See more : Leader Harmonious Drive Systems Co., Ltd. (688017.SS) Income Statement Analysis – Financial Results

Complete financial analysis of Enochian Biosciences, Inc. (ENOB) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Enochian Biosciences, Inc., a leading company in the Biotechnology industry within the Healthcare sector.

- Austin Engineering Company Limited (AUSTENG.BO) Income Statement Analysis – Financial Results

- Tracxn Technologies Limited (TRACXN.BO) Income Statement Analysis – Financial Results

- Yokogawa Electric Corporation (6841.T) Income Statement Analysis – Financial Results

- Joint-Stock Company Ryazanenergosbyt (RZSB.ME) Income Statement Analysis – Financial Results

- Gemdale Properties and Investment Corporation Limited (0535.HK) Income Statement Analysis – Financial Results

Enochian Biosciences, Inc. (ENOB)

About Enochian Biosciences, Inc.

Enochian Biosciences, Inc., a pre-clinical stage biotechnology company, engages in the research and development of pharmaceutical and biological products for the human treatment of human immunodeficiency virus (HIV), hepatitis B virus (HBV), influenza and coronavirus infections, and cancer. The company's lead candidate includes ENOB-HV-01 for autologous HIV curative treatment; ENOB-HV-11, a preventative HIV vaccine; ENOB-HV-12, a therapeutic HIV vaccine; and ENOB-HB-01, a coopting HBV polymerase. Its pipeline development products comprise ENOB-DC-11 off the shelf DC vaccine for multiple solid tumors; and ENOB-DC-21, a non-specific vaccine for intraturmoral injection. Enochian Biosciences, Inc. has strategic partnerships with The Scripps Institute, Fred Hutchinson Cancer Research Center, the Texas Biomedical Research Institute, the University of California, Los Angeles, and The Hepatitis B Foundation and Baruch S. Blumberg Institute. The company was incorporated in 2017 and is headquartered in Los Angeles, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 42.77K | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 121.86K | 113.50K | 123.59K | 391.42K | 366.27K | 71.71K | 18.48K | 14.53K | 32.67K | 314.64K | 0.00 | 0.00 |

| Gross Profit | -121.86K | -113.50K | -123.59K | -391.42K | -366.27K | -71.71K | -18.48K | -14.53K | 10.10K | -314.64K | 0.00 | 0.00 |

| Gross Profit Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 23.62% | 0.00% | 0.00% | 0.00% |

| Research & Development | 2.71M | 4.17M | 8.37M | 15.72M | 4.69M | 2.50M | 616.96K | 62.76K | 804.19K | 0.00 | 0.00 | 0.00 |

| General & Administrative | 24.17M | 15.32M | 14.33M | 7.56M | 7.12M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 383.55K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 24.56M | 15.32M | 14.33M | 7.56M | 7.12M | 8.42M | 2.60M | 2.32M | 1.33M | 2.11M | 37.09K | 29.95K |

| Other Expenses | 54.37M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 81.64M | 19.60M | 22.83M | 23.40M | 11.92M | 10.92M | 3.22M | 2.39M | 2.13M | 2.11M | 37.09K | 29.95K |

| Cost & Expenses | 81.64M | 19.60M | 22.83M | 23.40M | 11.92M | 10.99M | 3.24M | 2.40M | 2.16M | 2.43M | 37.09K | 29.95K |

| Interest Income | 0.00 | 0.00 | 122.04K | 13.18K | 50.30K | 73.49K | 45.82K | 0.00 | 0.00 | 5.94K | 0.00 | 0.00 |

| Interest Expense | 1.01M | 706.96K | 372.84K | 379.61K | 104.28K | 43.00 | 143.26K | 26.26K | 2.36K | 84.55K | 497.00 | 0.00 |

| Depreciation & Amortization | 121.86K | 113.50K | 123.59K | 123.53K | 366.27K | 71.71K | 18.48K | 14.53K | 27.40K | 45.20K | 0.00 | 0.00 |

| EBITDA | -79.52M | -19.48M | -22.70M | -23.28M | -11.51M | -17.94M | -5.31M | -2.39M | -2.17M | -2.42M | -37.09K | -29.95K |

| EBITDA Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -4,894.99% | 0.00% | 0.00% | 0.00% |

| Operating Income | -81.64M | -38.56M | -116.08M | -23.40M | -11.92M | -10.99M | -3.24M | -2.40M | -2.12M | -2.43M | -37.09K | -29.95K |

| Operating Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -4,959.04% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | 989.12K | -1.13M | 2.65M | -3.45M | 507.41K | -7.03M | -3.19M | 192.72K | -77.10K | -119.20K | -497.00 | 0.00 |

| Income Before Tax | -80.65M | -39.68M | -113.43M | -26.85M | -11.42M | -18.02M | -6.42M | -2.21M | -2.20M | -2.55M | -37.59K | -29.95K |

| Income Before Tax Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -5,139.30% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 0.00 | 706.96K | 34.00 | -125.28K | 104.28K | 1.00 | -111.72K | -64.88K | -462.79K | -177.54K | 0.00 | 0.00 |

| Net Income | -80.65M | -39.68M | -113.43M | -26.72M | -11.42M | -18.02M | -6.31M | -2.14M | -1.74M | -2.37M | -37.59K | -29.95K |

| Net Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -4,057.24% | 0.00% | 0.00% | 0.00% |

| EPS | -0.84 | -0.71 | -2.16 | -0.57 | -0.25 | -0.48 | -0.29 | -0.17 | -0.18 | -0.32 | -0.01 | 0.00 |

| EPS Diluted | -0.84 | -0.71 | -2.16 | -0.57 | -0.25 | -0.48 | -0.29 | -0.17 | -0.18 | -0.32 | -0.01 | 0.00 |

| Weighted Avg Shares Out | 96.25M | 56.27M | 52.53M | 47.17M | 46.33M | 37.55M | 21.94M | 12.27M | 9.53M | 7.50M | 5.00M | 10.44M |

| Weighted Avg Shares Out (Dil) | 96.25M | 56.27M | 52.53M | 47.17M | 46.33M | 37.55M | 21.94M | 12.27M | 9.53M | 7.50M | 5.00M | 10.44M |

The Daily Biotech Pulse: Mesoblast To Test Candidate On Coronavirus Symptoms, Proxy Battle Ahead For Rockwell Medical, Glaukos to Join S&P SmallCap 600 Index

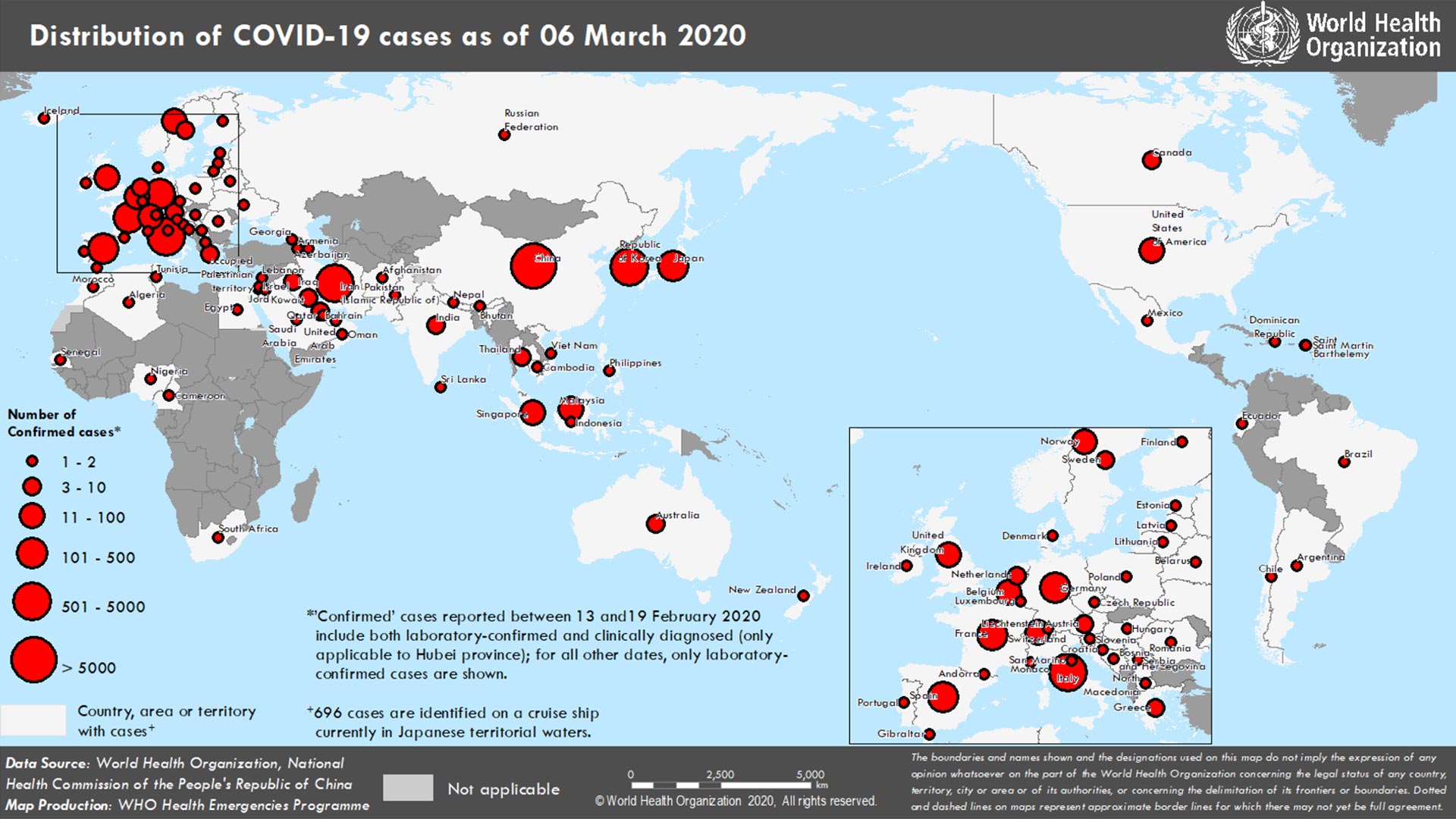

Coronavirus Now in 89 Countries, Over 98,000 Infected, COVID-19 & Influenza Similarities

The Daily Biotech Pulse: Gilead Kicks Off Coronavirus Drug Trials, Adcom Nod For Lily, FDA Approves Esperion's Lipid-Lowering Adjunctive Combo Therapy

Ethereum dApp Maestros MetaCartel Launch New Venture Arm

Investment Sorcery: MetaCartel Launches DAO Venture Fund

When should you be tested for vitamin B12?

Sex, lice and pubic shaving: study highlights risks - Capital Lifestyle

Source: https://incomestatements.info

Category: Stock Reports