See more : Social Capital Suvretta Holdings Corp. I (DNAA) Income Statement Analysis – Financial Results

Complete financial analysis of Echo Global Logistics, Inc. (ECHO) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Echo Global Logistics, Inc., a leading company in the Integrated Freight & Logistics industry within the Industrials sector.

- China Energy Engineering Corporation Limited (601868.SS) Income Statement Analysis – Financial Results

- Rightmove plc (RTMVF) Income Statement Analysis – Financial Results

- Maire Tecnimont S.p.A. (3OY1.F) Income Statement Analysis – Financial Results

- Ningbo Tuopu Group Co.,Ltd. (601689.SS) Income Statement Analysis – Financial Results

- California-Engels Mining Company (CAEN) Income Statement Analysis – Financial Results

Echo Global Logistics, Inc. (ECHO)

About Echo Global Logistics, Inc.

Echo Global Logistics, Inc. provides technology-enabled transportation and supply chain management solutions in the United States. It utilizes a proprietary technology platform to compile and analyze data from its multi-modal network of transportation providers for the transportation and logistics needs. The company offers services in various transportation modes, such as truckload, less-than truckload, small parcel, domestic air, and expedited and international. It also provides various transportation management and logistics services, which include rate negotiation; procurement of transportation; shipment execution and tracking; carrier management, selection, reporting, and compliance; executive dashboard presentations and detailed shipment reports; freight bill payment and audit; claims processing and service refund management; design and management of inbound client freight programs; individually configured Web portals and self-service data warehouses; enterprise resource planning integration with transactional shipment data; and integration of shipping applications into client e-commerce sites, as well as back-end reports customized to the internal reporting needs of the business. The company serves manufacturing, construction, food and beverage, consumer products, and retail industries. Echo Global Logistics, Inc. was founded in 2005 and is headquartered in Chicago, Illinois.

| Metric | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 2.51B | 2.18B | 2.44B | 1.94B | 1.72B | 1.51B | 1.17B | 884.19M | 757.69M | 602.76M | 426.37M | 259.56M | 202.81M | 95.46M | 33.19M |

| Cost of Revenue | 2.16B | 1.84B | 2.06B | 1.64B | 1.43B | 1.25B | 979.04M | 739.11M | 623.70M | 485.55M | 345.21M | 203.89M | 159.72M | 74.58M | 27.70M |

| Gross Profit | 354.71M | 347.65M | 383.73M | 306.31M | 286.44M | 266.12M | 194.34M | 145.09M | 133.99M | 117.22M | 81.17M | 55.67M | 43.09M | 20.89M | 5.49M |

| Gross Profit Ratio | 14.12% | 15.91% | 15.73% | 15.76% | 16.69% | 17.60% | 16.56% | 16.41% | 17.68% | 19.45% | 19.04% | 21.45% | 21.25% | 21.88% | 16.54% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 313.13M | 330.16M | 287.23M | 270.83M | 243.21M | 166.81M | 121.88M | 113.45M | 89.95M | 60.78M | 44.82M | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 0.00 | 313.13M | 330.16M | 287.23M | 270.83M | 243.21M | 166.81M | 121.88M | 113.45M | 89.95M | 60.78M | 44.82M | 0.00 | 0.00 | 0.00 |

| Other Expenses | 325.21M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 8.33M | 6.93M | 4.99M | 38.15M | 18.17M | 5.94M |

| Operating Expenses | 325.21M | 313.13M | 330.16M | 287.23M | 270.83M | 243.21M | 166.81M | 121.88M | 113.45M | 98.28M | 67.70M | 49.81M | 38.15M | 18.17M | 5.94M |

| Cost & Expenses | 2.48B | 2.15B | 2.39B | 1.92B | 1.70B | 1.49B | 1.15B | 860.99M | 737.16M | 583.83M | 412.91M | 253.70M | 197.86M | 92.75M | 33.65M |

| Interest Income | 0.00 | 0.00 | 0.00 | 31.88K | 0.00 | 23.91K | 0.00 | 0.00 | 2.85K | 115.75K | 93.10K | 23.97K | 20.26K | 208.06K | 218.24K |

| Interest Expense | 5.99M | 12.64M | 15.55M | 14.77M | 14.23M | 11.28M | 105.40K | 1.36K | 9.39K | 21.15K | 51.41K | 792.30K | 111.74K | 11.94K | 0.00 |

| Depreciation & Amortization | 38.49M | 38.39M | 36.64M | 32.73M | 32.14M | 24.14M | 13.88M | 10.56M | 9.14M | 8.33M | 6.93M | 4.99M | 3.23M | 1.85M | 691.39K |

| EBITDA | 67.99M | 72.90M | 90.20M | 51.85M | 47.75M | 46.95M | 41.26M | 33.41M | 29.25M | 27.01M | 20.15M | 10.37M | 8.14M | 4.76M | 224.97K |

| EBITDA Ratio | 2.71% | 3.34% | 3.70% | 2.67% | 2.78% | 3.10% | 3.52% | 3.78% | 3.86% | 4.48% | 4.73% | 3.99% | 4.02% | 4.99% | 0.68% |

| Operating Income | 29.50M | 34.52M | 53.57M | 19.09M | 15.61M | 22.91M | 27.53M | 23.20M | 20.53M | 18.93M | 13.46M | 5.86M | 4.95M | 2.71M | -453.03K |

| Operating Income Ratio | 1.17% | 1.58% | 2.20% | 0.98% | 0.91% | 1.51% | 2.35% | 2.62% | 2.71% | 3.14% | 3.16% | 2.26% | 2.44% | 2.84% | -1.36% |

| Total Other Income/Expenses | -5.99M | -12.64M | -15.55M | -14.74M | -14.23M | -11.38M | -249.53K | -355.84K | -433.40K | -273.18K | -291.38K | -1.27M | -143.87K | 190.70K | 201.06K |

| Income Before Tax | 23.51M | 21.88M | 38.02M | 4.35M | 1.38M | 11.53M | 27.28M | 22.85M | 20.10M | 18.66M | 13.17M | 4.59M | 4.80M | 2.90M | -251.97K |

| Income Before Tax Ratio | 0.94% | 1.00% | 1.56% | 0.22% | 0.08% | 0.76% | 2.32% | 2.58% | 2.65% | 3.10% | 3.09% | 1.77% | 2.37% | 3.04% | -0.76% |

| Income Tax Expense | 7.68M | 7.03M | 9.30M | -8.27M | -205.96K | 3.68M | 10.49M | 8.65M | 7.78M | 6.61M | 4.77M | -610.54K | 1.93M | 1.17M | -220.17K |

| Net Income | 15.83M | 14.85M | 28.72M | 12.62M | 1.59M | 7.85M | 16.79M | 14.20M | 12.32M | 12.05M | 8.40M | 5.20M | 2.88M | 1.73M | -246.24K |

| Net Income Ratio | 0.63% | 0.68% | 1.18% | 0.65% | 0.09% | 0.52% | 1.43% | 1.61% | 1.63% | 2.00% | 1.97% | 2.00% | 1.42% | 1.81% | -0.74% |

| EPS | 0.60 | 0.55 | 1.03 | 0.46 | 0.06 | 0.29 | 0.73 | 0.62 | 0.55 | 0.54 | 0.38 | 0.42 | 0.24 | 0.07 | -0.01 |

| EPS Diluted | 0.60 | 0.55 | 1.03 | 0.45 | 0.05 | 0.28 | 0.71 | 0.61 | 0.54 | 0.53 | 0.38 | 0.41 | 0.22 | 0.07 | -0.01 |

| Weighted Avg Shares Out | 26.40M | 26.80M | 27.90M | 27.44M | 26.49M | 27.05M | 23.00M | 22.91M | 22.40M | 22.31M | 22.12M | 12.49M | 12.17M | 23.43M | 26.63M |

| Weighted Avg Shares Out (Dil) | 26.40M | 26.80M | 27.90M | 28.00M | 29.30M | 28.10M | 23.60M | 23.40M | 22.90M | 22.73M | 22.12M | 12.81M | 12.82M | 24.90M | 26.63M |

Echo Global Logistics (NASDAQ:ECHO) PT Raised to $30.00

Echo Global Logistics, Inc. (ECHO) CEO Doug Waggoner on Q2 2020 Results - Earnings Call Transcript

Echo Global Logistics, Inc. 2020 Q2 - Results - Earnings Call Presentation

Echo Global Logistics, Inc. (NASDAQ:ECHO) Given Average Recommendation of “Buy” by Brokerages

Echo Global Logistics, Inc. (NASDAQ:ECHO) Shares Purchased by Alliancebernstein L.P.

Echo Global Logistics (NASDAQ:ECHO) Upgraded to “Hold” at Zacks Investment Research

Balyasny Asset Management LLC Buys 7,280 Shares of Echo Global Logistics, Inc. (NASDAQ:ECHO)

Echo Global Logistics (ECHO) – Investment Analysts’ Weekly Ratings Changes

Pass the parcel: How the rise of Instagram, Facebook and email has changed the game for Australia Post - SmartCompany

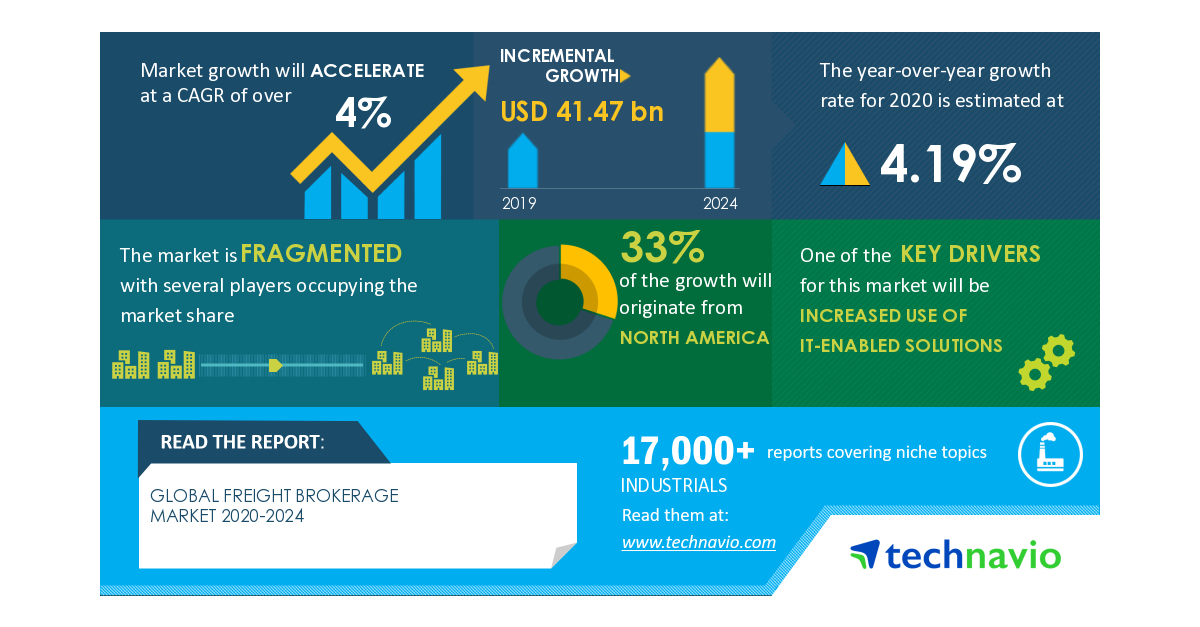

COVID-19 Impact: A Mix of Challenges and Opportunities | Freight Brokerage Market 2020-2024 | Increased Use of IT-Enabled Solutions to Boost Growth | Technavio

Source: https://incomestatements.info

Category: Stock Reports