See more : TaChan Securities Co.,Ltd. (6020.TWO) Income Statement Analysis – Financial Results

Complete financial analysis of Emerson Electric Co. (EMR) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Emerson Electric Co., a leading company in the Industrial – Machinery industry within the Industrials sector.

- Algernon Pharmaceuticals Inc. (AGNPF) Income Statement Analysis – Financial Results

- Expedia Group, Inc. (EXPE) Income Statement Analysis – Financial Results

- Botanix Pharmaceuticals Limited (BXPHF) Income Statement Analysis – Financial Results

- Ema India Limited (EMAINDIA.BO) Income Statement Analysis – Financial Results

- Trek Metals Limited (TKM.AX) Income Statement Analysis – Financial Results

Emerson Electric Co. (EMR)

About Emerson Electric Co.

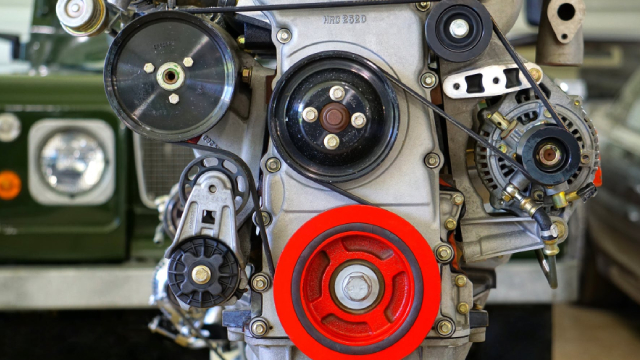

Emerson Electric Co., a technology and engineering company, provides various solutions for customers in industrial, commercial, and residential markets in the Americas, Asia, the Middle East, Africa, and Europe. The company operates through Automation Solutions, and Commercial & Residential Solutions segments. The Automation Solutions segment offers measurement and analytical instrumentation, industrial valves and equipment, and process control software and systems. It serves oil and gas, refining, chemicals, power generation, life sciences, food and beverage, automotive, pulp and paper, metals and mining, and municipal water supplies markets. The Commercial & Residential Solutions segment offers residential and commercial heating and air conditioning products, such as reciprocating and scroll compressors; system protector and flow control devices; standard, programmable, and Wi-Fi thermostats; monitoring equipment and electronic controls for gas and electric heating systems; gas valves for furnaces and water heaters; ignition systems for furnaces; sensors and thermistors for home appliances; and temperature sensors and controls. It also provides reciprocating, scroll, and screw compressors; precision flow controls; system diagnostics and controls; and environmental control systems. In addition, this segment offers air conditioning, refrigeration, and lighting control technologies, as well as facility design and product management, site commissioning, facility monitoring, and energy modeling services; tools for professionals and homeowners; and appliance solutions. Emerson Electric Co. was incorporated in 1890 and is headquartered in Saint Louis, Missouri.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 17.49B | 15.17B | 19.63B | 18.24B | 16.79B | 18.37B | 17.41B | 15.26B | 14.52B | 22.30B | 24.54B | 24.67B | 24.41B | 24.22B | 21.04B | 20.92B | 24.81B | 22.57B | 20.13B | 17.31B | 15.62B | 13.96B | 13.82B | 15.48B | 15.54B | 14.27B | 13.45B | 12.30B | 11.15B | 10.01B | 8.61B | 8.17B | 7.71B | 7.43B | 7.57B | 7.07B | 6.65B | 6.17B | 4.95B | 4.65B |

| Cost of Revenue | 9.68B | 7.74B | 11.44B | 10.67B | 9.78B | 10.56B | 9.95B | 8.86B | 8.26B | 13.26B | 14.38B | 14.72B | 14.64B | 14.67B | 12.71B | 13.22B | 15.67B | 14.46B | 12.97B | 11.12B | 10.05B | 9.06B | 9.00B | 10.12B | 10.02B | 9.19B | 8.60B | 7.87B | 7.17B | 6.48B | 5.55B | 4.95B | 4.76B | 4.55B | 4.73B | 4.43B | 4.21B | 3.88B | 3.04B | 2.82B |

| Gross Profit | 7.81B | 7.43B | 8.19B | 7.56B | 7.01B | 7.82B | 7.46B | 6.40B | 6.26B | 9.05B | 10.16B | 9.95B | 9.77B | 9.56B | 8.33B | 7.70B | 9.14B | 8.11B | 7.17B | 6.18B | 5.57B | 4.90B | 4.82B | 5.36B | 5.53B | 5.08B | 4.85B | 4.43B | 3.98B | 3.53B | 3.05B | 3.22B | 2.95B | 2.88B | 2.84B | 2.64B | 2.45B | 2.29B | 1.91B | 1.83B |

| Gross Profit Ratio | 44.64% | 48.97% | 41.71% | 41.47% | 41.76% | 42.54% | 42.85% | 41.95% | 43.12% | 40.57% | 41.40% | 40.34% | 40.01% | 39.46% | 39.57% | 36.81% | 36.84% | 35.93% | 35.60% | 35.73% | 35.65% | 35.09% | 34.90% | 34.63% | 35.57% | 35.57% | 36.08% | 36.04% | 35.74% | 35.28% | 35.48% | 39.45% | 38.24% | 38.78% | 37.51% | 37.33% | 36.77% | 37.19% | 38.53% | 39.26% |

| Research & Development | 0.00 | 523.00M | 385.00M | 485.00M | 439.00M | 454.00M | 436.00M | 340.00M | 320.00M | 336.00M | 356.00M | 576.00M | 547.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 5.14B | 4.19B | 4.25B | 4.18B | 3.99B | 4.46B | 4.26B | 3.62B | 3.46B | 5.18B | 5.72B | 5.65B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 5.14B | 4.19B | 4.25B | 4.18B | 3.99B | 4.46B | 4.26B | 3.62B | 3.46B | 5.18B | 5.72B | 5.65B | 5.44B | 5.33B | 4.94B | 4.53B | 5.06B | 4.59B | 4.10B | 3.60B | 3.28B | 2.94B | 2.92B | 3.08B | 2.99B | 2.77B | 2.68B | 2.45B | 2.19B | 1.93B | 1.68B | 1.61B | 1.46B | 1.43B | 1.43B | 1.34B | 1.22B | 1.16B | 987.90M | 937.80M |

| Other Expenses | 0.00 | 145.00M | 357.00M | 300.00M | -532.00M | 238.00M | -100.00M | -72.00M | -114.00M | -146.00M | -81.00M | -64.00M | 0.00 | 0.00 | 243.00M | 235.00M | 81.00M | 63.00M | 47.00M | 28.00M | 21.00M | 0.00 | 28.00M | 690.60M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 340.70M | 295.20M | 294.40M | 269.30M | 230.80M | 227.30M | 214.30M | 163.60M | 148.00M |

| Operating Expenses | 5.14B | 4.80B | 4.61B | 4.48B | 3.99B | 4.70B | 4.47B | 3.75B | 3.55B | 5.61B | 6.00B | 5.95B | 5.44B | 5.70B | 5.19B | 5.06B | 5.14B | 4.66B | 4.15B | 3.62B | 3.30B | 2.94B | 2.95B | 3.77B | 2.99B | 2.77B | 2.68B | 2.45B | 2.19B | 1.93B | 1.68B | 1.95B | 1.76B | 1.73B | 1.70B | 1.57B | 1.45B | 1.37B | 1.15B | 1.09B |

| Cost & Expenses | 14.83B | 12.54B | 16.05B | 15.15B | 13.76B | 15.25B | 14.42B | 12.61B | 11.81B | 18.87B | 20.37B | 20.66B | 20.08B | 20.37B | 17.90B | 18.28B | 20.81B | 19.12B | 17.11B | 14.75B | 13.35B | 12.00B | 11.95B | 13.89B | 13.00B | 11.96B | 11.27B | 10.32B | 9.36B | 8.41B | 7.23B | 6.90B | 6.51B | 6.28B | 6.43B | 6.00B | 5.66B | 5.25B | 4.20B | 3.91B |

| Interest Income | 86.00M | 41.00M | 35.00M | 12.00M | 19.00M | 27.00M | 43.00M | 36.00M | 27.00M | 29.00M | 24.00M | 16.00M | 17.00M | 0.00 | 19.00M | 24.00M | 56.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 175.00M | 34.00M | 193.00M | 154.00M | 156.00M | 174.00M | 159.00M | 201.00M | 215.00M | 200.00M | 218.00M | 234.00M | 224.00M | 223.00M | 280.00M | 220.00M | 244.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 1.69B | 1.05B | 842.00M | 969.00M | 854.00M | 822.00M | 758.00M | 636.00M | 568.00M | 815.00M | 831.00M | 819.00M | 823.00M | 867.00M | 816.00M | 727.00M | 707.00M | 656.00M | 607.00M | 562.00M | 557.00M | 534.00M | 541.00M | 708.50M | 678.50M | 637.50M | 562.50M | 511.60M | 464.60M | 408.90M | 364.50M | 340.70M | 295.20M | 294.40M | 269.30M | 230.80M | 227.30M | 214.30M | 163.60M | 148.00M |

| EBITDA | 4.03B | 4.04B | 3.50B | 4.05B | 3.36B | 3.88B | 3.63B | 3.17B | 3.10B | 4.58B | 4.40B | 4.25B | 4.18B | 4.74B | 3.98B | 3.39B | 4.54B | 4.09B | 3.61B | 3.12B | 2.82B | 2.50B | 2.45B | 2.98B | 3.22B | 2.94B | 2.74B | 2.49B | 2.26B | 2.01B | 1.74B | 1.62B | 1.49B | 1.45B | 1.41B | 1.30B | 1.22B | 1.14B | 920.50M | 887.50M |

| EBITDA Ratio | 23.05% | 25.61% | 25.05% | 22.95% | 19.93% | 21.50% | 20.96% | 22.04% | 23.26% | 14.41% | 22.55% | 21.70% | 21.12% | 19.49% | 18.80% | 16.08% | 19.87% | 18.74% | 18.68% | 19.21% | 19.36% | 20.17% | 18.02% | 17.34% | 21.19% | 21.29% | 21.10% | 20.91% | 20.76% | 20.34% | 18.56% | 20.36% | 20.02% | 19.94% | 19.15% | 19.01% | 19.28% | 18.90% | 18.44% | 19.27% |

| Operating Income | 2.67B | 2.83B | 3.88B | 3.22B | 2.49B | 3.13B | 2.99B | 2.65B | 2.71B | 3.44B | 4.16B | 4.01B | 4.33B | 4.23B | 3.14B | 2.64B | 4.00B | 3.46B | 3.02B | 2.56B | 2.26B | 1.96B | 1.87B | 1.59B | 2.54B | 2.31B | 2.17B | 1.98B | 1.79B | 1.60B | 1.37B | 1.28B | 1.19B | 1.15B | 1.14B | 1.07B | 995.50M | 922.90M | 756.90M | 739.50M |

| Operating Income Ratio | 15.24% | 18.67% | 19.76% | 17.64% | 14.84% | 17.03% | 17.18% | 17.36% | 18.69% | 15.42% | 16.97% | 16.24% | 17.75% | 17.46% | 14.92% | 12.61% | 16.13% | 15.31% | 15.01% | 14.79% | 14.50% | 14.06% | 13.56% | 10.26% | 16.35% | 16.16% | 16.17% | 16.12% | 16.08% | 15.97% | 15.97% | 15.63% | 15.46% | 15.50% | 15.09% | 15.17% | 14.97% | 14.96% | 15.28% | 15.91% |

| Total Other Income/Expenses | -646.00M | 8.00M | 76.00M | -127.00M | -249.00M | -45.00M | -60.00M | -149.00M | -162.00M | 628.00M | -312.00M | -532.00M | -857.00M | -256.00M | -261.00M | -220.00M | -188.00M | -340.00M | -338.00M | -411.00M | -412.00M | -549.00M | -315.00M | -659.00M | -362.60M | -284.60M | -251.40M | -198.50M | -183.90M | -139.40M | 53.20M | -165.40M | -147.40M | -148.30M | -154.20M | -119.00M | -135.70M | -112.30M | -41.90M | -45.40M |

| Income Before Tax | 2.02B | 2.73B | 4.09B | 2.91B | 2.34B | 2.86B | 2.67B | 2.34B | 2.32B | 4.16B | 3.35B | 3.20B | 3.12B | 3.63B | 2.88B | 2.42B | 3.59B | 3.11B | 2.68B | 2.15B | 1.85B | 1.41B | 1.57B | 1.59B | 2.18B | 2.02B | 1.92B | 1.78B | 1.61B | 1.46B | 1.43B | 1.11B | 1.04B | 1.00B | 989.00M | 954.00M | 859.80M | 810.60M | 715.00M | 694.10M |

| Income Before Tax Ratio | 11.55% | 17.98% | 20.81% | 15.97% | 13.91% | 15.56% | 15.32% | 15.30% | 15.95% | 18.66% | 13.64% | 12.96% | 12.76% | 14.99% | 13.68% | 11.56% | 14.48% | 13.76% | 13.33% | 12.42% | 11.86% | 10.13% | 11.32% | 10.26% | 14.01% | 14.16% | 14.30% | 14.50% | 14.43% | 14.58% | 16.59% | 13.60% | 13.55% | 13.51% | 13.06% | 13.49% | 12.93% | 13.14% | 14.44% | 14.93% |

| Income Tax Expense | 415.00M | 599.00M | 855.00M | 585.00M | 345.00M | 531.00M | 443.00M | 660.00M | 697.00M | 1.43B | 1.16B | 1.13B | 1.09B | 1.13B | 848.00M | 693.00M | 1.14B | 971.00M | 839.00M | 727.00M | 595.00M | 401.00M | 505.00M | 556.80M | 755.90M | 707.30M | 694.90M | 661.70M | 590.50M | 530.90M | 523.40M | 403.90M | 381.00M | 371.20M | 375.80M | 366.00M | 331.00M | 343.40M | 306.10M | 293.00M |

| Net Income | 1.97B | 13.22B | 3.23B | 2.30B | 1.97B | 2.31B | 2.20B | 1.52B | 1.64B | 2.71B | 2.15B | 2.00B | 1.97B | 2.48B | 2.16B | 1.72B | 2.41B | 2.14B | 1.85B | 1.42B | 1.26B | 1.09B | 122.00M | 1.03B | 1.42B | 1.31B | 1.23B | 1.12B | 1.02B | 907.70M | 788.50M | 708.10M | 662.90M | 631.90M | 613.20M | 588.00M | 528.80M | 467.20M | 408.90M | 401.10M |

| Net Income Ratio | 11.25% | 87.17% | 16.46% | 12.63% | 11.71% | 12.55% | 12.66% | 9.94% | 11.26% | 12.15% | 8.75% | 8.12% | 8.06% | 10.24% | 10.29% | 8.24% | 9.72% | 9.46% | 9.16% | 8.22% | 8.05% | 7.80% | 0.88% | 6.67% | 9.15% | 9.21% | 9.14% | 9.12% | 9.13% | 9.07% | 9.16% | 8.66% | 8.60% | 8.51% | 8.10% | 8.32% | 7.95% | 7.57% | 8.26% | 8.63% |

| EPS | 3.43 | 23.00 | 4.63 | 3.85 | 3.26 | 3.74 | 3.49 | 2.35 | 2.53 | 4.01 | 3.05 | 2.78 | 2.68 | 3.29 | 2.87 | 2.29 | 3.09 | 2.69 | 2.26 | 1.72 | 1.50 | 1.30 | 0.14 | 1.22 | 1.67 | 1.52 | 1.40 | 1.26 | 1.14 | 1.01 | 0.88 | 0.79 | 0.74 | 0.71 | 0.69 | 0.66 | 0.58 | 0.50 | 0.47 | 0.46 |

| EPS Diluted | 3.43 | 22.88 | 4.60 | 3.83 | 3.24 | 3.72 | 3.47 | 2.35 | 2.52 | 3.99 | 3.03 | 2.76 | 2.67 | 3.27 | 2.84 | 2.27 | 3.06 | 2.66 | 2.24 | 1.70 | 1.49 | 1.30 | 0.14 | 1.20 | 1.65 | 1.50 | 1.39 | 1.26 | 1.14 | 1.01 | 0.88 | 0.79 | 0.74 | 0.71 | 0.69 | 0.66 | 0.58 | 0.50 | 0.47 | 0.46 |

| Weighted Avg Shares Out | 574.00M | 574.20M | 592.90M | 598.10M | 602.90M | 616.20M | 632.00M | 642.10M | 644.00M | 673.30M | 700.20M | 717.70M | 730.60M | 748.50M | 750.70M | 753.70M | 780.30M | 793.80M | 816.37M | 829.15M | 838.00M | 837.69M | 841.38M | 850.80M | 854.80M | 867.06M | 877.57M | 890.40M | 897.36M | 894.29M | 896.93M | 896.33M | 895.81M | 890.00M | 888.70M | 890.91M | 911.72M | 934.40M | 870.00M | 881.54M |

| Weighted Avg Shares Out (Dil) | 574.00M | 577.30M | 592.90M | 601.80M | 606.60M | 620.60M | 635.30M | 643.40M | 646.80M | 676.50M | 704.10M | 722.90M | 734.60M | 753.50M | 757.00M | 758.70M | 789.40M | 803.90M | 823.66M | 836.47M | 843.62M | 840.93M | 841.38M | 859.00M | 862.80M | 875.73M | 887.08M | 891.51M | 897.36M | 894.29M | 896.93M | 896.33M | 895.81M | 890.00M | 888.70M | 890.91M | 911.72M | 934.40M | 870.00M | 881.54M |

Investors Heavily Search Emerson Electric Co. (EMR): Here is What You Need to Know

2 Top Automation and Robotics Stocks to Buy in October

Emerson Electric (EMR) Ascends While Market Falls: Some Facts to Note

Emerson Electric: Growing Margins At A Reasonable Valuation

Emerson Electric (EMR) Stock Falls Amid Market Uptick: What Investors Need to Know

Emerson Stock Exhibits Strong Prospects Despite Headwinds

3 Dividend Stocks to Buy Now That Have Raised Their Payouts for at Least 20 Consecutive Years

Emerson Electric (EMR) Beats Stock Market Upswing: What Investors Need to Know

Emerson Electric Co. (EMR) is Attracting Investor Attention: Here is What You Should Know

Emerson to Help Drive Greater Industrial Edge Interoperability

Source: https://incomestatements.info

Category: Stock Reports