See more : Signify N.V. (PHPPY) Income Statement Analysis – Financial Results

Complete financial analysis of Morgan Stanley Emerging Markets Domestic Debt Fund, Inc. (EDD) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Morgan Stanley Emerging Markets Domestic Debt Fund, Inc., a leading company in the Asset Management industry within the Financial Services sector.

- HK Electric Investments and HK Electric Investments Limited (HKCVF) Income Statement Analysis – Financial Results

- New Energy Exchange Ltd. (EBODF) Income Statement Analysis – Financial Results

- PT Pratama Abadi Nusa Industri Tbk (PANI.JK) Income Statement Analysis – Financial Results

- Figeac Aero Société Anonyme (FGA.PA) Income Statement Analysis – Financial Results

- Apex Development Public Company Limited (APEX.BK) Income Statement Analysis – Financial Results

Morgan Stanley Emerging Markets Domestic Debt Fund, Inc. (EDD)

Industry: Asset Management

Sector: Financial Services

About Morgan Stanley Emerging Markets Domestic Debt Fund, Inc.

Morgan Stanley Emerging Markets Domestic Debt Fund, Inc. is a closed ended fixed income mutual fund launched and managed by Morgan Stanley Investment Management Inc. The fund invests in fixed income markets of emerging market countries across the globe. It typically invests in government bonds denominated in the local currencies of emerging markets. The fund benchmarks the performance of its portfolio against the JPMorgan Government Bond Index - Emerging Markets Global Diversified Index. Morgan Stanley Emerging Markets Domestic Debt Fund, Inc. was formed on January 25, 2007 and is domiciled in United States.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 38.67M | -84.70M | 6.53M | -26.04M | 64.94M | -56.62M | 31.89M | 55.57M | 73.12M | 89.00M | 112.30M | 122.20M | 137.40M | 134.00M | 122.70M | 192.10M | 89.20M |

| Cost of Revenue | 4.86M | 5.47M | 6.74M | 7.05M | 7.99M | 9.19M | 9.81M | 9.93M | 17.83M | 16.80M | 19.90M | 18.80M | 18.90M | 26.10M | 21.40M | 19.80M | 11.90M |

| Gross Profit | 33.81M | -90.17M | -206.00K | -33.09M | 56.95M | -65.82M | 22.08M | 45.64M | 55.29M | 72.20M | 92.40M | 103.40M | 118.50M | 107.90M | 101.30M | 172.30M | 77.30M |

| Gross Profit Ratio | 87.42% | 106.46% | -3.15% | 127.06% | 87.69% | 116.24% | 69.23% | 82.13% | 75.62% | 81.12% | 82.28% | 84.62% | 86.24% | 80.52% | 82.56% | 89.69% | 86.66% |

| Research & Development | 0.00 | 0.93 | 0.29 | -7.61 | -14.20 | -1.45 | -1.41 | 0.85 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 957.00K | 940.00K | 1.09M | 1.08M | 1.22M | 1.37M | 1.69M | 100.00K | 109.00K | 200.00K | 200.00K | 1.00M | 1.50M | 1.40M | 900.00K | 300.00K | 100.00K |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -100.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 957.00K | 940.00K | 1.09M | 1.08M | 1.22M | 1.37M | 1.69M | 0.85 | 109.00K | 200.00K | 200.00K | 1.00M | 1.50M | 1.40M | 900.00K | 300.00K | 100.00K |

| Other Expenses | 37.71M | 167.00K | 134.00K | 151.00K | 192.00K | 137.00K | -19.00K | 67.13M | 226.00K | 200.00K | 100.00K | 100.00K | 100.00K | 500.00K | 600.00K | 16.50M | 11.90M |

| Operating Expenses | 38.67M | 1.11M | 1.22M | 1.24M | 1.41M | 1.51M | 1.67M | -184.95M | 335.00K | 400.00K | 300.00K | 1.10M | 1.60M | 1.90M | 1.50M | 16.80M | 12.00M |

| Cost & Expenses | 38.67M | 1.11M | 1.22M | 1.24M | 1.41M | 1.51M | 1.67M | 45.64M | 18.16M | 17.20M | 20.20M | 19.90M | 20.50M | 28.00M | 22.90M | 36.60M | 23.90M |

| Interest Income | 28.70M | 27.54M | 29.00M | 35.11M | 49.04M | 62.44M | 58.70M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 2.93M | 2.14M | 1.72M | 3.21M | 7.34M | 7.83M | 6.19M | 4.96M | -319.48M | -153.90M | -114.80M | 8.40M | -120.00M | 154.70M | 240.70M | -540.30M | 68.00M |

| Depreciation & Amortization | 0.00 | 228.49K | 236.56K | 206.30K | 171.86K | 161.14K | 52.52K | -10.28M | -638.93M | -307.70M | -229.60M | 16.80M | -240.00M | 309.80M | 487.40M | -1.09B | 148.00M |

| EBITDA | 39.43M | -83.66M | 5.32M | -27.28M | 63.53M | -50.31M | 36.41M | 225.63M | -583.98M | -235.90M | -137.50M | 119.20M | -123.10M | 415.80M | 587.20M | -934.70M | 213.30M |

| EBITDA Ratio | 101.98% | 98.78% | 81.34% | 104.74% | 97.83% | 88.85% | 114.19% | -306.02% | -798.71% | -265.06% | -122.44% | 97.55% | -89.59% | 310.30% | 478.57% | -486.57% | 239.13% |

| Operating Income | 39.43M | -83.66M | 5.32M | -27.28M | 63.53M | -50.31M | 36.41M | 230.59M | 54.95M | 71.80M | 92.10M | 102.40M | 116.90M | 106.00M | 99.80M | 155.40M | 65.30M |

| Operating Income Ratio | 101.98% | 98.78% | 81.34% | 104.74% | 97.83% | 88.85% | 114.19% | 414.94% | 75.16% | 80.67% | 82.01% | 83.80% | 85.08% | 79.10% | 81.34% | 80.90% | 73.21% |

| Total Other Income/Expenses | -1.95M | -2.14M | 0.00 | -4.89M | 0.00 | -7.83M | -844.00K | -183.33M | -319.46M | -153.80M | -114.80M | 8.40M | -120.00M | 155.10M | 246.70M | -549.80M | 80.00M |

| Income Before Tax | 37.49M | -85.80M | 5.32M | -27.28M | 63.53M | -58.13M | 30.22M | 47.26M | -264.51M | -82.00M | -22.70M | 110.80M | -3.10M | 261.10M | 346.50M | -394.40M | 145.30M |

| Income Before Tax Ratio | 96.94% | 101.31% | 81.34% | 104.74% | 97.83% | 102.67% | 94.77% | 85.05% | -361.77% | -92.13% | -20.21% | 90.67% | -2.26% | 194.85% | 282.40% | -205.31% | 162.89% |

| Income Tax Expense | 0.00 | -80.68M | 7.27M | -22.39M | 70.87M | -161.14K | 37.26M | 230.59M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Net Income | 37.49M | -85.80M | 5.32M | -27.28M | 63.53M | -58.13M | 30.22M | 230.59M | -264.51M | -82.00M | -22.70M | 110.80M | -3.10M | 261.10M | 346.50M | -394.40M | 145.30M |

| Net Income Ratio | 96.94% | 101.31% | 81.34% | 104.74% | 97.83% | 102.67% | 94.77% | 414.94% | -361.77% | -92.13% | -20.21% | 90.67% | -2.26% | 194.85% | 282.40% | -205.31% | 162.89% |

| EPS | 0.57 | -1.30 | 0.08 | -0.41 | 0.96 | -0.88 | 0.45 | 4.88 | -3.89 | -1.17 | -0.32 | 1.53 | -0.04 | 3.61 | 4.79 | -5.38 | 1.98 |

| EPS Diluted | 0.57 | -1.30 | 0.08 | -0.41 | 0.96 | -0.88 | 0.45 | 327.50M | -3.89 | -1.17 | -0.32 | 1.53 | -0.04 | 3.61 | 4.79 | -5.38 | 1.98 |

| Weighted Avg Shares Out | 65.26M | 65.99M | 66.09M | 66.09M | 66.18M | 66.06M | 67.13M | 47.26M | 67.96M | 69.80M | 71.30M | 72.40M | 72.40M | 72.40M | 72.40M | 73.30M | 73.30M |

| Weighted Avg Shares Out (Dil) | 65.26M | 65.99M | 66.09M | 66.09M | 66.18M | 66.06M | 67.15M | 0.70 | 67.96M | 69.80M | 71.30M | 72.40M | 72.40M | 72.40M | 72.40M | 73.30M | 73.30M |

'Scale wins' — Investment companies face more consolidation after Morgan Stanley-Eaton Vance deal, market analyst says

Uber Technologies (NYSE:UBER) PT Lowered to $45.00

Focus: IMF economic forecast and US bank earnings

Here are Morgan Stanley's top picks for the earnings season

| Invezz

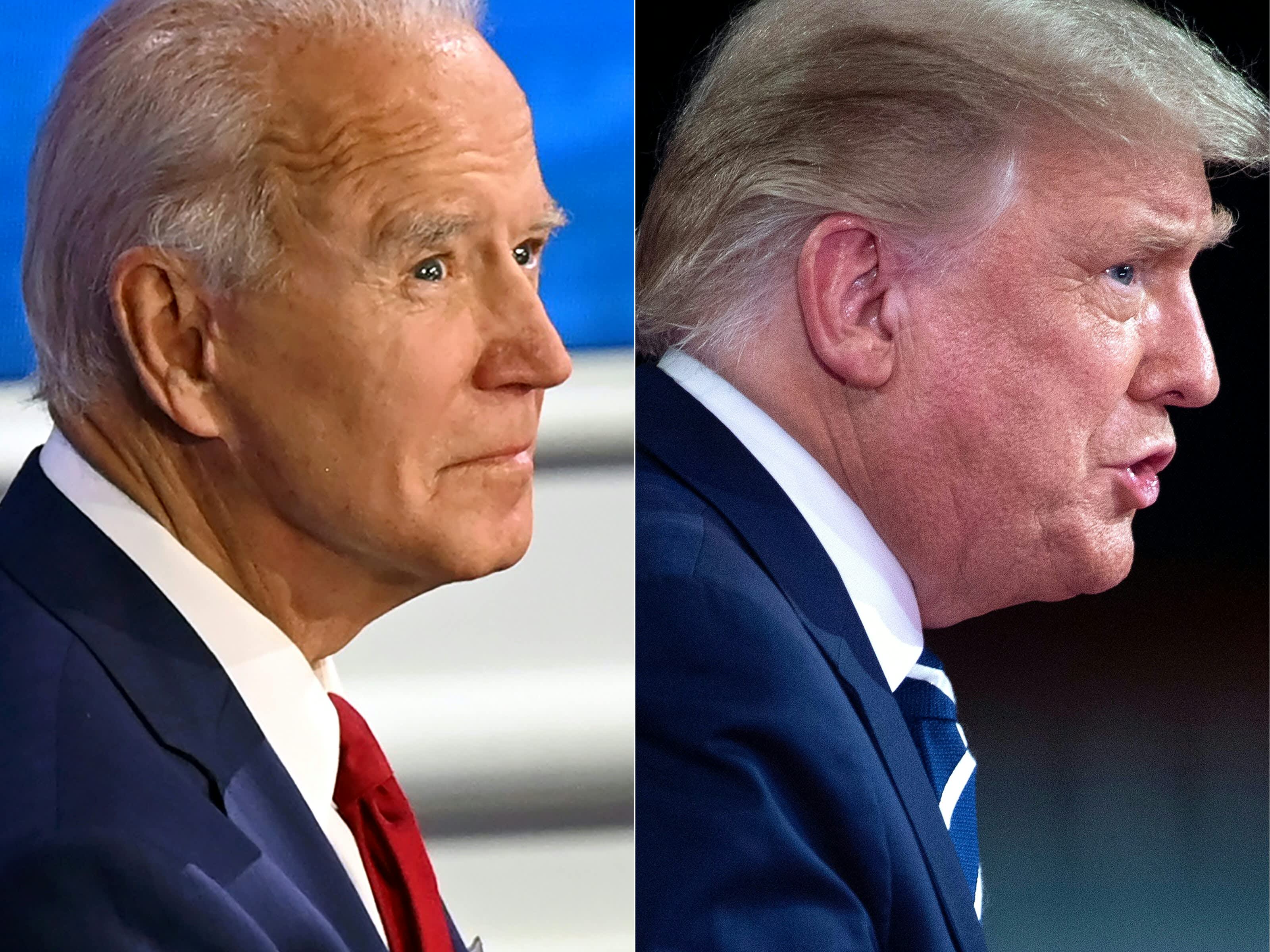

GOP pollster: Americans who are still undecided say they dislike Trump but fear Biden's policies

North Star Investment Management Corp. Purchases 524 Shares of Activision Blizzard, Inc. (NASDAQ:ATVI)

Morgan Stanley's Ridham Desai says Indian markets 'attractive', likes mid-caps

Morgan Stanleys nettoinkomst 2,11 miljarder pund under Q3 | Invezz

Source: https://incomestatements.info

Category: Stock Reports