See more : Magnachip Semiconductor Corporation (MX) Income Statement Analysis – Financial Results

Complete financial analysis of Equus Total Return, Inc. (EQS) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Equus Total Return, Inc., a leading company in the Asset Management industry within the Financial Services sector.

- TAG Immobilien AG (TAGOF) Income Statement Analysis – Financial Results

- D’Ieteren Group SA (DIE.BR) Income Statement Analysis – Financial Results

- Grifols, S.A. (GRF.MC) Income Statement Analysis – Financial Results

- Aker Horizons ASA (AKH.OL) Income Statement Analysis – Financial Results

- Zhejiang Jindun Fans Co., Ltd (300411.SZ) Income Statement Analysis – Financial Results

Equus Total Return, Inc. (EQS)

About Equus Total Return, Inc.

Equus Total Return, Inc. is a business development company (BDC) specializing in leveraged buyouts, management buyouts, corporate partnerships/joint ventures, growth and expansion capital, acquisition financing, roll-up acquisition strategies, operational turnarounds, recapitalizations of existing businesses, special situations, equity and equity-oriented securities issued by privately owned companies, debt securities including subordinate debt, debt convertible into common or preferred stock, or debt combined with warrants and common and preferred stock, and preferred equity financing. It invests in small to mid-sized companies and acts as a lead investor. It invests in technology, telecommunication, financial services, natural resource and industrial manufacturing and services. It invests in companies engaged in the alternative energy, real estate, healthcare, education, e-learning, leisure and entertainment, and foreign investment sector in the United States, China, India, and Europe. It investments include common and preferred stock, debt convertible into common or preferred stock, debt combined with warrants and options, and other rights to acquire common or preferred stock. It seeks to invest in companies between $1 million to $25 million with revenues between $5 million and $150 million with EBITDA between $2 million to $50 million. It seeks to take control and non-control equity positions. Equus Total Return, Inc. was founded in 1991 and is based in Houston, Texas with additional office in Vancouver, Canada.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 225.00K | 2.50M | 6.08M | 318.00K | 5.90M | 4.08M | 3.73M | 8.62M | 3.90M | 2.02M | 3.48M | -2.11M | 535.00K | -9.21M | 3.72M | 3.13M | 4.77M | 5.86M | 2.39M | 6.20M | 7.17M | 2.99M | 2.72M | 5.12M | 5.16M | 3.77M | 4.01M | 2.59M | 3.08M |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 7.45M | 0.00 | 0.00 | 2.50M | 0.00 | 0.00 | 0.00 | 0.00 | 2.11M | 0.00 | 9.21M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.63M | 2.55M | 2.14M | 2.06M | 3.42M | 4.34M | 4.68M | 3.23M | 2.43M | 1.56M |

| Gross Profit | 225.00K | 2.50M | 6.08M | -7.14M | 5.90M | 4.08M | 1.23M | 8.62M | 3.90M | 2.02M | 3.48M | -4.21M | 535.00K | -18.42M | 3.72M | 3.13M | 4.77M | 5.86M | 2.39M | 4.57M | 4.62M | 850.00K | 660.00K | 1.70M | 820.00K | -910.00K | 780.00K | 160.00K | 1.52M |

| Gross Profit Ratio | 100.00% | 100.00% | 100.00% | -2,244.03% | 100.00% | 100.00% | 33.02% | 100.00% | 100.00% | 100.00% | 100.00% | 200.00% | 100.00% | 200.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 73.71% | 64.44% | 28.43% | 24.26% | 33.20% | 15.89% | -24.14% | 19.45% | 6.18% | 49.35% |

| Research & Development | 0.00 | -1.13K | 6.12 | -0.65 | -0.91 | 0.10 | -1.49 | 7.39 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 2.31M | 2.05M | 1.79M | 1.98M | 1.99M | 2.28M | 2.31M | 2.02M | 1.46M | 2.42M | 2.24M | 2.10M | 2.06M | 2.21M | 2.28M | 3.00M | 3.73M | 4.83M | 3.82M | 860.00K | 1.22M | 700.00K | -500.00K | 1.15M | 2.99M | 1.28M | 1.70M | 8.40M | 2.16M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 2.31M | 2.05M | 1.79M | 1.98M | 1.99M | 2.28M | 2.31M | 2.02M | 1.46M | 2.42M | 2.24M | 2.10M | 2.06M | 2.21M | 2.28M | 3.00M | 3.73M | 4.83M | 3.82M | 860.00K | 1.22M | 700.00K | -500.00K | 1.15M | 2.99M | 1.28M | 1.70M | 8.40M | 2.16M |

| Other Expenses | 0.00 | 1.58M | 1.66M | 3.18M | 1.74M | 1.75M | 2.25M | 1.17M | 1.34M | 962.00K | 897.00K | 1.07M | 0.00 | 0.00 | -5.80M | -6.85M | -9.28M | -11.33M | -9.34M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -10.00K | 10.00K | 30.00K | 20.00K |

| Operating Expenses | 1.24M | 3.63M | 3.45M | 5.16M | 3.73M | 4.03M | 4.56M | 3.19M | 2.80M | 3.38M | 3.13M | 3.17M | 1.42M | 1.54M | -3.53M | -3.85M | -5.55M | -6.51M | -5.52M | 860.00K | 1.22M | 700.00K | -500.00K | 1.15M | 2.99M | 1.27M | 1.71M | 8.43M | 2.18M |

| Cost & Expenses | -12.69M | 3.63M | 3.45M | 5.16M | 3.73M | 4.03M | 4.19M | 3.19M | 2.80M | 3.38M | 3.13M | 3.17M | 1.42M | 1.54M | -3.53M | -3.85M | -5.55M | -6.51M | -5.52M | 2.49M | 3.77M | 2.84M | 1.56M | 4.57M | 7.33M | 5.95M | 4.94M | 10.86M | 3.74M |

| Interest Income | 249.00K | 4.00K | 3.00K | 294.00K | 297.00K | 480.00K | 560.00K | 748.00K | 446.00K | 965.00K | 7.00K | 516.00K | 539.00K | 2.90M | 3.77M | 3.18M | 4.60M | 5.47M | 1.89M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 25.00K | 4.00K | 3.00K | 27.00K | 11.00K | 4.00K | 11.00K | 8.00K | 2.00K | 0.00 | 2.00K | 2.00K | 4.00K | 36.00K | 51.00K | 49.00K | 83.00K | 156.55K | 141.10K | -2.47M | -7.67M | -120.00K | -10.87M | -5.88M | -5.06M | -25.15M | 31.79M | 37.73M | 6.39M |

| Depreciation & Amortization | 0.00 | 1.13M | -2.20M | 31.13M | -4.56M | 438.00K | 3.88M | -4.70M | 3.46M | 1.05M | 3.47M | -2.62M | 0.00 | 36.00K | -27.68M | -18.90M | 13.13M | 14.96M | 20.00M | -4.94M | -15.34M | -250.00K | -21.75M | -11.76M | -10.12M | -50.30M | 63.58M | 75.47M | 12.78M |

| EBITDA | 0.00 | 0.00 | 0.00 | -12.29M | 0.00 | 0.00 | 0.00 | 0.00 | 3.46M | 451.00K | 2.94M | -5.27M | -4.53M | -12.81M | -27.53M | -19.66M | 12.35M | 14.32M | 16.86M | -1.23M | -11.94M | -100.00K | -20.59M | -11.21M | -12.30M | -52.48M | 62.66M | 67.20M | 12.11M |

| EBITDA Ratio | 0.00% | 0.08% | 43.22% | -3,865.41% | 36.81% | 1.35% | -21.91% | 63.09% | 28.42% | -67.81% | 9.90% | 250.28% | -845.79% | 139.10% | -738.74% | -626.21% | 258.69% | 244.31% | 705.80% | -19.84% | -166.53% | -3.34% | -756.99% | -218.95% | -238.37% | -1,392.04% | 1,562.59% | 2,594.59% | 393.18% |

| Operating Income | 12.97M | -1.12M | 2.63M | -12.29M | 2.17M | 55.00K | -3.64M | -2.45M | -2.35M | -2.42M | -3.13M | -2.65M | -4.53M | -12.85M | 195.00K | -713.00K | -777.00K | -649.01K | -3.13M | 3.71M | 3.40M | 150.00K | 1.16M | 550.00K | -2.18M | -2.18M | -920.00K | -8.27M | -670.00K |

| Operating Income Ratio | 5,766.22% | -45.01% | 43.22% | -3,865.41% | 36.81% | 1.35% | -97.54% | -28.42% | -60.25% | -119.94% | -90.02% | 125.97% | -845.79% | 139.49% | 5.24% | -22.77% | -16.28% | -11.08% | -131.20% | 59.84% | 47.42% | 5.02% | 42.65% | 10.74% | -42.25% | -57.82% | -22.94% | -319.31% | -21.75% |

| Total Other Income/Expenses | -25.00K | 0.00 | -3.00K | 0.00 | 0.00 | 3.61M | 2.81M | 0.00 | 3.46M | 451.00K | 2.93M | -2.62M | -3.65M | 0.00 | -246.00K | 664.00K | 694.00K | 649.01K | 2.99M | -2.47M | -7.67M | -130.00K | -10.88M | -5.88M | -5.06M | -25.15M | 31.79M | 37.74M | 6.39M |

| Income Before Tax | 12.95M | -1.13M | 2.63M | -12.29M | 2.17M | 51.00K | -829.00K | 5.43M | 1.11M | -1.37M | 342.00K | -5.27M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.24M | -4.27M | 20.00K | -9.72M | -5.33M | -7.24M | -27.33M | 30.87M | 29.47M | 5.72M |

| Income Before Tax Ratio | 5,755.11% | -45.17% | 43.22% | -3,865.41% | 36.81% | 1.25% | -22.20% | 62.99% | 28.37% | -67.81% | 9.84% | 250.38% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 20.00% | -59.55% | 0.67% | -357.35% | -104.10% | -140.31% | -724.93% | 769.83% | 1,137.84% | 185.71% |

| Income Tax Expense | 0.00 | 1.12M | 38.00K | -4.87M | -3.39M | -3.55M | -3.33M | 5.43M | 0.00 | 0.00 | 15.00K | 0.00 | 4.53M | 0.00 | 27.73M | 18.95M | -13.04M | -14.81M | -19.85M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Net Income | 12.95M | -2.25M | 2.59M | -12.29M | 2.17M | 51.00K | -829.00K | 5.43M | 1.11M | -1.37M | 342.00K | -5.27M | -4.53M | -12.85M | -27.53M | -19.66M | 12.27M | 14.16M | 16.72M | 1.24M | -4.27M | 20.00K | -9.72M | -5.33M | -7.24M | -27.33M | 30.87M | 29.47M | 5.72M |

| Net Income Ratio | 5,755.11% | -90.19% | 42.59% | -3,865.41% | 36.81% | 1.25% | -22.20% | 62.99% | 28.37% | -67.81% | 9.84% | 250.38% | -846.54% | 139.49% | -740.11% | -627.78% | 256.95% | 241.64% | 699.90% | 20.00% | -59.55% | 0.67% | -357.35% | -104.10% | -140.31% | -724.93% | 769.83% | 1,137.84% | 185.71% |

| EPS | 0.96 | -0.17 | 0.19 | -0.91 | 0.16 | 0.00 | -0.06 | 0.43 | 0.08 | -0.11 | 0.03 | -0.50 | -0.45 | -1.45 | -3.13 | -2.33 | 1.49 | 1.78 | 2.41 | 0.18 | -0.65 | 0.00 | -1.48 | -0.86 | -1.38 | -5.36 | 6.17 | 7.31 | 1.83 |

| EPS Diluted | 0.96 | -0.17 | 0.19 | -0.91 | 0.16 | 0.00 | -0.06 | 0.43 | 0.08 | -0.11 | 0.03 | -0.50 | -0.45 | -1.45 | -3.13 | -2.33 | 1.49 | 1.78 | 2.41 | 0.18 | -0.65 | 0.00 | -1.48 | -0.86 | -1.38 | -5.36 | 6.17 | 7.31 | 1.83 |

| Weighted Avg Shares Out | 13.53M | 13.52M | 13.52M | 13.52M | 13.52M | 13.52M | 13.35M | 12.67M | 12.67M | 11.90M | 10.56M | 10.56M | 10.05M | 8.86M | 8.79M | 8.43M | 8.25M | 7.95M | 6.95M | 6.84M | 6.59M | 6.58M | 6.58M | 6.20M | 5.23M | 5.10M | 5.00M | 4.03M | 3.13M |

| Weighted Avg Shares Out (Dil) | 13.53M | 13.52M | 13.52M | 13.52M | 13.52M | 13.52M | 13.35M | 12.67M | 12.67M | 11.90M | 10.56M | 10.56M | 10.05M | 8.86M | 8.79M | 8.43M | 8.25M | 7.95M | 6.95M | 6.84M | 6.59M | 6.58M | 6.58M | 6.20M | 5.23M | 5.10M | 5.00M | 4.03M | 3.13M |

Wigig Market is expected to grow at the compound annual growth rate of 157.1%

Comparing Equus Total Return (NYSE:EQS) and Nuveen Municipal Value Fund (NYSE:NUV)

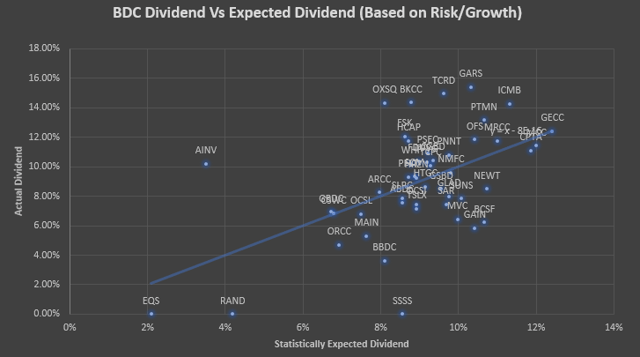

Ranking Business Development Companies From Most Undervalued To Overvalued

What the numbers show: Adding ELSS to your tax-saving investments is a good idea

2.000 richieste: lancio riuscito di EQS LEI Manager

2.000 Beantragungen: Glänzender Start des EQS LEI MANAGER

2,000 Applications: Successful Launch of EQS LEI Manager

L’habilitation d’EQS Group en France en tant que diffuseur professionnel marque une étape importante dans le développement de ses circuits de diffusion

EQS Group Certified as Primary Information Provider in France / Expansion of Extensive Media Distribution Network

Source: https://incomestatements.info

Category: Stock Reports