See more : Verizon Communications Inc. (VERIZ.BR) Income Statement Analysis – Financial Results

Complete financial analysis of Electric Royalties Ltd. (ELECF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Electric Royalties Ltd., a leading company in the Industrial Materials industry within the Basic Materials sector.

- Sanofi India Limited (SANOFI.BO) Income Statement Analysis – Financial Results

- Japan Engine Corporation (6016.T) Income Statement Analysis – Financial Results

- NextSource Materials Inc. (NSRCF) Income Statement Analysis – Financial Results

- TechnipFMC plc (FTI) Income Statement Analysis – Financial Results

- Neuronetics, Inc. (STIM) Income Statement Analysis – Financial Results

Electric Royalties Ltd. (ELECF)

About Electric Royalties Ltd.

Electric Royalties Ltd. focuses on acquiring royalties in mines and projects. The company primarily focuses on various commodities, including lithium, vanadium, manganese, tin, graphite, cobalt, nickel, and copper. Electric Royalties Ltd. is based in Vancouver, Canada.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|---|

| Revenue | 165.81K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 40.80K | 6.82K | 4.54K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 125.01K | -6.82K | -4.54K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit Ratio | 75.39% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Research & Development | 0.00 | 75.29K | 279.15K | 254.64K | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 1.27M | 2.03M | 1.98M | 976.44K | 51.00K | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 258.56K | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 1.27M | 2.03M | 1.98M | 1.23M | 51.00K | 75.51K | 55.96K | 3.11K |

| Other Expenses | -1.15M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 125.01K | 2.11M | 2.25M | 1.49M | 51.00K | 75.51K | 55.96K | 3.11K |

| Cost & Expenses | 165.81K | 2.11M | 2.25M | 1.49M | 51.00K | 75.51K | 55.96K | 3.11K |

| Interest Income | 37.77K | 37.59K | 18.55K | 13.26K | 122.00 | 1.26K | 0.00 | 0.00 |

| Interest Expense | 302.71K | 2.76K | 2.12K | 0.00 | 0.00 | 509.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 47.62K | 6.82K | 4.54K | 1.20M | 51.00K | 0.00 | 0.00 | 0.00 |

| EBITDA | -5.67M | -1.89M | -2.27M | 0.00 | 0.00 | -75.51K | -55.96K | -3.11K |

| EBITDA Ratio | -3,418.75% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Operating Income | -1.30M | -1.90M | -2.27M | -326.03K | -51.00K | -75.51K | -55.96K | -3.11K |

| Operating Income Ratio | -781.20% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | -4.72M | -522.63K | -592.97K | -1.44M | 122.00 | 748.00 | 4.00 | -3.00 |

| Income Before Tax | -6.02M | -1.90M | -2.27M | -2.64M | -50.87K | -74.76K | -55.96K | -3.11K |

| Income Before Tax Ratio | -3,630.03% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | -19.71K | 20.00K | 34.00K | -48.73K | -51.00K | 0.00 | 0.00 | 0.00 |

| Net Income | -6.00M | -1.92M | -2.30M | -2.64M | -50.87K | -74.76K | -55.96K | -3.11K |

| Net Income Ratio | -3,618.14% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| EPS | -0.06 | -0.02 | -0.04 | -0.08 | -0.06 | -0.07 | -0.33 | 0.00 |

| EPS Diluted | -0.06 | -0.02 | -0.04 | -0.08 | -0.06 | -0.07 | -0.33 | 0.00 |

| Weighted Avg Shares Out | 95.77M | 87.55M | 61.26M | 33.00M | 833.34K | 1.00M | 167.12K | 1.00M |

| Weighted Avg Shares Out (Dil) | 95.77M | 87.55M | 61.26M | 33.00M | 833.34K | 1.00M | 167.12K | 1.00M |

Electric Royalties Provides Four Updates on Its Lithium, Copper, Cobalt, and Tin Royalties

Electric Royalties Insider Files Another Early Warning Report

Electric Royalties Announces Interest Conversion Under Convertible Credit Facility

After Electric Royalties' Portfolio Rockets to 72 Assets, Stefan Gleason Further Boosts Equity Stake

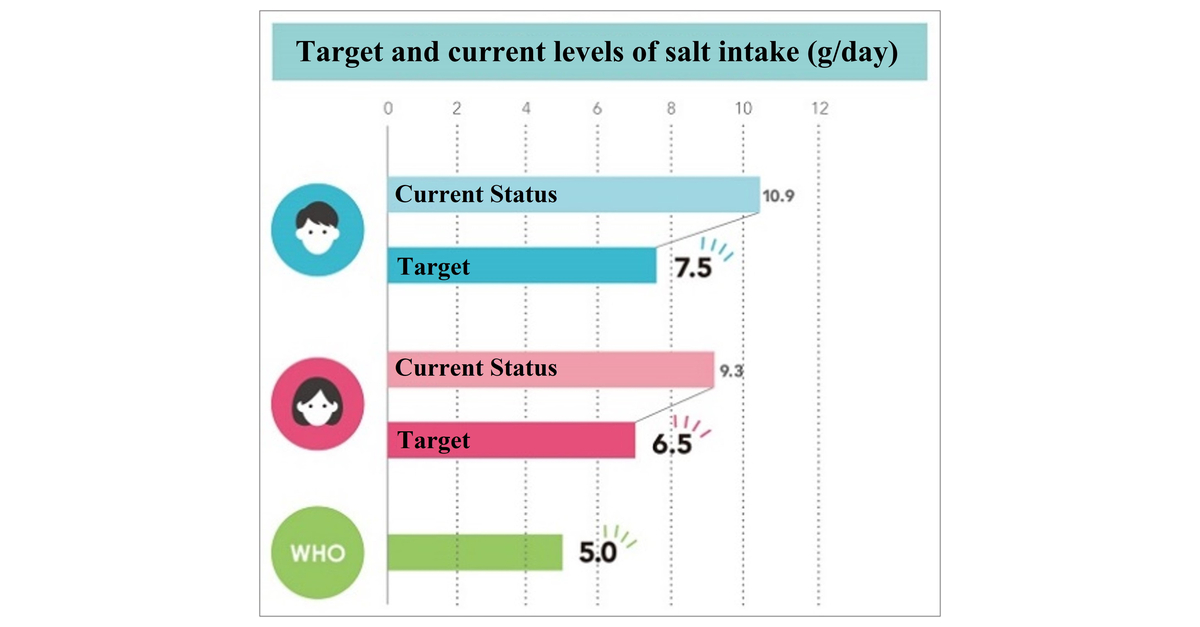

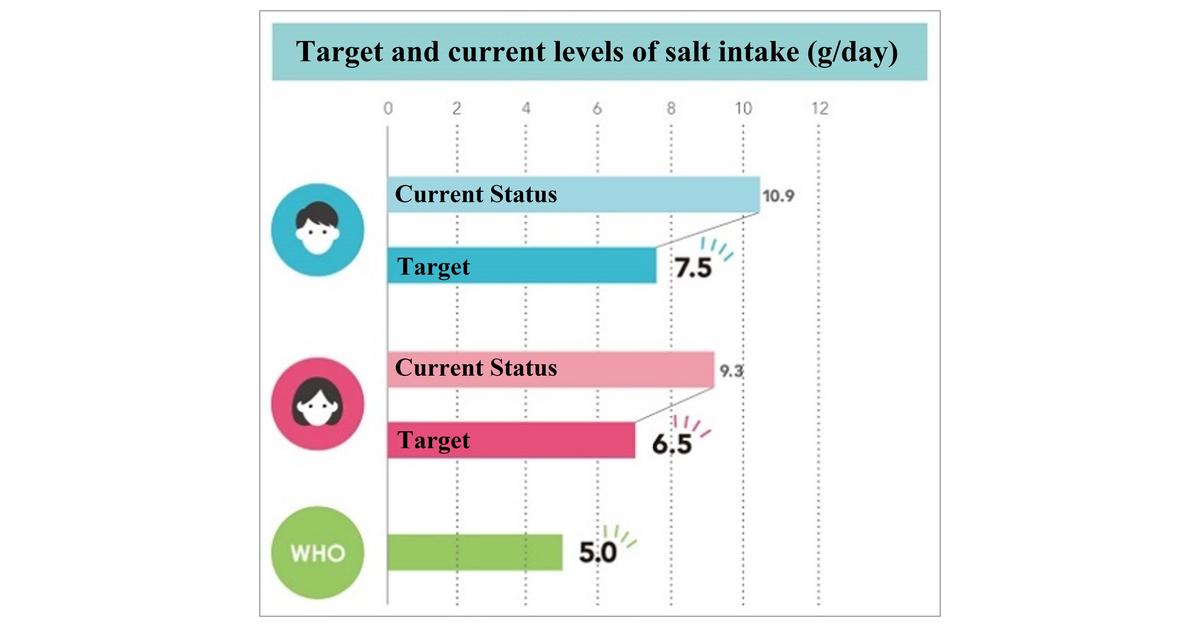

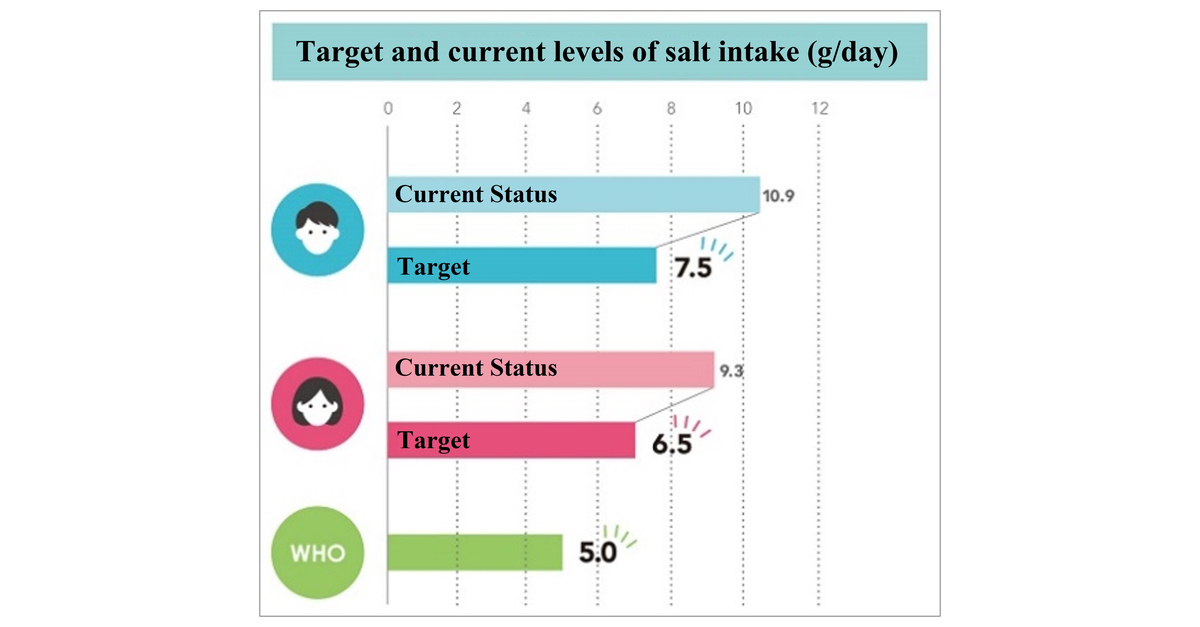

Kirin Holdings pondrá en marcha el 20 de mayo la venta en línea de la "Electric Salt Spoon", una cuchara que utiliza la electricidad para realzar el sabor salado y umami*1

A Kirin Holdings dará início às vendas da "Colher Elétrica de Sal" (electric salt spoon), uma colher que utiliza a eletricidade para realçar o sabor salgado e umami*1, em 20 de maio

Kirin Holdings will begin online sales of "Electric Salt Spoon", a spoon that uses electricity to enhance salty and umami taste*1, on May 20

Electric Royalties closes acquisition of Canadian lithium royalty and option portfolio

Electric Royalties Closes Acquisition of Lithium Royalty and Option Portfolio in Ontario, Canada

Principal of U.S. Metals Dealer Increases Stake in Electric Royalties to 24%

Source: https://incomestatements.info

Category: Stock Reports