See more : Andean Precious Metals Corp. (APM.V) Income Statement Analysis – Financial Results

Complete financial analysis of ERYTECH Pharma S.A. (ERYP) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of ERYTECH Pharma S.A., a leading company in the Biotechnology industry within the Healthcare sector.

- Giantplus Technology Co., Ltd. (8105.TW) Income Statement Analysis – Financial Results

- Aqua Power Systems Inc. (APSI) Income Statement Analysis – Financial Results

- Som Distilleries & Breweries Limited (SDBL.NS) Income Statement Analysis – Financial Results

- Sichuan Energy Investment Development Co., Ltd. (1713.HK) Income Statement Analysis – Financial Results

- SW Umwelttechnik Stoiser & Wolschner AG (SWUT.VI) Income Statement Analysis – Financial Results

ERYTECH Pharma S.A. (ERYP)

About ERYTECH Pharma S.A.

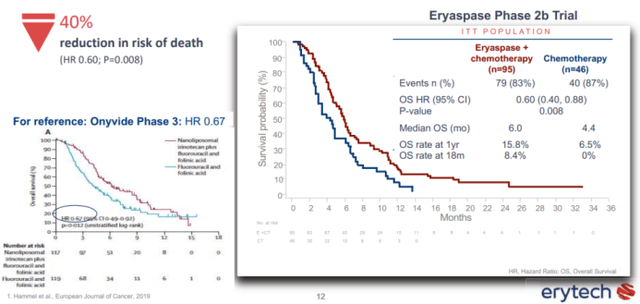

ERYTECH Pharma S.A., a clinical-stage biopharmaceutical company, develops red blood cell-based therapeutics for cancer and orphan diseases in France and the United States. Its lead product candidate is eryaspase, which is in Phase 3 clinical development for the treatment of second-line pancreatic cancer, and in Phase 2 stage for the treatment of triple-negative breast cancer and second-line acute lymphoblastic leukemia patients. The company also engages in developing erymethionase, a preclinical product candidate that consists of methionine-?-lyase in red blood cells to target methionine cancers. The company was incorporated in 2004 and is headquartered in Lyon, France.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 0.00 | 0.00 | 0.00 | 3.36M | 4.14M | 3.36M | 19.72M | 10.78M | 6.61M | 1.80M | 3.46M |

| Cost of Revenue | 0.00 | 0.00 | 57.58M | 52.19M | 33.47M | 25.46M | 19.72M | 10.78M | 6.61M | 5.33M | 3.46M |

| Gross Profit | 0.00 | 0.00 | -57.58M | -48.83M | -29.33M | -22.10M | 0.00 | 0.00 | 0.00 | -3.53M | 0.00 |

| Gross Profit Ratio | 0.00% | 0.00% | 0.00% | -1,451.52% | -708.80% | -656.90% | 0.00% | 0.00% | 0.00% | -195.63% | 0.00% |

| Research & Development | 19.91M | 45.10M | 57.58M | 52.19M | -19.72M | -25.46M | 0.00 | 0.00 | 0.00 | 2.50M | 0.00 |

| General & Administrative | 13.89M | 15.10M | 14.97M | 17.16M | 14.60M | 8.52M | 6.66M | 7.62M | 4.36M | 3.55M | 3.30M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 13.89M | 15.10M | 14.97M | 17.16M | 14.60M | 8.52M | 6.66M | 7.62M | 4.36M | 3.55M | 3.30M |

| Other Expenses | -6.65M | -3.69M | -3.72M | -5.28M | -4.45M | -3.10M | -3.99M | -2.81M | -2.03M | -4.29M | -5.68M |

| Operating Expenses | 27.15M | 56.52M | 68.83M | 64.07M | 10.15M | 5.43M | 2.67M | 4.81M | 2.34M | 1.76M | -2.39M |

| Cost & Expenses | 27.15M | 56.52M | 68.83M | 64.07M | 43.62M | 30.89M | 22.39M | 15.58M | 8.95M | 7.09M | 1.07M |

| Interest Income | 4.45M | 13.00K | 889.00K | 2.95M | 163.00K | 405.00K | 545.00K | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 1.36M | 2.14M | 5.35M | 1.53M | 9.00K | 15.00K | 4.00K | 5.00K | 6.80K | 4.66K | 9.38K |

| Depreciation & Amortization | -19.90M | 9.06M | 889.00K | 2.95M | 797.00K | 532.00K | 425.00K | 288.00K | 276.52K | 180.30K | 292.09K |

| EBITDA | -22.69M | -47.46M | -67.94M | 5.28M | 4.45M | 3.36M | -21.47M | -14.72M | -8.60M | -8.00M | -1.86M |

| EBITDA Ratio | 0.00% | 0.00% | 0.00% | -1,817.09% | -904.20% | -980.56% | -108.90% | -136.63% | -130.00% | -443.87% | -53.83% |

| Operating Income | -2.80M | -56.52M | -68.83M | -64.07M | -43.62M | -30.89M | -22.39M | -15.58M | -8.95M | -7.09M | -1.07M |

| Operating Income Ratio | 0.00% | 0.00% | 0.00% | -1,904.70% | -1,054.16% | -918.22% | -113.55% | -144.61% | -135.32% | -393.13% | -31.04% |

| Total Other Income/Expenses | 3.09M | 2.72M | -4.47M | -67.94M | -42.67M | -2.64M | 488.00K | 567.00K | 68.17K | -1.10M | -1.09M |

| Income Before Tax | 293.00K | -53.80M | -73.30M | -62.66M | -38.22M | -33.53M | -21.90M | -15.02M | -8.88M | -8.18M | -2.16M |

| Income Before Tax Ratio | 0.00% | 0.00% | 0.00% | -1,862.66% | -923.68% | -996.82% | -111.07% | -139.35% | -134.29% | -454.14% | -62.54% |

| Income Tax Expense | 521.00K | 2.00K | 3.00K | -1.00K | 2.00K | -3.00K | 10.00K | -3.00K | -20.16K | -40.02K | 7.64K |

| Net Income | -228.00K | -53.80M | -73.30M | -62.66M | -38.22M | -33.53M | -21.91M | -15.01M | -8.86M | -8.14M | -2.17M |

| Net Income Ratio | 0.00% | 0.00% | 0.00% | -1,862.63% | -923.73% | -996.73% | -111.13% | -139.32% | -133.98% | -451.92% | -62.77% |

| EPS | -0.01 | -2.27 | -3.99 | -3.49 | -2.13 | -1.87 | -2.74 | -2.16 | -1.51 | -1.74 | -0.39 |

| EPS Diluted | -0.01 | -2.27 | -3.99 | -3.49 | -2.13 | -1.87 | -2.74 | -2.16 | -1.51 | -1.74 | -0.39 |

| Weighted Avg Shares Out | 31.02M | 23.69M | 18.39M | 17.94M | 17.94M | 17.94M | 7.98M | 6.96M | 5.87M | 4.69M | 5.54M |

| Weighted Avg Shares Out (Dil) | 31.02M | 23.69M | 18.39M | 17.94M | 17.94M | 17.94M | 7.98M | 6.96M | 5.87M | 4.69M | 5.54M |

ERYTECH Provides Business Update and Reports Financial Results for the Third Quarter of 2020

ERYTECH Announces Abstract with Results from Eryaspase Phase 2 Trial in Acute Lymphoblastic Leukemia Selected for Oral Presentation at the American Society of Hematology 2020 Annual Meeting

Monthly information related to total number of voting rights and shares composing the share capital – October 31, 2020.

ERYTECH Secures €10 Million in Non-Dilutive Financing, Guaranteed by the French Government

ERYTECH to Host Third Quarter 2020 Conference Call and Business Update on November 6, 2020

ERYTECH Appoints Stewart Craig as Chief Technical Officer

Erytech Pharma: Exploring New Ways To Battle Cancer

Erytech Spikes On Fast Track, And Other News: The Good, Bad And Ugly Of Biopharma

ERYTECH to Host First Quarter 2018 Conference Call and Business Update

ERYTECH Reports Top-line Results of Phase 2b Study of Eryaspase for the Treatment of AML

Source: https://incomestatements.info

Category: Stock Reports