See more : GT Legend Automotive Holdings Inc. (GTLA) Income Statement Analysis – Financial Results

Complete financial analysis of Eastside Distilling, Inc. (EAST) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Eastside Distilling, Inc., a leading company in the Beverages – Wineries & Distilleries industry within the Consumer Defensive sector.

- Intervacc AB (publ) (IVACC.ST) Income Statement Analysis – Financial Results

- Prologic Management Systems, Inc. (PRLO) Income Statement Analysis – Financial Results

- Lisi S.A. (FII.PA) Income Statement Analysis – Financial Results

- Ellington Financial Inc. (EFC-PB) Income Statement Analysis – Financial Results

- CEAT Limited (CEATLTD.BO) Income Statement Analysis – Financial Results

Eastside Distilling, Inc. (EAST)

Industry: Beverages - Wineries & Distilleries

Sector: Consumer Defensive

Website: https://www.eastsidedistilling.com

About Eastside Distilling, Inc.

Eastside Distilling, Inc. manufactures, acquires, blends, bottles, imports, exports, markets, and sells various alcoholic beverages. It operates through two segments, Spirits and Craft Canning and Bottling. The company provides whiskey under the Burnside Whiskey brand; vodka under the Portland Potato Vodka brand; rum under the Hue-Hue Coffee Rum brand; and tequila under the Azuñia Tequila brand. It also offers gin and ready-to-drink products; and canning and bottling services to the craft beer and cider industries. The company sells its products on a wholesale basis to distributors in the United States. Eastside Distilling, Inc. was founded in 2008 and is headquartered in Portland, Oregon.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 10.50M | 13.88M | 12.39M | 13.72M | 15.60M | 6.12M | 2.61M | 2.11M | 1.70M | 1.06M | 64.04K | 122.32K | 74.68K |

| Cost of Revenue | 9.44M | 11.44M | 9.48M | 9.16M | 10.14M | 3.81M | 1.63M | 1.28M | 870.39K | 494.89K | 8.22K | 9.29K | 1.56K |

| Gross Profit | 1.06M | 2.44M | 2.91M | 4.56M | 5.46M | 2.31M | 976.93K | 827.96K | 832.23K | 560.56K | 55.82K | 113.04K | 73.12K |

| Gross Profit Ratio | 10.11% | 17.58% | 23.48% | 33.21% | 34.99% | 37.73% | 37.42% | 39.27% | 48.88% | 53.11% | 87.17% | 92.41% | 97.92% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 4.65M | 6.41M | 6.78M | 9.21M | 11.54M | 6.23M | 3.55M | 3.88M | 4.37M | 1.37M | 137.59K | 164.08K | 83.34K |

| Selling & Marketing | 1.60M | 2.63M | 2.61M | 3.90M | 7.50M | 4.35M | 2.22M | 1.24M | 923.31K | 303.00K | 56.00K | 53.00K | 0.00 |

| SG&A | 6.25M | 9.03M | 9.39M | 13.11M | 19.04M | 10.57M | 5.77M | 5.13M | 4.37M | 1.37M | 137.59K | 164.08K | 83.34K |

| Other Expenses | -364.00K | 52.00K | 2.10M | -372.00K | -2.67M | 2.70K | -212.99K | -39.19K | -59.55K | -3.74K | 10.74K | 8.81K | 82.00 |

| Operating Expenses | 5.88M | 9.03M | 9.39M | 13.11M | 19.04M | 10.57M | 5.77M | 5.13M | 4.37M | 1.37M | 137.59K | 164.08K | 83.42K |

| Cost & Expenses | 15.68M | 20.47M | 18.88M | 22.27M | 29.18M | 14.38M | 7.40M | 6.41M | 5.24M | 1.86M | 145.80K | 173.37K | 84.98K |

| Interest Income | 0.00 | 2.22M | 1.25M | 1.09M | 508.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 1.11M | 2.22M | 1.25M | 1.09M | 523.39K | 789.36K | 235.05K | 862.47K | 0.00 | 0.00 | 15.21K | 14.77K | 12.36K |

| Depreciation & Amortization | 1.36M | 1.40M | 1.30M | 2.30M | 1.70M | 364.81K | 92.02K | 21.99K | 19.28K | 5.89K | 10.74K | 8.81K | 0.00 |

| EBITDA | -5.07M | -12.65M | -3.50M | -6.26M | -10.92M | -7.89M | -4.95M | -4.32M | -3.52M | -799.90K | -81.77K | -51.05K | -10.30K |

| EBITDA Ratio | -48.30% | -47.10% | -35.35% | -65.04% | -104.20% | -128.90% | -188.05% | -204.67% | -206.87% | 231.77% | -110.91% | -34.54% | -13.79% |

| Operating Income | -4.82M | -6.59M | -6.48M | -8.55M | -13.58M | -8.26M | -4.83M | -4.30M | -3.54M | -4.05M | -81.77K | -51.05K | -10.30K |

| Operating Income Ratio | -45.91% | -47.48% | -52.29% | -62.33% | -87.08% | -134.91% | -184.98% | -203.86% | -208.00% | -383.91% | -127.69% | -41.73% | -13.79% |

| Total Other Income/Expenses | -2.72M | -9.62M | 846.00K | -1.46M | -3.18M | -786.66K | -448.04K | -901.66K | -59.55K | -3.74K | -4.47K | -5.97K | -12.36K |

| Income Before Tax | -7.54M | -16.27M | -6.05M | -9.65M | -16.91M | -9.05M | -5.28M | -5.20M | -3.60M | -4.06M | -86.24K | -57.02K | -22.66K |

| Income Before Tax Ratio | -71.77% | -117.16% | -48.85% | -70.31% | -108.41% | -147.75% | -202.14% | -246.63% | -211.50% | -384.26% | -134.67% | -46.61% | -30.34% |

| Income Tax Expense | 0.00 | 150.00K | -1.74M | -1.36M | -3.84M | 2.70K | 21.46K | 823.28K | 0.00 | 1.50K | 15.21K | 14.77K | 0.00 |

| Net Income | -7.54M | -16.42M | -4.31M | -8.29M | -13.07M | -9.05M | -5.28M | -5.20M | -3.60M | -4.06M | -86.24K | -57.02K | -22.66K |

| Net Income Ratio | -71.77% | -118.25% | -34.80% | -60.43% | -83.77% | -147.75% | -202.12% | -246.63% | -211.50% | -384.40% | -134.67% | -46.61% | -30.34% |

| EPS | -7.04 | -21.41 | -6.79 | -16.54 | -28.17 | -29.79 | -28.39 | -83.38 | -94.45 | -145.88 | -6.88 | -5.38 | -2.14 |

| EPS Diluted | -7.04 | -21.41 | -6.79 | -16.54 | -28.17 | -29.79 | -28.39 | -83.38 | -94.45 | -145.88 | -6.88 | -5.38 | -2.14 |

| Weighted Avg Shares Out | 1.09M | 766.85K | 635.40K | 501.35K | 463.80K | 303.72K | 185.90K | 62.36K | 38.13K | 27.81K | 12.53K | 10.59K | 10.59K |

| Weighted Avg Shares Out (Dil) | 1.09M | 766.85K | 635.40K | 501.35K | 463.80K | 303.72K | 185.90K | 62.36K | 38.13K | 27.81K | 12.53K | 10.59K | 10.59K |

Northern Virginia's 5 Best Apple Picking Farms (& Pumpkin Picking, Too!) - Grace & Lightness Magazine

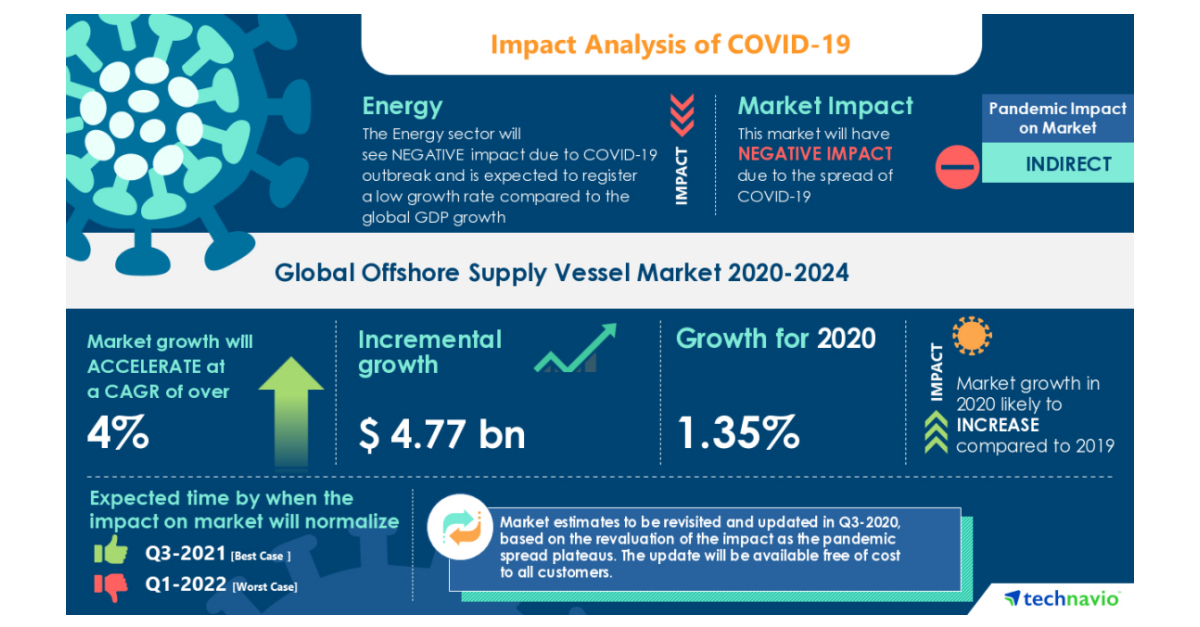

COVID-19 Recovery Analysis: Global Offshore Supply Vessel Market | Increasing Number of Global Offshore Oil and Gas Drills to Boost Market Growth | Technavio

Venture-Backed Hitch Works, Inc. is Changing How the Workplace Sees its Workforce

Whiskey sour recipe from the Irish Whiskey Museum

Sports Illustrated Unveils Preseason SI99 of Nation’s Top High School Football Prospects

Eastside Distilling, Inc. (EAST) CEO Paul Block on Q2 2020 Results - Earnings Call Transcript

Eastside Distilling (NASDAQ:EAST) Stock Rating Lowered by Zacks Investment Research

Eastside Distilling, Inc. (EAST) CEO Lawrence Firestone on Q1 2020 Results - Earnings Call Transcript

10 Best Music Scenes In Movies, Ranked

British Honey Company Collaborate with List Distillery of the US - DirectorsTalk

Source: https://incomestatements.info

Category: Stock Reports