See more : Windsor Machines Limited (WINDMACHIN.BO) Income Statement Analysis – Financial Results

Complete financial analysis of Esquire Financial Holdings, Inc. (ESQ) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Esquire Financial Holdings, Inc., a leading company in the Banks – Regional industry within the Financial Services sector.

- Esso S.A.F. (ES.PA) Income Statement Analysis – Financial Results

- Doctorglasses Chain Co.,Ltd. (300622.SZ) Income Statement Analysis – Financial Results

- Saint Jean Groupe Société anonyme (SABE.PA) Income Statement Analysis – Financial Results

- Coloplast A/S (CLPBY) Income Statement Analysis – Financial Results

- National Storage REIT (NSR.AX) Income Statement Analysis – Financial Results

Esquire Financial Holdings, Inc. (ESQ)

About Esquire Financial Holdings, Inc.

Esquire Financial Holdings, Inc. operates as the bank holding company for Esquire Bank, National Association that provides commercial banking products and services to legal industry and small businesses, and commercial and retail customers in the United States. The company offers checking, savings, money market, and time deposits, as well as certificates of deposit. It also provides commercial loans, including short-term financing for inventory, receivables, the purchase of supplies, or other operating needs arising during the normal course of business, as well as loans to its qualified merchant customers; commercial lines of credit; consumer loans consisting of post-settlement consumer and structured settlement loans to plaintiffs and claimants, as well as loans to individuals for debt consolidation, medical expenses, living expenses, payment of outstanding bills, or other consumer needs; and real estate loans, such as multifamily, 1-4 family residential, commercial real estate, and construction loans, as well as merchant services. As of January 25, 2022, the company operated a full-service branch in Jericho, New York; and an administrative office in Boca Raton, Florida. Esquire Financial Holdings, Inc. was founded in 2006 and is headquartered in Jericho, New York.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 |

|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 91.89M | 84.27M | 64.73M | 52.09M | 45.92M | 35.59M | 25.37M | 19.78M | 14.94M | 11.71M |

| Cost of Revenue | 3.06M | 2.79M | 1.97M | 1.86M | 1.45M | 1.69M | 1.02M | 0.00 | 0.00 | 0.00 |

| Gross Profit | 88.83M | 81.49M | 62.75M | 50.23M | 44.48M | 33.91M | 24.35M | 19.78M | 14.94M | 11.71M |

| Gross Profit Ratio | 96.67% | 96.69% | 96.95% | 96.43% | 96.85% | 95.26% | 95.96% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 33.27M | 25.77M | 21.74M | 16.87M | 14.68M | 13.04M | 10.07M | 8.46M | 6.60M | 2.17M |

| Selling & Marketing | 1.82M | 1.46M | 1.17M | 584.00K | 718.00K | 524.00K | 485.00K | 430.00K | 334.00K | 367.49K |

| SG&A | 35.10M | 25.77M | 21.74M | 16.87M | 14.68M | 13.04M | 10.07M | 8.89M | 6.94M | 10.13M |

| Other Expenses | 0.00 | -24.45M | -63.76M | -51.79M | -41.46M | -38.74M | -5.80M | -23.57M | -19.58M | 0.00 |

| Operating Expenses | 1.82M | 2.79M | -42.02M | -34.92M | -26.78M | -22.46M | 485.00K | -14.68M | -12.64M | 11.26M |

| Cost & Expenses | 4.88M | 2.79M | -42.02M | -34.92M | -26.78M | -22.46M | 1.51M | -14.68M | -12.64M | 11.26M |

| Interest Income | 91.89M | 60.99M | 44.53M | 38.63M | 36.66M | 28.95M | 20.39M | 16.17M | 12.45M | 0.00 |

| Interest Expense | 8.12M | 1.65M | 828.00K | 1.19M | 2.55M | 1.21M | 538.00K | 511.00K | 457.00K | 0.00 |

| Depreciation & Amortization | 1.27M | 1.17M | 1.22M | 959.00K | 888.00K | 421.00K | 411.00K | 166.00K | 237.00K | -757.37K |

| EBITDA | 58.42M | 41.35M | 24.94M | 18.79M | 20.03M | 12.72M | 0.00 | 4.75M | 2.72M | -306.00K |

| EBITDA Ratio | 63.58% | 48.83% | 38.54% | 36.08% | 43.61% | 38.09% | 31.46% | 26.62% | 16.94% | -2.61% |

| Operating Income | 59.74M | 38.60M | 22.71M | 17.17M | 19.14M | 13.14M | 18.89M | 5.10M | 2.29M | 757.37K |

| Operating Income Ratio | 65.01% | 45.81% | 35.08% | 32.96% | 41.68% | 36.91% | 74.43% | 25.78% | 15.35% | 6.47% |

| Total Other Income/Expenses | -3.85M | -3.34M | -2.42M | -2.23M | -1.89M | -3.31M | -1.28M | -986.00K | -1.03M | -306.00K |

| Income Before Tax | 55.88M | 38.80M | 22.71M | 17.17M | 19.14M | 11.92M | 7.03M | 4.59M | 1.84M | 451.37K |

| Income Before Tax Ratio | 60.82% | 46.04% | 35.08% | 32.96% | 41.68% | 33.50% | 27.72% | 23.19% | 12.29% | 3.85% |

| Income Tax Expense | 14.87M | 10.28M | 4.78M | 4.55M | 5.00M | 3.19M | 3.39M | 1.77M | 664.00K | 410.57K |

| Net Income | 41.01M | 28.52M | 17.93M | 12.62M | 14.14M | 8.73M | 3.64M | 2.82M | 1.17M | 40.81K |

| Net Income Ratio | 44.63% | 33.84% | 27.69% | 24.22% | 30.80% | 24.54% | 14.36% | 14.27% | 7.85% | 0.35% |

| EPS | 5.31 | 3.73 | 2.40 | 1.70 | 1.91 | 1.18 | 0.59 | 0.56 | 0.25 | 0.01 |

| EPS Diluted | 4.91 | 3.47 | 2.26 | 1.65 | 1.82 | 1.13 | 0.58 | 0.55 | 0.25 | 0.01 |

| Weighted Avg Shares Out | 7.72M | 7.64M | 7.47M | 7.41M | 7.39M | 7.40M | 6.23M | 4.99M | 4.49M | 4.08M |

| Weighted Avg Shares Out (Dil) | 8.35M | 8.21M | 7.95M | 7.64M | 7.78M | 7.73M | 6.24M | 5.02M | 4.53M | 3.67M |

Pete Hamill, legendary New York columnist and novelist, dies

Glancy Prongay & Murray Reminds Investors of Looming Deadline in the Class Action Lawsuit Against Guidewire Software, Inc. (GWRE)

Glancy Prongay & Murray Reminds Investors of Looming Deadline in the Class Action Lawsuit Against Insperity, Inc. (NSP)

Weapons rooms, fake windows and a $3m price tag: inside a luxury doomsday bunker

Glancy Prongay & Murray LLP Announces the Filing of a Securities Class Action on Behalf of Wins Finance Holdings Inc. (WINS) Investors

Oprah ends print editions of O Magazine, announces new Apple TV+ series

Oprah's O Mag to end regular print editions after 20 years

Deadline Reminder: The Law Offices of Howard G. Smith Reminds Investors of Looming Deadline in the Class Action Lawsuit Against Deutsche Bank Aktiengesellschaft (DB)

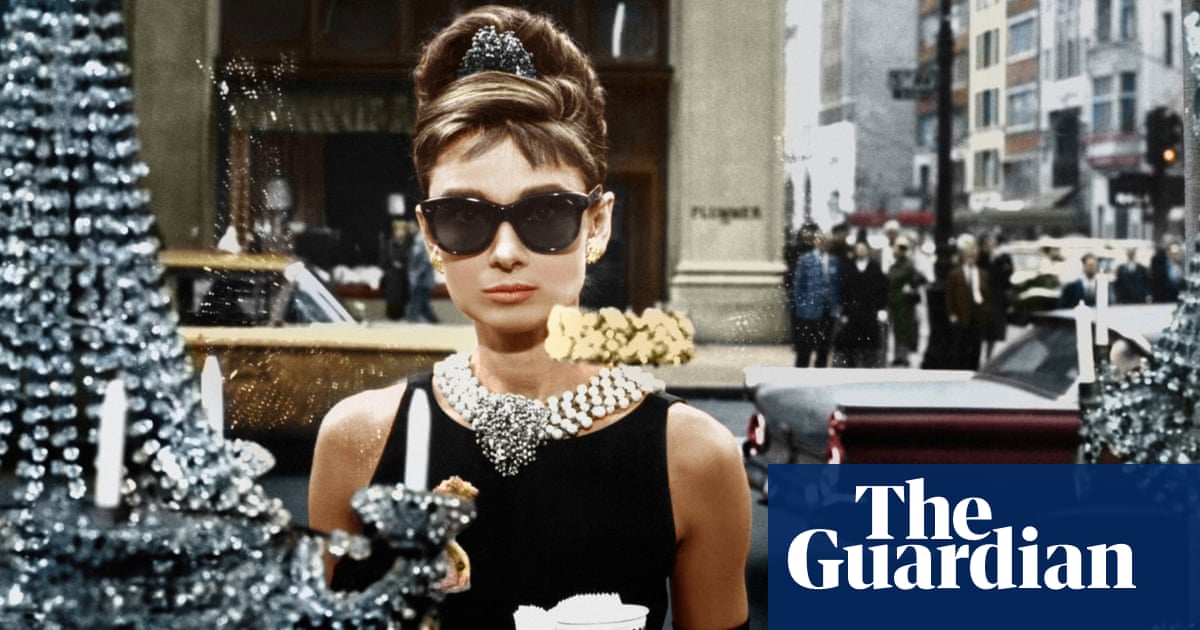

Manuscript shows how Truman Capote renamed his heroine Holly Golightly

Glancy Prongay & Murray Reminds Investors of Looming Deadline in the Class Action Lawsuit Against Verrica Pharmaceuticals Inc. (VRCA)

Source: https://incomestatements.info

Category: Stock Reports