See more : Zhejiang Jinsheng New Materials Co.,Ltd. (300849.SZ) Income Statement Analysis – Financial Results

Complete financial analysis of Embecta Corp. (EMBC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Embecta Corp., a leading company in the Drug Manufacturers – Specialty & Generic industry within the Healthcare sector.

- Bangkok Bank Public Company Limited (BKKLY) Income Statement Analysis – Financial Results

- Vor Biopharma Inc. (VOR) Income Statement Analysis – Financial Results

- Unique Mining Services Public Company Limited (UMS.BK) Income Statement Analysis – Financial Results

- Mohammed Hasan AlNaqool Sons Co. (9514.SR) Income Statement Analysis – Financial Results

- Centricus Acquisition Corp. (CENHW) Income Statement Analysis – Financial Results

Embecta Corp. (EMBC)

Industry: Drug Manufacturers - Specialty & Generic

Sector: Healthcare

Website: https://www.embecta.com

About Embecta Corp.

Embecta Corp., a medical device company, focuses on the provision of various solutions to enhance the health and wellbeing of people living with diabetes. Its products include pen needles, syringes, and safety devices, as well as digital applications to assist people with managing their diabetes. The company primarily sells its products to wholesalers and distributors in the United States and internationally. Embecta Corp. was founded in 1924 and is based in Parsippany, New Jersey. Embecta Corp.(NasdaqGS:EMBC) operates independently of Becton, Dickinson and Company as of April 1, 2022.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|---|

| Revenue | 1.12B | 1.12B | 1.13B | 1.17B | 1.09B | 1.11B |

| Cost of Revenue | 387.90M | 370.90M | 354.60M | 365.00M | 322.90M | 323.00M |

| Gross Profit | 735.20M | 749.90M | 774.90M | 800.00M | 762.60M | 786.00M |

| Gross Profit Ratio | 65.46% | 66.91% | 68.61% | 68.67% | 70.25% | 70.87% |

| Research & Development | 78.80M | 85.20M | 66.90M | 63.00M | 61.40M | 62.00M |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | -300.00K | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 240.00M | 215.00M | 222.00M |

| SG&A | 365.10M | 341.30M | 294.80M | 240.00M | 214.70M | 222.00M |

| Other Expenses | 124.50M | 101.90M | 44.70M | 5.00M | -700.00K | -2.00M |

| Operating Expenses | 568.40M | 528.40M | 406.40M | 308.00M | 276.10M | 284.00M |

| Cost & Expenses | 956.30M | 899.30M | 761.00M | 673.00M | 599.00M | 607.00M |

| Interest Income | 0.00 | 0.00 | 46.20M | 0.00 | 0.00 | 0.00 |

| Interest Expense | 112.30M | 107.00M | 46.20M | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 36.20M | 32.60M | 31.70M | 38.00M | 38.00M | 36.00M |

| EBITDA | 199.00M | 245.40M | 400.20M | 530.00M | 524.00M | 538.00M |

| EBITDA Ratio | 17.72% | 21.90% | 34.83% | 45.49% | 48.28% | 48.51% |

| Operating Income | 166.80M | 221.50M | 309.60M | 492.00M | 486.50M | 502.00M |

| Operating Income Ratio | 14.85% | 19.76% | 27.41% | 42.23% | 44.82% | 45.27% |

| Total Other Income/Expenses | -122.60M | -115.80M | -53.00M | 3.00M | -700.00K | -2.00M |

| Income Before Tax | 44.20M | 105.70M | 256.60M | 495.00M | 485.80M | 500.00M |

| Income Before Tax Ratio | 3.94% | 9.43% | 22.72% | 42.49% | 44.75% | 45.09% |

| Income Tax Expense | -34.10M | 35.30M | 33.00M | 80.00M | 58.20M | 68.00M |

| Net Income | 78.30M | 70.40M | 223.60M | 414.80M | 427.60M | 432.00M |

| Net Income Ratio | 6.97% | 6.28% | 19.80% | 35.61% | 39.39% | 38.95% |

| EPS | 1.36 | 1.23 | 3.92 | 7.31 | 7.50 | 7.58 |

| EPS Diluted | 1.34 | 1.22 | 3.92 | 7.31 | 7.50 | 7.58 |

| Weighted Avg Shares Out | 0.00 | 57.24M | 57.06M | 56.80M | 57.00M | 57.00M |

| Weighted Avg Shares Out (Dil) | 0.00 | 57.76M | 57.06M | 56.80M | 57.00M | 57.00M |

Embecta Corp's (EMBC) CEO Dev Kurdikar on Q3 2022 Results - Earnings Call Transcript

embecta Announces Earnings Conference Call Information for the Third Quarter of Fiscal Year 2022

Spinoffs Roundup: These Companies Could Unlock Value in 2022

Embecta Is A Winner In A Growing Market

Embecta Corp. (EMBC) CEO Devdatt Kurdikar on Q2 2022 Results - Earnings Call Transcript

Why Embecta Shares Are Falling Today

Medliminal’s New Advocacy Program Revolutionizes Medical Bill Review

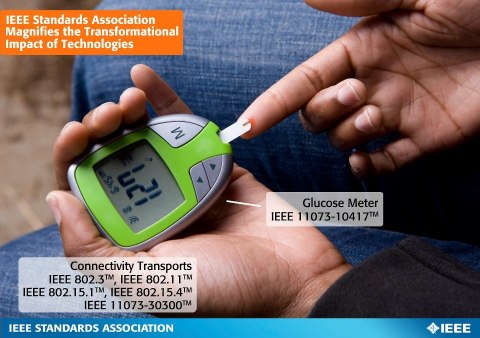

IEEE Announces IT Healthcare Standard and New Projects in Advance of the IEEE Annual International Conference of the Engineering in Medicine and Biology Society (EMBC ’17)

CORRECTING and REPLACING IEEE Approves Standard Revision to Enable Open Communication and Interoperability for Glucose Metering Devices

Source: https://incomestatements.info

Category: Stock Reports