% | 26.28% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | -2.30B | -1.93B | -1.51B | -3.65B | -1.61B | -1.61B | -1.36B | -1.47B | -1.46B | -1.12B | -1.06B | -675.00M | -312.00M | -251.00M | -418.00M | -620.00M | -264.00M | 133.00M | 2.50B | -1.39B | -972.00M | -696.00M | -538.00M | -293.00M | -519.00M | -448.00M | -356.80M | -369.80M | -386.00M | -143.80M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Income Before Tax | 4.77B | 4.08B | 3.99B | 920.00M | 4.10B | 3.07B | 4.27B | 3.73B | 4.14B | 4.13B | 3.92B | 2.45B | 2.47B | 2.21B | 1.83B | 1.90B | 2.23B | 2.86B | 3.82B | 1.77B | -1.71B | 1.65B | 3.14B | 2.80B | 1.30B | 2.04B | 1.61B | 1.21B | 1.18B | 1.04B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Income Before Tax Ratio | 16.40% | 14.18% | 16.21% | 3.94% | 16.34% | 12.53% | 18.10% | 16.42% | 17.64% | 17.28% | 15.94% | 12.49% | 16.97% | 15.48% | 14.38% | 14.35% | 17.56% | 18.85% | 22.79% | 7.87% | -7.60% | 10.55% | 5.28% | 5.67% | 5.98% | 11.57% | 9.89% | 25.34% | 25.25% | 23.08% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 438.00M | 300.00M | 268.00M | -169.00M | 519.00M | 448.00M | 1.20B | 1.16B | 1.33B | 1.67B | 1.26B | 705.00M | 752.00M | 890.00M | 758.00M | 616.00M | 712.00M | 843.00M | 1.28B | 540.00M | -707.00M | 618.00M | 1.15B | 1.02B | 453.00M | 777.00M | 638.90M | 475.70M | 466.40M | 397.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Net Income | 2.84B | 2.55B | 3.91B | 1.38B | 3.75B | 2.67B | 3.06B | 2.15B | 2.82B | 1.88B | 2.67B | 1.77B | 1.71B | 1.32B | 1.08B | 1.36B | 1.50B | 1.86B | 1.82B | 1.49B | -1.32B | 1.03B | 1.90B | 1.78B | 1.51B | 1.25B | 974.40M | 730.00M | 714.50M | 638.90M | 626.40M | 508.10M | 583.60M | 538.20M | 571.60M | 448.10M | 500.20M | 467.80M | 437.60M |

| Net Income Ratio | 9.78% | 8.86% | 15.87% | 5.89% | 14.94% | 10.87% | 12.98% | 9.46% | 12.00% | 7.87% | 10.83% | 9.01% | 11.74% | 9.25% | 8.44% | 10.31% | 11.79% | 12.27% | 10.89% | 6.62% | -5.87% | 6.60% | 3.19% | 3.60% | 6.93% | 7.11% | 5.97% | 15.34% | 15.28% | 14.23% | 14.63% | 12.83% | 15.29% | 14.62% | 15.71% | 12.35% | 13.50% | 13.76% | 15.10% |

| EPS | 3.55 | 3.33 | 4.94 | 1.72 | 5.06 | 3.77 | 4.36 | 3.11 | 4.05 | 2.66 | 3.77 | 3.07 | 3.83 | 3.00 | 2.49 | 3.24 | 3.57 | 4.77 | 11.64 | 4.77 | -4.44 | 3.66 | 7.35 | 7.17 | 6.12 | 5.12 | 3.77 | 4.28 | 4.88 | 4.32 | 3.18 | 3.33 | 3.90 | 3.60 | 3.87 | 2.94 | 3.30 | 3.03 | 2.79 |

| EPS Diluted | 3.55 | 3.33 | 4.94 | 1.72 | 5.06 | 3.77 | 4.36 | 3.11 | 4.05 | 2.66 | 3.76 | 3.07 | 3.83 | 3.00 | 2.49 | 3.21 | 3.54 | 4.71 | 11.28 | 4.62 | -4.44 | 3.66 | 7.32 | 7.14 | 6.09 | 5.10 | 3.75 | 4.25 | 4.88 | 4.32 | 3.18 | 3.33 | 3.90 | 3.60 | 3.87 | 2.94 | 3.30 | 3.03 | 2.79 |

| Weighted Avg Shares Out | 771.00M | 770.00M | 769.00M | 737.00M | 729.00M | 708.00M | 700.00M | 691.00M | 694.00M | 707.00M | 706.00M | 574.00M | 444.00M | 439.00M | 431.00M | 421.67M | 420.00M | 390.00M | 312.00M | 310.48M | 301.00M | 278.96M | 255.67M | 245.33M | 243.00M | 240.67M | 240.00M | 240.80M | 136.57M | 136.57M | 136.29M | 135.65M | 135.62M | 134.89M | 134.13M | 134.29M | 135.12M | 134.98M | 135.02M |

| Weighted Avg Shares Out (Dil) | 771.00M | 770.00M | 769.00M | 738.00M | 729.00M | 708.00M | 700.00M | 691.00M | 694.00M | 707.00M | 706.00M | 575.00M | 444.00M | 440.00M | 431.33M | 422.33M | 422.00M | 396.00M | 324.33M | 320.56M | 301.33M | 278.96M | 257.38M | 246.08M | 244.17M | 241.37M | 240.43M | 240.80M | 136.64M | 136.59M | 136.29M | 135.65M | 135.62M | 134.89M | 134.13M | 134.29M | 135.12M | 134.98M | 135.02M |

Dividend Champion And Contender Highlights: Week Of September 13

Rotating Into Value For The Remainder Of 2020

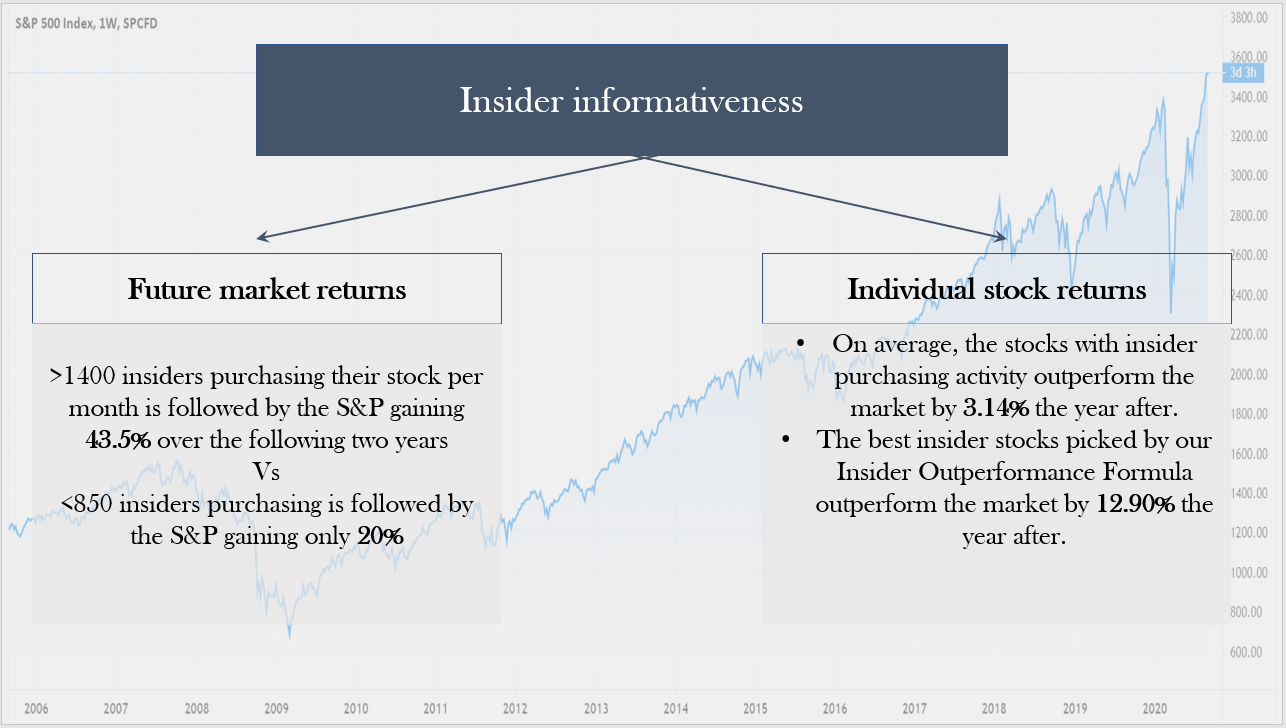

What Insiders Have To Say About This All-Time High - August 2020 Insider Update

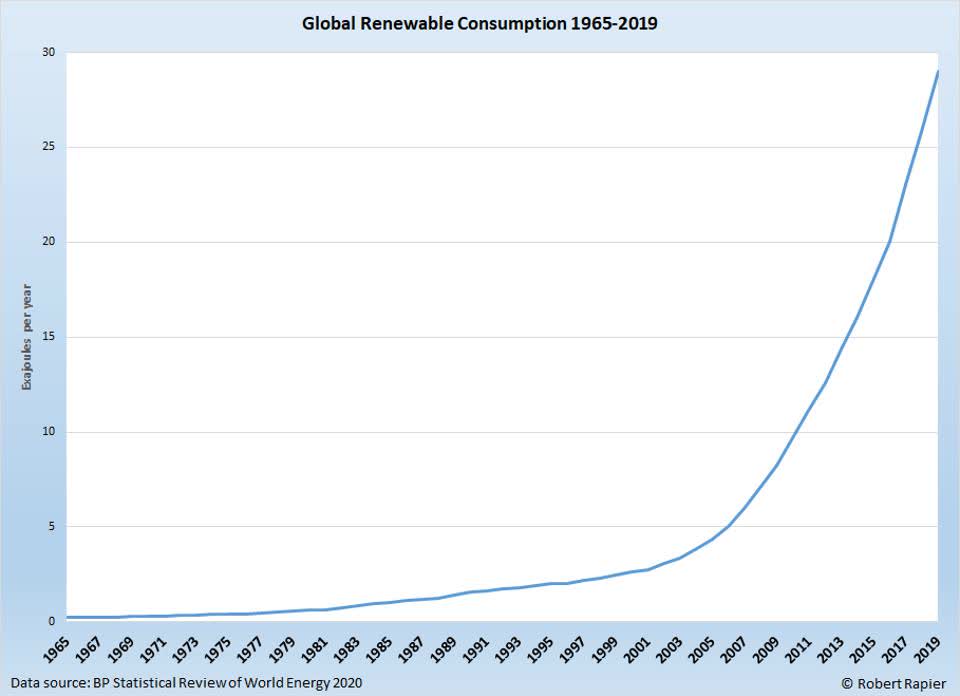

Renewable Energy Is Set For Exponential Growth In The Years Ahead

The Retiree's Dividend Portfolio - John's July Update: The Roth IRA Shows Weakness

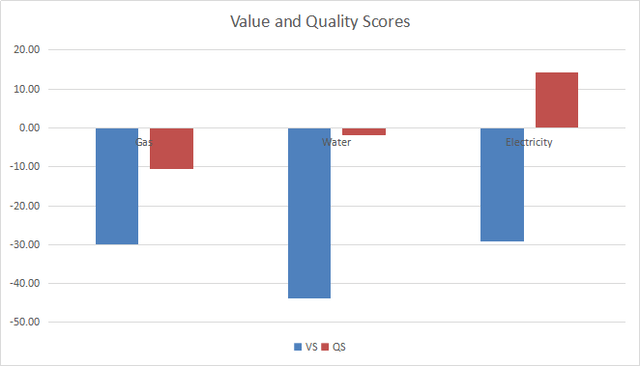

Utilities Dashboard For August

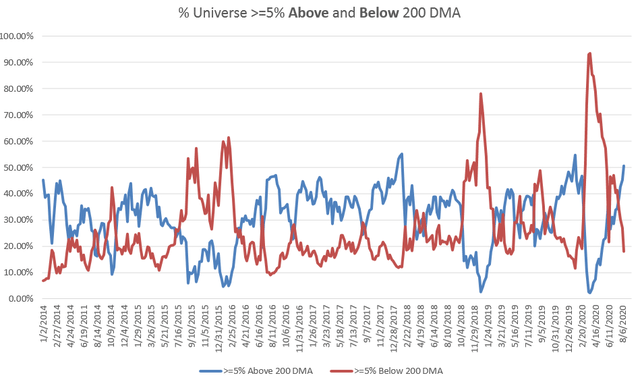

Why I'm Worrying Over A Market Drop

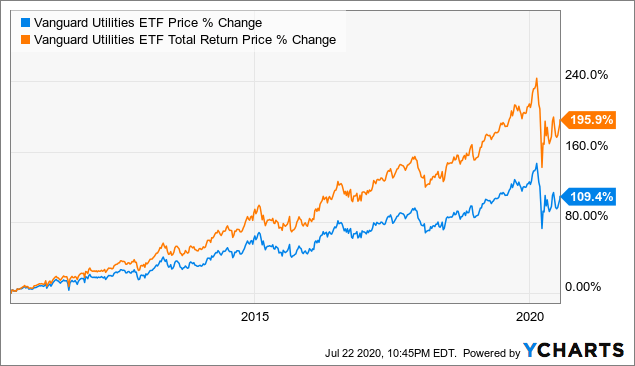

Vanguard Utilities ETF: The Current Low Rate Environment Should Support Its Higher Fund Price

Different Perspectives On The Success Or Failure Of Dominion Energy

The Retiree's Dividend Portfolio - John's May Update: Selling Kimco Preferred Series L For Better Opportunities

Source: https://incomestatements.info

Category: Stock Reports