See more : General Plastic Industrial Co., Ltd. (6128.TW) Income Statement Analysis – Financial Results

Complete financial analysis of Eagle Point Credit Company Inc. 6.6875% NT 28 (ECCX) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Eagle Point Credit Company Inc. 6.6875% NT 28, a leading company in the Asset Management industry within the Financial Services sector.

- MMEX Resources Corporation (MMEX) Income Statement Analysis – Financial Results

- Lument Finance Trust, Inc. (LFT-PA) Income Statement Analysis – Financial Results

- Industrias Bachoco, S.A.B. de C.V. (BACHOCOB.MX) Income Statement Analysis – Financial Results

- Brunswick Corporation 6.500% Se (BC-PA) Income Statement Analysis – Financial Results

- Yusin Holding Corp. (4557.TW) Income Statement Analysis – Financial Results

Eagle Point Credit Company Inc. 6.6875% NT 28 (ECCX)

About Eagle Point Credit Company Inc. 6.6875% NT 28

Eagle Point Credit Co., Inc. is a closed-end investment company. Its investment objective is to generate high current income, and generate capital appreciation by investing primarily in equity and junior debt tranches of CLOs. The company was founded on March 24, 2014 and is headquartered in Greenwich, CT.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 |

|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 139.07M | -92.73M | 140.84M | 64.06M | -5.37M | -49.60M | 35.10M | 57.76M | 42.35M | 23.00M |

| Cost of Revenue | 0.00 | 27.14M | 21.18M | 15.02M | 16.60M | 17.77M | 16.32M | 13.61M | 0.00 | 0.00 |

| Gross Profit | 139.07M | -119.87M | 119.66M | 49.04M | -21.97M | -67.37M | 18.78M | 44.14M | 42.35M | 23.00M |

| Gross Profit Ratio | 100.00% | 129.27% | 84.96% | 76.55% | 408.95% | 135.83% | 53.51% | 76.43% | 100.00% | 100.00% |

| Research & Development | 0.00 | -0.85 | 1.44 | 2.29 | -0.15 | -0.76 | 0.46 | 1.58 | 0.00 | 0.00 |

| General & Administrative | 37.92M | 7.23M | 6.83M | 3.18M | 3.33M | 5.46M | 3.20M | 15.36M | 13.20M | 2.40M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -15.36M | 0.00 | 0.00 |

| SG&A | 37.92M | 7.23M | 6.83M | 3.18M | 3.33M | 5.46M | 3.20M | 1.57 | 13.20M | 2.40M |

| Other Expenses | 0.00 | 1.85M | 2.15M | -6.52K | -7.22K | -213.56K | 760.20K | -7.94M | 0.00 | 0.00 |

| Operating Expenses | 37.92M | 9.08M | 8.98M | 3.17M | 3.32M | 5.25M | 3.96M | 42.68M | 80.79M | 14.65M |

| Cost & Expenses | 37.92M | 9.08M | 8.98M | 3.17M | 3.32M | 5.25M | 3.96M | 42.68M | 80.79M | 14.65M |

| Interest Income | 131.72M | 111.04M | 81.88M | 58.54M | 61.59M | 65.20M | 60.92M | 7.94M | 2.52M | 0.00 |

| Interest Expense | 13.63M | 14.13M | 14.47M | 10.50M | 13.46M | 14.80M | 12.93M | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 31.23M | 206.02M | -55.21M | -43.96M | 67.17M | 125.11M | 36.74M | -33.21M | -28.59M | -20.60M |

| EBITDA | 132.38M | -87.68M | 0.00 | 0.00 | -8.69M | -40.05M | 44.06M | 51.27M | 0.00 | 0.00 |

| EBITDA Ratio | 95.19% | 94.56% | 93.62% | 95.05% | 161.79% | 80.75% | 125.54% | 88.77% | -164.23% | -53.29% |

| Operating Income | 101.15M | -87.68M | 131.86M | 60.89M | -8.69M | -40.05M | 44.06M | 39.31M | 28.59M | 20.60M |

| Operating Income Ratio | 72.73% | 94.56% | 93.62% | 95.05% | 161.79% | 80.75% | 125.54% | 68.06% | 67.51% | 89.57% |

| Total Other Income/Expenses | 17.60M | -14.13M | 0.00 | 0.00 | 0.00 | -14.80M | 16.32M | -384.79K | -69.54M | -12.25M |

| Income Before Tax | 118.75M | -101.81M | 131.86M | 60.89M | -8.69M | -54.85M | 31.13M | 90.58M | -40.96M | 8.34M |

| Income Before Tax Ratio | 85.39% | 109.79% | 93.62% | 95.05% | 161.79% | 110.58% | 88.70% | 156.83% | -96.72% | 36.29% |

| Income Tax Expense | 0.00 | 82.99M | 150.00K | 36.48M | 33.71M | -161.14K | 44.82M | 98.90M | -69.54M | -12.25M |

| Net Income | 116.89M | -101.81M | 131.86M | 60.89M | -8.69M | -54.85M | 31.13M | 90.96M | -40.96M | 8.34M |

| Net Income Ratio | 84.05% | 109.79% | 93.62% | 95.05% | 161.79% | 110.58% | 88.70% | 157.50% | -96.72% | 36.29% |

| EPS | 1.52 | -2.17 | 3.51 | 1.88 | -0.30 | -2.37 | 1.76 | 15.11M | -2.96 | 1.02 |

| EPS Diluted | 1.52 | -2.17 | 3.51 | 1.88 | -0.30 | -2.27 | 1.76 | 15.11M | -2.96 | 1.02 |

| Weighted Avg Shares Out | 76.95M | 46.89M | 37.53M | 32.35M | 28.63M | 23.15M | 17.69M | 6.02 | 13.82M | 8.16M |

| Weighted Avg Shares Out (Dil) | 76.95M | 46.89M | 37.53M | 32.35M | 28.63M | 24.16M | 17.69M | 6.02 | 13.82M | 8.16M |

The Chemist's Quality Closed-End Fund Report: August 2020

Weekly Closed-End Fund Roundup: August 30, 2020

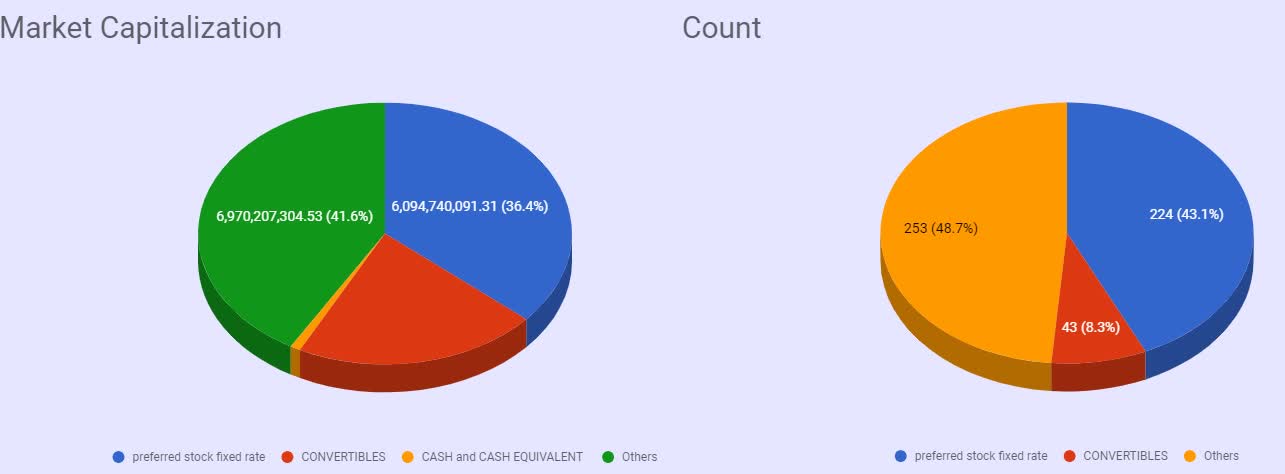

Fixed-Rate Preferred Stocks - Complete Review

What We Hold Across The CLO Equity Capital Structures

How To Get CEF Yields Without CEF Problems

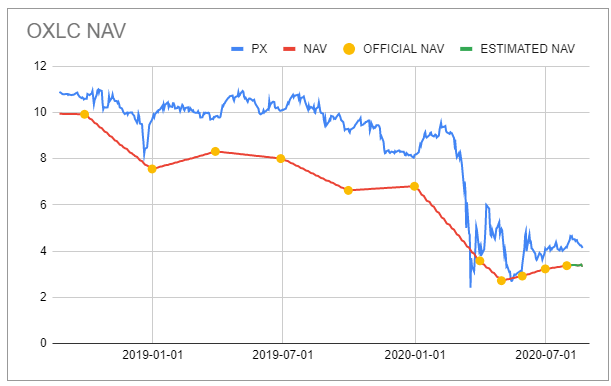

Eagle Point Credit Company Inc. (ECC) CEO Tom Majewski on Q2 2020 Results - Earnings Call Transcript

The Chemist's Closed-End Fund Report: July 2020

Rare 12% Yield And 38% Discount: HFRO

Weekly Closed-End Fund Roundup: July 19, 2020

Weekly Closed-End Fund Roundup: TYG/NTG Reinstates Distributions (July 12, 2020)

Source: https://incomestatements.info

Category: Stock Reports