See more : Kanungo Financiers Limited (KANUNGO.BO) Income Statement Analysis – Financial Results

Complete financial analysis of Enstar Group Limited (ESGR) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Enstar Group Limited, a leading company in the Insurance – Diversified industry within the Financial Services sector.

- Controladora Vuela Compañía de Aviación, S.A.B. de C.V. (VLRS) Income Statement Analysis – Financial Results

- GD Entertainment & Technology, Inc. (GDET) Income Statement Analysis – Financial Results

- M LAKHAMSI INDUSTRIES LIMITED (MLINDLTD.BO) Income Statement Analysis – Financial Results

- Harris Technology Group Limited (HT8.AX) Income Statement Analysis – Financial Results

- Condor Hospitality Trust, Inc. (CDOR) Income Statement Analysis – Financial Results

Enstar Group Limited (ESGR)

About Enstar Group Limited

Enstar Group Limited acquires and manages insurance and reinsurance companies, and portfolios of insurance and reinsurance business in run-off. It engages in the run-off property and casualty, and other non-life lines insurance businesses. The company also provides consulting services, including claims inspection, claims validation, reinsurance asset collection, syndicate management, and IT consulting services to the insurance and reinsurance industry. It operates in Bermuda, the United States, the United Kingdom, Australia, and other Continental European countries. The company was formerly known as Castlewood Holdings Limited and changed its name to Enstar Group Limited in January 2007. The company was founded in 1993 and is headquartered in Hamilton, Bermuda.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 1.15B | -1.08B | 864.00M | 2.54B | 2.54B | 785.78M | 1.06B | 1.13B | 987.83M | 853.56M | 420.94M | 159.54M | 108.85M | 136.06M | 101.71M | 50.10M | 96.25M | 81.91M | 31.07M | 16.74M | 16.68M | 30.12M | 5.36M | 4.59M | 4.42M | 40.50M | 11.88M | 1.87M | 1.01M |

| Cost of Revenue | -276.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 1.43B | -1.08B | 864.00M | 2.54B | 2.54B | 785.78M | 1.06B | 1.13B | 987.83M | 853.56M | 420.94M | 159.54M | 108.85M | 136.06M | 101.71M | 50.10M | 96.25M | 81.91M | 31.07M | 16.74M | 16.68M | 30.12M | 5.36M | 4.59M | 4.42M | 40.50M | 11.88M | 1.87M | 1.01M |

| Gross Profit Ratio | 123.94% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 369.00M | 331.00M | 367.00M | 501.48M | 473.09M | 407.38M | 435.99M | 423.73M | 399.60M | 352.49M | 211.23M | 157.07M | 161.66M | 145.88M | 115.36M | 109.63M | 31.41M | 18.88M | 3.11M | 2.98M | 3.11M | 3.13M | 3.47M | 2.46M | 2.40M | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 369.00M | 331.00M | 367.00M | 501.48M | 473.09M | 407.38M | 435.99M | 423.73M | 399.60M | 352.49M | 211.23M | 157.07M | 161.66M | 145.88M | 115.36M | 109.63M | 31.41M | 18.88M | 3.11M | 2.98M | 3.11M | 3.13M | 3.47M | 2.46M | 2.40M | 3.73M | 1.45M | 2.34M | 606.00K |

| Other Expenses | 0.00 | -42.00M | -731.00M | -1.27B | -2.11B | -1.32B | -1.16B | -1.23B | -1.13B | -968.24M | -375.56M | -95.87M | -83.00M | -10.47M | -36.67M | -7.95M | -68.45M | 0.00 | -6.22M | -4.52M | -3.57M | -4.69M | -6.96M | 1.80M | -4.54M | -4.41M | -3.43M | -2.60M | 69.28M |

| Operating Expenses | 1.39B | 289.00M | -364.00M | -764.11M | -1.64B | -915.91M | -727.65M | -805.17M | -730.32M | -615.74M | -164.33M | 61.20M | 78.65M | 135.41M | 78.69M | 101.68M | -37.03M | 5.38M | -3.11M | -1.54M | -468.00K | -1.56M | -3.49M | 4.26M | -2.14M | -681.00K | -1.98M | -260.00K | 69.88M |

| Cost & Expenses | 369.00M | -195.00M | 264.00M | 1.05B | 1.67B | 1.05B | 746.40M | 798.17M | 759.67M | 615.18M | 161.50M | -76.27M | -124.89M | -156.10M | -102.90M | -94.12M | 50.86M | 18.23M | 3.11M | 2.98M | -635.00K | 2.52M | 3.49M | -4.24M | 2.16M | 709.00K | 2.74M | 1.13M | -13.11M |

| Interest Income | 0.00 | 89.00M | 69.00M | 59.00M | 53.00M | 521.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 4.26M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 90.00M | 89.00M | 68.00M | 57.98M | 51.59M | 26.22M | 28.10M | 20.64M | 19.40M | 12.92M | 12.39M | 8.43M | 8.53M | 10.25M | 17.58M | 23.37M | 4.88M | 1.99M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 12.00K | 12.00K | 28.00K | 761.00K | 871.00K | 2.29M |

| Depreciation & Amortization | 113.00M | 129.00M | 129.00M | 59.00M | 34.70M | 33.30M | 32.46M | 34.94M | 55.16M | 5.79M | 1.06M | 1.47M | 26.68M | 1.52M | 1.14M | 808.00K | 1.13M | 2.46M | 0.00 | 0.00 | 0.00 | 27.00K | 102.00K | 99.00K | 104.00K | 15.00K | 11.00K | 9.00K | 16.00K |

| EBITDA | 1.16B | -665.00M | 685.00M | 1.61B | 964.54M | -201.03M | 374.97M | 382.90M | 302.72M | 257.09M | 272.89M | 245.70M | 243.86M | 303.93M | 223.33M | 168.40M | 51.22M | 65.67M | 0.00 | 15.44M | 16.21M | 0.00 | 0.00 | 8.95M | 2.38M | 39.83M | 9.91M | 1.62M | 16.43M |

| EBITDA Ratio | 100.43% | 68.65% | 66.44% | 72.29% | 36.99% | -12.32% | 34.47% | 31.56% | 31.65% | 28.54% | 61.21% | 139.28% | 196.76% | 200.64% | 178.48% | 304.58% | 62.70% | 105.58% | 89.99% | 90.81% | 97.19% | 94.93% | 36.83% | 194.82% | 53.83% | 98.36% | 83.45% | 86.58% | 7,020.59% |

| Operating Income | 770.00M | -789.00M | 500.00M | 1.78B | 905.36M | -130.13M | 333.17M | 320.32M | 257.51M | 237.81M | 256.61M | 220.73M | 187.51M | 271.47M | 180.40M | 151.78M | 59.22M | 84.02M | 27.96M | 15.20M | 16.21M | 28.57M | 1.87M | 8.85M | 2.27M | 39.82M | 9.90M | 1.61M | 70.89M |

| Operating Income Ratio | 66.78% | 73.19% | 57.87% | 69.95% | 35.59% | -16.56% | 31.41% | 28.46% | 26.07% | 27.86% | 60.96% | 138.36% | 172.26% | 199.53% | 177.36% | 302.96% | 61.52% | 102.57% | 89.99% | 90.81% | 97.19% | 94.84% | 34.92% | 192.66% | 51.47% | 98.32% | 83.36% | 86.10% | 7,019.01% |

| Total Other Income/Expenses | 185.00M | -74.00M | 109.00M | 167.00M | 11.00M | -1.79M | -56.08M | -26.71M | -19.64M | -7.80M | -12.02M | -8.83M | 25.28M | -9.85M | -41.37M | -38.36M | 45.39M | 63.68M | 26.92M | -526.00K | 167.00K | 27.60M | 1.87M | -12.00K | -12.00K | -28.00K | -761.00K | -871.00K | -56.77M |

| Income Before Tax | 955.00M | -883.00M | 422.00M | 1.50B | 876.75M | -260.54M | 314.41M | 327.32M | 228.16M | 238.38M | 259.44M | 235.81M | 233.74M | 292.16M | 204.61M | 144.22M | 45.39M | 63.68M | 27.96M | 13.76M | 17.32M | 27.60M | 1.87M | 8.84M | 2.26M | 39.79M | 9.14M | 740.00K | 14.12M |

| Income Before Tax Ratio | 82.83% | 81.91% | 48.84% | 58.84% | 34.47% | -33.16% | 29.64% | 29.08% | 23.10% | 27.93% | 61.63% | 147.81% | 214.73% | 214.73% | 201.17% | 287.88% | 47.16% | 77.74% | 89.99% | 82.19% | 103.81% | 91.63% | 34.92% | 192.40% | 51.20% | 98.25% | 76.95% | 39.55% | 1,398.22% |

| Income Tax Expense | -250.00M | -12.00M | 27.00M | 23.83M | 4.44M | -6.12M | -6.40M | 34.87M | 17.82M | 11.14M | 35.62M | 44.29M | 25.28M | 87.13M | 27.61M | 46.85M | -7.44M | -318.00K | 8.92M | 4.81M | 2.99M | 6.07M | 299.00K | 530.00K | 124.00K | 1.44M | 221.00K | 0.00 | -54.48M |

| Net Income | 1.12B | -871.00M | 538.00M | 1.76B | 938.09M | -150.22M | 311.46M | 264.81M | 220.29M | 213.75M | 208.60M | 168.02M | 153.69M | 174.09M | 135.21M | 81.55M | 61.79M | 82.35M | 19.05M | 10.39M | 13.23M | 22.49M | 1.57M | 8.31M | 2.14M | 38.35M | 8.92M | 740.00K | 68.60M |

| Net Income Ratio | 96.96% | 80.80% | 62.27% | 69.17% | 36.88% | -19.12% | 29.36% | 23.53% | 22.30% | 25.04% | 49.56% | 105.32% | 141.19% | 127.95% | 132.93% | 162.79% | 64.19% | 100.53% | 61.29% | 62.08% | 79.29% | 74.68% | 29.35% | 180.86% | 48.39% | 94.69% | 75.09% | 39.55% | 6,792.48% |

| EPS | 69.22 | -50.62 | 25.33 | 79.76 | 42.00 | -7.26 | 16.06 | 13.72 | 11.44 | 11.61 | 12.62 | 10.22 | 11.03 | 12.91 | 10.01 | 6.45 | 5.27 | 8.36 | 4.39 | 3.98 | 3.19 | 3.36 | 0.30 | 1.58 | 0.41 | 9.08 | 2.61 | 0.18 | 16.49 |

| EPS Diluted | 68.47 | -50.62 | 25.33 | 78.79 | 42.00 | -7.19 | 15.95 | 13.62 | 11.35 | 11.44 | 12.49 | 10.10 | 10.81 | 12.66 | 9.84 | 6.31 | 5.15 | 8.26 | 4.30 | 3.95 | 3.19 | 3.36 | 0.29 | 1.55 | 0.40 | 8.97 | 2.61 | 0.18 | 16.49 |

| Weighted Avg Shares Out | 15.63M | 17.21M | 19.82M | 21.55M | 21.48M | 20.70M | 19.39M | 19.30M | 19.25M | 18.41M | 16.52M | 16.44M | 13.93M | 13.49M | 13.51M | 12.64M | 11.73M | 9.86M | 18.35M | 9.62M | 9.58M | 18.00M | 5.28M | 5.27M | 5.27M | 4.22M | 3.41M | 4.16M | 4.16M |

| Weighted Avg Shares Out (Dil) | 15.80M | 17.21M | 19.82M | 21.82M | 21.48M | 20.90M | 19.53M | 19.45M | 19.41M | 18.68M | 16.70M | 16.64M | 14.21M | 13.75M | 13.74M | 12.92M | 12.01M | 9.97M | 18.75M | 9.69M | 9.58M | 18.00M | 5.45M | 5.37M | 5.33M | 4.28M | 3.42M | 4.16M | 4.16M |

Enstar Completes the Reinsurance of $690 Million of Continental Casualty Company's Legacy Excess Workers' Compensation Business

Enstar Group Limited Announces Quarterly Preference Share Dividends

Enstar Announces Reinsurance Transaction With ProSight

Enstar Group Limited Announces Reinsurance of $690 Million of Continental Casualty Company's Legacy Excess Workers' Compensation Business

Enstar Completes Sale and Recapitalization of StarStone U.S.

Enstar to Sell Starstone Lloyd's Managing Agency to Newly Formed Venture Inigo

Enstar Group Limited Reports Third Quarter Results

Enstar Group Limited Announces Quarterly Preference Share Dividends

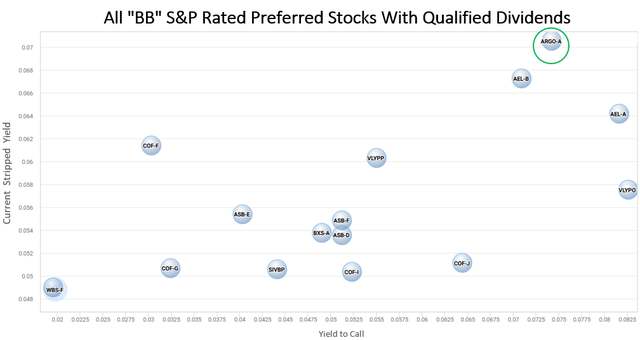

Argo Group: By Far, The Best Preferred Stock With An S&P Rating Of BB

Watford (NASDAQ:WTRE) Upgraded to "Strong-Buy" at ValuEngine

Source: https://incomestatements.info

Category: Stock Reports