See more : Daewon Kang Up Co., Ltd. (000430.KS) Income Statement Analysis – Financial Results

Complete financial analysis of Enel Américas S.A. (ENIA) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Enel Américas S.A., a leading company in the Regulated Electric industry within the Utilities sector.

- Talent Property Group Limited (0760.HK) Income Statement Analysis – Financial Results

- Tai Hing Group Holdings Limited (6811.HK) Income Statement Analysis – Financial Results

- Universe Group plc (UNG.L) Income Statement Analysis – Financial Results

- Havyard Group ASA (HYARD.OL) Income Statement Analysis – Financial Results

- Moneysupermarket.com Group PLC (MONY.L) Income Statement Analysis – Financial Results

Enel Américas S.A. (ENIA)

About Enel Américas S.A.

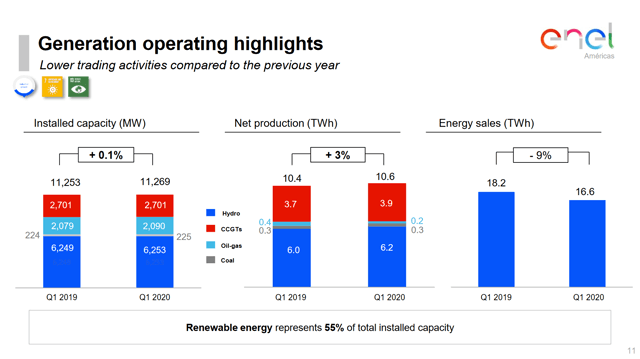

Enel Américas S.A., together with its subsidiaries, explores, develops, operates, generates, transfers, transforms, distributes, and sells electricity using hydroelectric and thermal energy sources in Argentina, Brazil, Colombia, and Peru. As of December 31, 2020, it had 11,269 megawatts of installed generation capacity and 25.6 million distribution customers. The company was formerly known as Enersis Américas S.A. and changed its name to Enel Américas S.A. in December 2016. Enel Américas S.A. was founded in 1889 and is headquartered in Santiago, Chile. Enel Américas S.A. operates as a subsidiary of Enel S.p.A.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 12.55B | 13.57B | 12.81B | 11.24B | 13.05B | 12.12B | 9.59B | 7.13B | 6.58B | 11.25B | 10.82B | 12.77B | 12.58B | 13.72B | 12.71B | 10.41B | 9.41B | 7.31B | 6.25B | 4.88B | 3.96B | 3.45B | 4.49B | 4.53B | 4.29B | 3.20B | 0.00 |

| Cost of Revenue | 7.65B | 9.00B | 10.45B | 7.56B | 8.54B | 8.14B | 5.99B | 3.96B | 3.92B | 6.50B | 5.87B | 7.48B | 6.81B | 7.36B | 6.32B | 6.74B | 6.35B | 4.87B | 4.24B | 3.42B | 2.78B | 2.40B | 2.98B | 2.35B | 2.33B | 1.49B | 0.00 |

| Gross Profit | 4.89B | 4.56B | 2.36B | 3.68B | 4.51B | 3.98B | 3.61B | 3.18B | 2.67B | 4.75B | 4.95B | 5.29B | 5.77B | 6.36B | 6.39B | 3.67B | 3.06B | 2.44B | 2.00B | 1.46B | 1.18B | 1.05B | 1.52B | 2.17B | 1.96B | 1.71B | 0.00 |

| Gross Profit Ratio | 38.99% | 33.63% | 18.40% | 32.77% | 34.57% | 32.81% | 37.60% | 44.53% | 40.50% | 42.21% | 45.77% | 41.40% | 45.85% | 46.35% | 50.30% | 35.25% | 32.49% | 33.34% | 32.05% | 29.93% | 29.78% | 30.40% | 33.80% | 48.05% | 45.65% | 53.52% | 0.00% |

| Research & Development | 0.00 | 319.00K | 154.00K | 54.00K | 86.00K | 856.00K | 137.00K | 288.00K | 385.95K | 5.90M | 3.80M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 1.04B | 859.17M | 730.00M | 418.00M | 628.00M | 662.00M | 665.00M | 532.63M | 593.04M | 723.91M | 767.06M | 849.34M | 728.98M | 783.08M | 730.06M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 17.74M | 15.18M | 12.05M | 9.18M | 11.81M | 12.74M | 5.14M | 5.27M | 7.43M | 13.97M | 15.64M | 16.30M | 19.87M | 0.00 | 32.20M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 1.06B | 874.35M | 730.00M | 418.00M | 628.00M | 662.00M | 665.00M | 532.63M | 593.04M | 723.91M | 767.06M | 849.34M | 728.98M | 783.08M | 730.06M | 572.51M | 536.63M | 431.15M | 437.48M | 317.94M | 285.11M | 309.77M | 410.60M | 549.94M | 462.08M | 267.99M | 0.00 |

| Other Expenses | 1.45B | 2.13B | -1.48B | 969.00M | 838.00M | 1.06B | 948.74M | 641.88M | 893.65M | 716.29M | 1.08B | 647.41M | 1.16B | 2.01B | 1.46B | 0.00 | 8.90M | 11.41M | 0.00 | 0.00 | 0.00 | 120.25M | 0.00 | 833.25M | 718.60M | 437.08M | 0.00 |

| Operating Expenses | 2.50B | 3.01B | -753.00M | 1.39B | 1.47B | 1.48B | 1.31B | 1.20B | 840.18M | 1.75B | 1.50B | 2.15B | 2.75B | 2.57B | 2.60B | 572.51M | 545.52M | 442.56M | 437.48M | 317.94M | 285.11M | 430.03M | 410.60M | 1.38B | 1.18B | 705.07M | 0.00 |

| Cost & Expenses | 10.16B | 12.01B | 9.70B | 8.94B | 10.01B | 9.62B | 7.29B | 5.15B | 4.76B | 8.25B | 7.37B | 9.63B | 9.57B | 9.93B | 8.92B | 7.32B | 6.90B | 5.31B | 4.68B | 3.73B | 3.06B | 2.83B | 3.39B | 3.73B | 3.51B | 2.19B | 0.00 |

| Interest Income | 264.56M | 229.86M | 295.00M | 321.00M | 450.00M | 358.00M | 294.00M | 279.60M | 415.63M | 438.71M | 494.24M | 540.01M | 449.87M | 357.89M | 314.71M | 276.17M | 233.75M | 234.36M | 180.24M | 132.54M | 113.09M | 118.38M | 83.13M | 122.03M | 0.00 | 99.68M | 0.00 |

| Interest Expense | 713.32M | 626.55M | 1.05B | 768.00M | 1.09B | 1.07B | 870.00M | 781.93M | 543.49M | 811.57M | 737.90M | 925.03M | 896.24M | 916.17M | 950.95M | 776.26M | 817.83M | 733.75M | 686.19M | 648.25M | 707.17M | 610.08M | 659.80M | 822.77M | 2.21B | 478.87M | 0.00 |

| Depreciation & Amortization | 949.16M | 982.73M | 874.93M | 858.10M | 948.00M | 862.00M | 648.00M | 478.61M | 451.96M | 790.65M | 827.40M | 903.42M | 818.23M | 938.45M | 895.56M | 979.38M | 965.48M | 886.99M | 807.14M | 760.30M | 684.66M | 1.19B | 687.22M | -833.25M | -718.60M | -437.08M | 0.00 |

| EBITDA | 3.11B | 4.82B | 2.90B | 2.82B | 3.41B | 3.51B | 2.64B | 2.40B | 2.88B | 3.24B | 3.57B | 4.39B | 4.17B | 4.88B | 5.14B | 3.73B | 3.47B | 3.04B | 2.48B | 934.07M | -3.58B | 2.02B | 1.94B | 1.72B | 1.50B | 1.40B | 0.00 |

| EBITDA Ratio | 24.81% | 35.55% | 34.60% | 32.17% | 35.20% | 31.60% | 33.76% | 39.26% | 43.74% | 36.29% | 44.00% | 35.84% | 34.05% | 37.08% | 40.42% | 41.78% | 38.27% | 43.07% | 42.67% | 43.18% | 44.77% | 67.12% | 43.05% | 22.42% | 35.18% | 43.86% | 0.00% |

| Operating Income | 2.39B | 3.71B | 2.66B | 2.76B | 2.77B | 2.44B | 2.22B | 1.82B | 1.77B | 2.92B | 3.31B | 3.05B | 3.02B | 3.56B | 3.79B | 3.10B | 2.52B | 2.01B | 1.56B | 1.14B | 893.31M | 739.31M | 1.11B | 1.85B | 2.23B | 1.84B | 0.00 |

| Operating Income Ratio | 19.03% | 27.38% | 20.80% | 24.54% | 21.21% | 20.09% | 23.14% | 25.53% | 26.88% | 25.94% | 30.56% | 23.91% | 23.97% | 25.97% | 29.84% | 29.76% | 26.79% | 27.44% | 25.04% | 23.41% | 22.58% | 21.43% | 24.66% | 40.83% | 51.94% | 57.54% | 0.00% |

| Total Other Income/Expenses | -936.82M | -984.22M | -695.77M | -404.37M | -436.10M | -329.53M | -573.75M | -423.95M | 185.57M | -345.55M | -215.59M | -402.44M | -460.03M | -538.40M | -505.33M | -647.64M | -997.68M | -824.50M | -786.50M | -663.57M | -756.75M | -1.11B | -765.60M | -287.34M | -763.13M | -669.83M | 0.00 |

| Income Before Tax | 1.45B | 1.14B | 1.94B | 1.75B | 2.41B | 2.11B | 1.65B | 1.39B | 1.80B | 2.52B | 3.07B | 2.66B | 2.57B | 3.02B | 3.29B | 2.68B | 1.40B | 1.24B | 777.46M | 477.99M | 136.56M | -366.27M | 376.84M | 398.16M | 13.38M | 335.65M | 0.00 |

| Income Before Tax Ratio | 11.56% | 8.43% | 15.16% | 15.55% | 18.43% | 17.37% | 17.16% | 19.51% | 27.42% | 22.38% | 28.39% | 20.85% | 20.40% | 22.04% | 25.91% | 25.75% | 14.87% | 16.93% | 12.45% | 9.80% | 3.45% | -10.62% | 8.39% | 8.80% | 0.31% | 10.50% | 0.00% |

| Income Tax Expense | 672.90M | 840.01M | 806.00M | 567.00M | 236.00M | 438.00M | 519.00M | 537.49M | 738.36M | 819.40M | 957.92M | 840.26M | 887.43M | 723.15M | 709.04M | 706.23M | 508.32M | 205.47M | 346.27M | 247.03M | 69.92M | -91.63M | 200.78M | 240.76M | 160.95M | 149.66M | 0.00 |

| Net Income | 864.27M | 303.10M | 1.14B | 1.18B | 2.17B | 1.20B | 709.00M | 572.93M | 932.84M | 1.01B | 1.25B | 769.80M | 723.04M | 1.02B | 1.30B | 894.00M | 378.26M | 537.03M | 132.09M | 79.75M | 20.97M | -310.56M | 61.92M | 157.40M | -147.57M | 185.98M | 0.00 |

| Net Income Ratio | 6.89% | 2.23% | 8.86% | 10.51% | 16.62% | 9.91% | 7.39% | 8.03% | 14.17% | 8.95% | 11.56% | 6.03% | 5.75% | 7.41% | 10.24% | 8.58% | 4.02% | 7.35% | 2.12% | 1.64% | 0.53% | -9.00% | 1.38% | 3.48% | -3.44% | 5.82% | 0.00% |

| EPS | 0.00 | 0.00 | 0.01 | 0.02 | 0.03 | 0.02 | 0.01 | 0.01 | 0.02 | 0.02 | 0.03 | 0.02 | 0.02 | 0.03 | 0.04 | 0.02 | 0.01 | 0.02 | 0.00 | 0.00 | 0.00 | -0.04 | 0.01 | 0.02 | -0.02 | 0.03 | 0.00 |

| EPS Diluted | 0.00 | 0.00 | 0.01 | 0.02 | 0.03 | 0.02 | 0.01 | 0.01 | 0.02 | 0.02 | 0.03 | 0.02 | 0.02 | 0.03 | 0.04 | 0.02 | 0.01 | 0.02 | 0.00 | 0.00 | 0.00 | -0.04 | 0.01 | 0.02 | -0.02 | 0.03 | 0.00 |

| Weighted Avg Shares Out | 197.59B | 107.28B | 99.59B | 76.09B | 65.48B | 57.45B | 57.45B | 50.56B | 49.88B | 49.88B | 45.94B | 33.17B | 33.17B | 34.09B | 34.09B | 34.09B | 34.09B | 34.08B | 34.16B | 34.09B | 8.66B | 8.66B | 8.66B | 7.64B | 7.10B | 7.10B | 7.00B |

| Weighted Avg Shares Out (Dil) | 107.28B | 107.28B | 99.59B | 76.09B | 65.48B | 57.45B | 57.45B | 50.56B | 49.88B | 49.88B | 45.94B | 33.17B | 33.17B | 34.09B | 34.09B | 34.09B | 34.09B | 34.09B | 34.16B | 34.09B | 8.66B | 8.66B | 8.66B | 7.64B | 7.10B | 7.10B | 7.00B |

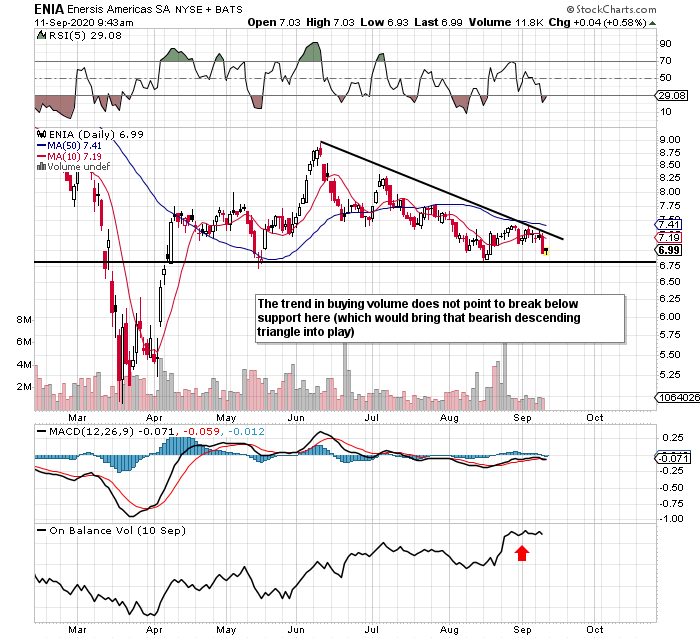

Enel Américas S.A.: Attractive Value Setup

Enel Américas S.A. (ENIA) CEO Maurizio Bezzeccheri on Q2 2020 Results - Earnings Call Transcript

Enel Américas S.A. 2020 Q2 - Results - Earnings Call Presentation

Enel Americas Not Recognised For ESG Exposure And Diversified Concession Risk

Enel Americas (NYSE:ENIA) vs. Dominion Energy (NYSE:D) Head-To-Head Comparison

Bank of America Corp DE Reduces Stake in Enel Americas SA (NYSE:ENIA)

NRG Energy (NYSE:NRG) versus Enel Americas (NYSE:ENIA) Head to Head Analysis

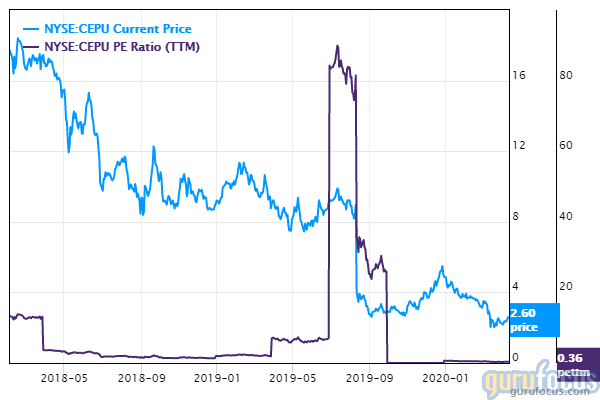

5 Utilities Trading With Low Price-Earnings Ratios

Enel Americas (NYSE:ENIA) Trading 2% Higher

Enel Americas (NYSE:ENIA) Lifted to Buy at Sanford C. Bernstein

Source: https://incomestatements.info

Category: Stock Reports