See more : Fujisash Co.,Ltd. (5940.T) Income Statement Analysis – Financial Results

Complete financial analysis of Esperion Therapeutics, Inc. (ESPR) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Esperion Therapeutics, Inc., a leading company in the Drug Manufacturers – Specialty & Generic industry within the Healthcare sector.

- HKScan Oyj (HKSAV.HE) Income Statement Analysis – Financial Results

- Kawasaki Kisen Kaisha, Ltd. (9107.T) Income Statement Analysis – Financial Results

- Brembo S.p.A. (BRBOF) Income Statement Analysis – Financial Results

- Castle Biosciences, Inc. (CSTL) Income Statement Analysis – Financial Results

- Corsair Partnering Corporation (CORS-UN) Income Statement Analysis – Financial Results

Esperion Therapeutics, Inc. (ESPR)

Industry: Drug Manufacturers - Specialty & Generic

Sector: Healthcare

Website: https://www.esperion.com

About Esperion Therapeutics, Inc.

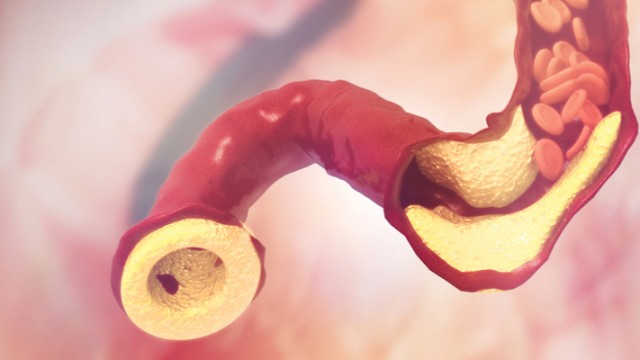

Esperion Therapeutics, Inc., a pharmaceutical company, develops and commercializes medicines for the treatment of patients with elevated low density lipoprotein cholesterol. Its lead product candidates are NEXLETOL (bempedoic acid) and NEXLIZET (bempedoic acid and ezetimibe) tablets for the treatment of patients with atherosclerotic cardiovascular disease or heterozygous familial hypercholesterolemia. The company has a license and collaboration agreement with Daiichi Sankyo Europe GmbH; and Serometrix to in-license its oral, small molecule PCSK9 inhibitor program. Esperion Therapeutics, Inc. was incorporated in 2008 and is headquartered in Ann Arbor, Michigan.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2002 | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 116.33M | 75.48M | 78.45M | 227.55M | 148.36M | 184.47M | 0.00 | 0.00 | 0.00 | 0.00 | 4.98B | 0.00 | 0.00 | 0.00 | 0.00 | 2.00K | 0.00 |

| Cost of Revenue | 43.27M | 26.97M | 14.22M | 2.39M | 175.61M | 265.00K | 258.00K | 252.00K | 236.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 786.00K | 683.22K |

| Gross Profit | 73.07M | 48.51M | 64.23M | 225.16M | -27.25M | 184.21M | -258.00K | -252.00K | -236.00K | 0.00 | 4.98B | 0.00 | 0.00 | 0.00 | 0.00 | -784.00K | -683.22K |

| Gross Profit Ratio | 62.81% | 64.27% | 81.88% | 98.95% | -18.36% | 99.86% | 0.00% | 0.00% | 0.00% | 0.00% | 100.00% | 0.00% | 0.00% | 0.00% | 0.00% | -39,200.00% | 0.00% |

| Research & Development | 86.11M | 118.93M | 105.98M | 146.94M | 175.61M | 171.49M | 147.60M | 57.87M | 29.80M | 25.30M | 16.01M | 8.00M | 7.81M | 21.99M | 21.45M | 21.79M | 8.48M |

| General & Administrative | 126.92M | 97.78M | 171.29M | 180.32M | 65.85M | 33.10M | 21.38M | 18.28M | 20.24M | 10.92M | 6.74M | 2.21M | 2.36M | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 15.60M | 11.30M | 13.70M | 19.30M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 142.52M | 109.08M | 184.99M | 199.62M | 65.85M | 33.10M | 21.38M | 18.28M | 20.24M | 10.92M | 6.74M | 2.21M | 2.36M | 5.96M | 5.02M | 2.95M | 2.52M |

| Other Expenses | 0.00 | 2.65M | 3.98M | 515.00K | 4.06M | 2.78M | 2.19M | 1.55M | 776.00K | 119.00K | 194.01K | -83.65K | -75.81K | 0.00 | 0.00 | 5.00M | 3.20M |

| Operating Expenses | 228.63M | 228.01M | 290.96M | 346.55M | 241.47M | 204.59M | 168.98M | 76.15M | 50.04M | 36.22M | 22.76M | 10.20M | 10.16M | 29.24M | 29.33M | 26.79M | 11.69M |

| Cost & Expenses | 271.90M | 254.98M | 305.18M | 348.94M | 241.47M | 204.59M | 168.98M | 76.15M | 50.04M | 36.22M | 22.76M | 10.20M | 10.16M | 29.24M | 29.33M | 27.57M | 12.37M |

| Interest Income | 0.00 | 2.60M | 112.00K | 600.00K | 4.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 58.98M | 56.81M | 46.35M | 22.67M | 8.12M | 100.00K | 198.00K | 376.00K | 520.00K | 270.00K | 936.58K | 1.49M | 577.16K | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 164.00K | 500.00K | 612.00K | 547.00K | 319.00K | 265.00K | 258.00K | 252.00K | 236.00K | 160.00K | 70.55K | 139.43K | 178.47K | -1.29M | -2.01M | -2.05M | -683.22K |

| EBITDA | -150.11M | -176.35M | -222.14M | -120.33M | -88.73M | -204.32M | -166.53M | -74.35M | -49.03M | -36.06M | -22.69M | -10.12M | -10.06M | -27.22M | -26.80M | -25.52M | -11.69M |

| EBITDA Ratio | -129.03% | -234.31% | -283.96% | -53.12% | -60.02% | -110.90% | 0.00% | 0.00% | 0.00% | 0.00% | -0.45% | 0.00% | 0.00% | 0.00% | 0.00% | -1,086,150.00% | 0.00% |

| Operating Income | -155.56M | -179.50M | -226.73M | -121.40M | -93.10M | -204.59M | -168.98M | -76.15M | -50.04M | -36.22M | -22.76M | -10.20M | -10.16M | -27.95M | -27.32M | -27.57M | -12.37M |

| Operating Income Ratio | -133.72% | -237.83% | -289.02% | -53.35% | -62.75% | -110.90% | 0.00% | 0.00% | 0.00% | 0.00% | -0.46% | 0.00% | 0.00% | 0.00% | 0.00% | -1,378,600.00% | 0.00% |

| Total Other Income/Expenses | -53.69M | -54.16M | -42.38M | -22.16M | -4.06M | 2.78M | 1.99M | 1.17M | 256.00K | -151.00K | -3.33M | -1.54M | -652.97K | -780.00K | 2.39M | -3.80M | 0.00 |

| Income Before Tax | -209.25M | -233.66M | -269.11M | -143.55M | -97.17M | -201.81M | -166.99M | -74.98M | -49.78M | -36.38M | -26.09M | -11.74M | -10.82M | -28.73M | -24.93M | -31.37M | 0.00 |

| Income Before Tax Ratio | -179.87% | -309.58% | -343.04% | -63.09% | -65.49% | -109.40% | 0.00% | 0.00% | 0.00% | 0.00% | -0.52% | 0.00% | 0.00% | 0.00% | 0.00% | -1,568,550.00% | 0.00% |

| Income Tax Expense | 0.00 | 54.16M | 49.72M | 22.64M | 11.86M | 2.88M | 2.13M | 1.67M | 1.06M | 229.00K | 1.13M | 1.40M | 501.34K | 2.07M | 468.00K | 4.10M | -331.84K |

| Net Income | -209.25M | -287.82M | -318.82M | -166.19M | -109.02M | -201.81M | -166.99M | -74.98M | -49.78M | -36.38M | -26.09M | -11.74M | -10.82M | -28.73M | -24.93M | -27.58M | -10.67M |

| Net Income Ratio | -179.87% | -381.34% | -406.42% | -73.04% | -73.48% | -109.40% | 0.00% | 0.00% | 0.00% | 0.00% | -0.52% | 0.00% | 0.00% | 0.00% | 0.00% | -1,378,800.00% | 0.00% |

| EPS | -2.03 | -4.33 | -11.03 | -6.05 | -4.02 | -7.54 | -6.98 | -3.33 | -2.26 | -2.22 | -1.71 | -1.22 | -1.13 | -6.86 | -6.38 | -9.35 | -7.94 |

| EPS Diluted | -2.03 | -4.33 | -11.03 | -6.05 | -4.02 | -7.54 | -6.98 | -3.33 | -2.26 | -2.22 | -1.70 | -1.22 | -1.13 | -6.86 | -6.38 | -9.35 | -7.94 |

| Weighted Avg Shares Out | 103.11M | 66.41M | 28.90M | 27.47M | 27.09M | 26.75M | 23.93M | 22.54M | 22.02M | 16.37M | 15.29M | 9.61M | 9.61M | 4.19M | 3.91M | 2.95M | 1.34M |

| Weighted Avg Shares Out (Dil) | 103.11M | 66.41M | 28.90M | 27.47M | 27.09M | 26.75M | 23.93M | 22.54M | 22.02M | 16.37M | 15.34M | 9.61M | 9.61M | 4.19M | 3.91M | 2.95M | 1.34M |

Esperion Therapeutics (ESPR) Reports Q4 Loss, Tops Revenue Estimates

Esperion Reports Fourth Quarter and Full Year 2023 Financial Results

Esperion Announces Inducement Grants Under NASDAQ Listing Rule 5635(c)(4)

Esperion Therapeutics (ESPR) Expected to Beat Earnings Estimates: Can the Stock Move Higher?

Esperion to Report Fourth Quarter and Full Year 2023 Financial Results on February 27

RFK, Esperion Therapeutics Announce 2024 Promotional Schedule

This late-January stock-trading pattern has been a winner in 30 of the past 38 years

Esperion Announces Closing of Public Offering of Common Stock and Exercise in Full of Underwriters' Option to Purchase Additional Shares

Navigating Esperion Therapeutics' Surprise Secondary Offering: Some Investment Considerations

Why Is Esperion Therapeutics (ESPR) Stock Down 24% Today?

Source: https://incomestatements.info

Category: Stock Reports